Analyzing The Canadian Dollar's Performance Against Major Currencies

Table of Contents

Recent Performance of the Canadian Dollar

The Canadian dollar's performance has been dynamic recently, exhibiting both periods of strength and weakness against major currencies. Analyzing its movement over different timeframes provides valuable context. (Note: Actual data would need to be inserted here using a current data source and presented in charts and graphs. The following is example text.)

For example, over the past year, the CAD/USD exchange rate might have shown a range between 1.25 and 1.35, reflecting periods of both Canadian dollar appreciation and depreciation. Similarly, the CAD/EUR rate might have fluctuated within a specific band, while the CAD/GBP and CAD/JPY rates exhibited their own unique patterns. Significant highs and lows often correlate with specific events, such as changes in oil prices or shifts in interest rate policies.

- CAD/USD exchange rate trends: (Insert chart and data here, including explanation of trends and key events influencing the rate).

- CAD/EUR exchange rate trends: (Insert chart and data here, including explanation of trends and key events influencing the rate).

- CAD/GBP exchange rate trends: (Insert chart and data here, including explanation of trends and key events influencing the rate).

- CAD/JPY exchange rate trends: (Insert chart and data here, including explanation of trends and key events influencing the rate).

Key Factors Influencing the Canadian Dollar Exchange Rate

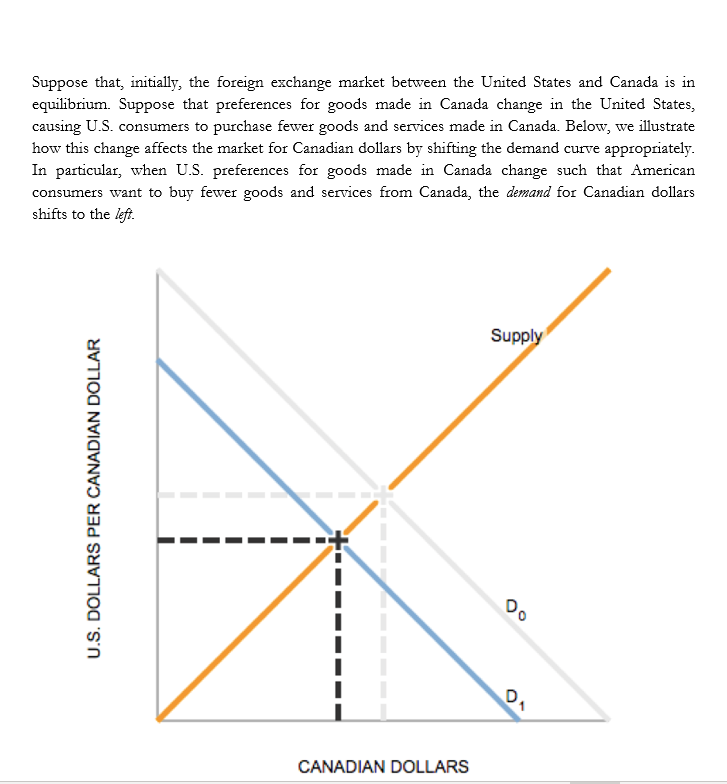

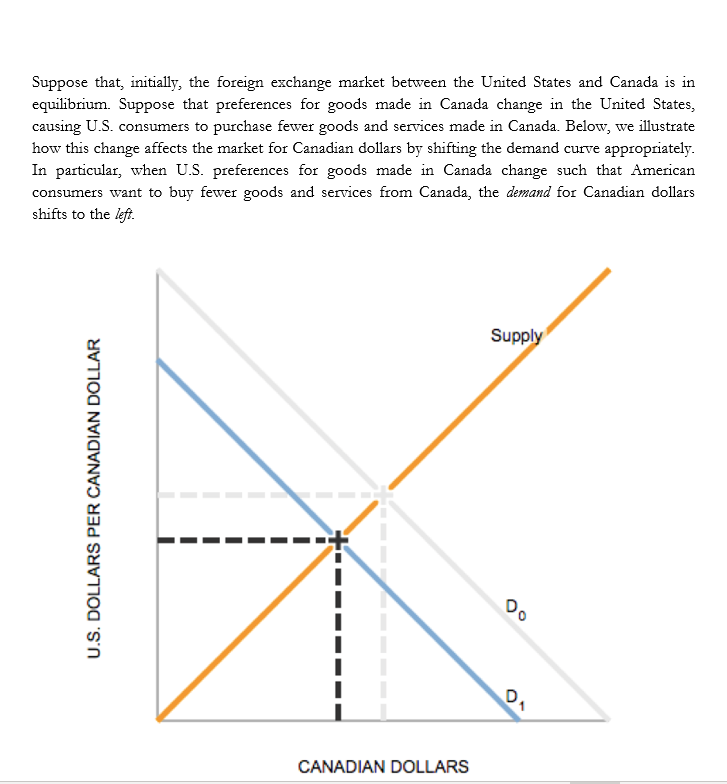

Several macroeconomic factors significantly influence the Canadian dollar exchange rate. Understanding these factors is essential for predicting future movements.

