Where To Invest: Mapping The Country's Newest Business Hotspots

Table of Contents

The Rise of Tech Hubs: Investing in Innovation

The technology sector continues to be a major driver of economic growth, and several regions are emerging as significant players in this space. Investing in these burgeoning tech hubs offers substantial potential for high returns, but careful consideration of risks is crucial.

Silicon Valley's Rivals: Emerging Tech Clusters

Numerous cities across the country are challenging Silicon Valley's dominance, creating exciting opportunities for investors.

- Austin, Texas: Booming in AI, SaaS, and fintech, Austin benefits from a large talent pool and a vibrant startup ecosystem. Major players include Tesla and Oracle.

- Denver, Colorado: A strong presence in aerospace, telecommunications, and renewable energy tech, Denver attracts investment due to its skilled workforce and high quality of life.

- Raleigh-Durham, North Carolina: Known as the "Research Triangle," this area excels in biotechnology, pharmaceuticals, and software development, fueled by strong university research.

- Seattle, Washington: While established, Seattle continues its rapid growth in cloud computing (Amazon, Microsoft) and related technologies.

These areas thrive due to factors like:

- Access to a skilled workforce: Universities and technical schools provide a constant stream of talented graduates.

- Venture capital funding: Abundant VC funding fuels innovation and supports the growth of startups.

- Supportive government policies: Tax incentives and regulations often encourage investment and business growth.

However, challenges exist:

- Competition for talent: Rapid growth leads to intense competition for skilled workers, driving up salaries.

- Infrastructure limitations: Rapid expansion can strain existing infrastructure, including transportation and housing.

Investing in Tech Infrastructure: Data Centers and Beyond

The ever-increasing demand for data storage and processing power is driving massive investment in data centers and cloud infrastructure. Several regions are strategically positioned to benefit from this trend.

- Northern Virginia: Home to major cloud providers like Amazon Web Services (AWS) and numerous data centers, this area benefits from robust internet connectivity and a skilled workforce.

- Silicon Valley (California): Remains a key location due to its established infrastructure and proximity to major tech companies.

- Salt Lake City, Utah: Growing as a data center hub, benefiting from its relatively low energy costs and ample space.

The long-term growth potential is substantial, driven by the expansion of the internet of things (IoT), artificial intelligence (AI), and big data analytics. However, risks include:

- High energy consumption: Data centers require significant energy, raising environmental concerns.

- Cybersecurity threats: Protecting sensitive data from cyberattacks is paramount.

Beyond Tech: Exploring Other Promising Sectors

While technology remains a dominant force, other sectors offer compelling investment opportunities.

The Green Economy Boom: Renewable Energy and Sustainability

Government initiatives and growing consumer awareness are fueling the growth of the renewable energy sector. Regions with strong renewable energy resources and supportive policies are particularly attractive.

- Texas: Leading in wind energy production, benefiting from its vast plains and supportive regulatory environment.

- California: A pioneer in solar energy, with strong government incentives and a large consumer market.

- Iowa: A leader in wind energy, boasting significant installed capacity and ongoing expansion.

Driving factors include:

- Government incentives: Tax credits, subsidies, and renewable portfolio standards incentivize investment and deployment.

- Falling costs: The cost of renewable energy technologies has fallen dramatically, making them increasingly competitive.

Challenges include:

- Intermittency of renewable sources: Solar and wind energy are dependent on weather conditions.

- Grid modernization: Upgrading the electricity grid to handle the influx of renewable energy is crucial.

Healthcare and Biotech: Investing in a Growing Industry

The aging population and advances in medical technology are driving significant growth in the healthcare and biotech sectors.

- Boston, Massachusetts: A global hub for biotechnology, with a concentration of leading research institutions and pharmaceutical companies.

- San Diego, California: Strong in biotechnology and medical devices, benefiting from its research institutions and favorable climate.

- San Francisco Bay Area (California): A significant presence in biotech, attracting significant venture capital investment.

Growth drivers include:

- Aging population: An increasing elderly population drives demand for healthcare services and related technologies.

- Advances in medical technology: Innovation in areas like gene therapy, personalized medicine, and medical devices fuels market growth.

Challenges include:

- Regulatory hurdles: Navigating the complex regulatory landscape can be challenging and time-consuming.

- High R&D costs: Developing new drugs and medical devices is expensive and requires significant investment.

Analyzing Investment Risk and Opportunities

Successful investing requires careful analysis and a well-defined strategy.

Due Diligence: Understanding Local Markets

Thorough market research is critical before committing to any investment. This includes:

- Analyzing local economic conditions: Assessing factors such as employment rates, GDP growth, and inflation.

- Evaluating competition: Understanding the competitive landscape and the potential for market share.

- Reviewing the regulatory environment: Assessing any potential legal or regulatory risks.

Assessing your risk tolerance is equally important, allowing you to choose investment strategies that align with your comfort level.

