Stock Market Valuations: BofA Explains Why Investors Shouldn't Panic

Table of Contents

BofA's Analysis of Current Stock Market Valuations

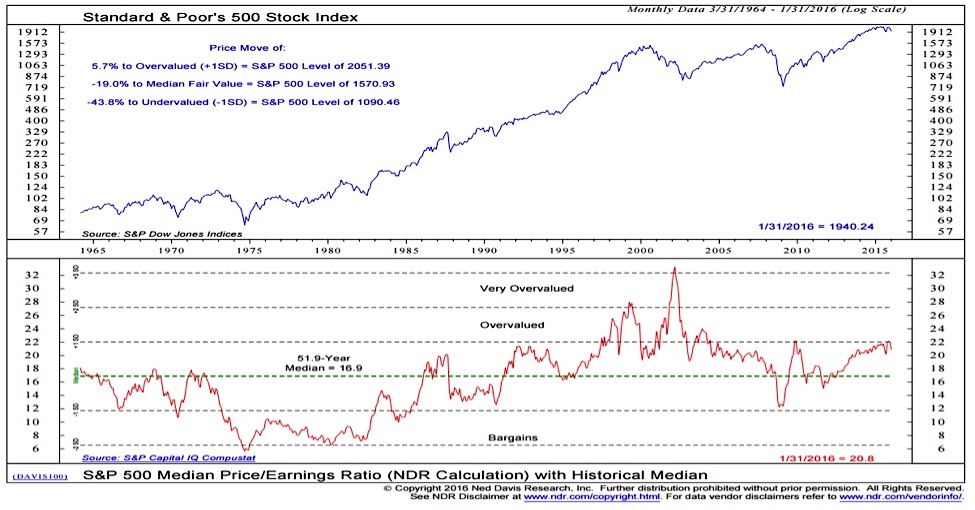

BofA's analysts take a nuanced view of current stock market valuations, urging investors to look beyond simplistic metrics. While the price-to-earnings ratio (P/E) is a commonly used indicator, BofA emphasizes the need for a broader perspective encompassing various valuation multiples and a deep understanding of individual company performance.

-

Beyond P/E Ratios: BofA's analysis goes beyond simply looking at P/E ratios. They incorporate other key metrics like price-to-sales (P/S), price-to-book (P/B), and enterprise value-to-EBITDA (EV/EBITDA) to gain a more comprehensive understanding of a company's valuation relative to its fundamentals. This multifaceted approach offers a more robust assessment than relying on a single metric.

-

Individual Company Performance and Industry Trends: BofA's assessment considers the unique circumstances of individual companies and the prevailing trends within their respective industries. A high P/E ratio for a rapidly growing tech company might be justified by future earnings potential, while a similar ratio for a mature company in a declining industry could signal overvaluation.

-

Market Capitalization and Future Earnings Projections: BofA's analysts assess current market capitalization in relation to historical averages and project future earnings. This involves sophisticated forecasting techniques that consider economic factors, industry dynamics, and company-specific developments. They compare current market capitalization against these projections to determine if valuations are justified by anticipated future growth.

-

Discounted Cash Flow (DCF) Analysis and Other Sophisticated Models: BofA utilizes DCF analysis and other sophisticated valuation models to determine the intrinsic value of companies. DCF models project future cash flows and discount them back to their present value, providing a more precise estimate of a company's worth compared to simpler metrics. This approach allows for a more accurate assessment of whether current market prices accurately reflect a company's long-term value.

-

Relative Valuation: BofA utilizes relative valuation techniques to compare the stock prices of companies within the same sector and against their competitors. This allows for a comparison of valuations across similar businesses, helping identify potentially overvalued or undervalued opportunities. This comparative analysis adds another layer of context to their overall assessment.

Factors Supporting BofA's Optimistic Outlook

BofA's optimistic outlook is grounded in several key factors that support continued growth despite the high valuations.

