Private Credit Jobs: 5 Do's And Don'ts To Get Hired

Table of Contents

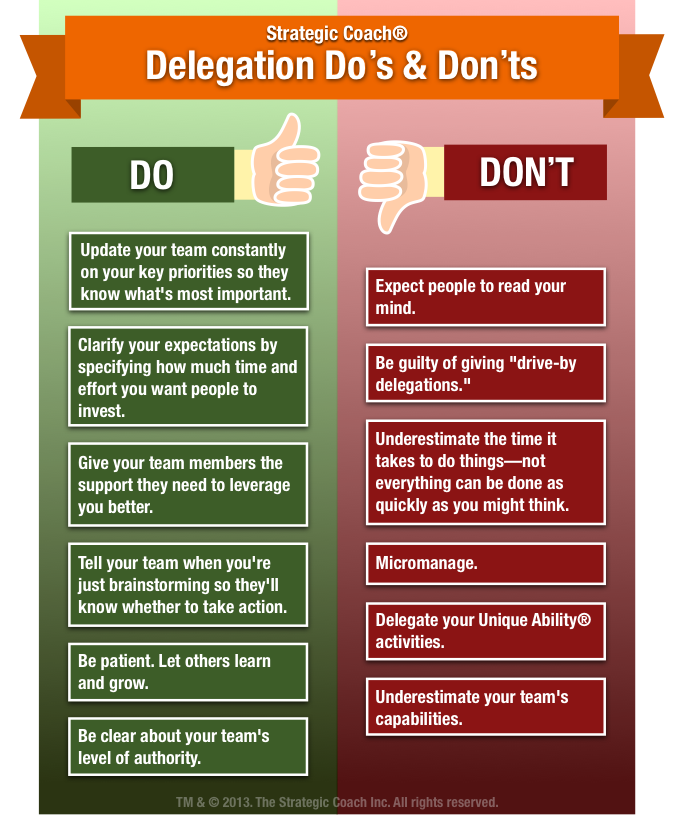

5 DOs to Land Your Dream Private Credit Job

DO 1: Master the Fundamentals of Private Credit Investing

Private credit, a significant segment of the alternative investment landscape, demands a robust understanding of its core principles. Developing a strong foundation is crucial for success in securing a private credit job. This involves:

- Understanding Private Debt Markets: Gain expertise in various private debt instruments, including leveraged loans, mezzanine financing, and direct lending. Each has its unique risk-return profile and requires a distinct analytical approach.

- Diverse Private Credit Strategies: Familiarize yourself with different investment strategies such as distressed debt (acquiring debt at a discount), real estate debt (financing real estate projects), and infrastructure debt (funding infrastructure developments). Understanding these strategies will allow you to contribute meaningfully to deal discussions.

- Staying Current: The private credit landscape is dynamic. Stay updated on market trends, regulatory changes (like LIBOR transition), and industry news by reading reputable publications like Private Debt Investor, Debtwire, and attending industry conferences and webinars.

- Obtain Relevant Certifications: Demonstrate your commitment and expertise by pursuing relevant certifications like the Chartered Financial Analyst (CFA) charter or the Chartered Alternative Investment Analyst (CAIA) designation. These credentials significantly bolster your resume for private credit jobs.

DO 2: Network Strategically within the Private Credit Industry

Networking is paramount in the private credit industry. Building relationships is crucial for uncovering hidden job opportunities and gaining valuable insights.

- Industry Events: Attend industry conferences and events like those hosted by the Association for Corporate Growth (ACG) and the American Securitization Forum (ASF). These events provide unparalleled networking opportunities.

- Leverage LinkedIn: Actively engage on LinkedIn, connect with professionals in private credit, and join relevant groups. This platform is a powerful tool for identifying and reaching out to potential employers and recruiters.

- Informational Interviews: Don't hesitate to reach out to individuals working in private credit for informational interviews. These conversations offer valuable insights into the industry and can lead to unexpected opportunities.

- Join Professional Organizations: Membership in professional organizations like the ACG provides access to networking events, educational resources, and a community of professionals in the field.

DO 3: Tailor Your Resume and Cover Letter to Specific Private Credit Roles

A generic application rarely gets noticed in the competitive private credit job market. Each application requires a customized approach.

- Highlight Relevant Experience: Carefully review the job description and highlight the specific experiences and skills that directly align with the requirements. Use action verbs to describe your accomplishments.

- Quantify Accomplishments: Use numbers to quantify your achievements wherever possible. For example, instead of saying "improved efficiency," say "improved efficiency by 15%." This demonstrates a tangible impact.

- Keywords are Key: Incorporate keywords directly from the job posting into your resume and cover letter. This improves the chances of your application being picked up by Applicant Tracking Systems (ATS).

- Customization is Crucial: Always tailor your resume and cover letter to each specific application. Show that you've done your research and understand the firm's investment strategy and culture.

DO 4: Ace the Private Credit Job Interview

Private credit interviews are rigorous and often involve technical questions, behavioral assessments, and case studies. Thorough preparation is essential.

