5 Tips For Success: Do's And Don'ts For Private Credit Job Seekers

Table of Contents

Tailor Your Resume and Cover Letter for Private Credit Roles

Your resume and cover letter are your first impression—make it count! In the competitive landscape of private credit, a generic application won't cut it. You need to showcase your skills and experience specifically tailored to the target role and firm.

Highlight Relevant Skills and Experience

Your resume should clearly highlight skills crucial for private credit roles. Quantifiable achievements are key to demonstrating your impact.

- Financial Modeling: Showcase proficiency in building and interpreting financial models, including discounted cash flow (DCF) analysis, leveraged buyout (LBO) modeling, and sensitivity analysis.

- Credit Analysis: Detail your experience in assessing credit risk, conducting due diligence, and preparing credit reports. Mention experience with specific credit scoring models.

- Portfolio Management: Highlight your experience in managing and monitoring credit portfolios, including performance tracking and risk mitigation.

- Software Proficiency: Emphasize your skills with essential software like Bloomberg Terminal, Argus, and other relevant financial modeling tools.

- Specific Asset Classes: Mention experience with specific asset classes such as distressed debt, mezzanine financing, senior secured loans, or other relevant private credit strategies. For example, quantify your success in a previous role – "Managed a $50 million portfolio of distressed debt, resulting in a 15% annualized return."

Research the Specific Firm and Role

Demonstrate genuine interest by showcasing your understanding of the firm's investment strategy and recent activities.

- Company Website: Thoroughly review the firm's website to understand their investment thesis, recent deals, and company culture.

- LinkedIn: Research the team members you might interview with, understanding their backgrounds and expertise.

- Press Releases and News Articles: Stay up-to-date on the firm's recent activities and announcements. Reference specific deals or initiatives in your cover letter to show you've done your homework. For instance, "I was particularly impressed by your recent investment in [Company X], which aligns perfectly with my experience in [relevant area]."

Use Keywords Strategically

Incorporate relevant keywords from job descriptions into your resume and cover letter to improve your chances of getting noticed by Applicant Tracking Systems (ATS).

- Underwriting: Highlight your experience in underwriting loans and assessing creditworthiness.

- Leveraged Finance: Mention your expertise in leveraged buyouts, debt financing, and other leveraged finance transactions.

- Debt Restructuring: If relevant, showcase experience in debt restructuring and workout situations.

- Capital Markets: Mention experience in capital markets transactions, if applicable.

Network Effectively Within the Private Credit Industry

Networking is paramount in securing a private credit job. Building genuine relationships can open doors to opportunities you might not find through online applications.

Attend Industry Events and Conferences

Industry events provide invaluable networking opportunities.

- Private Equity Conferences: Attend conferences focused on private equity and alternative investments.

- Industry-Specific Events: Seek out smaller, more focused events relevant to private credit.

- Networking Platforms: Actively utilize professional networking platforms like LinkedIn to connect with professionals in the private credit industry.

Leverage Your Existing Network

Reach out to your existing network for potential leads and referrals.

- Informational Interviews: Schedule informational interviews with people working in private credit to learn about their experiences and gain insights into the industry.

- Referrals: Ask your network for referrals to potential employers. A referral can significantly increase your chances of getting an interview.

Build Relationships

Focus on building genuine, long-term relationships, not just transactional connections.

- Follow-up Emails: Send personalized follow-up emails after networking events or meetings.

- Stay in Touch: Maintain contact with your network, even after securing a job.

