BofA Reassures Investors: Why Current Market Valuations Are Not A Threat

Table of Contents

BofA's Strong Financial Position and Growth Projections

BofA's unwavering confidence stems from its robust financial health and positive growth projections. The bank's recent earnings reports showcase impressive results, reflecting a strong balance sheet and consistent profitability. This solid foundation underpins their optimistic outlook for the future. Their projected growth for the coming quarters and years is fueled by several key factors:

- Strong Loan Growth: BofA is experiencing significant growth in its loan portfolio, indicating increased demand for credit and a healthy economic environment, at least in specific sectors.

- Increased Investment Banking Activity: Despite market uncertainty, BofA's investment banking division continues to see strong activity, reflecting ongoing corporate dealmaking and capital market transactions.

- Positive Outlook for Consumer Spending: While inflation remains a concern, BofA's analysis suggests a resilient consumer sector, with continued spending fueling economic growth. This suggests a healthy underlying economy that could weather short-term shocks.

These positive indicators solidify BofA's belief that the current market valuations are not only sustainable but potentially represent attractive investment opportunities.

Addressing Market Concerns: A Macroeconomic Perspective

While acknowledging the macroeconomic challenges impacting market sentiment – inflation, interest rate hikes, and geopolitical instability – BofA offers a nuanced perspective. Their analysis suggests these factors are being overblown by some market participants, leading to possibly unwarranted pessimism in the valuation of many assets. BofA's long-term perspective is crucial here:

- Inflation is Expected to Ease: BofA's economists predict a gradual decline in inflation rates as supply chain issues resolve and monetary policy takes effect.

- Interest Rate Hikes Are Nearing Their Peak: The bank anticipates that the current cycle of interest rate increases by central banks is nearing its end, mitigating further negative impacts on market valuations.

- Long-Term Growth Potential Remains Strong: Despite short-term headwinds, BofA maintains a positive outlook on long-term economic growth, driven by technological advancements and emerging market expansion. This long-term perspective is vital to understanding their confidence.

By carefully considering these factors, BofA concludes that the current market conditions do not represent an existential threat to long-term investment strategies.

Strategic Investment Opportunities Highlighted by BofA

Despite the market's volatility, BofA identifies several compelling investment opportunities. Their analysis points to specific sectors and asset classes positioned for growth, even in the current climate. This is where investors can capitalize on current valuations.

- Technology Sector Poised for Growth: BofA believes the technology sector remains a key driver of long-term growth, with opportunities in artificial intelligence, cloud computing, and cybersecurity.

- Emerging Market Opportunities: BofA highlights attractive investment opportunities in emerging markets, recognizing their significant growth potential and relatively lower valuations.

- Value Stocks Undervalued in the Current Market: The bank points to certain value stocks as being undervalued, presenting attractive entry points for long-term investors.

These strategic recommendations demonstrate BofA's proactive approach to identifying value within the current market dynamics and building a diversified portfolio.

BofA's Expertise and Track Record

BofA's confidence isn't merely conjecture; it's grounded in decades of experience and proven analytical capabilities. As a global financial powerhouse, BofA boasts a wealth of expertise in navigating various market cycles, building a strong reputation and a track record of success. Their deep understanding of the financial markets and sophisticated analytical tools allows them to provide well-informed insights and guidance to investors. Their ability to weather previous market storms enhances the credibility of their current reassuring message.

Conclusion: Why You Should Trust BofA's Reassurance

BofA's reassurance regarding current market valuations is based on a thorough analysis of macroeconomic factors, their robust financial position, and a long-term investment perspective. Their confidence is further bolstered by their identification of compelling investment opportunities and their impressive track record in navigating complex market dynamics. Don't let market volatility deter you. Learn more about BofA's investment strategies and gain confidence in your portfolio decisions. Consider BofA's market analysis and explore the investment opportunities highlighted in their investor reassurance. BofA's investment outlook provides a valuable framework for navigating the current financial landscape.

