Posthaste: How A Canadian Travel Boycott Affects The American Economy

Table of Contents

The Tourism Sector Takes a Hit

A significant impact of a Canadian travel boycott would be felt immediately within the American tourism sector. Millions of Canadians cross the border annually, contributing significantly to the US economy. A reduction in this flow would have devastating consequences.

Reduced Spending in Border States: States directly bordering Canada, such as Washington, New York, Montana, and Vermont, would be hit particularly hard.

- Loss of revenue: Hotels, restaurants, attractions, and retail businesses reliant on Canadian tourism would experience a sharp decline in revenue. Think of the small businesses in towns like Blaine, Washington, or Niagara Falls, New York, that cater specifically to Canadian visitors. Their survival could be at stake.

- Job losses: The tourism and hospitality industries in these border states would face significant job losses, impacting families and communities. This could ripple outwards affecting related jobs, from transportation to local suppliers.

- Reduced tax revenue: State and local governments would see a substantial decrease in tax revenue, impacting public services and infrastructure projects.

Decreased Demand for Flights and Transportation: A reduced number of Canadian travelers would lead to a significant drop in demand for air travel, bus services, and other transportation options between the two countries.

- Lower profits for airlines: Airlines like Air Canada and Delta, heavily reliant on transborder routes, would face lower profits, potentially leading to route cancellations or reduced service frequency.

- Impact on related industries: Airport services, fuel providers, and other businesses supporting the transportation sector would also experience a decline in activity.

Ripple Effects Across Related Industries

The economic consequences of a Canadian travel boycott would extend far beyond the tourism sector, impacting numerous related industries.

Impact on Retail and Shopping: Canadian tourists contribute significantly to American retail sales. A boycott would directly affect this spending power.

- Decline in sales: Retail businesses, especially those near the border, would see a decline in sales. This would impact everything from large department stores to smaller boutiques.

- Impact on e-commerce: E-commerce businesses selling to Canadian customers would also experience a drop in sales. The convenience of online shopping doesn't negate the impact of a reduced customer base.

- Potential for price increases: Some American businesses might attempt to compensate for lost revenue through price increases, further impacting consumers.

The Entertainment Industry's Losses: The American entertainment industry, including sporting events, concerts, and theme parks, would suffer from a reduction in Canadian attendance.

- Fewer ticket sales: Lower attendance at events would lead to fewer ticket sales, impacting venues and event organizers.

- Reduced merchandise sales: Lower attendance also translates to reduced merchandise sales, impacting another revenue stream for entertainment companies.

- Impact on related industries: Hotels and restaurants near entertainment venues would also feel the pinch, as Canadian tourists would no longer be contributing to their revenue.

Economic Modeling and Forecasting

Predicting the exact economic impact of a Canadian travel boycott requires sophisticated economic modeling and forecasting techniques.

Analyzing the Economic Impact: Economists would use various methods to assess the potential damage.

- Relevant economic indicators: Key economic indicators like GDP, employment rates, and consumer spending would be closely monitored.

- Different scenarios: Models would explore various scenarios, from a mild boycott to a widespread and prolonged one, to gauge the potential range of economic consequences.

- Economic mitigation strategies: Researchers would also explore potential mitigation strategies to lessen the negative impact on the American economy.

Geopolitical Considerations

A Canadian travel boycott transcends mere economics; it carries significant geopolitical implications.

Beyond Economics: The impact extends beyond financial losses.

- Trade negotiations: A boycott could negatively affect ongoing or future trade negotiations between the two countries, potentially leading to trade barriers or disputes.

- Impact on diplomatic relations: Such an action would strain diplomatic relations, impacting overall cooperation on various issues.

- Public opinion and political fallout: The boycott would likely trigger public debate and political fallout in both countries, further complicating the relationship.

