High Stock Market Valuations: A BofA Analyst's Take On Investor Concerns

Table of Contents

Understanding Current High Stock Market Valuations

Several key valuation metrics paint a picture of elevated stock prices. Let's examine these indicators and the factors driving them.

Key Valuation Metrics

Investors utilize various metrics to gauge market valuation. The most common include:

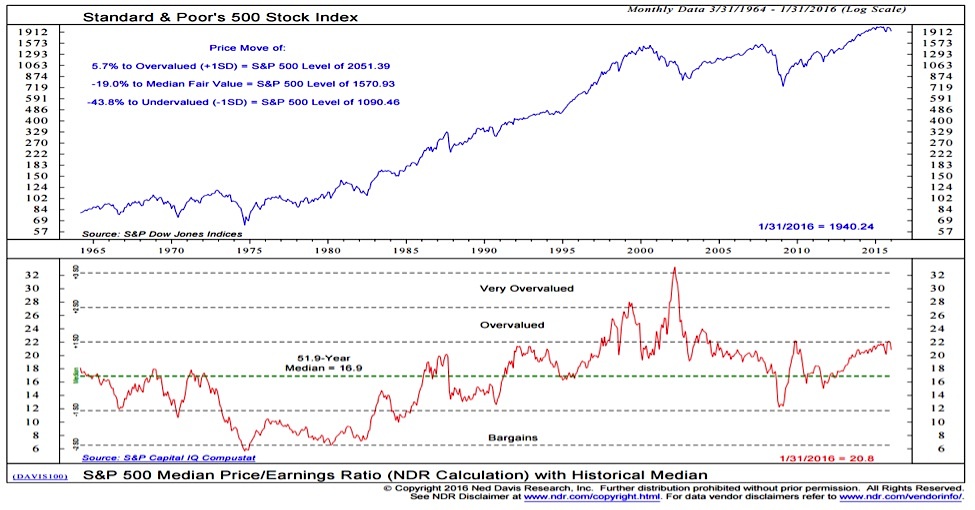

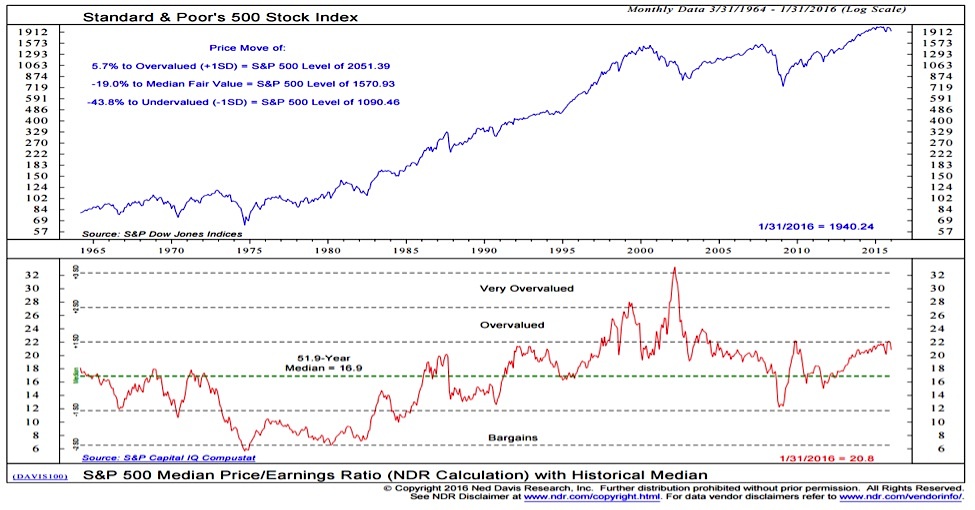

- Price-to-Earnings Ratio (P/E): This compares a company's stock price to its earnings per share (EPS). A high P/E suggests investors are paying a premium for each dollar of earnings. Currently, many sectors show elevated P/E ratios compared to historical averages.

- Price-to-Sales Ratio (P/S): This ratio compares a company's market capitalization to its revenue. It's often used for companies with negative earnings. High P/S ratios may indicate overvaluation, particularly if revenue growth doesn't justify the price.

- Shiller P/E (CAPE): Also known as the cyclically adjusted price-to-earnings ratio, this metric uses average inflation-adjusted earnings over the past 10 years to smooth out short-term earnings volatility. A high CAPE ratio often suggests overvaluation and a potential for lower returns.