Diversification: Spreading Your Investment Portfolio

Diversification is crucial for mitigating risk. Consider diversifying across:

- Different sectors: Investing across various sectors reduces your reliance on any single industry's performance.

- Geographic locations: Spreading investments across different regions reduces the impact of localized economic downturns.

- Asset classes: Investing in a mix of stocks, bonds, and real estate can help balance risk and return.

Conclusion

This exploration of the country's newest business hotspots reveals exciting investment opportunities across diverse sectors. From the burgeoning tech scene to the rapidly expanding green economy and healthcare innovations, careful analysis and strategic diversification are key to maximizing returns. Remember to conduct thorough due diligence before making any investment decisions. Discover your own path to success by further researching these promising locations and identifying the best places where to invest to build your portfolio's future. Start your research today and find the best investment opportunities for you!

Featured Posts

-

Exclusive High Rollers John Travoltas New Action Movie Poster And Photo Preview

Apr 24, 2025

Exclusive High Rollers John Travoltas New Action Movie Poster And Photo Preview

Apr 24, 2025 -

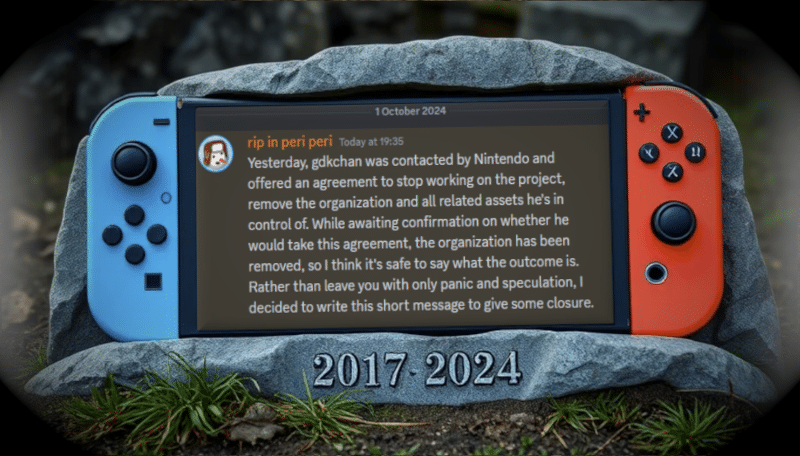

Ryujinx Emulator Project Ends After Reported Nintendo Contact

Apr 24, 2025

Ryujinx Emulator Project Ends After Reported Nintendo Contact

Apr 24, 2025 -

Eus Plan To Eliminate Russian Gas Focusing On The Spot Market

Apr 24, 2025

Eus Plan To Eliminate Russian Gas Focusing On The Spot Market

Apr 24, 2025 -

Actors And Writers Strike Hollywood Faces Unprecedented Production Shutdown

Apr 24, 2025

Actors And Writers Strike Hollywood Faces Unprecedented Production Shutdown

Apr 24, 2025 -

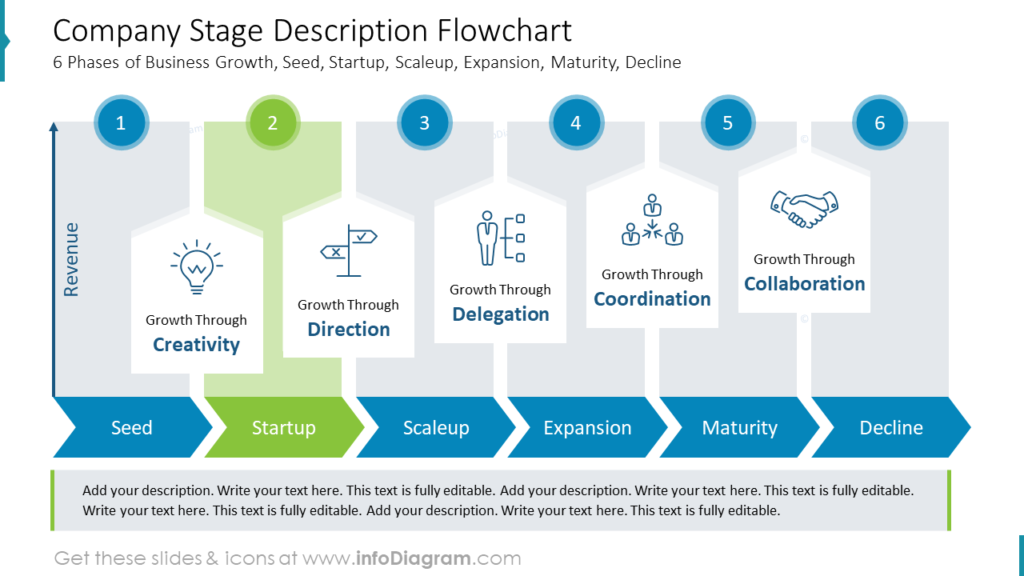

Investing In Middle Management A Strategic Approach To Business Growth

Apr 24, 2025

Investing In Middle Management A Strategic Approach To Business Growth

Apr 24, 2025