BofA On Stretched Stock Market Valuations: A Reason For Investor Calm

Table of Contents

BofA's Assessment of Current Market Valuations

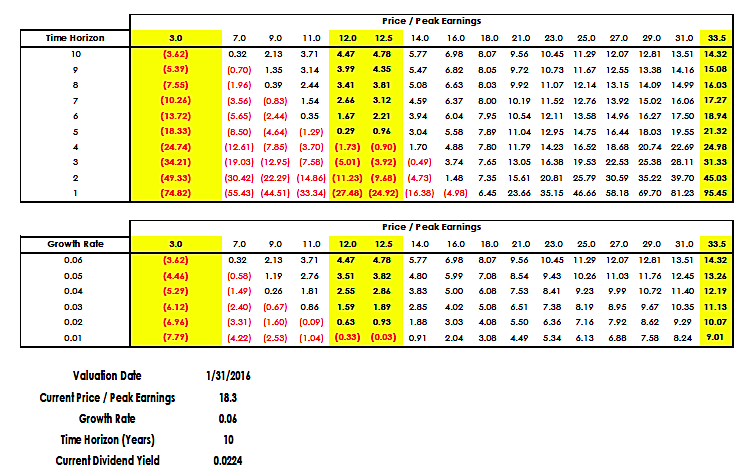

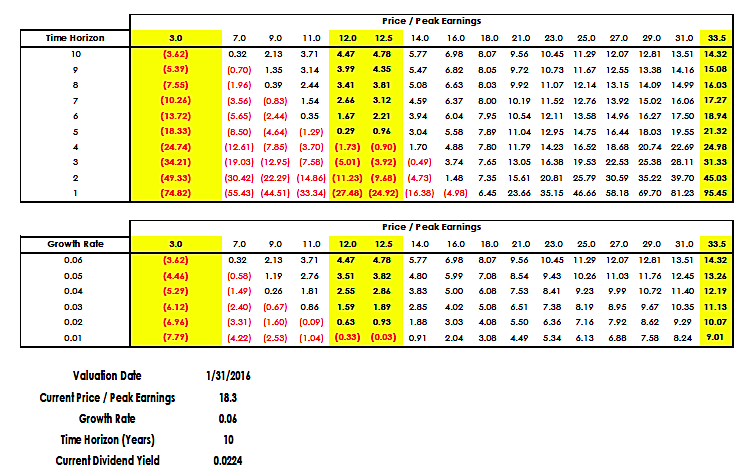

BofA's analysis of current market valuations utilizes a comprehensive approach, drawing on a variety of data sources including historical market data, earnings projections, and macroeconomic indicators. Their methodology involves examining several key valuation metrics to determine the overall health of the market. While acknowledging that valuations appear stretched by some historical measures, their assessment isn't necessarily a cause for immediate alarm.

- Specific valuation metrics used: BofA employed both traditional and alternative metrics, including the Price-to-Earnings (P/E) ratio, the Shiller PE ratio (also known as the CAPE ratio, cyclically adjusted price-to-earnings ratio), and other proprietary models considering future earnings growth.

- Comparison to historical valuations: The report compared current valuations to historical averages, acknowledging that some metrics suggest a slightly elevated valuation compared to long-term averages. However, they contextualize this by considering current economic factors.

- Specific sectors highlighted: BofA's report likely highlighted specific sectors or market segments showing more or less stretched valuations, potentially guiding investors toward opportunities or areas requiring caution. This granular analysis is crucial for informed investment decisions.

Factors Contributing to BofA's Relatively Optimistic Outlook

BofA's relatively optimistic outlook is not simply a dismissal of high valuations. It's rooted in several key economic factors that, according to their analysis, mitigate the risks associated with stretched valuations.

- Strong corporate earnings growth projections: BofA likely projects continued strong earnings growth for many companies, suggesting that even at current prices, future earnings could justify the valuations. This projection is crucial to their overall assessment.

- Impact of low interest rates on stock valuations: Low interest rates make stocks comparatively more attractive than bonds, potentially supporting higher valuations. This is a key element in their analysis.

