Canada's Economic Outlook: The Importance Of Fiscal Prudence

Table of Contents

Current State of the Canadian Economy

Economic Growth and Challenges

Canada's economy has shown resilience in the face of global headwinds. However, challenges remain. Recent GDP growth rates, while positive, have been fluctuating. Inflation remains a significant concern, impacting consumer spending and eroding purchasing power. The unemployment rate, while relatively low, doesn't fully capture the nuances of labor market participation and underemployment.

- Canadian GDP Growth: While recent quarters have shown positive growth, the rate has been inconsistent, impacted by factors such as global supply chain disruptions and fluctuating commodity prices.

- Inflation Rate: Inflation has consistently exceeded the Bank of Canada's target range, necessitating interest rate hikes to cool the economy. This has implications for both consumers and businesses.

- Unemployment Rate: The unemployment rate, though relatively low, may not reflect the full picture of underemployment and the participation rate in the Canadian labor market.

- Economic Challenges: Global economic uncertainty, including geopolitical instability and potential recessions in major trading partners, presents significant headwinds for the Canadian economy.

Government Revenue and Expenditure

The Canadian government's revenue streams primarily consist of taxes on personal and corporate income, goods and services, and various other levies. Government expenditure encompasses a wide range of programs and initiatives, including:

- Healthcare: A significant portion of the budget is dedicated to healthcare, reflecting the growing demands of an aging population.

- Education: Investment in education is crucial for long-term human capital development and economic growth.

- Infrastructure: Investment in infrastructure, including roads, bridges, and public transit, is essential for economic productivity and competitiveness.

While these expenditures are necessary, a thorough review of government spending is needed to identify areas where efficiency improvements can be made without compromising essential services. Optimizing procurement processes and streamlining administrative functions could generate significant savings.

The Importance of Fiscal Prudence for Long-Term Stability

Reducing Government Debt

High government debt poses significant risks to Canada's long-term economic stability. A high debt-to-GDP ratio increases the country's vulnerability to economic shocks and can lead to higher interest rates, squeezing government budgets and hindering economic growth. Strategies for reducing government debt include:

- Targeted Spending Cuts: Identifying areas where government spending can be reduced without compromising essential services.

- Revenue Enhancement: Exploring opportunities to increase government revenue through efficient tax collection and potentially broadening the tax base.

- Economic Growth Initiatives: Investing in programs and policies that stimulate economic growth, leading to increased tax revenue and a lower debt-to-GDP ratio.

A sustainable approach is crucial, balancing debt reduction with necessary investments in infrastructure and human capital.

Investing in Infrastructure and Human Capital

Fiscal prudence doesn't solely mean cutting spending; it also involves strategic investment. Investing in infrastructure and human capital is essential for fostering long-term economic growth and enhancing Canada's competitiveness on the global stage.

- Infrastructure Projects: Investments in modernizing transportation networks, upgrading energy grids, and expanding broadband access can boost productivity and create jobs.

- Human Capital Development: Investing in education and skills training programs equips Canadians with the skills needed for a rapidly evolving job market, thereby increasing productivity and earning potential.

These investments, while requiring upfront capital, yield significant long-term returns by increasing productivity, attracting investment, and fostering innovation, contributing to fiscal sustainability.

Potential Risks of Fiscal Irresponsibility

Impact on Interest Rates and Investment

Fiscal irresponsibility, characterized by consistently high deficits and rising debt, can have severe consequences. It leads to:

- Higher Interest Rates: Increased government borrowing pushes up interest rates, making it more expensive for businesses to invest and for consumers to borrow.

- Reduced Private Investment: Uncertainty about the government's fiscal position can deter private investment, hindering economic growth.

- Slower Economic Growth: A combination of higher interest rates and reduced investment leads to slower economic growth, impacting jobs and living standards.

Credit Rating Downgrades and Increased Borrowing Costs

If Canada fails to demonstrate a commitment to fiscal prudence, credit rating agencies may downgrade the country's credit rating. This results in:

- Increased Borrowing Costs: A lower credit rating makes it more expensive for the government to borrow money, increasing the cost of servicing the national debt.

- Reduced Investor Confidence: A credit downgrade erodes investor confidence, making it more challenging to attract foreign investment.

Conclusion: Securing Canada's Economic Future Through Fiscal Prudence

Canada's economic outlook hinges on a commitment to fiscal prudence. Responsible government spending, coupled with strategic investments in infrastructure and human capital, is crucial for ensuring long-term economic stability and prosperity. Ignoring this path risks higher interest rates, reduced investment, slower growth, and potential credit downgrades. Understanding Canada's economic outlook and advocating for fiscal prudence is crucial for securing a prosperous future. Engage with your elected officials, participate in public discussions on the Canadian budget, and stay informed about economic policy. Let's work together to ensure a fiscally responsible and economically vibrant Canada.

Featured Posts

-

Navigate The Private Credit Boom 5 Key Dos And Don Ts

Apr 24, 2025

Navigate The Private Credit Boom 5 Key Dos And Don Ts

Apr 24, 2025 -

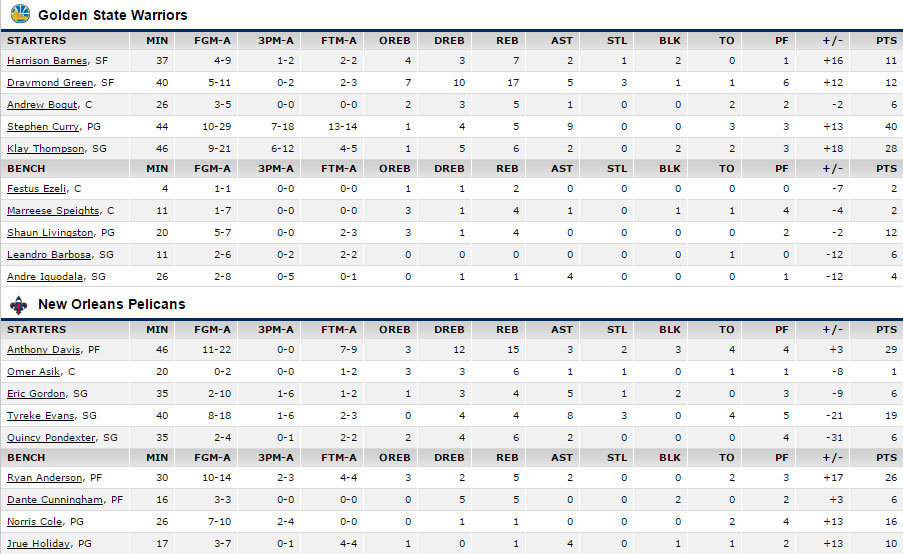

Key Bench Performances From Hield And Payton Secure Warriors Win

Apr 24, 2025

Key Bench Performances From Hield And Payton Secure Warriors Win

Apr 24, 2025 -

Us Stock Futures Surge Trumps Powell Comments Boost Markets

Apr 24, 2025

Us Stock Futures Surge Trumps Powell Comments Boost Markets

Apr 24, 2025 -

Analysis Of Teslas Q1 2024 Earnings Political Factors And Financial Performance

Apr 24, 2025

Analysis Of Teslas Q1 2024 Earnings Political Factors And Financial Performance

Apr 24, 2025 -

Rocket Launch Abort Blue Origin Cites Vehicle Subsystem Failure

Apr 24, 2025

Rocket Launch Abort Blue Origin Cites Vehicle Subsystem Failure

Apr 24, 2025