-

Economic Growth: BofA's analysts project continued, albeit moderate, economic growth in the coming years. This positive economic environment is expected to support corporate earnings and overall market performance. They consider factors like consumer spending, business investment, and government policies in their projections.

-

Interest Rates and Inflation: While interest rate hikes impact stock valuations, BofA assesses the current rate environment as manageable and anticipates that inflation will gradually subside. Their projections consider the impact of central bank policies and their potential effect on market sentiment.

-

Corporate Earnings: BofA's analysis indicates that corporate earnings are expected to remain strong despite macroeconomic headwinds. They consider various factors, such as supply chain improvements and increasing productivity, which contribute to their positive outlook on corporate profitability.

-

Technological Innovation: BofA highlights the transformative potential of technological innovation, citing it as a key driver of future economic growth. Specific sectors benefiting from this innovation, such as artificial intelligence and renewable energy, are identified as particularly promising areas for investment.

-

Promising Sectors: BofA identifies several sectors—for example, technology, healthcare, and renewable energy—as poised for robust growth, potentially offsetting concerns about overall market valuations.

Addressing Investor Concerns about High Stock Market Valuations

High valuations naturally raise concerns about market risk and potential corrections. BofA addresses these concerns by emphasizing the importance of long-term investing and effective risk management strategies.

-

Market Volatility and Potential Corrections: BofA acknowledges the inherent volatility of the stock market and the possibility of future corrections. However, they emphasize that short-term market fluctuations are normal and shouldn't trigger panic selling.

-

Diversification as a Risk Management Strategy: BofA strongly advocates diversification across asset classes and sectors to mitigate risk. A diversified portfolio reduces exposure to the negative impact of any single investment or sector underperforming.

-

Long-Term Investing and Market Resilience: BofA emphasizes the long-term nature of stock market investing, highlighting the historical resilience of the market despite cyclical downturns. A long-term perspective allows investors to weather short-term volatility and benefit from the market's overall upward trajectory.

-

Effective Risk Management Strategies: BofA recommends employing various risk management strategies, including dollar-cost averaging, stop-loss orders, and regular portfolio rebalancing. These strategies can help protect against significant losses during market downturns.

-

Personal Risk Tolerance and Investment Goals: BofA emphasizes the importance of understanding your own risk tolerance and aligning your investment strategy with your long-term financial goals. Investors should only invest in assets that align with their risk profile and their ability to withstand potential market corrections.

Conclusion

While high stock market valuations may seem alarming, BofA's analysis suggests a more cautious, rather than panicked, response is warranted. By considering various valuation metrics, understanding macroeconomic factors, and employing sound risk management strategies, investors can navigate the current market environment effectively. BofA's perspective underscores the importance of a long-term investment approach and the potential for continued growth despite current valuations. Don't let fear dictate your investment decisions. Understand your stock market valuations thoroughly and develop a robust investment strategy based on a comprehensive analysis. Learn more about BofA's insights and refine your approach to stock market valuations today!

Featured Posts

-

Papal Conclave How The Catholic Church Elects Its New Leader

Apr 22, 2025

Papal Conclave How The Catholic Church Elects Its New Leader

Apr 22, 2025 -

Stock Market Valuations Bof A Explains Why Investors Shouldnt Panic

Apr 22, 2025

Stock Market Valuations Bof A Explains Why Investors Shouldnt Panic

Apr 22, 2025 -

Chinas Export Dependence Vulnerability To Tariff Hikes

Apr 22, 2025

Chinas Export Dependence Vulnerability To Tariff Hikes

Apr 22, 2025 -

High Stock Market Valuations A Bof A Analysts Take On Investor Concerns

Apr 22, 2025

High Stock Market Valuations A Bof A Analysts Take On Investor Concerns

Apr 22, 2025 -

Office365 Security Failure Millions Lost In Executive Email Breach

Apr 22, 2025

Office365 Security Failure Millions Lost In Executive Email Breach

Apr 22, 2025