Village Roadshow Sale Finalized: Alcon's $417.5 Million Offer Accepted

Table of Contents

Deal Details and Financial Implications

The $417.5 Million Acquisition

The final sale price of $417.5 million represents a significant investment in the entertainment sector. This figure reflects Alcon's confidence in Village Roadshow's assets and potential for future growth. While the exact premium paid over initial offers remains undisclosed, industry analysts suggest it reflects the strategic value of Village Roadshow's extensive film library and production capabilities.

- Payment Structure: While the exact breakdown isn't publicly available, it's likely a combination of cash and possibly some form of equity consideration. Further details are expected to be released in official company statements.

- Conditions Precedent: All necessary regulatory approvals and other conditions precedent to the deal's closure have been successfully met, paving the way for a smooth transition of ownership.

- Financing: The acquisition's financing details are yet to be fully disclosed. However, given the deal's size, it likely involved a combination of Alcon's internal resources and potentially external financing from investment banks or other financial institutions. This acquisition price is comparable to other recent major entertainment industry deals, such as [cite a comparable deal with a link], indicating a healthy valuation for the assets acquired.

Impact on Village Roadshow Shareholders

Village Roadshow shareholders can expect a significant return on their investment, although the exact payout will depend on individual shareholdings. The share price reaction following the announcement of the finalized deal should provide a good indication of market sentiment. This will be closely analyzed by financial experts and investors.

- Percentage Return: The percentage return will vary depending on the purchase price of each shareholder's shares. Calculations need to take into account the initial investment cost and dividends received, compared to the sale price per share.

- Future Implications: The long-term implications for shareholder value are dependent on Alcon's success in managing and growing Village Roadshow's assets. Successful integration and strategic growth will boost future returns.

- Dissenting Opinions: Although the acquisition has been finalized, monitoring for any lingering dissent among shareholders is crucial. Any significant opposition could lead to further developments.

Strategic Rationale Behind Alcon's Acquisition

Expanding Alcon's Portfolio

The acquisition aligns perfectly with Alcon Entertainment's strategic goals of expanding its portfolio and strengthening its position within the global entertainment market. The synergies between the two companies are substantial.

- Assets Acquired: This acquisition gives Alcon access to Village Roadshow's extensive film library, established production studios, and distribution networks. This significantly expands their reach and capabilities.

- Synergies: The combination of Alcon's established Hollywood presence and Village Roadshow's strong Australian and international footprint creates substantial synergies, particularly in film production and distribution. Both companies possess complementary expertise.

Alcon's Growth in the Global Entertainment Market

Alcon's ambitions for global expansion are significantly boosted by this acquisition. Village Roadshow's international reach and established relationships provide a springboard for further growth.

- Market Share Gains: The acquisition will undoubtedly increase Alcon's market share, particularly in the Australian and Asian entertainment markets.

- Geographical Expansion: Village Roadshow's international distribution networks provide Alcon with immediate access to new markets and audiences worldwide.

- Access to New Talent and IP: The acquisition unlocks access to a new pool of talented individuals and intellectual property, bolstering Alcon's production capabilities. This access to diverse content will help Alcon’s future growth.

Future of Village Roadshow Under Alcon Ownership

Changes in Management and Operations

The acquisition will inevitably lead to changes in management and operational strategies. While specific details are still emerging, a restructuring is expected.

- Leadership Changes: Key leadership positions within Village Roadshow are likely to be reshaped, reflecting Alcon's strategic vision for the company.

- Operational Changes: Alcon is expected to implement new operational strategies to streamline processes, improve efficiency, and align Village Roadshow's operations with its overall business model.

- Strategic Partnerships: Alcon might forge new partnerships and collaborations, leveraging the combined strengths of both organizations.

Impact on the Australian Film Industry

The acquisition has significant implications for the Australian film industry. While concerns about potential job losses might arise, increased investment and international collaborations are also possibilities.

- Investment in Australian Film: Alcon's acquisition could potentially lead to increased investment in Australian film production, fostering growth and creating new opportunities.

- Impact on Local Talent: The long-term impact on local talent will depend on Alcon's commitment to fostering Australian creativity and talent.

- Competition: The acquisition's impact on competition within the Australian entertainment market will require close observation and analysis.