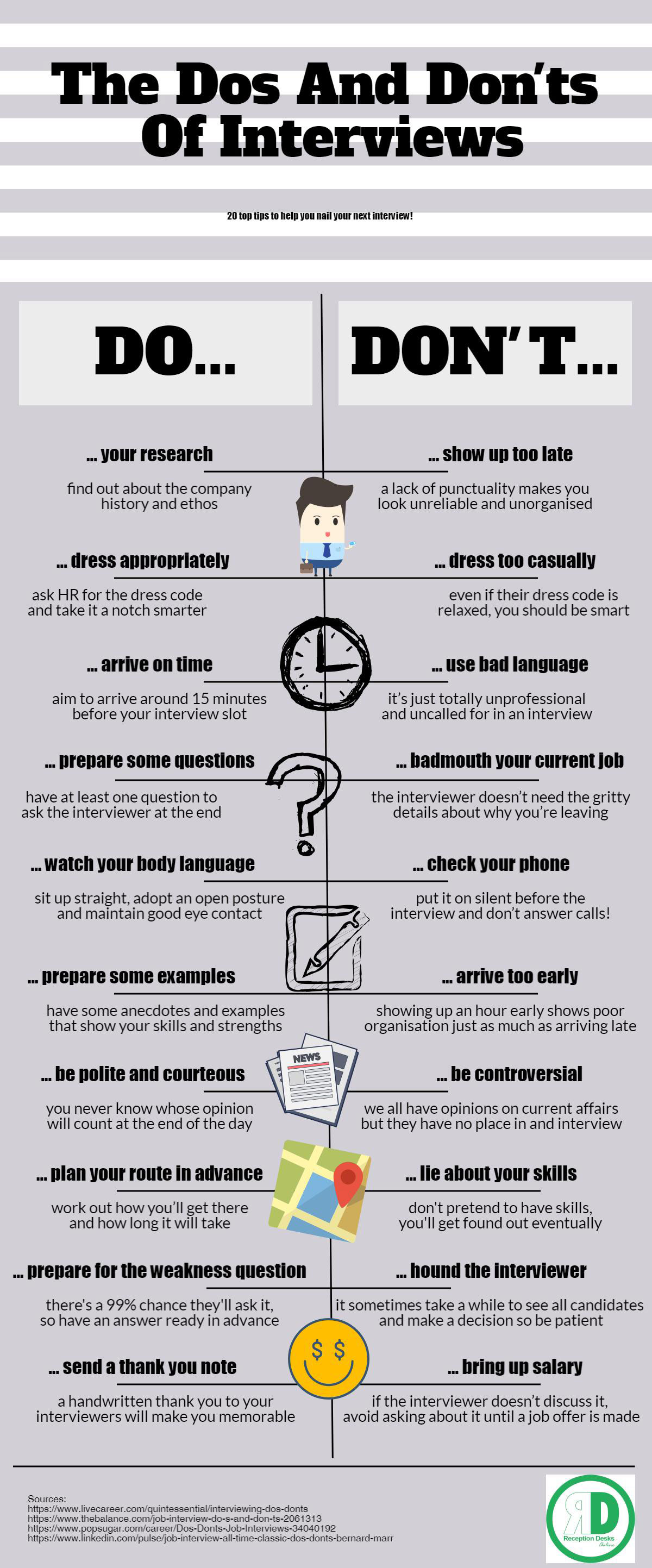

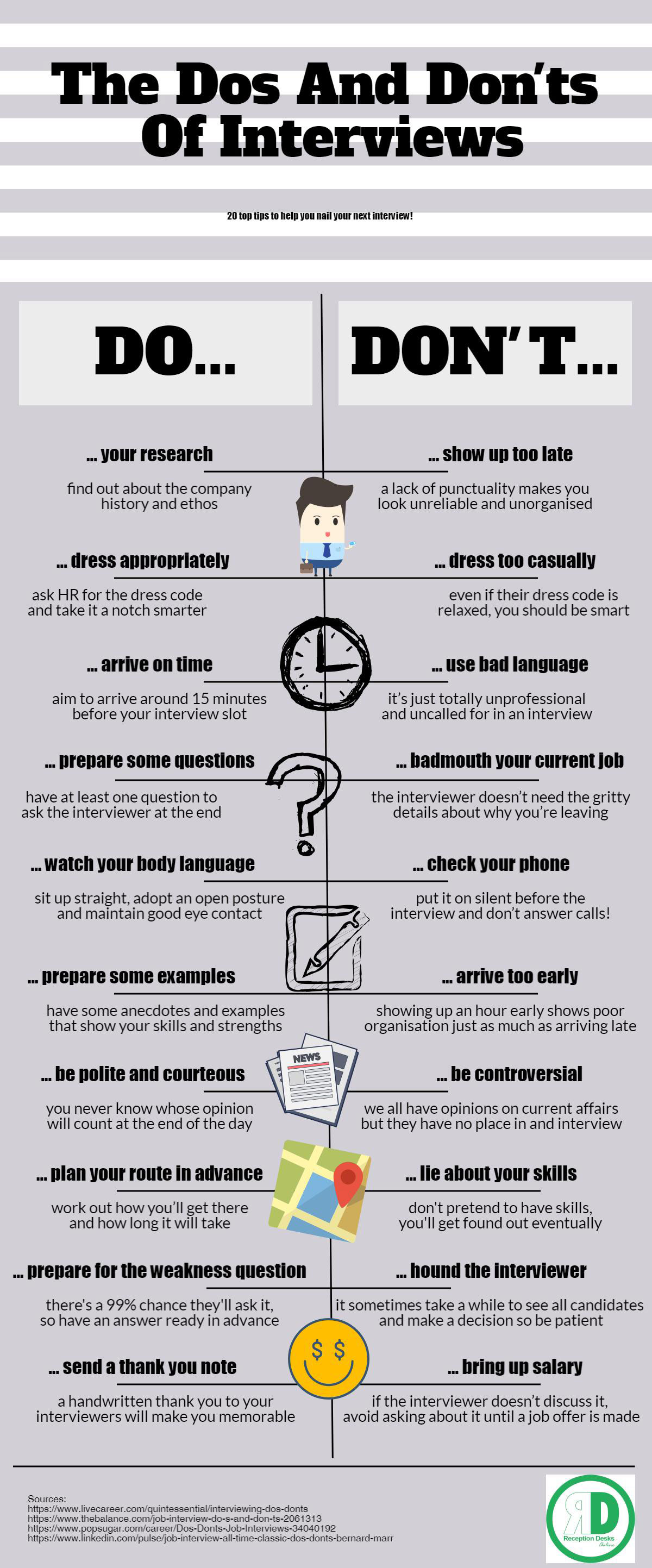

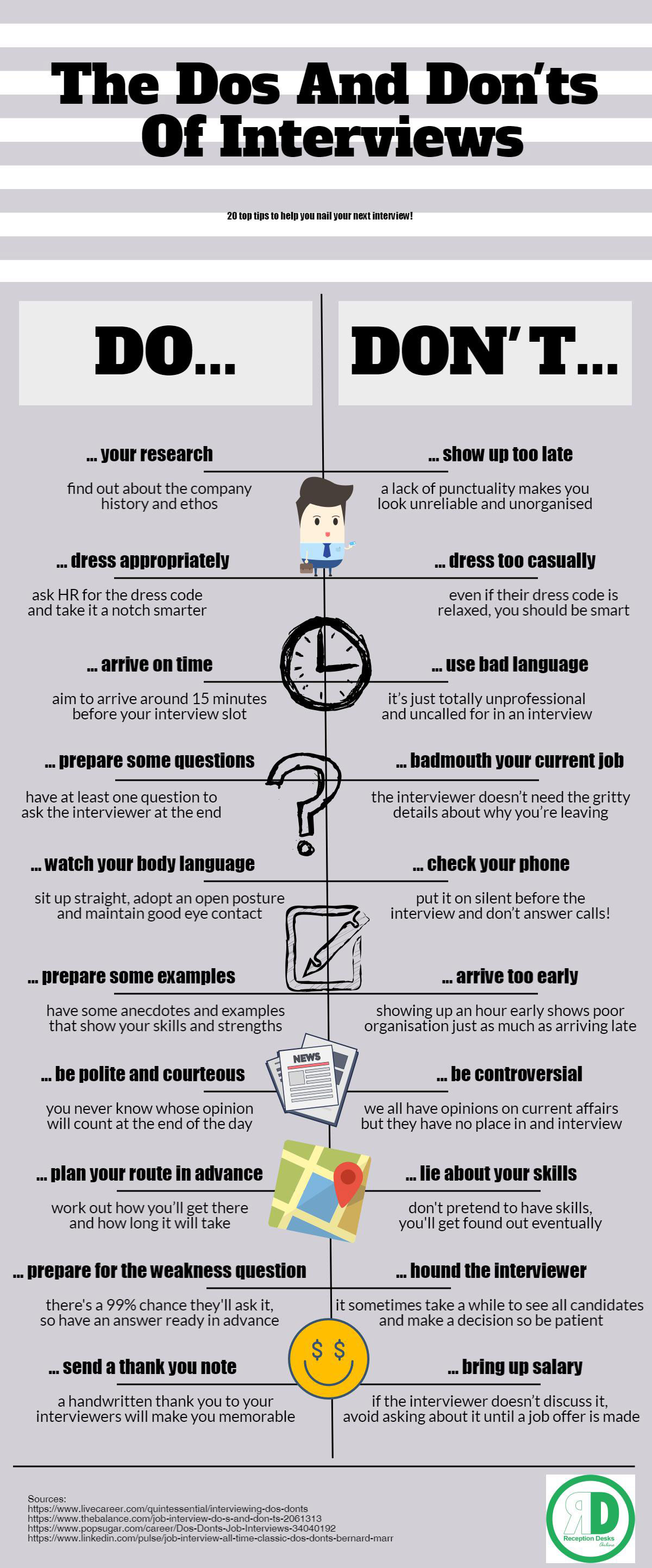

Master the Private Credit Interview Process

The interview process for private credit roles is rigorous. Preparation is key to success.

Practice Behavioral Questions

Prepare for behavioral questions that assess your problem-solving skills, teamwork abilities, and how you handle challenging situations. Use the STAR method (Situation, Task, Action, Result) to structure your responses.

- "Tell me about a time you failed."

- "Describe a situation where you had to work under pressure."

- "Give an example of a time you had to deal with a difficult colleague."

Showcase Your Technical Skills

Be ready to demonstrate your understanding of financial modeling, valuation, and credit analysis techniques. Prepare for technical questions related to your specific experience and the requirements of the role.

- "Walk me through a DCF model."

- "How would you assess the creditworthiness of a potential borrower?"

- "Explain your understanding of different types of debt instruments."

Ask Thoughtful Questions

Asking insightful questions demonstrates your genuine interest and engagement.

- "What are the firm's current investment priorities?"

- "What are the biggest challenges facing the firm right now?"

- "What opportunities for professional development are available?"