- Other macroeconomic factors: BofA likely considers broader macroeconomic factors, such as stable employment and government policies, which can influence market valuations and overall investor sentiment. These factors often play a critical role in their market assessments.

The Role of Interest Rates in Market Valuation

The relationship between interest rates and stock valuations is inversely proportional. Lower interest rates generally lead to higher stock valuations, as investors seek higher returns in the equity market. BofA's view on the expected trajectory of interest rates plays a pivotal role in their valuation assessment.

- Expected trajectory of interest rates: BofA's projection of interest rate movements is crucial. If they anticipate rates remaining low or even falling further, this supports their optimistic outlook on valuations.

- Impact of interest rate changes on discounting future earnings: Changes in interest rates impact the present value of future earnings. Lower rates lead to higher present values, supporting higher valuations.

- Comparison of current interest rates to historical levels: BofA's analysis probably compared current interest rates to historical levels, showcasing the current environment as relatively favorable for equity investments.

Strategies for Investors Based on BofA's Analysis

While BofA's analysis might suggest a degree of calm, investors should still maintain a balanced approach. The report doesn’t advocate ignoring the potential risks.

- Diversification strategies: Maintaining a well-diversified portfolio across different asset classes and sectors remains paramount, regardless of market valuations. This limits exposure to any single sector's underperformance.

- Sector-specific investment opportunities: BofA's report might highlight specific sectors with more attractive valuations, guiding investors toward opportunities where the risk-reward balance seems favorable. Careful sector selection is key.

- Importance of long-term investment horizons: Maintaining a long-term perspective is crucial. Short-term market fluctuations should not dictate long-term investment strategies.

Counterarguments and Potential Risks

While BofA’s analysis offers a measured perspective, it's essential to acknowledge potential counterarguments and risks. No assessment is perfect, and unforeseen events can dramatically alter market dynamics.

- Geopolitical risks: Global political instability can significantly impact market sentiment and valuations. This is a major external factor impacting market performance.

- Inflationary pressures: Unexpected inflationary pressures could lead to higher interest rates, negatively impacting stock valuations. Inflation remains a constant threat.

- Unexpected economic downturn: An unforeseen economic downturn could drastically alter the outlook, rendering even the most well-informed analyses less effective. Recessions can impact all investment strategies.

Conclusion: BofA on Stretched Stock Market Valuations: Maintaining a Balanced Perspective

BofA's analysis of stretched stock market valuations offers a measured perspective, suggesting that while valuations are high, various economic factors might mitigate the risks. However, it's crucial to remember that this is just one perspective, and investors must conduct their own thorough due diligence, considering various factors including geopolitical risks, inflationary pressures, and potential economic downturns. While BofA's analysis offers a reason for investor calm regarding stretched stock market valuations, remember to conduct thorough research and consider all perspectives before making any investment decisions. Stay informed about the latest developments impacting stock market valuations and adjust your strategy accordingly.

Featured Posts

-

Fiscal Responsibility A Missing Element In Canadas Vision

Apr 24, 2025

Fiscal Responsibility A Missing Element In Canadas Vision

Apr 24, 2025 -

Viral Whataburger Video Propels Hisd Mariachi To Uil State Competition

Apr 24, 2025

Viral Whataburger Video Propels Hisd Mariachi To Uil State Competition

Apr 24, 2025 -

Is Open Ai Buying Google Chrome Chat Gpt Ceos Remarks Explained

Apr 24, 2025

Is Open Ai Buying Google Chrome Chat Gpt Ceos Remarks Explained

Apr 24, 2025 -

A Memoir From Cassidy Hutchinson Her Perspective On The January 6th Hearings

Apr 24, 2025

A Memoir From Cassidy Hutchinson Her Perspective On The January 6th Hearings

Apr 24, 2025 -

Klaus Schwab Under Scrutiny World Economic Forum Faces New Investigation

Apr 24, 2025

Klaus Schwab Under Scrutiny World Economic Forum Faces New Investigation

Apr 24, 2025