Conclusion

A Canadian travel boycott would negatively impact various sectors of the American economy, leading to job losses, reduced revenue, and broader economic consequences. Border states and related industries would be particularly vulnerable. Understanding the potential impact of a Canadian travel boycott is crucial for maintaining a healthy US-Canada economic relationship. Further research and proactive strategies are needed to mitigate potential economic damage and preserve the strong economic ties between the two nations. We must understand the interconnectedness of our economies to prevent and address potential disruptions like a Canadian travel boycott.

Featured Posts

-

Beyond Bmw And Porsche A Broader Look At The Challenges Facing Foreign Automakers In China

Apr 27, 2025

Beyond Bmw And Porsche A Broader Look At The Challenges Facing Foreign Automakers In China

Apr 27, 2025 -

Napoleon Grills Ceos Commitment To Canadian Sourcing

Apr 27, 2025

Napoleon Grills Ceos Commitment To Canadian Sourcing

Apr 27, 2025 -

German Renewables Expansion Pne Group Receives Permits For Wind And Solar Projects

Apr 27, 2025

German Renewables Expansion Pne Group Receives Permits For Wind And Solar Projects

Apr 27, 2025 -

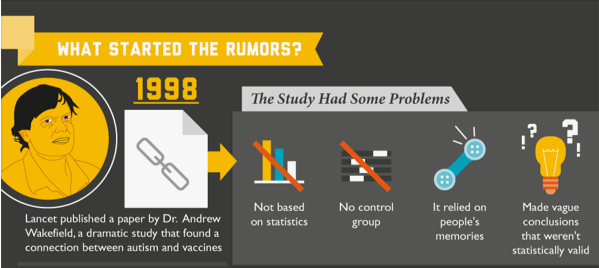

