Chainalysis Acquires Alterya: Blockchain Meets AI

Table of Contents

Synergistic Strengths: How Chainalysis and Alterya Complement Each Other

The acquisition of Alterya by Chainalysis represents a strategic synergy, combining two industry leaders with complementary strengths. This powerful partnership is poised to significantly enhance the fight against financial crime.

Chainalysis' Blockchain Expertise

Chainalysis is a globally recognized leader in blockchain data analysis. Their comprehensive suite of products provides critical tools for investigating cryptocurrency-related crimes. Their established client base includes law enforcement agencies and financial institutions worldwide, relying on Chainalysis for critical insights.

- Leading provider of blockchain analytics: Chainalysis processes vast amounts of blockchain data to provide actionable intelligence.

- Comprehensive suite of products: Their platform includes tools for tracing illicit funds, identifying darknet markets, and analyzing cryptocurrency transactions.

- Extensive client base: They work with governments, law enforcement, and financial institutions globally, providing critical support in cryptocurrency investigations and regulatory compliance efforts. This deep network provides invaluable real-world testing and feedback for their solutions.

- Focus on regulatory compliance: Chainalysis helps organizations meet AML (Anti-Money Laundering) and KYC (Know Your Customer) regulatory requirements, reducing risk and fostering trust.

Alterya's AI-Powered Capabilities

Alterya brings to the table its expertise in AI-driven data analysis and machine learning. Their technology excels at processing and interpreting massive datasets, identifying patterns and anomalies that might otherwise go unnoticed.

- Advanced AI algorithms: Alterya utilizes sophisticated machine learning algorithms to detect fraudulent activities, predict risks, and enhance the accuracy of financial investigations.

- Data analysis and risk assessment: Their platform provides powerful tools for assessing risk, identifying potentially suspicious transactions, and providing early warnings of emerging threats.

- Scalability and efficiency: Alterya's technology can handle massive volumes of data, providing faster and more efficient analysis compared to traditional methods.

- Focus on fraud detection: Alterya's core strength lies in identifying and preventing fraudulent transactions across various financial systems.

The Combined Power

The merger of Chainalysis and Alterya’s capabilities results in a significant leap forward in the fight against financial crime. The combination allows for:

- Enhanced Investigations: Faster analysis of complex transactions, improved accuracy in identifying illicit activities, and more efficient tracing of stolen funds.

- Improved Accuracy: AI-powered algorithms enhance the precision of blockchain analysis, reducing false positives and improving the efficiency of investigative resources.

- Faster Analysis: The combined technologies streamline the investigation process, enabling quicker identification and response to threats.

- Fraud Prevention: Proactive identification of suspicious activities allows for timely intervention and prevention of future crimes.

Impact on Cryptocurrency Investigations and Financial Crime

The Chainalysis acquisition of Alterya has far-reaching implications for cryptocurrency investigations and the broader fight against financial crime.

Enhanced Investigative Capabilities

The combined power of blockchain analytics and AI significantly enhances investigative techniques. This translates into:

- Cryptocurrency Tracing: More effectively tracking stolen cryptocurrencies across multiple blockchains, even when sophisticated mixing techniques are used.

- Money Laundering Detection: Uncovering complex money laundering schemes that previously might have gone undetected.

- Illicit Funds Tracing: Identifying and seizing assets obtained through illegal activities, disrupting criminal networks.

- Darknet Market Investigations: Deepening insights into the activities of darknet markets and identifying those involved in illegal transactions.

Improved Regulatory Compliance

The merger helps financial institutions meet regulatory requirements more effectively. This includes:

- AML Compliance: More easily identifying and reporting suspicious activities, reducing the risk of penalties.

- KYC Compliance: Enhancing customer due diligence processes to prevent the use of their services for illicit purposes.

- Regulatory Reporting: Streamlining the reporting process to regulators, ensuring compliance and maintaining a strong reputation.

- Risk Mitigation: Proactive risk assessment and mitigation strategies to protect financial institutions from financial crime.

Strengthening Global Security

The combined strengths of Chainalysis and Alterya contribute to a safer and more secure global financial system. This includes:

- Disrupting Criminal Networks: Providing law enforcement with the tools they need to effectively investigate and dismantle criminal organizations involved in cryptocurrency-related crimes.

- Protecting Consumers: Safeguarding consumers from fraud and scams involving cryptocurrencies.

- Improving Trust: Fostering greater trust in the cryptocurrency ecosystem by enhancing security and compliance.

Future Implications and Industry Predictions

The acquisition positions Chainalysis as a dominant player in the rapidly evolving field of blockchain analytics and AI-driven investigations.

Market Leadership

This merger solidifies Chainalysis' position as a market leader, providing a comprehensive suite of tools that address the complex challenges of the digital asset world.

Innovation in Blockchain Technology

The combined expertise promises to drive innovation in the development of advanced AI-powered blockchain analysis tools, leading to new breakthroughs in the fight against financial crime. Expect to see improved detection of sophisticated money laundering schemes and more robust tools for regulatory compliance.

Industry Trends

The increasing adoption of blockchain technology and the growing regulatory scrutiny of the cryptocurrency space drive the demand for robust solutions like those offered by the combined entity. This acquisition reflects the crucial role blockchain analytics and AI play in the future of finance.