Highlight Your Unique Value Proposition

In a competitive market, you need to showcase what makes you stand out.

Identify Your Strengths

Identify the skills and experiences that differentiate you from other candidates. Quantify your achievements whenever possible.

- Exceptional analytical skills.

- Proven ability to manage complex projects.

- Strong communication and interpersonal skills.

Differentiate Yourself

Highlight unique experiences or skills that directly relate to the private credit industry.

- Experience in a specific niche within private credit (e.g., distressed debt, real estate).

- Strong academic background in finance or a related field.

- Relevant certifications (e.g., CFA, CAIA).

Communicate Your Passion

Show your genuine interest in private credit and your commitment to a long-term career in the field.

- Demonstrate your understanding of market trends and industry dynamics.

- Express enthusiasm for the specific firm and its investment strategy.

- Articulate your long-term career goals within private credit.

Common Mistakes to Avoid in Your Private Credit Job Search

Avoiding these common pitfalls can significantly improve your chances of success.

Generic Applications

Sending generic resumes and cover letters that aren't tailored to specific roles demonstrates a lack of effort and genuine interest.

- Personalize each application to reflect the specific requirements of the role and the firm's investment strategy.

Lack of Research

Not thoroughly researching the firm or the role indicates a lack of preparation and commitment.

- Conduct thorough research before applying, demonstrating your understanding of the firm's investment strategy, recent transactions, and team members.

Poor Networking

Failing to actively network within the private credit industry limits your access to potential opportunities.

- Attend industry events, leverage your existing network, and build strong professional relationships.

Insufficient Preparation

Not adequately preparing for interviews (both behavioral and technical) can significantly hurt your chances.

- Practice answering common interview questions, prepare examples to showcase your skills, and research the firm and interviewers.

Conclusion: Securing Your Dream Private Credit Job

Successfully navigating the private credit job market requires a tailored approach. Remember to tailor your resume and cover letter, network effectively, master the interview process, and highlight your unique value proposition. Avoid generic applications, lack of research, poor networking, and insufficient preparation. By implementing these five key tips, you'll significantly improve your chances of securing your dream private credit job. Start your successful private credit job search today! Use these tips to find your ideal private credit position.

