EU's Plan To Eliminate Russian Gas: Focusing On The Spot Market

Table of Contents

The Urgent Need for Russian Gas Independence

The EU's reliance on Russian gas has presented significant geopolitical and economic risks.

- Geopolitical Implications: Dependence on a single supplier, particularly one with a history of using energy as a political weapon, creates significant vulnerability and undermines the EU's energy security and sovereignty. Russia's actions have underscored this risk.

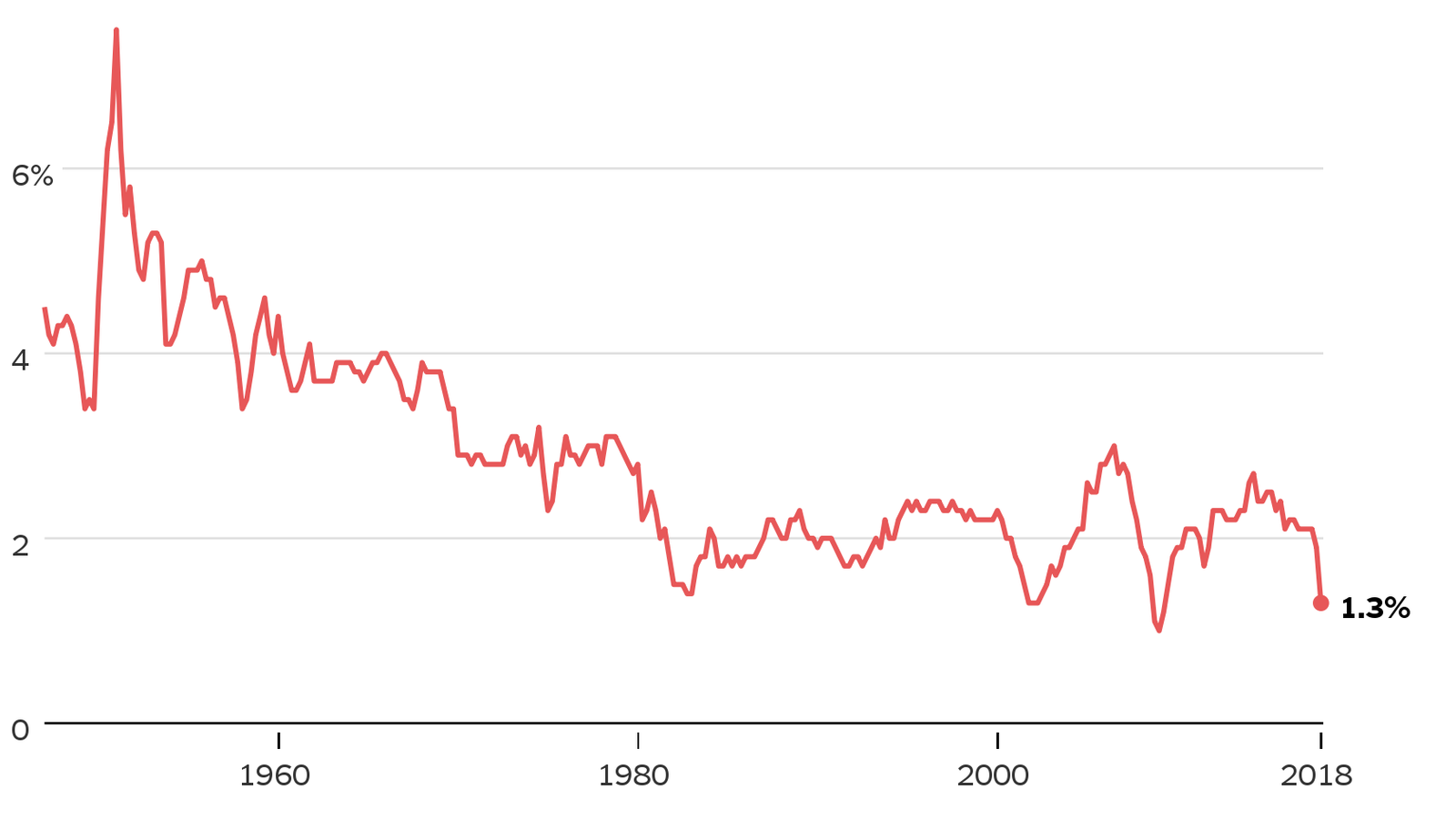

- Economic Vulnerabilities: Volatile gas prices dictated by a single supplier expose the EU economy to significant shocks. Price hikes, often politically motivated, can cripple industries and inflate consumer costs.

