The Next Fed Chair: Inheriting Trump's Economic Challenges

Table of Contents

Inflationary Pressures: A Lingering Threat

The next Fed Chair will inherit a challenging inflationary environment, a legacy partly shaped by the economic policies of the Trump administration.

The Legacy of Trump-era Tax Cuts and Spending

The 2017 Tax Cuts and Jobs Act, a cornerstone of the Trump administration's economic policy, significantly reduced corporate and individual income taxes. While proponents argued it would stimulate economic growth, critics warned of its potential to exacerbate the national debt and fuel inflation. This increase in the national debt, coupled with increased government spending, contributed to inflationary pressures. Furthermore, the trade wars initiated during the Trump administration disrupted global supply chains, adding to inflationary pressures. These disruptions, exacerbated by the COVID-19 pandemic, led to shortages of goods and increased prices.

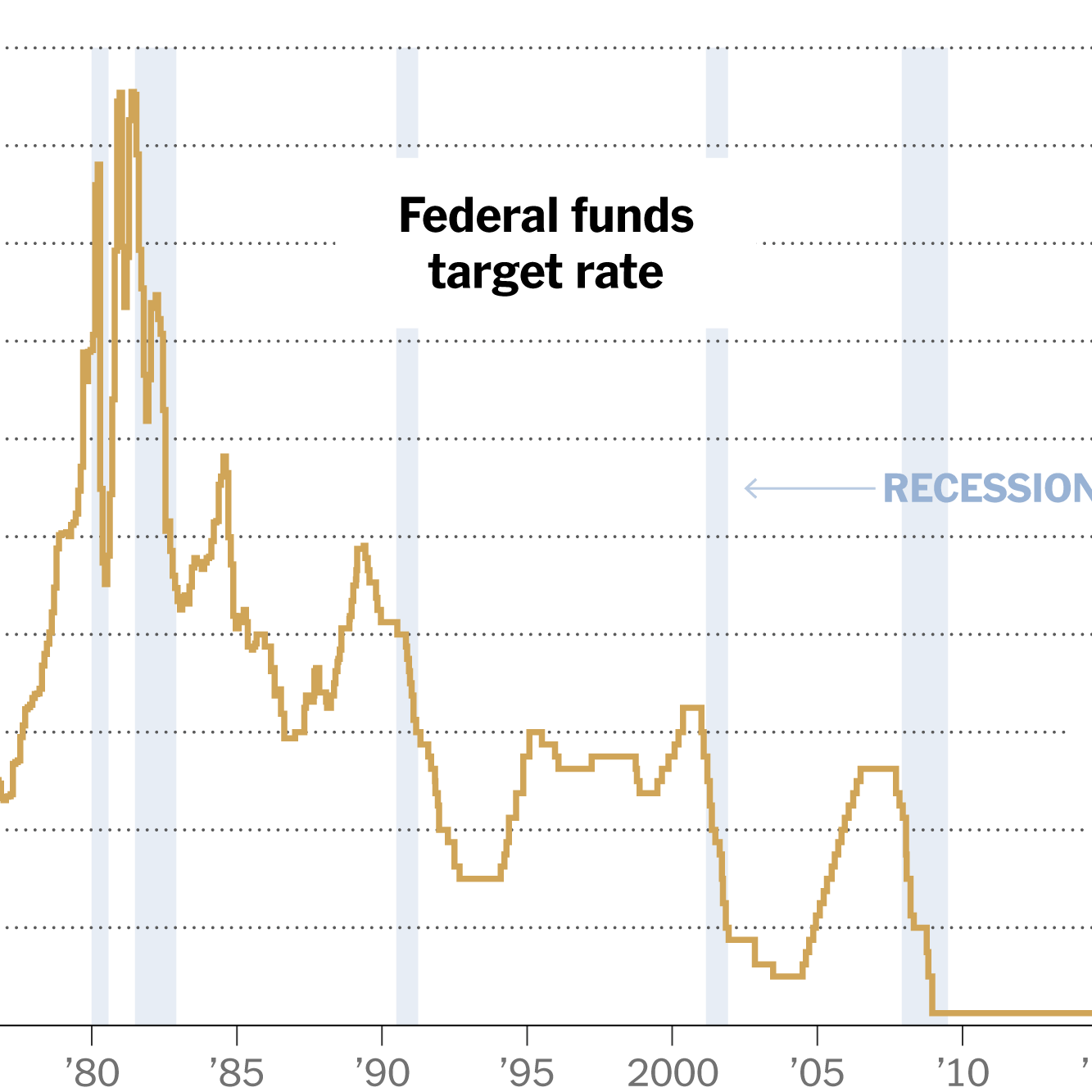

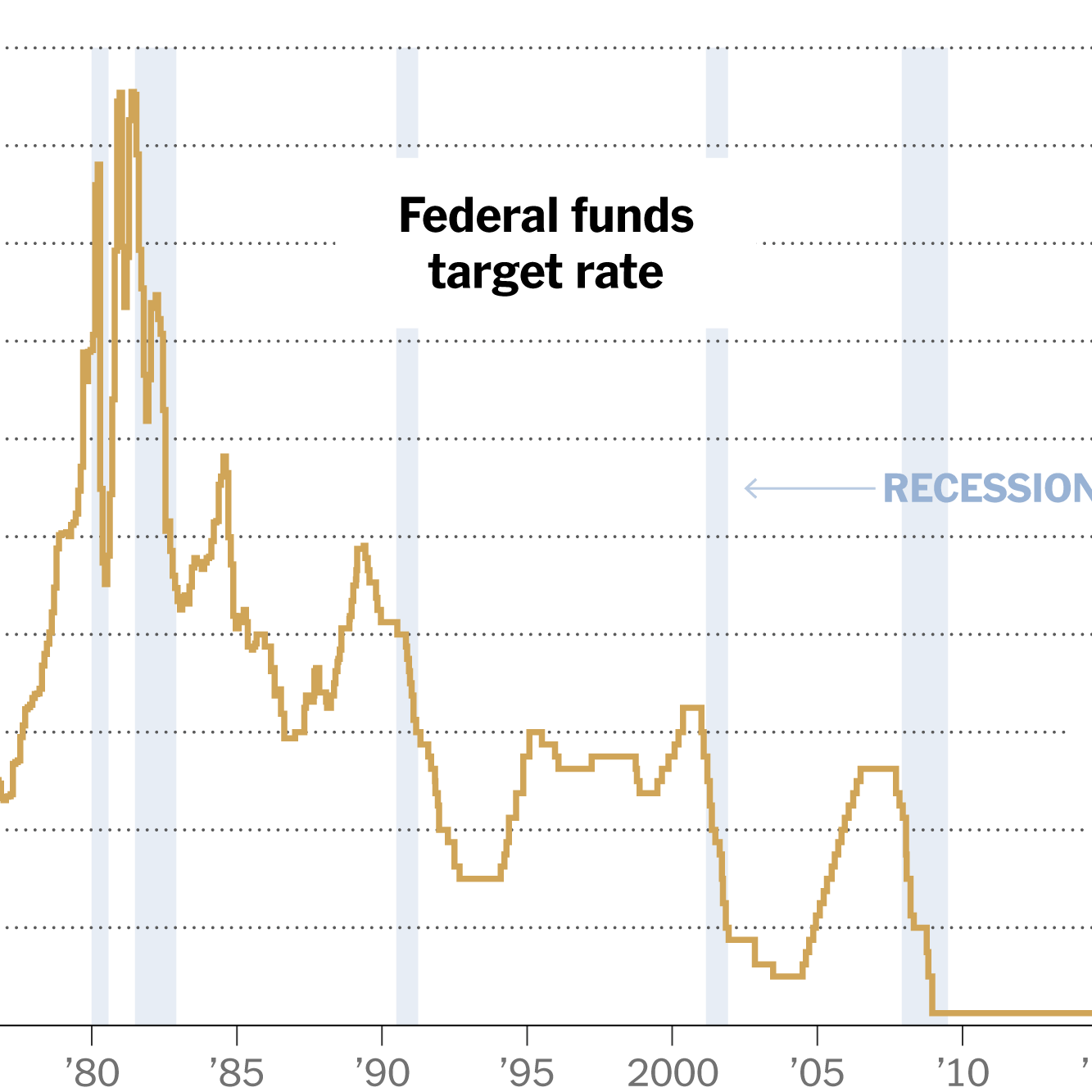

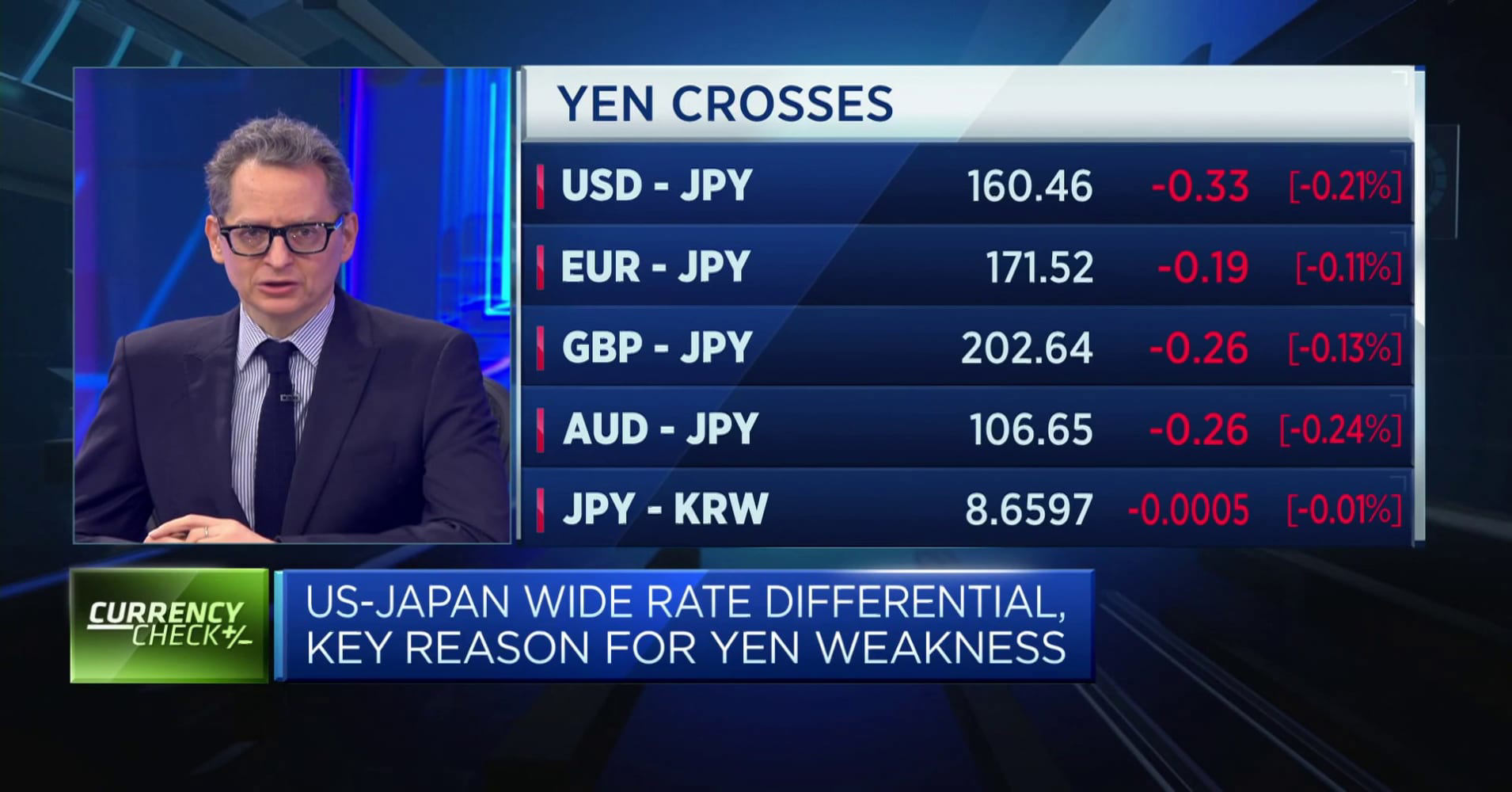

Navigating Monetary Policy in a High-Inflation Environment

Balancing economic growth with inflation control will be a key challenge for the next Fed Chair. Strategies to combat inflation may include:

- Interest rate hikes: Increasing interest rates makes borrowing more expensive, potentially slowing down economic growth and reducing demand-pull inflation.

