Point72 Traders Depart As Emerging Markets Fund Shuts Down

Table of Contents

Reasons Behind the Fund Closure

Point72's decision to liquidate its emerging markets fund wasn't impulsive. Several factors likely contributed to this strategic shift. While the firm hasn't publicly disclosed all the reasons, industry analysts and experts point to several key possibilities:

-

Underperformance compared to benchmarks: The fund may have consistently underperformed compared to its benchmarks and competitor funds specializing in emerging markets. This persistent underperformance could have eroded investor confidence and made the fund unsustainable in the long term. Failure to meet projected returns is a significant factor in many hedge fund closures.

-

Shifting investment strategies within Point72: Point72 might be realigning its overall investment strategy, focusing resources on areas deemed more profitable or less risky. This strategic realignment could involve a shift away from emerging markets towards other asset classes offering better risk-adjusted returns.

-

Challenges specific to emerging markets: Emerging markets are inherently volatile, susceptible to geopolitical risks, regulatory hurdles, and currency fluctuations. These unpredictable factors can significantly impact investment performance and potentially make emerging markets less attractive compared to more stable markets.

-

Increased competition in the emerging markets investment space: The emerging markets investment space is becoming increasingly competitive, with many established and new players vying for opportunities. This increased competition could have squeezed profit margins and made it challenging for Point72's fund to maintain a competitive edge.

Impact on Affected Traders

The closure of the emerging markets fund has directly impacted the traders employed within that specific unit. While the exact number remains undisclosed, a significant number of experienced professionals have been affected, requiring them to navigate a challenging job market.

-

Number of traders affected by the closure: Although Point72 hasn't released official figures, reports suggest a substantial number of traders were employed in the emerging markets fund, resulting in a significant number of job losses.

-

Potential job prospects for departing traders: These traders, possessing specialized knowledge of emerging markets and a proven track record, are likely to be sought after by other firms. However, finding similar roles with comparable compensation and responsibility may present challenges.

-

Challenges in finding similar roles within the industry: The competitive nature of the hedge fund industry means securing a new role might take time and effort. The specialized nature of their expertise might limit the number of suitable positions available.

-

Analysis of the expertise of these traders and its value to other firms: The expertise of these traders, particularly their in-depth understanding of specific emerging markets, their established networks, and their ability to navigate complex regulatory environments, remains highly valuable to other firms.

Broader Implications for the Hedge Fund Industry

The closure of Point72's emerging markets fund has broader implications for the hedge fund industry, especially regarding investment strategies in emerging markets.

-

Increased scrutiny of emerging markets investments: This event might lead to increased scrutiny of emerging markets investments across the hedge fund industry, prompting a more cautious approach and a reevaluation of risk tolerance.

-

Potential impact on investor confidence: The closure could potentially shake investor confidence in emerging markets funds, leading to some investors seeking more stable investment options.

-

Analysis of similar closures or underperformance in other funds: This situation might encourage a closer examination of the performance and stability of other hedge funds focusing on emerging markets, potentially triggering further adjustments within the industry.

-

Future outlook for emerging markets investment within hedge funds: While emerging markets offer significant opportunities, the inherent risks and recent events suggest a potential shift towards a more selective and cautious approach to emerging markets investments.

Point72's Future Strategy

Point72's future strategic direction following this significant event remains to be seen. However, several potential scenarios are worth considering:

-

Possible reallocation of resources to other investment strategies: The resources previously allocated to the emerging markets fund might be redirected towards other investment strategies deemed more promising, potentially within different asset classes.

-

Potential changes in investment philosophy: This closure could signify a shift in Point72's investment philosophy, perhaps towards a more risk-averse approach or a focus on specific sectors or regions.

-

Future expansion or contraction in other asset classes: Point72 might expand its presence in other asset classes considered more lucrative or contract its overall size, depending on its future strategic objectives.

-

Statements from Point72 regarding their future plans: Any official statements from Point72 regarding its future plans would offer clearer insights into its strategic direction and future investment priorities.

Conclusion

The closure of Point72's emerging markets fund and the subsequent trader departures represent a significant event with implications that extend beyond a single hedge fund. The reasons behind the closure – ranging from underperformance to broader strategic shifts within Point72 – highlight the challenges and volatility inherent in emerging markets investments. The impact on affected traders underscores the competitive realities of the hedge fund industry, while the broader implications for the industry suggest a potential reevaluation of emerging markets strategies. Stay updated on the latest developments concerning Point72’s investment decisions and the evolving landscape of emerging market fund closures. Learn more about the key factors influencing hedge fund strategies and the future of emerging markets investments.