- Energy Security Goals: The EU aims to significantly diversify its energy sources, reduce its dependence on Russian gas, and enhance its resilience against future disruptions. This is a crucial aspect of its broader energy security strategy.

The EU's current dependence on Russian gas remains substantial, although it has decreased significantly since the start of the war. The target is a complete elimination of this reliance, a process requiring substantial investment and policy changes. Sanctions imposed on Russia have further complicated the energy landscape, accelerating the need for alternative supply sources and efficient market mechanisms.

The Spot Market as a Key Solution

The spot market offers a crucial solution to the EU's dependence on Russian gas.

- Flexibility and Price Discovery: The spot market allows for flexible purchasing arrangements, enabling buyers to procure gas from multiple suppliers based on real-time prices and availability. This contrasts with long-term contracts that often lock in unfavorable terms.

- LNG Imports: Liquefied Natural Gas (LNG) plays a pivotal role in supplying the spot market. Increased LNG imports from diverse global sources are crucial for diversifying the EU's energy mix.

- Robust Infrastructure: Efficient spot market transactions require a robust gas infrastructure, including new LNG import terminals, expanded pipeline networks, and upgraded storage facilities.

Several new LNG import terminals are under construction or planned across the EU, significantly boosting the region's capacity to receive LNG from various suppliers. However, challenges remain in ensuring sufficient pipeline interconnectivity to efficiently distribute gas across the bloc. Upgrades to existing infrastructure are also crucial to optimize the flow of gas within the EU.

Challenges in Transitioning to the Spot Market

The transition to a spot market-centric approach is not without its difficulties.

- Price Volatility: Spot market prices are inherently volatile, potentially exposing consumers and businesses to significant price fluctuations. This necessitates effective risk management strategies.

- Market Manipulation: The risk of market manipulation and the need for robust regulatory oversight are paramount to maintain market fairness and transparency.

- Infrastructural Limitations: Existing infrastructure may not be sufficient to accommodate the increased volumes of gas traded on the spot market, necessitating significant investments in upgrades and expansion.

To mitigate price volatility, the EU encourages the use of hedging strategies and risk management tools, such as futures contracts and options. Regulatory bodies are actively working to ensure the spot market operates fairly and transparently.

Supporting Strategies to Complement the Spot Market

The spot market is not a standalone solution; it needs to be complemented by other strategies.

- Renewable Energy: Investing in renewable energy sources, such as solar, wind, and hydropower, is crucial to reducing the overall demand for natural gas and bolstering energy independence.

- Energy Efficiency: Implementing energy efficiency measures and demand-side management initiatives can significantly lower gas consumption.

- Strategic Gas Storage: Building up strategic gas storage capacity can provide a buffer against price spikes and supply disruptions, enhancing market stability.

The EU has set ambitious targets for renewable energy deployment across its member states. Successful energy efficiency programs already implemented in various EU countries demonstrate the potential for significant gas savings.

Conclusion: The Future of EU's Gas Supply and the Spot Market

The EU's plan to eliminate its reliance on Russian gas hinges significantly on the spot market's ability to provide a flexible and diversified gas supply. While the transition presents challenges, including price volatility and infrastructural limitations, strategies like increased LNG imports, robust regulatory oversight, and complementary measures such as renewable energy deployment and energy efficiency programs are crucial. By addressing these challenges proactively, the EU can achieve its energy independence goals and build a more resilient and secure energy system. Learn more about the EU's energy policies and the ongoing transition to a more diversified and secure gas supply by exploring resources on EU gas diversification, spot market energy trading, and reducing reliance on Russian gas. The future of European energy security depends on a collaborative effort towards achieving energy independence.

Featured Posts

-

Ray Epps V Fox News A Deep Dive Into The Jan 6th Defamation Lawsuit

Apr 24, 2025

Ray Epps V Fox News A Deep Dive Into The Jan 6th Defamation Lawsuit

Apr 24, 2025 -

Canadas Conservatives Tax Cuts And Deficit Reduction Plan

Apr 24, 2025

Canadas Conservatives Tax Cuts And Deficit Reduction Plan

Apr 24, 2025 -

Stock Market Live Dow Nasdaq S And P 500 Gains Fueled By Tariff Relief

Apr 24, 2025

Stock Market Live Dow Nasdaq S And P 500 Gains Fueled By Tariff Relief

Apr 24, 2025 -

Los Angeles Wildfires The Rise Of Disaster Betting

Apr 24, 2025

Los Angeles Wildfires The Rise Of Disaster Betting

Apr 24, 2025 -

Harvard And The Trump Administration Could A Settlement Be Near

Apr 24, 2025

Harvard And The Trump Administration Could A Settlement Be Near

Apr 24, 2025