Featured Posts

-

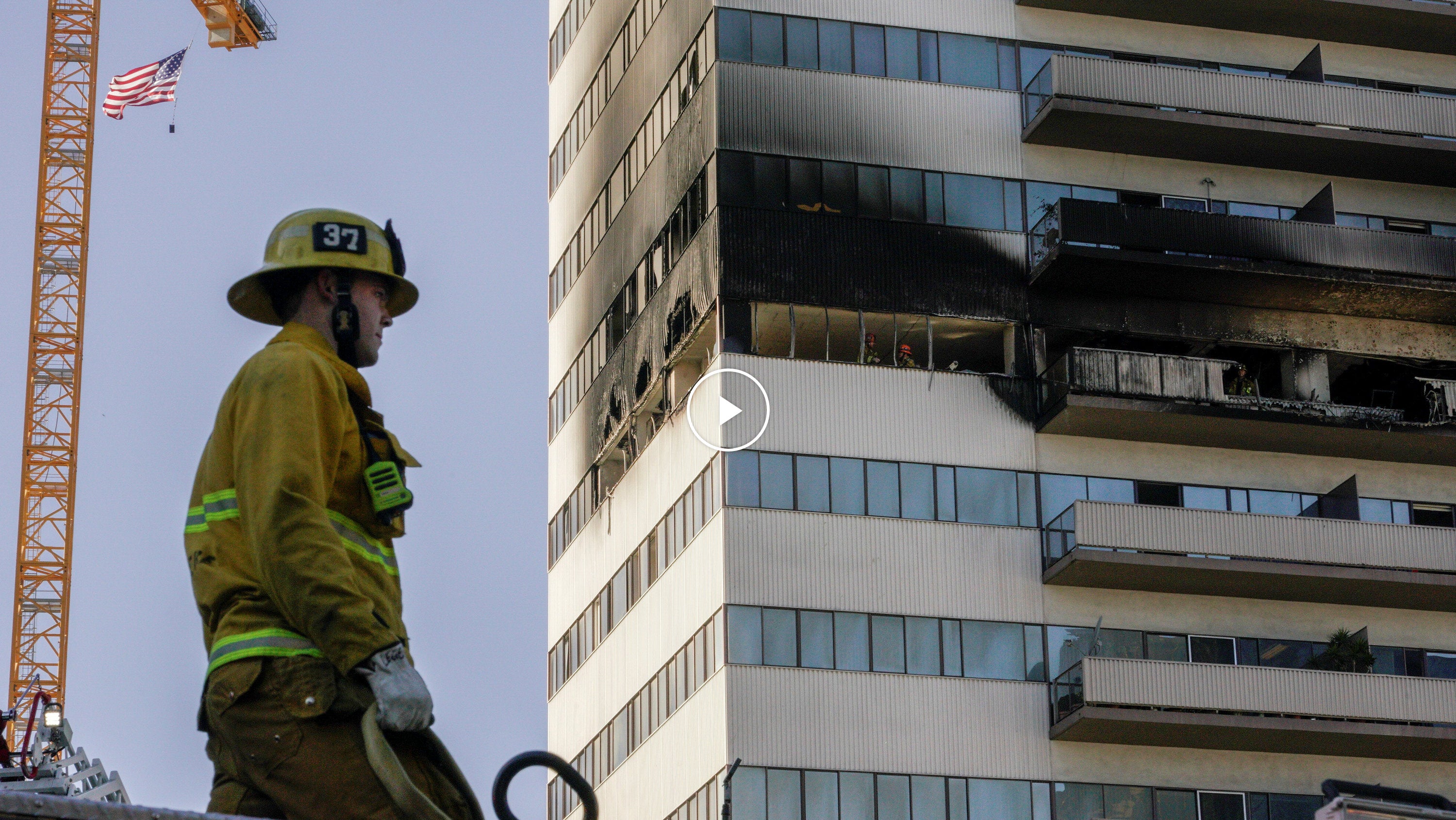

La Fire Victims Face Exploitative Rent Hikes Claims Reality Star

Apr 26, 2025

La Fire Victims Face Exploitative Rent Hikes Claims Reality Star

Apr 26, 2025 -

5 Tips For Success Dos And Don Ts For Private Credit Job Seekers

Apr 26, 2025

5 Tips For Success Dos And Don Ts For Private Credit Job Seekers

Apr 26, 2025 -

American Battleground A David Vs Goliath Showdown

Apr 26, 2025

American Battleground A David Vs Goliath Showdown

Apr 26, 2025 -

Chinas Auto Industry A Look At Its Global Impact

Apr 26, 2025

Chinas Auto Industry A Look At Its Global Impact

Apr 26, 2025 -

Chronology Of The Legal Battles In The Karen Read Murder Case

Apr 26, 2025

Chronology Of The Legal Battles In The Karen Read Murder Case

Apr 26, 2025