Stock Market Valuations: BofA Explains Why Investors Shouldn't Worry

Table of Contents

BofA's Key Arguments Against Excessive Valuation Concerns

BofA's analysis goes beyond simply looking at traditional metrics like price-to-earnings ratios (P/E ratios) to determine if the stock market is overvalued. Their assessment incorporates a broader perspective, considering several key factors.

Considering the Broader Economic Context

BofA's approach to stock market valuation analysis is holistic. They don't solely rely on price-to-earnings ratios or other single valuation metrics. Instead, their analysis considers a wider economic context:

- Analysis considers factors beyond traditional valuation metrics: They incorporate factors like macroeconomic indicators, industry trends, and company-specific fundamentals.

- Macroeconomic forecasts are integrated into the valuation assessment: This includes projections for economic growth, inflation, and interest rates. Understanding future economic conditions is critical for predicting future earnings.

- Emphasis on long-term growth potential rather than short-term fluctuations: BofA focuses on the long-term potential of companies and the overall market, rather than reacting to daily price swings.

- Discussion of the impact of monetary policy on equity valuations: The Federal Reserve's actions, such as interest rate adjustments, significantly influence market valuations. BofA’s analysis considers these impacts.

The Importance of Earnings Growth

A key element of BofA's argument is the projected robust earnings growth of many companies. They believe this growth justifies current valuations, even in the face of market uncertainty:

- Focus on companies with strong earnings potential and growth trajectories: BofA identifies companies poised for future earnings expansion.

- Examination of industry-specific growth drivers and their impact on valuations: Certain sectors are better positioned for growth than others; BofA’s analysis accounts for this.

- Comparison of current earnings growth to historical trends: Placing current growth within a historical context provides valuable perspective.

- Discussion of how earnings revisions affect market sentiment and valuations: Positive earnings surprises can boost market confidence and valuations.