Featured Posts

-

Surveillance Footage Confusion And Chaos Before Shooting Of Weezer Bassists Wife

Apr 28, 2025

Surveillance Footage Confusion And Chaos Before Shooting Of Weezer Bassists Wife

Apr 28, 2025 -

Astkshaf Ealm Fn Abwzby 19 Nwfmbr

Apr 28, 2025

Astkshaf Ealm Fn Abwzby 19 Nwfmbr

Apr 28, 2025 -

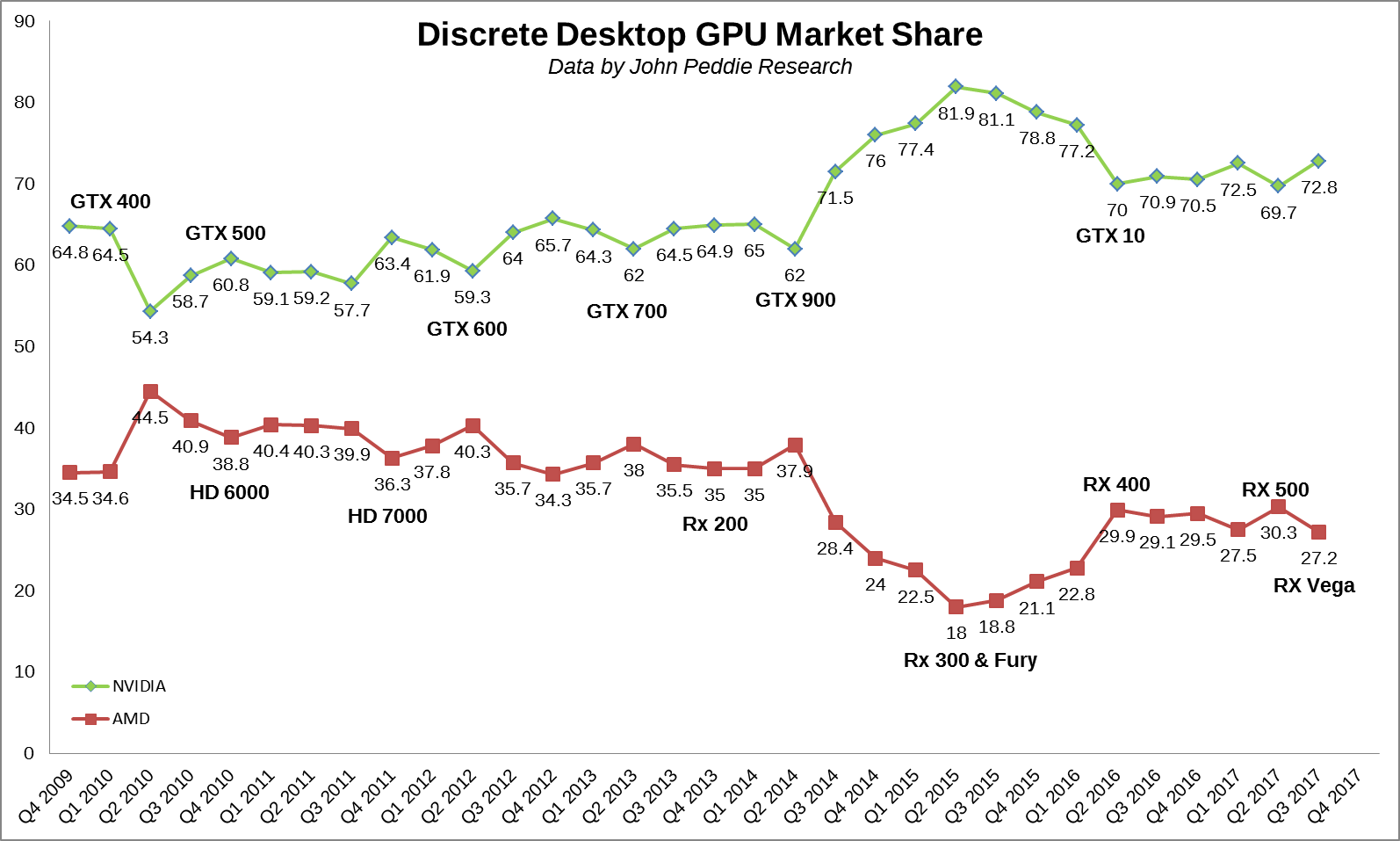

Understanding The Current Gpu Market High Prices And Their Impact

Apr 28, 2025

Understanding The Current Gpu Market High Prices And Their Impact

Apr 28, 2025 -

Monstrous Beauty A Feminist Reinterpretation Of Chinoiserie At The Met

Apr 28, 2025

Monstrous Beauty A Feminist Reinterpretation Of Chinoiserie At The Met

Apr 28, 2025 -

Red Sox Offseason Strategy Addressing The O Neill Departure In 2025

Apr 28, 2025

Red Sox Offseason Strategy Addressing The O Neill Departure In 2025

Apr 28, 2025