(Insert chart or graph here visually representing current P/E, P/S, and CAPE ratios for major indices like the S&P 500 and Nasdaq.)

Factors Contributing to High Valuations

Several interconnected factors contribute to these high valuations:

- Low Interest Rates: Historically low interest rates make borrowing cheaper, increasing corporate investment and boosting stock buybacks, thus driving up prices. This also makes bonds less attractive, pushing investors towards higher-yielding assets like stocks.

- Quantitative Easing (QE): Central bank QE programs inject liquidity into the market, further inflating asset prices, including stocks. This increased money supply can fuel speculation and drive up valuations beyond what fundamentals might suggest.

- Strong Corporate Earnings (Potentially): While some sectors show strong earnings growth, this alone may not fully justify the current high valuations across the board. Further investigation into specific company performance is crucial.

- Investor Sentiment and Speculation: A wave of optimism and speculative trading can inflate asset bubbles, pushing valuations to unsustainable levels. Fear of missing out (FOMO) can further amplify this effect.

The BofA Analyst's Perspective on Investor Concerns

A recent BofA Securities report highlights potential risks and opportunities associated with the current high valuations.

Identifying Potential Risks

The BofA analyst emphasizes several key risks:

- Increased Market Volatility: High valuations inherently increase the potential for sharp corrections or even market crashes. Small negative news can trigger disproportionately large sell-offs.

- Inflationary Pressures: Rising inflation can erode corporate earnings and reduce the real value of stock prices, potentially leading to a market downturn. Central bank responses to inflation also impact market conditions.

- Geopolitical Uncertainties: Global political instability and unforeseen events can significantly impact investor confidence and market performance, leading to volatility and price corrections.

Opportunities Amidst High Valuations

Despite the risks, the BofA analyst also identifies potential opportunities:

- Sector-Specific Opportunities: While overall valuations are high, some sectors might offer better value than others. Careful analysis of individual companies and their prospects within their sectors is crucial.

- Long-Term Investment Strategies: A long-term investment horizon can help mitigate the impact of short-term market volatility. Focusing on fundamental analysis and strong company performance can be beneficial.

- Defensive Investment Options: Investors may consider shifting towards more defensive assets, like high-quality bonds or dividend-paying stocks, during periods of high market valuations to reduce risk.

Strategies for Navigating High Stock Market Valuations

Navigating this environment requires a thoughtful approach.

Diversification

Diversifying your portfolio across different asset classes (stocks, bonds, real estate, etc.) is crucial to mitigate risk. Don't put all your eggs in one basket.

Value Investing

Value investing focuses on identifying undervalued companies with strong fundamentals. This strategy can be particularly effective in a high-valuation market.

Risk Management

Assess your risk tolerance carefully and adjust your investment strategy accordingly. Don't invest more than you can afford to lose.

Seeking Professional Advice

Consider consulting with a qualified financial advisor for personalized guidance tailored to your specific financial situation and goals.

Addressing High Stock Market Valuations – A Call to Action

The BofA analyst's perspective highlights both the risks and opportunities presented by high stock market valuations. Understanding these factors is crucial for making informed investment decisions. Don't let high stock market valuations leave you feeling uncertain. Learn more about effective strategies to navigate this environment by [link to further resources/BofA report]. Remember to diversify your portfolio, practice sound risk management, and consider seeking professional financial advice. Proactive management of your investments is key to weathering periods of high valuations and potentially capitalizing on emerging opportunities.

Featured Posts

-

Ryujinx Emulator Development Halted Nintendos Involvement Confirmed

Apr 22, 2025

Ryujinx Emulator Development Halted Nintendos Involvement Confirmed

Apr 22, 2025 -

Blue Origin Launch Cancelled Vehicle Subsystem Issue Delays Mission

Apr 22, 2025

Blue Origin Launch Cancelled Vehicle Subsystem Issue Delays Mission

Apr 22, 2025 -

Anchor Brewing Company Closing After 127 Years The End Of An Era

Apr 22, 2025

Anchor Brewing Company Closing After 127 Years The End Of An Era

Apr 22, 2025 -

La Fires Price Gouging Accusations Against Landlords Surface

Apr 22, 2025

La Fires Price Gouging Accusations Against Landlords Surface

Apr 22, 2025 -

Car Dealerships Renew Pushback On Mandatory Ev Sales

Apr 22, 2025

Car Dealerships Renew Pushback On Mandatory Ev Sales

Apr 22, 2025