US Stock Futures Surge: Trump's Powell Comments Boost Markets

Table of Contents

Trump's Comments and Their Market Impact

Trump's recent comments regarding Jerome Powell and the Federal Reserve's monetary policy sent ripples through the financial markets. While the exact wording varied across different media reports, the overall tone suggested disapproval of the Fed's current approach to interest rates and inflation control. This sparked a considerable market reaction, highlighting the potent influence political figures can exert on investor sentiment.

- Direct quotes from Trump's statements: While precise quotes may vary depending on the source, many reports indicated a critical stance on Powell's handling of inflation and a suggestion of alternative monetary policy approaches. Locating and citing these quotes from reputable news sources is crucial for accurate analysis.

- Summary of market reaction: Following Trump's comments, US stock futures contracts saw a significant jump. Specific indices like the Dow Jones Industrial Average and the S&P 500 futures experienced noticeable gains, reflecting immediate investor optimism.

- Expert opinions: Market analysts offered diverse interpretations. Some attributed the surge to a perceived shift in anticipated Federal Reserve policy, while others cautioned against overreacting to short-term political pronouncements. These differing perspectives highlight the complexities in interpreting market responses to political commentary.

Analyzing the Federal Reserve's Current Stance

The Federal Reserve's current monetary policy is characterized by efforts to combat inflation without triggering a recession. This delicate balancing act involves careful consideration of various economic indicators. Trump's comments appear to challenge the Fed's strategy, potentially influencing investor expectations regarding future interest rate adjustments.

- Current inflation rates and projections: Current inflation data and projections by the Federal Reserve are crucial context for understanding the Fed's policies. These figures and the Fed's forecasts provide a factual basis for analyzing the market reaction to Trump's comments.

- Recent Federal Reserve statements and announcements: The Fed regularly releases statements and holds press conferences to communicate its policy decisions. Examining these official communications helps to contextualize Trump's criticism and gauge potential shifts in the Fed's stance.

- Potential future interest rate adjustments: Market participants closely watch the Fed's decisions regarding interest rates. Trump's comments could influence speculation about future rate hikes or cuts, directly impacting investor decisions and market volatility.

- Expert forecasts: Economists and financial analysts offer a variety of predictions on the future economic outlook and the Fed's likely course of action. Examining these differing forecasts highlights uncertainty in the market and the challenges in forecasting future trends.

Implications for Investors and Trading Strategies

The surge in US stock futures following Trump's comments presents both opportunities and risks for investors. Navigating this increased market volatility requires careful consideration of risk tolerance and investment goals.

- Strategies for long-term investors: Long-term investors should maintain a balanced and diversified portfolio, avoiding impulsive reactions to short-term political noise. A long-term perspective minimizes the impact of such market fluctuations.

- Strategies for short-term traders: Short-term traders might attempt to profit from the increased volatility, but this requires sophisticated risk management strategies and a keen understanding of market dynamics.

- Risk management techniques: Effective risk management is crucial in volatile markets. Diversification, stop-loss orders, and careful position sizing are essential tools for mitigating potential losses.

- Advice on diversifying investment portfolios: Diversification remains a cornerstone of sound investment strategy. Spreading investments across various asset classes reduces exposure to risk associated with specific sectors or political events.

Understanding Market Volatility

Market volatility refers to the rate at which the price of a security or market index fluctuates. Several factors influence this volatility, making it essential for investors to understand and manage associated risks.

- Definition and explanation of market volatility: Volatility measures the degree of price fluctuation, often expressed as a percentage or standard deviation. Higher volatility suggests greater price swings and potentially increased risk.

- Factors contributing to market volatility: Numerous factors can contribute, including political events (like Trump's comments), economic data releases, global geopolitical events, and unexpected company news.

- Strategies for managing risk during periods of high volatility: Strategies include reducing exposure to riskier assets, increasing cash holdings, and using hedging techniques to protect against potential losses.

Conclusion

Trump's comments unexpectedly boosted US stock futures, highlighting the significant influence political statements can have on market sentiment. The Federal Reserve's current policy stance and its potential response to external pressures, alongside the implications for investors, have been analyzed. Successfully navigating the resulting market volatility requires careful planning and risk management.

Call to Action: Stay informed about US stock futures and market movements by following our blog for regular updates on economic news and investment strategies. Understanding the impact of events like these is crucial for successfully navigating the complexities of the US stock market. Learn more about managing your investments during periods of market volatility and protecting your portfolio.

Featured Posts

-

John Travolta Honors Late Son Jetts 33rd Birthday With Moving Photo

Apr 24, 2025

John Travolta Honors Late Son Jetts 33rd Birthday With Moving Photo

Apr 24, 2025 -

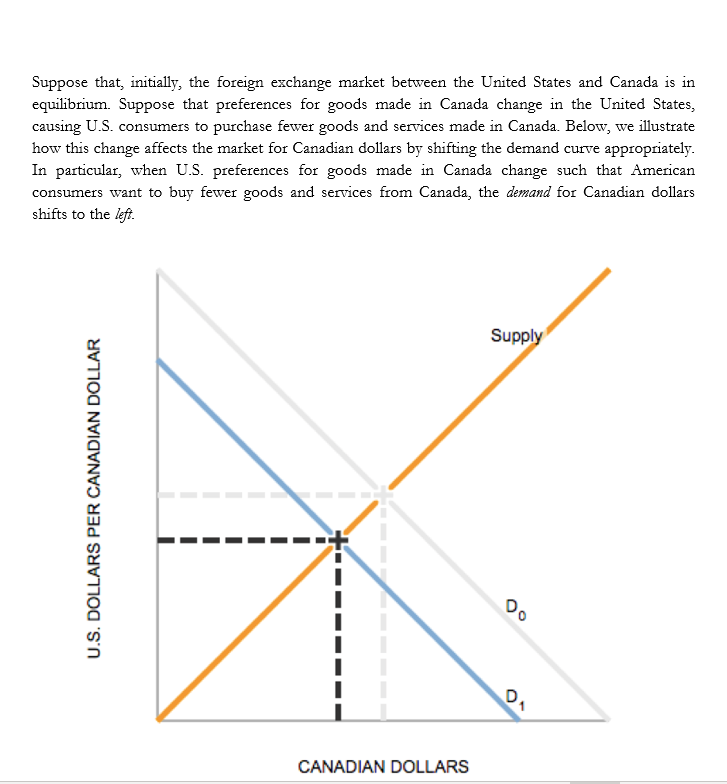

Analyzing The Canadian Dollars Performance Against Major Currencies

Apr 24, 2025

Analyzing The Canadian Dollars Performance Against Major Currencies

Apr 24, 2025 -

Toxic Chemical Residue From Ohio Derailment Months Long Impact On Buildings

Apr 24, 2025

Toxic Chemical Residue From Ohio Derailment Months Long Impact On Buildings

Apr 24, 2025 -

Us Dollar Gains Momentum Impact Of Trumps Comments On The Federal Reserve

Apr 24, 2025

Us Dollar Gains Momentum Impact Of Trumps Comments On The Federal Reserve

Apr 24, 2025 -

Finns Promise To Liam The Bold And The Beautiful Spoilers April 23rd

Apr 24, 2025

Finns Promise To Liam The Bold And The Beautiful Spoilers April 23rd

Apr 24, 2025