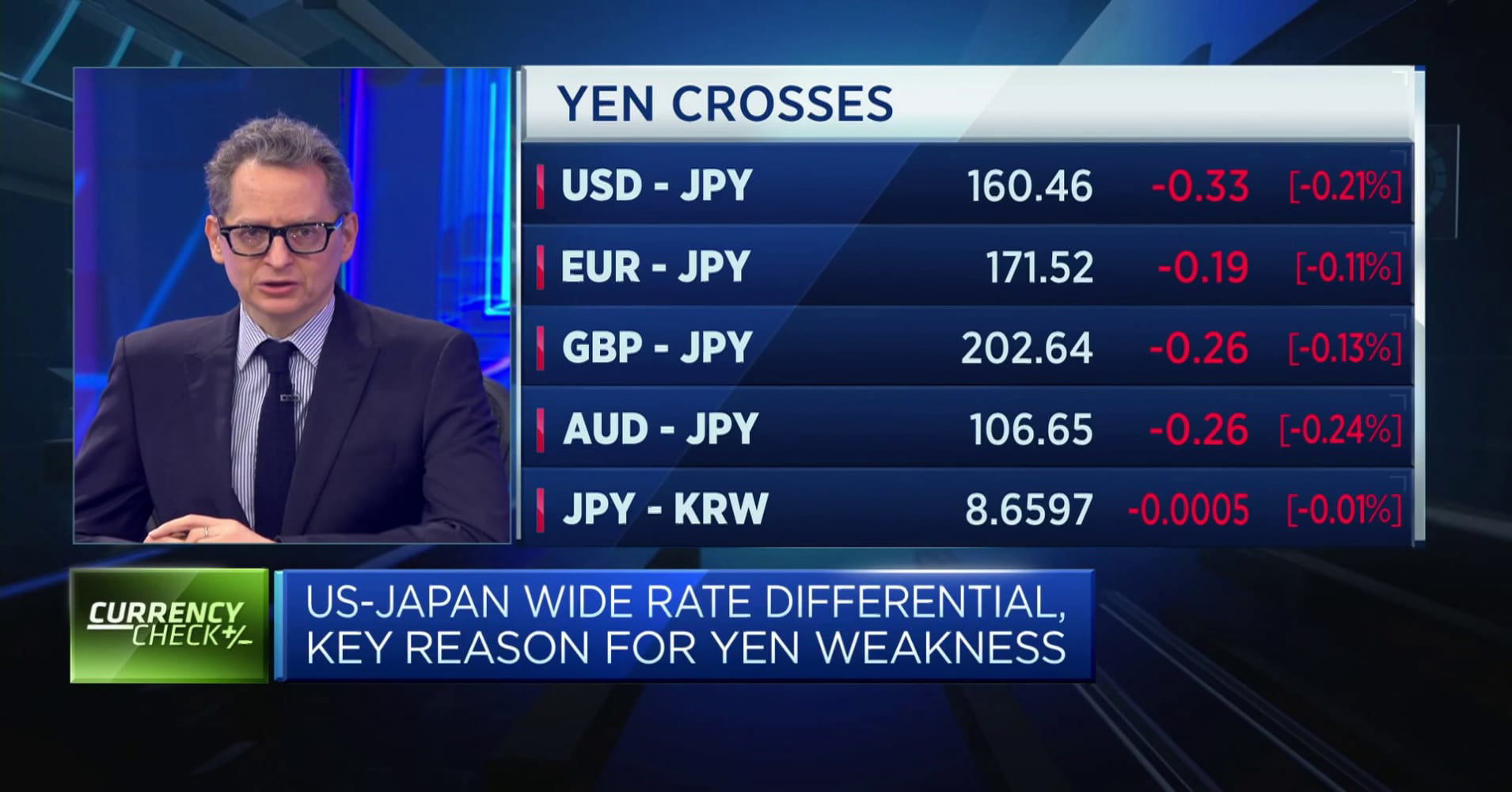

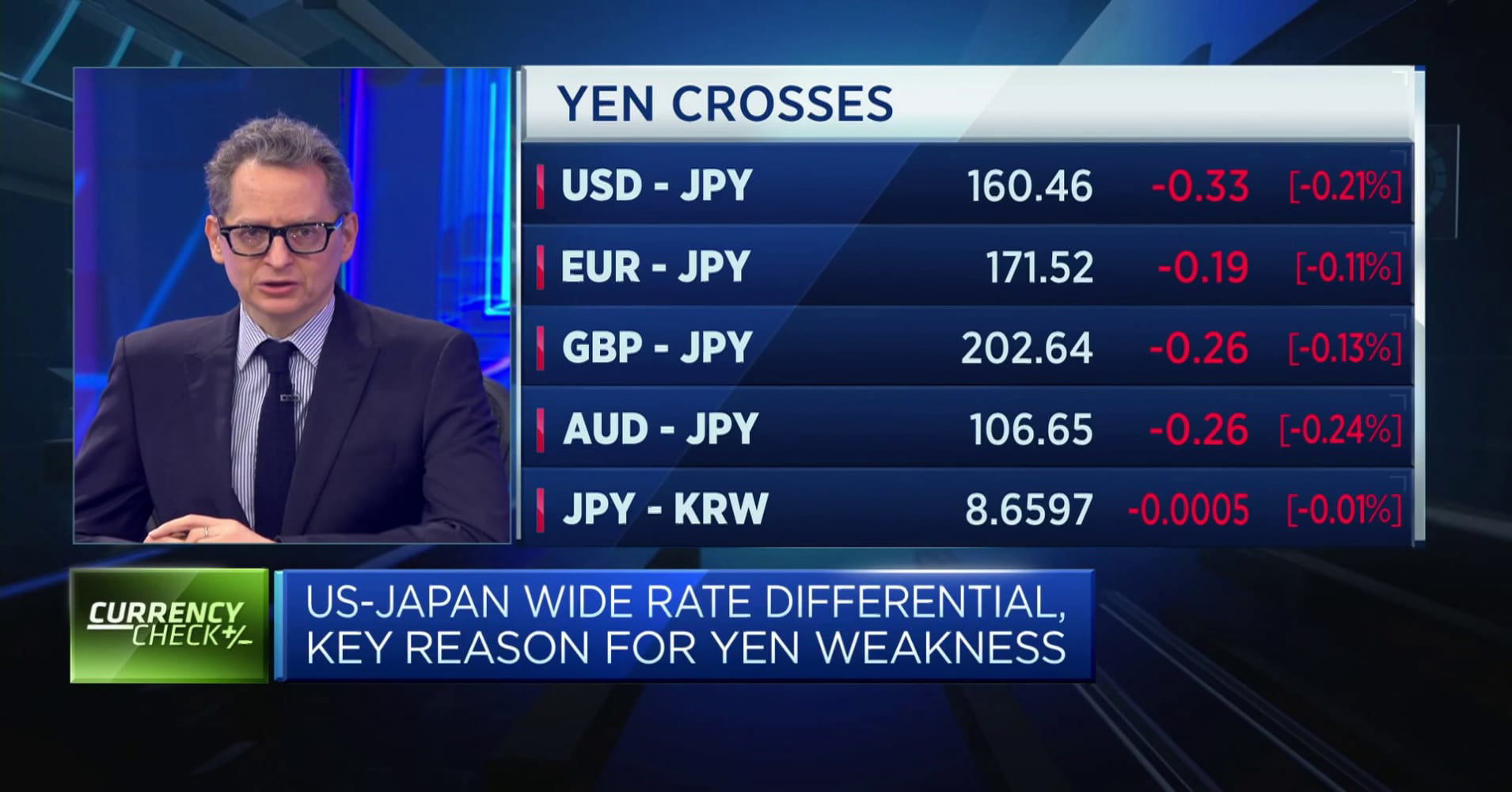

The Role of Interest Rates in Valuation

Rising interest rates are a major concern for investors. BofA addresses this, offering a balanced perspective on their impact on stock valuations:

- Analysis of the relationship between interest rates and discounted cash flow valuations: Higher interest rates discount future cash flows, potentially lowering valuations.

- Explanation of how higher rates might affect future earnings growth: Increased borrowing costs can impact company profitability.

- Discussion of the impact of interest rate hikes on different sectors: Some sectors are more sensitive to interest rate changes than others.

- Assessment of the overall impact of interest rate changes on market valuations: BofA provides an overall assessment of the effect of interest rate policy on market valuation.

Long-Term Investment Strategies and Risk Management

BofA emphasizes the importance of a long-term investment strategy to weather short-term market volatility. This involves both a strategic mindset and effective risk management.

Maintaining a Long-Term Perspective

Avoiding knee-jerk reactions is crucial for long-term investment success. BofA advocates for patience and discipline:

- Advantages of a buy-and-hold investment strategy: A buy-and-hold approach allows investors to benefit from long-term growth, even during periods of market decline.

- Strategies for mitigating risk in a volatile market: Diversification, dollar-cost averaging, and stop-loss orders are crucial tools.

- Importance of diversification across asset classes: Spreading investments across different asset classes (stocks, bonds, real estate, etc.) reduces overall portfolio risk.

- The role of patience and discipline in long-term investment success: Emotional decision-making often leads to poor investment outcomes.

Diversification and Portfolio Rebalancing

Diversification and regular rebalancing are key to managing risk and maximizing returns:

- Strategies for optimizing portfolio diversification: Consider diversification across sectors, market capitalization, and geographic regions.

- Importance of regular portfolio rebalancing: Rebalancing helps maintain your desired asset allocation and reaps benefits from market fluctuations.

- Asset allocation strategies suitable for different risk tolerances: Your investment strategy should align with your personal risk tolerance and financial goals.

- The role of professional financial advice in portfolio management: A financial advisor can provide personalized guidance on building and managing your portfolio.

Conclusion

While concerns about stock market valuations are understandable given recent volatility, BofA's analysis offers a more measured perspective. By considering broader economic factors, focusing on long-term earnings growth, and adopting a disciplined investment strategy, investors can navigate current market conditions effectively. Don't let short-term market fluctuations dictate your long-term investment strategy. Learn more about understanding and managing your own stock market valuations and how to build a resilient investment portfolio. Understanding how to properly analyze stock market valuations is crucial for long-term success.

Featured Posts

-

The Mississippi Deltas Visual Scope In Sinners A Cinematographers Perspective

Apr 26, 2025

The Mississippi Deltas Visual Scope In Sinners A Cinematographers Perspective

Apr 26, 2025 -

Memoir Planned Cassidy Hutchinson Reflects On Her January 6th Testimony

Apr 26, 2025

Memoir Planned Cassidy Hutchinson Reflects On Her January 6th Testimony

Apr 26, 2025 -

The Zuckerberg Trump Dynamic Impact On Tech And Politics

Apr 26, 2025

The Zuckerberg Trump Dynamic Impact On Tech And Politics

Apr 26, 2025 -

Open Ais 2024 Developer Event Easier Voice Assistant Creation

Apr 26, 2025

Open Ais 2024 Developer Event Easier Voice Assistant Creation

Apr 26, 2025 -

White House Cocaine Incident Secret Service Concludes Probe

Apr 26, 2025

White House Cocaine Incident Secret Service Concludes Probe

Apr 26, 2025