- Quantitative tightening: Reducing the Fed's balance sheet by selling assets can decrease the money supply and curb inflation.

However, aggressive monetary tightening carries risks. Raising interest rates too quickly could trigger a recession, leading to job losses and economic hardship. The next Fed Chair must carefully monitor key economic indicators:

- Consumer Price Index (CPI): Measures the average change in prices paid by urban consumers for a basket of consumer goods and services.

- Producer Price Index (PPI): Measures the average change over time in the selling prices received by domestic producers for their output.

- Unemployment rate: Indicates the percentage of the labor force that is unemployed and actively seeking employment.

Managing the National Debt: A Looming Crisis

The substantial increase in the national debt during the Trump era presents a significant long-term challenge for the US economy.

The Trump Administration's Fiscal Policies and their Impact

The combination of tax cuts and increased government spending during the Trump administration led to a significant expansion of the national debt. This debt accumulation has long-term consequences, including:

- Increased interest payments, potentially crowding out other government spending.

- Higher borrowing costs for businesses and consumers.

- Increased vulnerability to economic shocks.

Strategies for Debt Reduction and Fiscal Responsibility

The next Fed Chair may advocate for fiscal consolidation strategies, such as:

- Spending cuts: Reducing government spending in non-essential areas.

- Tax increases: Raising taxes on corporations or high-income earners.

However, implementing these measures faces significant political challenges. Balancing debt reduction with the need to maintain economic growth will require careful consideration. Failure to address the national debt could lead to:

- A sovereign debt crisis.

- Higher inflation.

- Reduced economic growth.

Preparing for Future Recessions: Proactive Measures

The next Fed Chair must be prepared to navigate potential future recessions.

Economic Vulnerability and the Risk of Recession

The US economy faces various vulnerabilities that could trigger a recession, including:

- Geopolitical instability: Conflicts and tensions around the world can negatively impact the global economy and US markets.

- Aggressive interest rate hikes: As mentioned earlier, rapid interest rate increases can stifle economic growth and lead to a recession.

- Lingering pandemic effects: Supply chain issues and lingering health concerns continue to pose economic risks.

Building Economic Resilience and Mitigation Strategies

The next Fed Chair needs to implement proactive measures to mitigate the impact of a potential recession:

- Maintaining financial stability: Ensuring the stability of the financial system through appropriate regulatory oversight.

- Supporting economic growth: Using monetary policy tools to stimulate economic activity during a downturn.

- Coordinating with fiscal policy: Working with Congress to implement fiscal measures to support the economy.

Potential policy tools for economic stabilization include:

- Lowering interest rates.

- Quantitative easing.

- Targeted fiscal stimulus.

Conclusion

The selection of the next Fed Chair is paramount given the complex economic inheritance from the Trump administration. The next chair will face significant challenges including persistent inflation, a burgeoning national debt, and the looming threat of recession. Successfully navigating these intertwined issues requires a sophisticated understanding of monetary policy, fiscal responsibility, and the ability to effectively communicate with both the public and political stakeholders. The decisions made by The Next Fed Chair will have profound and lasting consequences for the US economy. Choosing the right candidate to address these multifaceted challenges is therefore crucial for the nation's economic future. Understanding the challenges facing the next Fed Chair is a crucial step in ensuring a stable and prosperous future for the US economy.

