Point72 Closes Emerging Markets-Focused Hedge Fund

Table of Contents

Understanding Point72's Decision to Close the Emerging Markets Fund

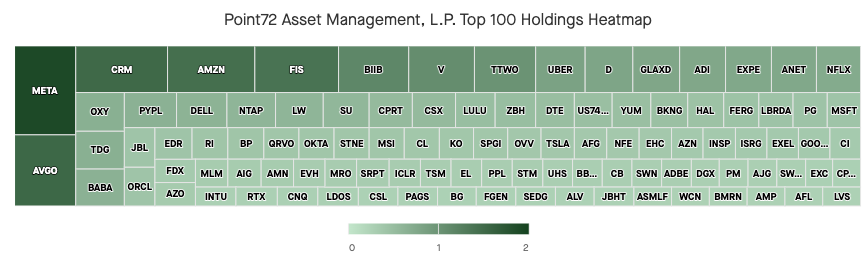

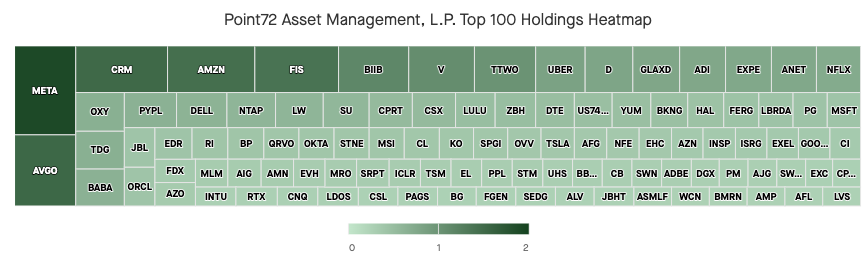

Point72, under the leadership of billionaire Steve Cohen, has historically shown interest in emerging markets, viewing them as potential sources of high growth. However, the firm's recent decision to close its dedicated emerging markets hedge fund indicates a strategic reassessment of this sector. Several factors could contribute to this decision. Analyzing Point72's overall investment strategy reveals a preference for calculated risk and consistent performance. The closure could be attributed to a combination of reasons:

-

Underperformance compared to benchmarks: The fund may have consistently underperformed compared to its benchmarks or other comparable emerging markets funds, leading to a strategic decision to cut losses and reallocate resources. Specific performance data, if publicly available, would be crucial in confirming this hypothesis.

-

Changes in the regulatory environment of target emerging markets: Increased regulatory scrutiny or unpredictable policy changes in certain emerging markets could have increased the risk profile beyond Point72's comfort level, prompting the closure. This could involve new capital controls, tax laws, or political instability affecting specific target regions.

-

Shift in Point72's overall investment philosophy: Point72 might have undergone a broader shift in its investment philosophy, prioritizing different asset classes or geographical regions that align better with its current risk tolerance and return expectations. This could involve a pivot towards more established markets or a focus on specific sectors experiencing rapid growth.

-

Internal restructuring or reallocation of resources: The closure could simply be a part of a larger internal restructuring within Point72, involving a reallocation of capital and human resources towards other, potentially more lucrative, investment opportunities. This is a common practice among large hedge fund managers to optimize portfolio performance.

Impact on Investors and the Broader Market

The closure of Point72's emerging markets fund has several implications for investors and the broader market. Investors previously invested in the fund will likely need to re-evaluate their investment portfolios and potentially seek alternative emerging market exposure.

-

Investor confidence and potential withdrawals: The closure could erode investor confidence in emerging markets as an asset class, potentially leading to further withdrawals from other similar funds. This could create a negative feedback loop affecting market liquidity.

-

Impact on the liquidity of emerging market assets: The reduction in investment from a major player like Point72 could impact the liquidity of certain emerging market assets, making it more difficult for other investors to buy or sell these assets quickly and efficiently.

-

Potential opportunities for other players in the emerging markets space: The departure of Point72 creates an opportunity for competing hedge funds and investment firms to acquire market share and potentially attract investors seeking exposure to emerging markets. This could lead to a consolidation of the emerging market investment landscape.

-

Changes in market sentiment towards emerging markets: The closure might influence market sentiment towards emerging markets, potentially leading to a short-term decline in valuations before the market stabilizes and finds a new equilibrium.

Point72's Future Investment Strategies and Emerging Market Exposure

While Point72 has closed its dedicated emerging markets hedge fund, it doesn't necessarily signify a complete withdrawal from emerging markets. The firm may continue to invest in emerging markets through alternative strategies.

-

Direct investments in specific companies: Point72 may choose to make direct investments in promising companies within emerging markets on a case-by-case basis, rather than through a dedicated fund.