- Prepare for Various Question Types: Practice answering behavioral questions (e.g., "Tell me about a time you failed"), technical questions (e.g., "Explain discounted cash flow analysis"), and case studies (e.g., analyzing a company's financial statements).

- Practice Makes Perfect: Rehearse your answers to common interview questions related to private credit, your experience, and your career goals.

- Research the Firm: Demonstrate your genuine interest by thoroughly researching the firm, its investment strategy, and the interviewer's background. Show that you've done your homework.

- Ask Thoughtful Questions: Prepare insightful questions to ask the interviewer. This demonstrates your engagement and helps you learn more about the role and the firm.

DO 5: Follow Up After the Interview

Following up after an interview is crucial; it shows persistence and reinforces your interest.

- Send a Thank-You Note: Send a personalized thank-you note reiterating your interest and highlighting key discussion points from the interview.

- Follow Up Strategically: Follow up with the recruiter or hiring manager after a reasonable timeframe (e.g., 2-3 business days). Be persistent but not overly aggressive.

- Maintain Professional Communication: Maintain professional and courteous communication throughout the hiring process, regardless of the outcome.

- Express Continued Interest: Express your continued interest in the role and the firm, even if you haven't heard back immediately.

5 DON'Ts When Applying for Private Credit Jobs

DON'T 1: Neglect Your Financial Modeling Skills

Financial modeling is the backbone of private credit analysis. Proficiency in Excel and financial modeling software is non-negotiable.

- Master Excel: Develop strong Excel skills, including proficiency in functions like discounted cash flow (DCF) modeling, LBO modeling, and sensitivity analysis.

- Understand the "Why": Focus on understanding the underlying assumptions and drivers of your models. Don't just build models; understand what they mean.

- Practice Regularly: Practice creating models for different scenarios and performing sensitivity analysis to test the robustness of your assumptions.

DON'T 2: Underestimate the Importance of Networking

Relying solely on online job boards is a mistake. Active networking significantly improves your chances.

- Be Proactive: Don't be passive; actively reach out to people in your network for informational interviews or referrals.

- Engage Authentically: Attend industry events and make genuine connections with professionals. Networking is about building relationships, not just collecting business cards.

- Leverage Your Network: Utilize your existing network—friends, family, former colleagues—to identify potential opportunities.

DON'T 3: Submit Generic Resumes and Cover Letters

A generic application shows a lack of effort and interest. Each application should be tailored to the specific opportunity.

- Avoid the Template Trap: Don't use a generic template; personalize your resume and cover letter for every application.

- Show You Understand: Demonstrate a clear understanding of the firm's investment strategy and its alignment with your career aspirations.

- Highlight Relevance: Focus on experiences and skills that are directly relevant to the specific job description.

DON'T 4: Fail to Prepare for Technical Questions

Private credit interviews often involve challenging technical questions. Underestimating this aspect can be detrimental.

- Brush Up on Fundamentals: Refresher your knowledge of key concepts, including financial statement analysis, valuation methodologies, and credit risk assessment.

- Practice Technical Questions: Practice answering technical questions related to financial statements, valuation (DCF, comparable company analysis), and credit analysis (credit ratings, covenants).

- Understand Credit Risk: Gain a deep understanding of different credit risk assessment methodologies (e.g., Altman Z-score) and their application.

DON'T 5: Neglect Post-Interview Follow-Up

Always follow up after an interview, even if you feel the interview went well.

- Stay in Touch: Don't assume you'll be contacted if you're a strong candidate; always follow up with a thank-you note and a subsequent check-in.

- Be Persistent (But Professional): Maintain professional communication, expressing your continued interest in the role.

- Track Your Progress: Keep track of your applications and follow up at appropriate intervals.

Conclusion

Securing a rewarding position in private credit requires dedication and a strategic approach. By following these five "do's" and avoiding the five "don'ts," you significantly enhance your prospects. Remember to master the fundamentals of private credit, network effectively, tailor your application materials, excel in your interviews, and follow up diligently. Take control of your career path and start your journey toward a successful career in private credit jobs today!

Featured Posts

-

Recent X Financials Post Musks Debt Sale Key Takeaways And Analysis

Apr 28, 2025

Recent X Financials Post Musks Debt Sale Key Takeaways And Analysis

Apr 28, 2025 -

How The Red Sox Can Replace Tyler O Neill In 2025

Apr 28, 2025

How The Red Sox Can Replace Tyler O Neill In 2025

Apr 28, 2025 -

Rhlat Tyran Alerbyt Mn Abwzby Ila Kazakhstan Dlyl Shaml

Apr 28, 2025

Rhlat Tyran Alerbyt Mn Abwzby Ila Kazakhstan Dlyl Shaml

Apr 28, 2025 -

Luigi Mangione A Voice For His Supporters

Apr 28, 2025

Luigi Mangione A Voice For His Supporters

Apr 28, 2025 -

Inside The Luigi Mangione Campaign What Supporters Are Saying

Apr 28, 2025

Inside The Luigi Mangione Campaign What Supporters Are Saying

Apr 28, 2025