-

Commodity Prices: Canada is a major exporter of commodities, particularly crude oil. Fluctuations in global oil prices directly impact the CAD. Higher oil prices generally strengthen the Canadian dollar, while lower prices weaken it. Other commodity prices, such as those for natural gas, lumber, and metals, also play a role.

-

Interest Rates: The Bank of Canada's monetary policy, particularly its interest rate decisions, significantly affects the CAD. Higher interest rates in Canada relative to other countries attract foreign investment, increasing demand for the CAD and strengthening its value. Conversely, lower interest rates tend to weaken the currency.

-

Economic Growth: Canada's Gross Domestic Product (GDP) growth is a key indicator of economic health and investor confidence. Strong GDP growth typically supports a stronger CAD, while slower growth or recessionary concerns tend to weaken it.

-

Geopolitical Events: Global political instability, trade wars, and other geopolitical events can significantly impact investor sentiment and currency markets. Negative geopolitical developments often lead to a flight to safety, potentially weakening the CAD in favor of safer haven currencies like the USD or JPY.

-

Government Policies: Canadian government policies, such as fiscal policy decisions and trade agreements, can also have an indirect impact on the CAD. Policies that promote economic growth and stability tend to support a stronger currency.

Forecasting the Canadian Dollar's Future

Forecasting the Canadian dollar's future exchange rate is inherently challenging, as numerous unpredictable factors are at play. However, analyzing current economic indicators and expert predictions can provide a reasonable outlook.

- Short-term forecasts (1-3 months): (Insert forecast and rationale here, citing reliable sources).

- Mid-term forecasts (6-12 months): (Insert forecast and rationale here, citing reliable sources).

- Long-term forecasts (1-5 years): (Insert forecast and rationale here, acknowledging the higher degree of uncertainty).

- Potential factors that could alter these forecasts: (Discuss potential unforeseen events like global recession, significant shifts in commodity prices, or unexpected policy changes).

Strategies for Managing Canadian Dollar Exchange Rate Risk

Businesses and individuals engaging in international transactions face Canadian dollar exchange rate risk. Employing appropriate hedging strategies can mitigate potential losses.

- Forward contracts: These contracts lock in a specific exchange rate for a future transaction, eliminating uncertainty.

- Options contracts: These provide the right, but not the obligation, to buy or sell currency at a predetermined rate, offering flexibility.

- Currency hedging strategies: Various sophisticated hedging techniques can be implemented to manage exchange rate risk based on specific circumstances and risk tolerance.

- Diversification of assets: Spreading investments across different currencies and asset classes reduces exposure to fluctuations in a single currency.

Conclusion

The Canadian dollar exchange rate is influenced by a complex interplay of factors, including commodity prices, interest rates, economic growth, geopolitical events, and government policies. Monitoring these factors is essential for informed decision-making. Recent performance indicates periods of both strength and weakness, highlighting the dynamic nature of the currency. Understanding these dynamics and employing appropriate risk management strategies are crucial for businesses, investors, and anyone impacted by CAD fluctuations. Stay informed on the latest fluctuations in the Canadian Dollar exchange rate to make informed financial decisions. Learn more about effective currency hedging strategies today!

Featured Posts

-

Chinese Investment Firm May Sell Utac Semiconductor Tester

Apr 24, 2025

Chinese Investment Firm May Sell Utac Semiconductor Tester

Apr 24, 2025 -

The Zuckerberg Trump Dynamic Implications For Facebook And Beyond

Apr 24, 2025

The Zuckerberg Trump Dynamic Implications For Facebook And Beyond

Apr 24, 2025 -

John Travoltas Rotten Tomatoes Record Is It Really That Bad

Apr 24, 2025

John Travoltas Rotten Tomatoes Record Is It Really That Bad

Apr 24, 2025 -

Judge Abrego Garcia Issues Strong Warning Against Stonewalling In Us Courts

Apr 24, 2025

Judge Abrego Garcia Issues Strong Warning Against Stonewalling In Us Courts

Apr 24, 2025 -

Us Stock Futures Surge Trumps Powell Comments Boost Markets

Apr 24, 2025

Us Stock Futures Surge Trumps Powell Comments Boost Markets

Apr 24, 2025