Conclusion

The Chainalysis acquisition of Alterya represents a significant advancement in the fight against financial crime. The synergistic combination of blockchain analytics and AI-powered capabilities results in enhanced investigations, improved regulatory compliance, and strengthened global security. This merger signifies a pivotal moment for the industry, paving the way for future innovations and setting a new standard for blockchain security. Learn more about the impact of Chainalysis Acquiring Alterya by visiting the Chainalysis website and exploring their resources on blockchain analytics and AI-powered investigations. Stay informed on the latest in blockchain analytics and AI – the future of financial security depends on it.

Featured Posts

-

77 Inch Lg C3 Oled Is It Worth The Investment My Honest Review

Apr 24, 2025

77 Inch Lg C3 Oled Is It Worth The Investment My Honest Review

Apr 24, 2025 -

Jan 6th Conspiracy Theories Ray Epps Defamation Case Against Fox News Explained

Apr 24, 2025

Jan 6th Conspiracy Theories Ray Epps Defamation Case Against Fox News Explained

Apr 24, 2025 -

Bitcoin Btc Price Increase Analyzing The Influence Of Trade And Monetary Policy

Apr 24, 2025

Bitcoin Btc Price Increase Analyzing The Influence Of Trade And Monetary Policy

Apr 24, 2025 -

Blue Origin Scraps Rocket Launch Due To Vehicle Subsystem Problem

Apr 24, 2025

Blue Origin Scraps Rocket Launch Due To Vehicle Subsystem Problem

Apr 24, 2025 -

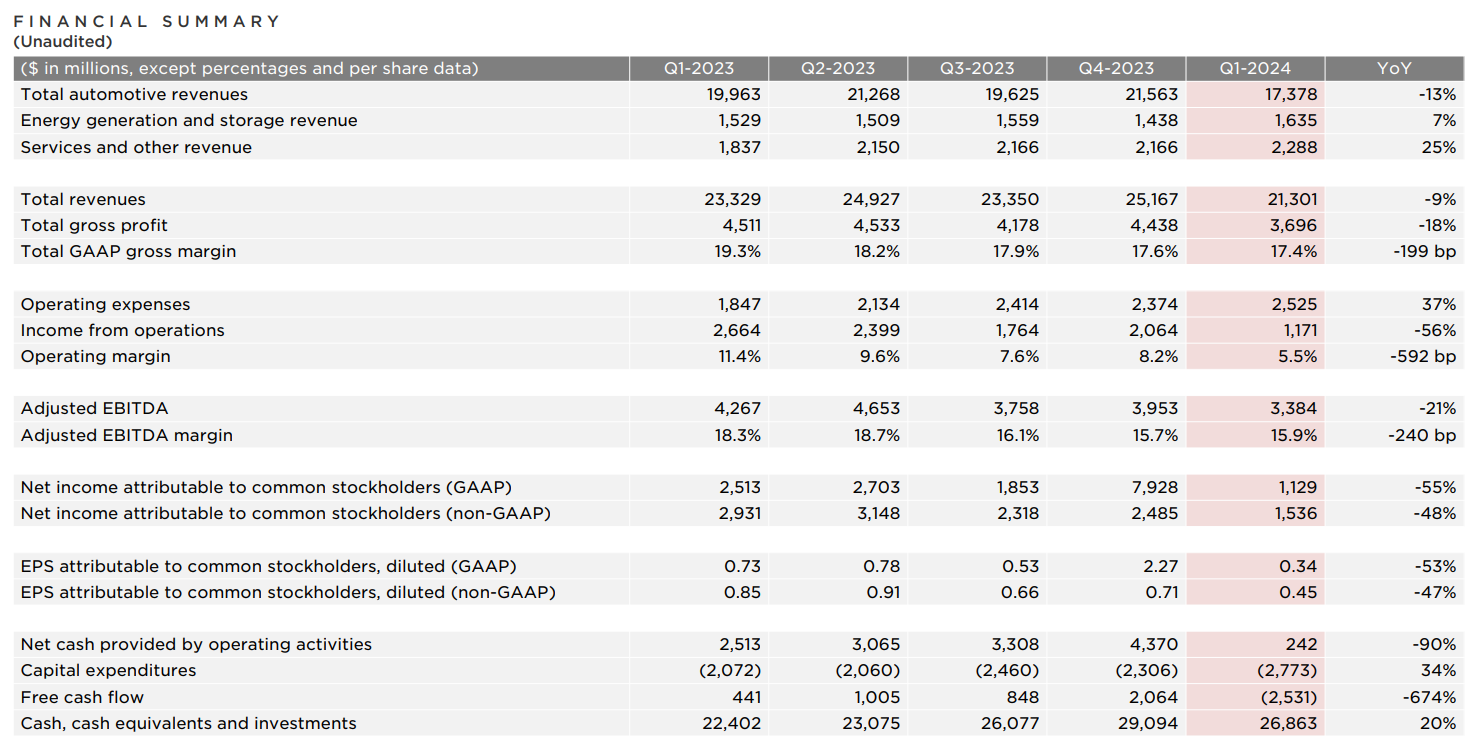

Tesla Profit Decline In Q1 2024 The Role Of Musks Political Associations

Apr 24, 2025

Tesla Profit Decline In Q1 2024 The Role Of Musks Political Associations

Apr 24, 2025