Federal Study On Immunizations And Autism Concerns Raised By Skeptics Leadership

Apr 27, 2025

Federal Study On Immunizations And Autism Concerns Raised By Skeptics Leadership

Apr 27, 2025 -

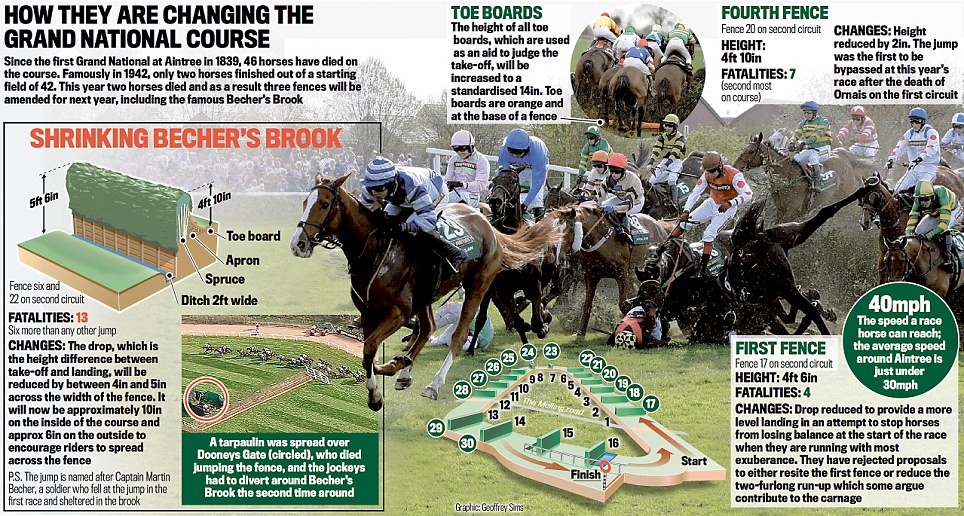

Grand National 2025 Examining The History Of Horse Fatalities

Apr 27, 2025

Grand National 2025 Examining The History Of Horse Fatalities

Apr 27, 2025

Latest Posts

-

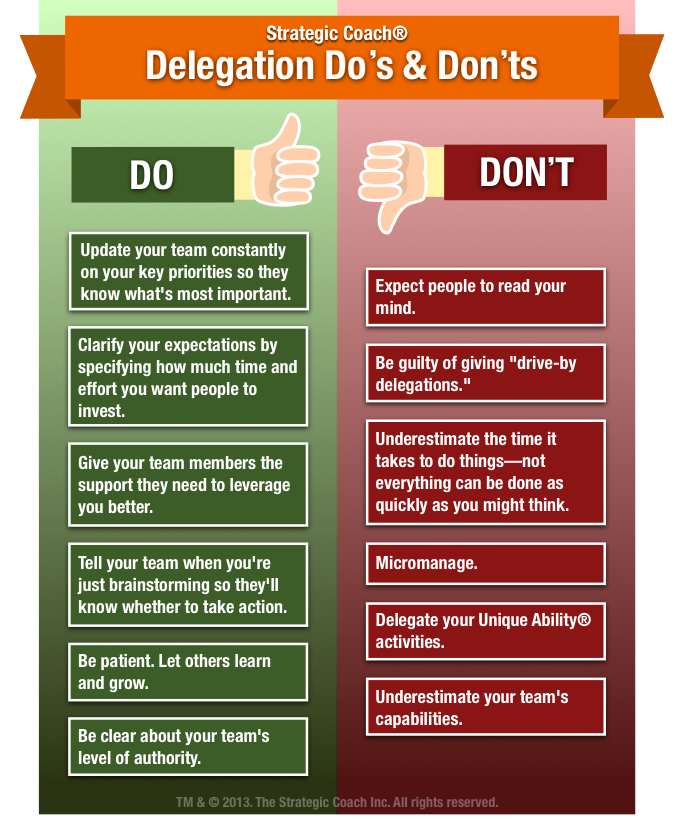

Private Credit Jobs 5 Dos And Don Ts To Get Hired

Apr 28, 2025

Private Credit Jobs 5 Dos And Don Ts To Get Hired

Apr 28, 2025 -

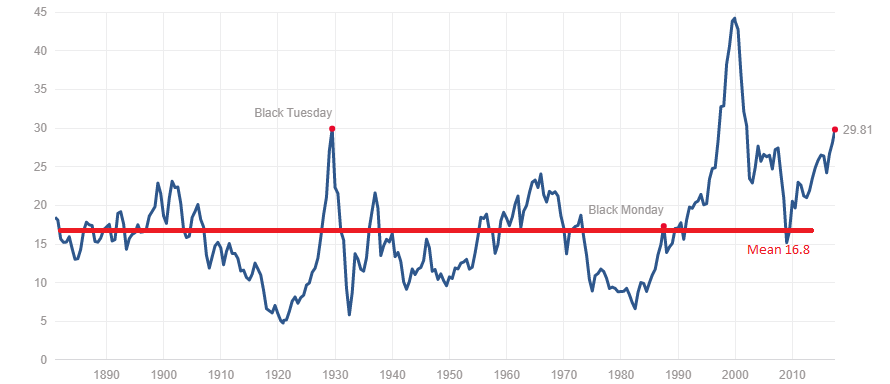

Stock Market Valuation Concerns Bof As Perspective And Reassurance For Investors

Apr 28, 2025

Stock Market Valuation Concerns Bof As Perspective And Reassurance For Investors

Apr 28, 2025 -

Bof A Reassures Investors Why Current Market Valuations Are Not A Threat

Apr 28, 2025

Bof A Reassures Investors Why Current Market Valuations Are Not A Threat

Apr 28, 2025 -

Are High Stock Market Valuations A Concern Bof A Says No

Apr 28, 2025

Are High Stock Market Valuations A Concern Bof A Says No

Apr 28, 2025 -

Bof As Take Why High Stock Market Valuations Shouldnt Worry Investors

Apr 28, 2025

Bof As Take Why High Stock Market Valuations Shouldnt Worry Investors

Apr 28, 2025