Featured Posts

-

Cassidy Hutchinsons Fall Memoir Insights From A January 6th Key Witness

Apr 26, 2025

Cassidy Hutchinsons Fall Memoir Insights From A January 6th Key Witness

Apr 26, 2025 -

Stock Market Valuations Bof A Explains Why Investors Shouldnt Worry

Apr 26, 2025

Stock Market Valuations Bof A Explains Why Investors Shouldnt Worry

Apr 26, 2025 -

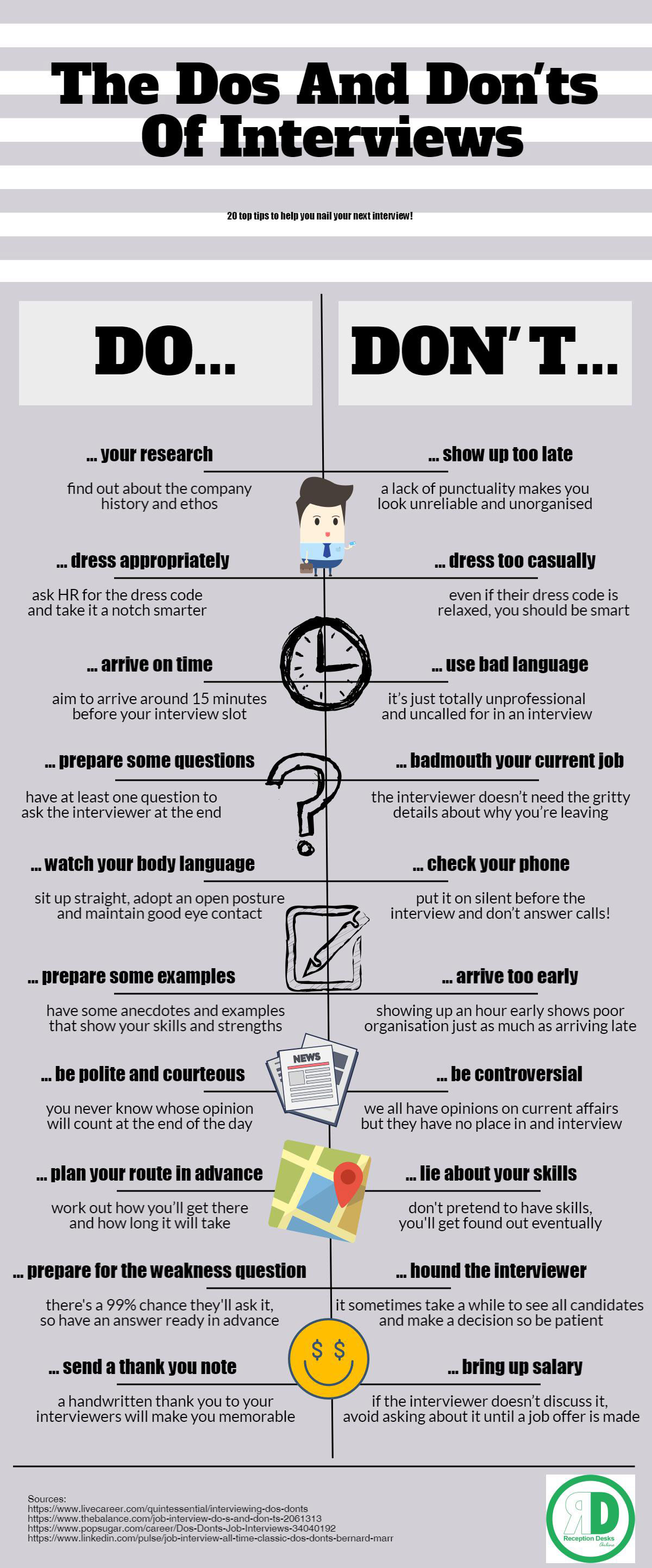

5 Tips For Success Dos And Don Ts For Private Credit Job Seekers

Apr 26, 2025

5 Tips For Success Dos And Don Ts For Private Credit Job Seekers

Apr 26, 2025 -

End Of An Era Point72 Exits Emerging Markets Trading

Apr 26, 2025

End Of An Era Point72 Exits Emerging Markets Trading

Apr 26, 2025 -

Resumption Of Construction On Worlds Tallest Abandoned Skyscraper

Apr 26, 2025

Resumption Of Construction On Worlds Tallest Abandoned Skyscraper

Apr 26, 2025