-

Private equity or venture capital in emerging markets: Point72's involvement in private equity or venture capital investments could offer another avenue for exposure to emerging markets' high-growth potential. This strategy allows for targeted investments in companies with strong growth potential, minimizing exposure to broader market volatility.

-

Shift to other asset classes or geographical regions: Point72 might shift its focus to other asset classes, such as real estate or technology, or to different geographical regions where it perceives more favorable risk-reward opportunities.

-

Potential for future re-entry into emerging markets: Depending on market conditions and Point72's future strategic goals, there is always a possibility that the firm might re-enter the emerging markets space in the future with a revised strategy and a refined risk management approach.

Conclusion

Point72's decision to close its emerging markets-focused hedge fund represents a significant development in the hedge fund industry and the broader global investment landscape. The reasons behind this move are likely multifaceted, involving a complex interplay of performance, regulatory concerns, and strategic realignment. The implications for investors and the market are significant, ranging from potential shifts in investor sentiment to opportunities for other players. While the future of Point72's emerging markets exposure remains uncertain, understanding this strategic shift is crucial for navigating the complexities of the emerging markets investment landscape. Stay tuned for further updates on Point72's strategic moves in the evolving world of emerging markets investment.

Featured Posts

-

The Closing Of Anchor Brewing Company What Happens Next

Apr 26, 2025

The Closing Of Anchor Brewing Company What Happens Next

Apr 26, 2025 -

Layoff And Rehire How To Respond To Your Old Companys Offer

Apr 26, 2025

Layoff And Rehire How To Respond To Your Old Companys Offer

Apr 26, 2025 -

Zuckerberg And Trump A New Era For Facebook And Politics

Apr 26, 2025

Zuckerberg And Trump A New Era For Facebook And Politics

Apr 26, 2025 -

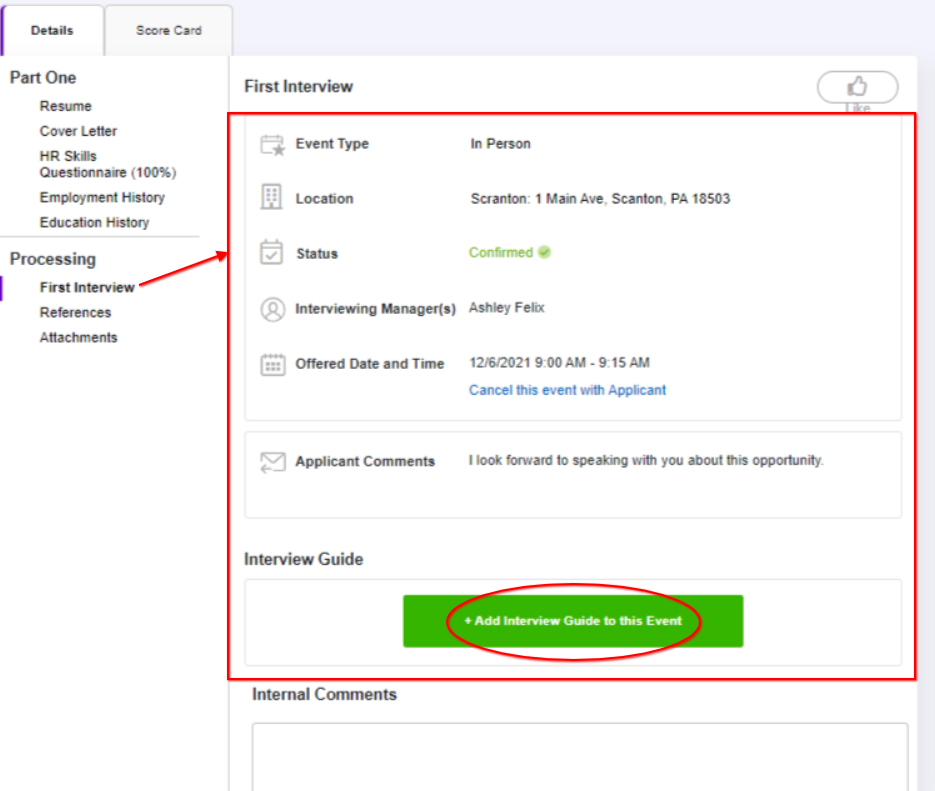

5 Dos And Don Ts For Landing A Job In The Private Credit Boom

Apr 26, 2025

5 Dos And Don Ts For Landing A Job In The Private Credit Boom

Apr 26, 2025 -

The Human Element An Interview With Microsofts Head Of Design On Ai

Apr 26, 2025

The Human Element An Interview With Microsofts Head Of Design On Ai

Apr 26, 2025