End Of An Era: Point72 Exits Emerging Markets Trading

Table of Contents

The Point72 Decision: Reasons Behind the Exit

Point72's departure from emerging markets trading is likely a multifaceted decision driven by a confluence of factors.

Shifting Market Dynamics

The economic and political landscape of emerging markets has become increasingly volatile in recent years. Geopolitical risks, regulatory uncertainties, and unpredictable economic shifts have created a more challenging investment environment.

- Examples: The ongoing war in Ukraine, escalating tensions in the Taiwan Strait, and political instability in several Latin American countries have all contributed to increased uncertainty. Specific countries heavily impacted include Ukraine, Russia, and several nations in South America.

- Detailed Explanation: This heightened volatility translates into significantly higher risk for investors. Unforeseen events can dramatically impact returns, potentially leading to substantial losses. The complexity of navigating these shifting political and economic sands makes emerging market investments far riskier than they were previously, leading many firms to re-evaluate their strategies. Furthermore, regulatory changes in various emerging markets have added another layer of complexity, increasing compliance costs and reducing profitability for some firms.

Internal Strategy Adjustments

Beyond external factors, Point72's decision likely reflects internal strategic adjustments. The firm may be realigning its portfolio to focus on areas perceived as offering more consistent returns and lower risk.

- Internal Shifts: Reports suggest a potential shift in Point72's investment priorities towards technology and private equity, sectors considered to offer potentially higher growth and more stable returns in the current environment. There have also been no major leadership changes directly cited as a cause for this decision.

- Detailed Explanation: This realignment signifies a shift in investment philosophy, prioritizing stability and consistent returns over potentially higher but riskier gains in emerging markets. This is a common strategy employed by many firms during periods of high global uncertainty. This internal refocusing may have led the firm to deem its emerging markets portfolio less aligned with its overall strategic goals.

Performance and Profitability

Point72's recent performance in emerging markets trading is crucial to understanding their exit strategy. While specific figures haven't been publicly released, it's plausible that underperformance or reduced profitability played a role in the decision.

- Performance Data: (Note: Access to precise data on Point72's emerging market performance is limited due to the private nature of the firm. Further research into available financial news sources could potentially unearth more specific data). Any available data should be sourced and cited accordingly.

- Detailed Explanation: If the returns in emerging markets fell short of expectations or profitability margins were squeezed due to increased volatility and risk, the decision to withdraw would be a logical business move to protect capital and optimize overall portfolio performance.

Impact on Emerging Markets and Investors

Point72's withdrawal has significant implications for emerging markets and the broader investor community.

Reduced Investment Flows

Point72's investment in emerging markets was substantial; its absence will likely reduce capital flows into these economies.

- Scale of Investment: While the exact figures remain undisclosed, Point72's presence was undoubtedly considerable, contributing to market liquidity and overall investment sentiment.

- Detailed Explanation: Reduced investment flows could negatively impact smaller emerging market economies that heavily rely on foreign direct investment for economic growth and development. This could lead to slower economic expansion and potentially exacerbate existing challenges.

Opportunities for Other Players

Point72's exit creates a vacuum in the emerging markets investment landscape. Other firms are likely to see this as an opportunity to expand their presence.

- Potential Competitors: Firms such as Renaissance Technologies, Citadel, and Millennium Management could potentially increase their investments in the sectors previously occupied by Point72.

- Detailed Explanation: This shift could lead to increased competition among investment firms vying for opportunities in emerging markets. This increased competition could, in turn, benefit emerging markets by potentially drawing in more capital and fostering innovation.

Investor Sentiment and Market Volatility

The announcement of Point72's withdrawal could negatively impact investor sentiment and increase market volatility in the short term.

- Market Reactions: A careful analysis of market indices related to emerging markets following the announcement would reveal any immediate reactions such as price drops or increased trading volume.

- Detailed Explanation: Investor confidence in emerging markets might waver, potentially leading to capital flight and increased price fluctuations. However, the long-term impact is harder to predict and depends on various factors, including overall global economic conditions and the reactions of other major investors.

Conclusion

Point72's decision to exit emerging markets trading marks a significant turning point. The move reflects the increasing complexity and risk associated with emerging market investments, driven by geopolitical uncertainty and shifting economic landscapes. This withdrawal will undoubtedly impact capital flows, investor sentiment, and the competitive dynamics within the industry. The long-term implications remain to be seen, but it's clear that this decision represents a substantial shift in the approach to emerging market investments.

To stay informed about the evolving landscape of Point72 Emerging Markets Trading and its broader implications for global finance, we encourage readers to follow reputable financial news outlets and conduct further research on the topic. Understanding these dynamics is crucial for both seasoned investors and those just beginning to explore the complexities of the global financial system.

Featured Posts

-

How California Became The Worlds Fourth Largest Economy

Apr 26, 2025

How California Became The Worlds Fourth Largest Economy

Apr 26, 2025 -

Ai And Human Design A Conversation With Microsofts Chief Designer

Apr 26, 2025

Ai And Human Design A Conversation With Microsofts Chief Designer

Apr 26, 2025 -

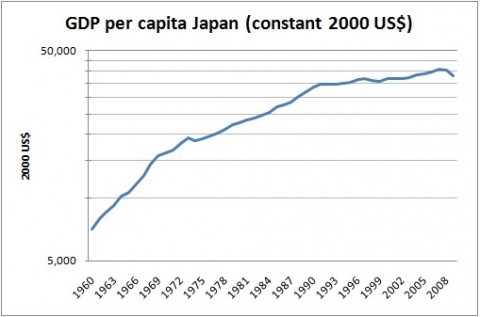

Californias Economic Rise Overtaking Japans Gdp

Apr 26, 2025

Californias Economic Rise Overtaking Japans Gdp

Apr 26, 2025 -

Abb Vie Abbv Raises Profit Outlook On Strong New Drug Sales

Apr 26, 2025

Abb Vie Abbv Raises Profit Outlook On Strong New Drug Sales

Apr 26, 2025 -

Is Betting On Natural Disasters Like The La Wildfires The New Normal

Apr 26, 2025

Is Betting On Natural Disasters Like The La Wildfires The New Normal

Apr 26, 2025