Navigate The Private Credit Boom: 5 Key Dos And Don'ts

Table of Contents

Do Your Due Diligence: Thoroughly Research Before Investing

Investing in private credit, whether through direct lending or private debt funds, demands rigorous due diligence. This isn't a space for impulsive decisions; thorough credit analysis and risk assessment are paramount. Private credit due diligence goes beyond simply reviewing financial statements.

-

Independently verify financial statements and projections: Don't solely rely on the information provided by the borrower. Engage independent professionals to validate the data and ensure its accuracy. This is critical for accurate private debt analysis.

-

Assess the borrower's management team, industry, and competitive landscape: A strong management team with a proven track record significantly reduces risk. Understanding the borrower's industry position and competitive dynamics provides valuable insight into their future prospects.

-

Analyze the loan structure, covenants, and repayment terms meticulously: The loan structure, including collateral, interest rates, and repayment schedules, is crucial. Meticulously review covenants to understand the protections afforded to lenders.

-

Understand the potential risks associated with the specific investment, including default risk and market risk: Private credit investments, like any high-yield investments, carry inherent risks. Accurately assessing these risks, including the potential for default, is essential.

-

Seek professional advice from experienced private credit specialists: Engaging experienced professionals provides invaluable expertise and insight, bolstering your investment due diligence process.

Diversify Your Private Credit Portfolio: Don't Put All Your Eggs in One Basket

Portfolio diversification is crucial in managing risk within the private credit space. A concentrated portfolio is highly vulnerable to losses if one investment defaults. Effective private credit portfolio management necessitates a strategic approach to diversification.

-

Spread investments across various borrowers, industries, and geographies: Diversifying across multiple borrowers mitigates the risk associated with any single borrower's failure. Similarly, geographic and industry diversification reduces exposure to sector-specific risks.

-

Consider different types of private credit instruments, such as senior secured loans, mezzanine debt, and subordinated debt: Each instrument carries a different level of risk and return. A well-diversified portfolio includes a mix of these instruments to optimize risk and return.

-

Use a combination of direct lending and funds to achieve diversification: Direct lending offers more control, while funds provide access to a diversified pool of borrowers. A combination allows for optimized portfolio construction.

-

Regularly review and rebalance your portfolio to maintain an appropriate level of risk and return: Market conditions change, and your portfolio needs to adapt. Regular reviews ensure your asset allocation remains aligned with your investment goals and risk tolerance.

Understand the Liquidity Landscape: Don't Expect Easy Exits

Unlike publicly traded securities, private credit investments are generally illiquid. This illiquidity risk is a defining characteristic of the asset class and requires careful consideration. Private debt liquidity is often limited, making quick exits challenging.

-

Recognize that private credit investments are generally illiquid, meaning they are not easily sold quickly: This lack of liquidity requires a long-term perspective. Investors should not expect to readily sell their investments on demand.

-

Have a long-term investment horizon to account for potential liquidity constraints: Your investment timeline should align with the expected duration of the private credit investment.

-

Consider your liquidity needs and ensure they align with your investment timeframe: Don't invest in private credit if you anticipate needing access to your capital in the short term.

-

Don't over-allocate to private credit if you have immediate liquidity requirements: Maintain a balanced portfolio that considers your overall liquidity needs.

Manage Your Risk Appetite: Don't Overextend Yourself

Private credit investments, while offering attractive yields, are not without risk. Understanding and managing your risk appetite is crucial to prevent significant losses. High-yield investments often carry higher risk.

-

Carefully assess your risk tolerance before investing in private credit: Only invest an amount you are comfortable potentially losing. Risk management should be a top priority.

-

Diversify your portfolio to mitigate risks associated with individual borrowers or sectors: Diversification remains a critical risk mitigation strategy.

-

Use appropriate leverage and don't overextend yourself financially: Leverage can amplify both gains and losses. Avoid excessive leverage to prevent financial distress.

-

Continuously monitor your investments and adjust your strategy as needed: Regular monitoring allows for timely adjustments to your portfolio, mitigating potential losses.

Seek Professional Expertise: Don't Go It Alone

Navigating the complexities of the private credit market can be challenging. Seeking professional expertise is highly beneficial, especially for those new to the space.

-

Consider engaging experienced private credit advisors or fund managers to assist with your investments: These professionals offer invaluable expertise and guidance.

-

Utilize their expertise in due diligence, portfolio construction, and risk management: Benefit from their experience to improve your investment outcomes.

