BofA's Take: Why High Stock Market Valuations Shouldn't Worry Investors

Table of Contents

BofA's Rationale: Understanding the Current Market Context

BofA's optimistic outlook isn't based on blind faith; it stems from a thorough analysis of the current economic landscape and its impact on market valuations. Two key factors stand out: historically low interest rates and the continued effects of quantitative easing.

Low Interest Rates and Quantitative Easing

Historically low interest rates and the ongoing impact of quantitative easing (QE) are significant contributors to the current high stock market valuations.

- Effect on Corporate Borrowing Costs and Profitability: Low interest rates make it cheaper for corporations to borrow money, leading to increased investment, expansion, and ultimately, higher profitability. This increased profitability often translates into higher stock prices.

- Encouraging Investment and Inflating Asset Prices: These policies inject liquidity into the market, encouraging investment and potentially inflating asset prices across the board. This effect is amplified when coupled with robust corporate earnings.

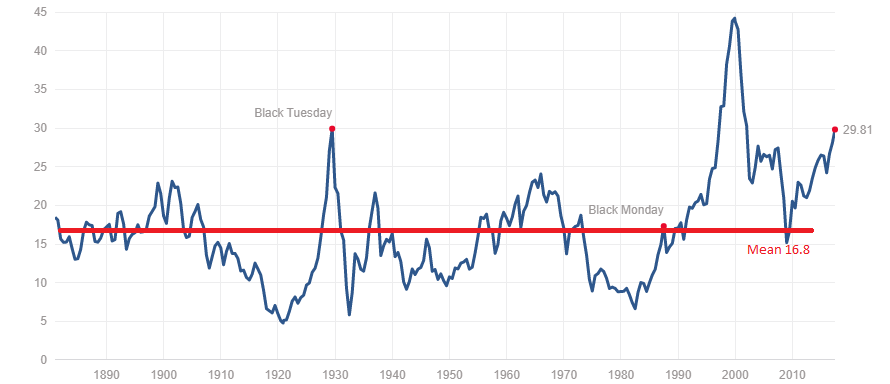

- Comparison to Previous Periods: While high valuations are a cause for caution, it’s crucial to compare the current situation to previous periods of low rates and elevated valuations. Historical data can provide valuable context and help determine whether current valuations are truly unsustainable.

Strong Corporate Earnings and Future Growth Projections

BofA's analysis points to strong corporate earnings as another key factor supporting their positive outlook. Furthermore, projections for future growth remain robust in several key sectors.

- Strong Performing Sectors: Technology, healthcare, and certain consumer staples sectors continue to demonstrate impressive growth, contributing significantly to overall market strength.

- Technological Innovation and Future Earnings: Technological innovation acts as a powerful engine of growth, driving productivity and creating new markets. This contributes significantly to future earnings expectations.

- Caveats and Potential Risks: While the outlook is positive, BofA acknowledges potential risks, such as inflation, geopolitical instability, and supply chain disruptions. These factors should be carefully considered when making investment decisions.

Re-evaluating Valuation Metrics: Beyond Simple P/E Ratios

Relying solely on traditional Price-to-Earnings (P/E) ratios to gauge market valuation can be misleading, particularly in a low-interest-rate environment.

The Limitations of Traditional Valuation Methods

The limitations of relying solely on P/E ratios are significant, especially in a low-interest environment where discount rates are compressed.

- Alternative Valuation Metrics: Investors should consider alternative valuation metrics such as Price-to-Sales (P/S) ratios, cash flow multiples, and discounted cash flow (DCF) analysis. These metrics offer a more comprehensive view.

- A More Nuanced Picture: Utilizing multiple valuation metrics provides a more nuanced understanding of a company's value and helps to mitigate the biases inherent in any single metric.

- Misleading Traditional Metrics: In some growth sectors, high P/E ratios may accurately reflect strong future earnings potential, and not necessarily overvaluation.

Considering Long-Term Growth Potential

Focusing solely on current valuations can be short-sighted. A key takeaway from BofA's analysis is the importance of considering long-term growth potential.

- Growth at a Reasonable Price (GARP): The GARP strategy involves investing in companies exhibiting both strong growth potential and reasonable valuations, even if current P/E ratios appear high.

- Long-Term Growth Justifying High Valuations: High valuations can be justified by exceptionally strong long-term growth prospects. This requires careful analysis of a company's competitive landscape, innovation pipeline, and management team.

- Companies with Strong Long-Term Growth Prospects: Many companies with high valuations show considerable promise for long-term growth, making them attractive investment opportunities despite their current price.

Managing Risk in a High-Valuation Market

Even with a positive outlook, managing risk remains crucial in a market with high valuations.

Diversification and Portfolio Management

Diversification is paramount to mitigate risk in any market, and particularly in one with potentially inflated asset prices.

- Diversification Strategies: Investors should diversify across different asset classes (stocks, bonds, real estate), sectors, and geographies to reduce the impact of any single market downturn.

- Long-Term Investment Strategy: A long-term investment horizon allows investors to weather short-term market volatility and benefit from the power of compounding returns.

- Regular Portfolio Review and Rebalancing: Regularly reviewing and rebalancing your portfolio ensures that your asset allocation aligns with your risk tolerance and investment goals.

Staying Informed and Adapting Your Strategy

The market is constantly evolving, and adapting your strategy is essential.

- Reliable Sources for Financial News: Stay updated on economic indicators, market trends, and company-specific news from reputable sources.

- Seeking Professional Financial Advice: Consider seeking the guidance of a financial advisor, particularly if you are uncertain about how to navigate the complexities of the current market.

- Adjusting Your Strategy: Be prepared to adjust your investment strategy based on evolving market conditions and new information.

Conclusion

BofA's analysis suggests that while high stock market valuations are a valid concern, several factors mitigate the risk of an immediate crash. Low interest rates, strong corporate earnings, and robust long-term growth prospects all contribute to a more optimistic outlook. However, investors should not be complacent. Considering alternative valuation metrics, adopting a well-diversified portfolio, and maintaining a long-term investment strategy are crucial for navigating this market environment effectively. Don't let high stock market valuations deter you. Understand the context, diversify your portfolio, and make informed decisions for long-term growth. For more detailed insights and analysis, explore resources from BofA and other reputable financial institutions.

Featured Posts

-

Tecno Universal Tone

Apr 28, 2025

Tecno Universal Tone

Apr 28, 2025 -

Turning Poop Into Profit An Ai Powered Podcast Revolution

Apr 28, 2025

Turning Poop Into Profit An Ai Powered Podcast Revolution

Apr 28, 2025 -

Get 10 Gb Data And 15 Off Abu Dhabi With This Tourist Sim Card

Apr 28, 2025

Get 10 Gb Data And 15 Off Abu Dhabi With This Tourist Sim Card

Apr 28, 2025 -

Is This Red Sox Outfielder The Next Jarren Duran A Breakout Season Prediction

Apr 28, 2025

Is This Red Sox Outfielder The Next Jarren Duran A Breakout Season Prediction

Apr 28, 2025 -

Analyzing The Mets Spring Training Performance Week 1 Roster Projections

Apr 28, 2025

Analyzing The Mets Spring Training Performance Week 1 Roster Projections

Apr 28, 2025