Conclusion

The finalized sale of Village Roadshow to Alcon Entertainment for $417.5 million is a pivotal moment for both companies. This strategic acquisition strengthens Alcon's global position, while Village Roadshow’s future trajectory will be shaped by its new ownership. The consequences for shareholders, the Australian film industry, and the wider entertainment sector will be closely monitored in the coming months and years. To stay abreast of the latest developments regarding this significant entertainment industry acquisition, continue following news related to the Village Roadshow sale and its effects on Alcon Entertainment's future endeavors.

Featured Posts

-

Teslas Optimus Robot Chinas Rare Earth Restrictions Delay Production

Apr 24, 2025

Teslas Optimus Robot Chinas Rare Earth Restrictions Delay Production

Apr 24, 2025 -

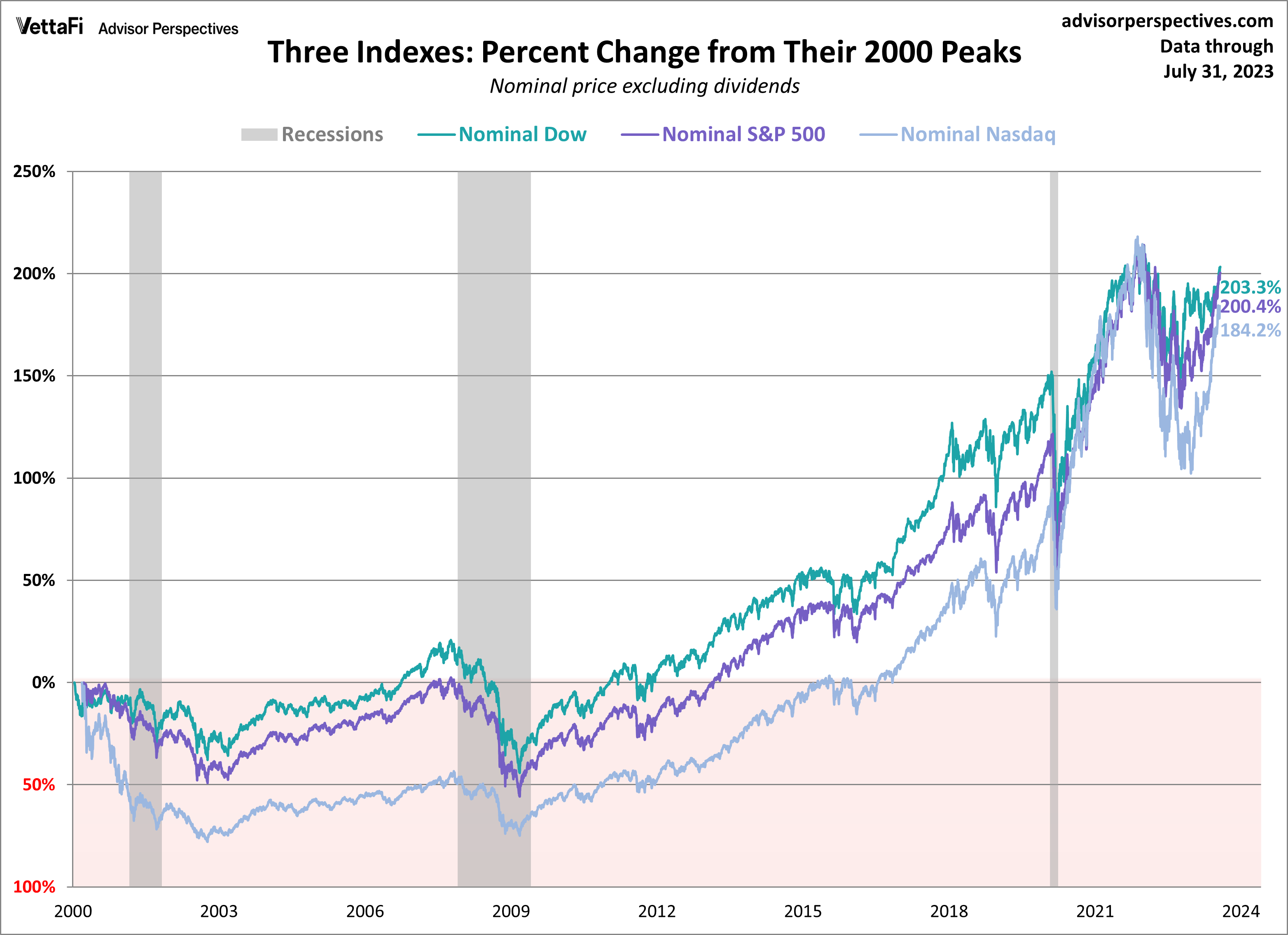

Stock Market Update Dow Jones S And P 500 Live Data April 23

Apr 24, 2025

Stock Market Update Dow Jones S And P 500 Live Data April 23

Apr 24, 2025 -

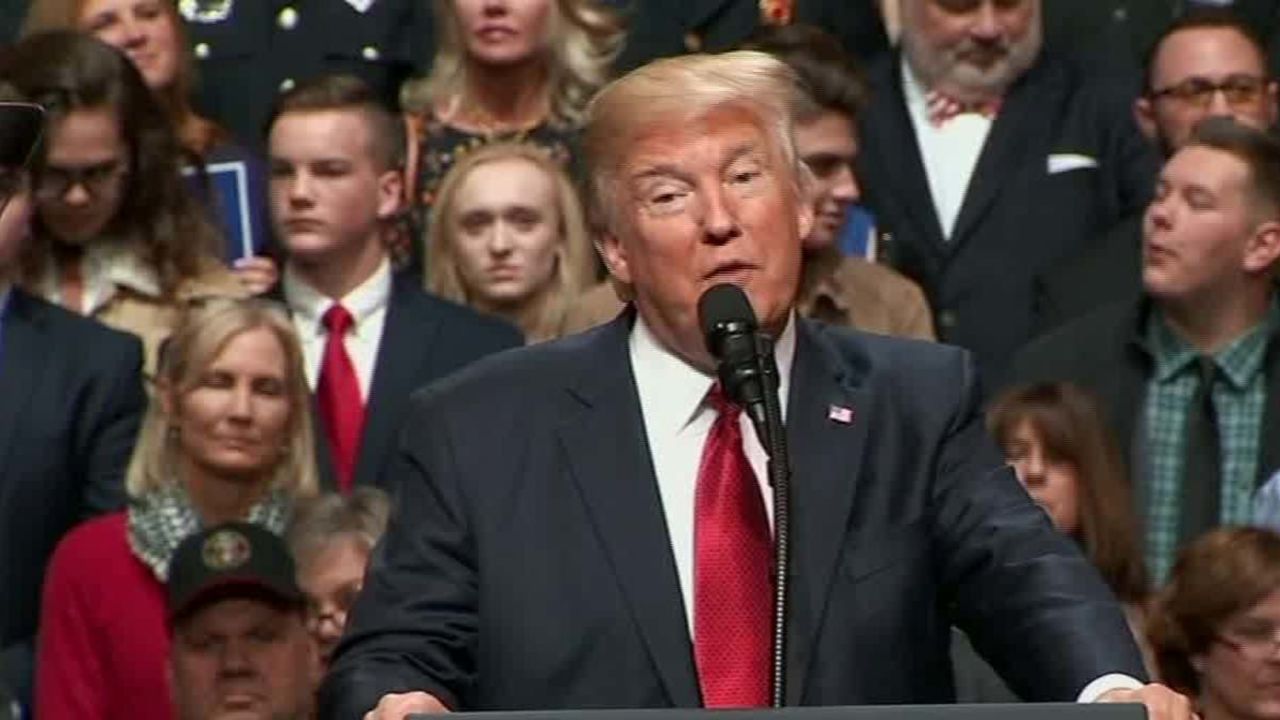

The Impact Of Trumps Budget Cuts On Tornado Preparedness And Response

Apr 24, 2025

The Impact Of Trumps Budget Cuts On Tornado Preparedness And Response

Apr 24, 2025 -

How Middle Managers Drive Company Success And Improve Employee Experience

Apr 24, 2025

How Middle Managers Drive Company Success And Improve Employee Experience

Apr 24, 2025 -

Chainalysis Acquires Alterya Blockchain Meets Ai

Apr 24, 2025

Chainalysis Acquires Alterya Blockchain Meets Ai

Apr 24, 2025