-

Benefit from their network of contacts and market insights: Access to a wider network provides valuable market intelligence and opportunities.

-

Regularly communicate with your advisors to stay informed about your investments: Maintain open communication to ensure your investment strategy remains aligned with your goals.

Conclusion:

The private credit market presents significant opportunities for investors seeking higher yields and diversification. However, navigating this market requires a disciplined approach. By following these five dos and don'ts – conducting thorough due diligence, diversifying your portfolio, managing liquidity expectations, understanding your risk tolerance, and seeking professional expertise – you can significantly improve your chances of success in this dynamic asset class. Don't miss out on the potential of private credit; start exploring smart investment strategies today and begin navigating the private credit boom effectively.

Featured Posts

-

Bof A On Stretched Stock Market Valuations A Reason For Investor Calm

Apr 24, 2025

Bof A On Stretched Stock Market Valuations A Reason For Investor Calm

Apr 24, 2025 -

Tzin Xakman O Tzon Travolta Apoxaireta Ton Thryliko Ithopoio

Apr 24, 2025

Tzin Xakman O Tzon Travolta Apoxaireta Ton Thryliko Ithopoio

Apr 24, 2025 -

Metas Future Under The Shadow Of The Trump Administration

Apr 24, 2025

Metas Future Under The Shadow Of The Trump Administration

Apr 24, 2025 -

How Trumps Presidency Will Shape Zuckerbergs Leadership At Meta

Apr 24, 2025

How Trumps Presidency Will Shape Zuckerbergs Leadership At Meta

Apr 24, 2025 -

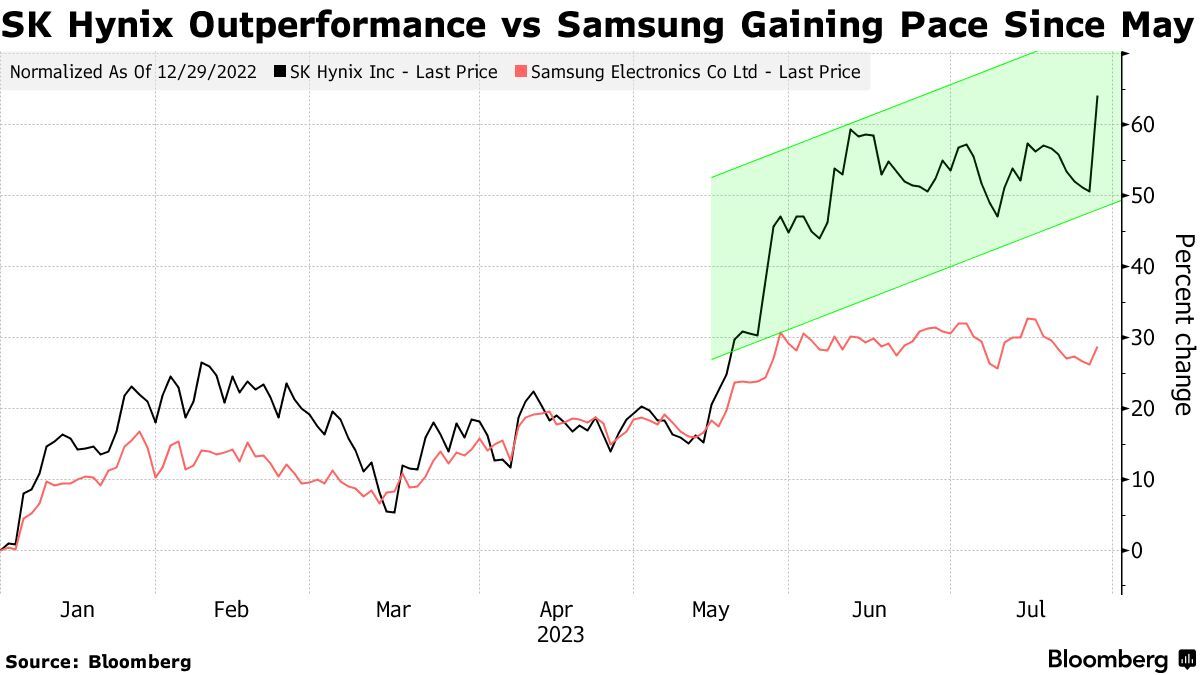

Ai Boost Propels Sk Hynix To Top Dram Manufacturer Overtaking Samsung

Apr 24, 2025

Ai Boost Propels Sk Hynix To Top Dram Manufacturer Overtaking Samsung

Apr 24, 2025