Featured Posts

-

Anchor Brewing 127 Years And Counting Down

Apr 26, 2025

Anchor Brewing 127 Years And Counting Down

Apr 26, 2025 -

Navigating The Trump Aftermath The Fed Chairs Uncertain Future

Apr 26, 2025

Navigating The Trump Aftermath The Fed Chairs Uncertain Future

Apr 26, 2025 -

The Trump Ukraine Nato Equation An Analysis

Apr 26, 2025

The Trump Ukraine Nato Equation An Analysis

Apr 26, 2025 -

Point72 Closes Emerging Markets Focused Hedge Fund

Apr 26, 2025

Point72 Closes Emerging Markets Focused Hedge Fund

Apr 26, 2025 -

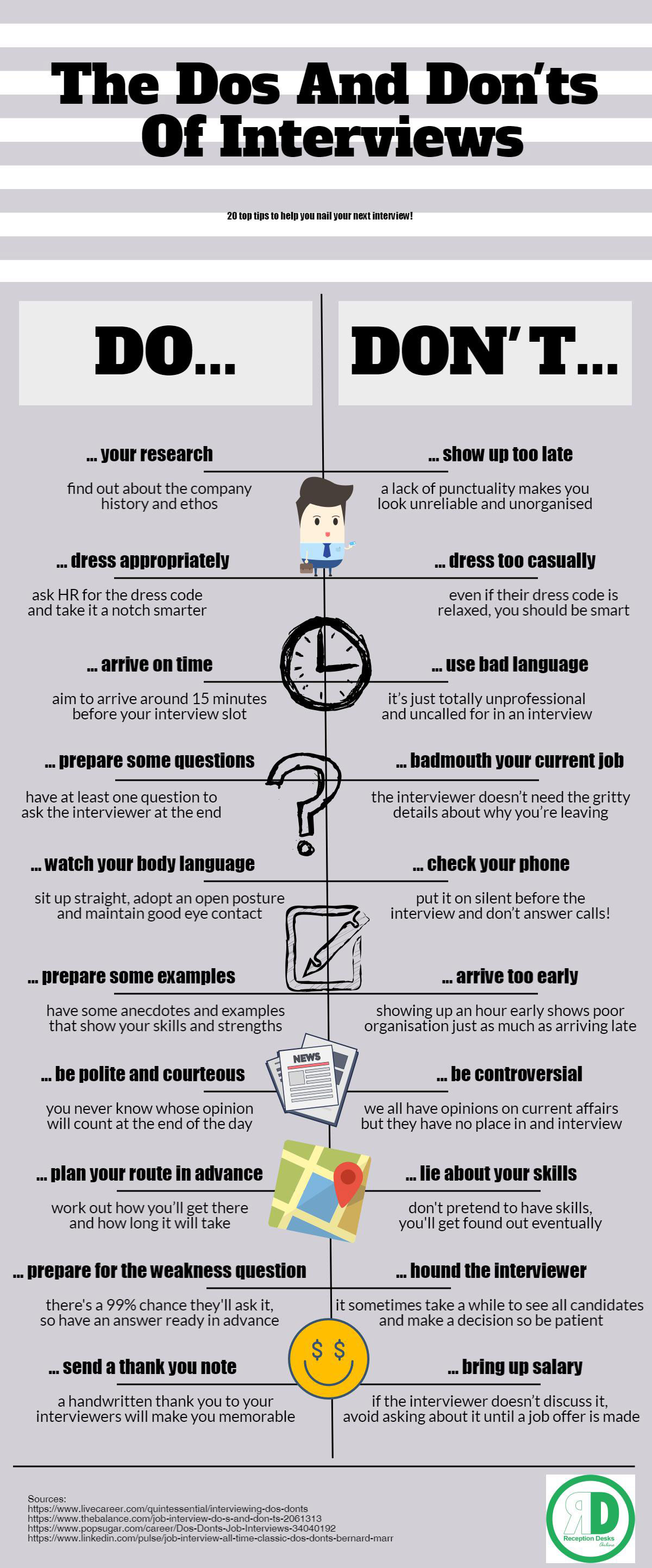

5 Tips For Success Dos And Don Ts For Private Credit Job Seekers

Apr 26, 2025

5 Tips For Success Dos And Don Ts For Private Credit Job Seekers

Apr 26, 2025