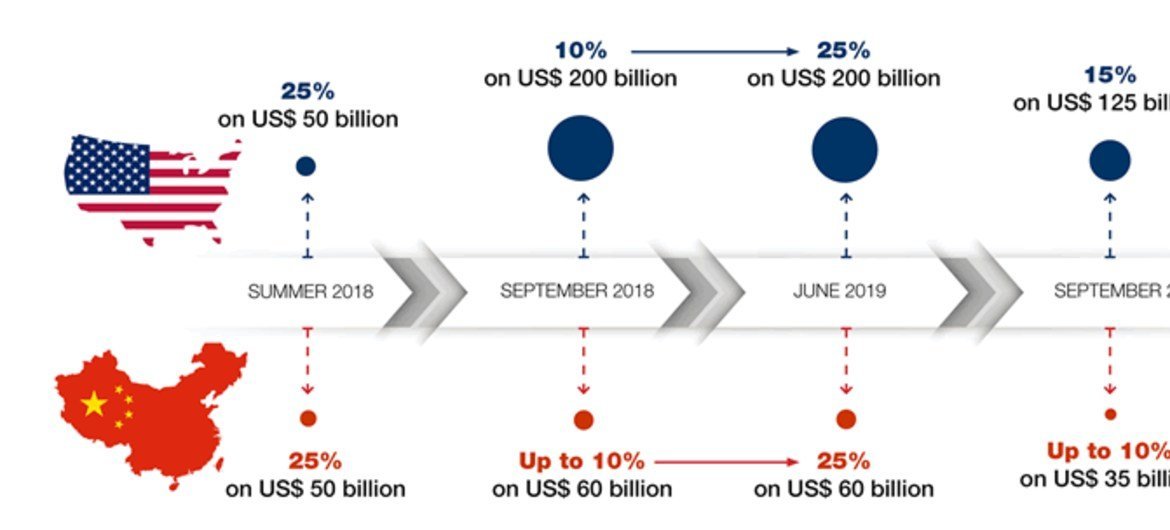

US-China Trade War Impact: Today's Stock Market Analysis

Table of Contents

Impact on Specific Sectors

The US-China trade war's effects haven't been uniform across all sectors. Some have felt the brunt of the conflict far more acutely than others.

Technology Sector Volatility

The technology sector has been particularly vulnerable. Export restrictions targeting crucial technologies and supply chain disruptions stemming from the trade war have significantly impacted tech companies.

- Affected Companies: Companies heavily reliant on Chinese manufacturing or those selling products into the Chinese market have experienced significant stock price fluctuations. Examples include semiconductor manufacturers, smartphone companies, and software providers with large Chinese user bases.

- Stock Price Fluctuations: The uncertainty surrounding trade policies has led to periods of intense volatility in tech stocks, making long-term investment planning challenging.

- Impact on Innovation: The trade war has created headwinds for innovation, forcing companies to rethink their supply chains and potentially slowing down the pace of technological advancements. This includes delays in product launches and increased research and development costs. Keywords: Tech stocks, semiconductor industry, supply chain, export restrictions, Chinese tech companies.

Agricultural Sector Challenges

The agricultural sector has also faced substantial headwinds. Tariffs imposed by both countries have significantly disrupted agricultural exports and imports.

- Affected Products: Soybeans, pork, and other agricultural products have been at the center of the trade disputes, leading to significant price fluctuations.

- Price Fluctuations and Government Support: Farmers have experienced price volatility and, in some cases, significant losses due to reduced exports and increased competition. Government support measures have been implemented in some countries to mitigate the negative impacts.

- Trade Agreements and Uncertainty: The uncertainty surrounding future trade agreements adds to the instability facing the agricultural sector, making long-term planning exceedingly difficult. Keywords: Agricultural exports, soybean prices, tariffs, farm subsidies, trade agreements.

Manufacturing and Industrial Impact

The manufacturing and industrial sectors have experienced a ripple effect from the trade war, facing increased tariffs and trade uncertainty.

- Affected Industries: Industries reliant on global supply chains, particularly those involving components manufactured in China, have been heavily impacted. This includes automotive parts, electronics manufacturing, and other assembly-heavy sectors.

- Production Shifts and Job Losses: Some manufacturers have shifted production to other countries to avoid tariffs, leading to job losses in certain regions.

- Impact on Consumer Prices: Increased tariffs have contributed to higher consumer prices for imported goods, impacting consumer spending and overall economic growth. Keywords: Manufacturing sector, industrial production, tariffs, supply chain disruptions, global trade.

Macroeconomic Indicators and their Correlation

The US-China trade war has had a significant impact on several key macroeconomic indicators.

Inflation and Interest Rates

The trade war has exerted upward pressure on inflation due to increased costs of imported goods.

- Inflation Rates: Inflation rates in several countries have seen an increase, partly due to the tariffs and supply chain disruptions caused by the trade war.

- Central Bank Responses: Central banks have responded to the inflationary pressures with varying degrees of interest rate adjustments.

- Impact on Investment Decisions: The uncertainty surrounding inflation and interest rates has made investment decisions more complex, requiring careful analysis of the potential impact on returns. Keywords: Inflation, interest rates, monetary policy, economic growth, recession risk.

Currency Fluctuations and Exchange Rates

The trade war has also influenced currency fluctuations.

- US Dollar and Chinese Yuan: The US dollar and Chinese Yuan have experienced volatility in their exchange rates, impacting import and export costs.

- Impact on Import/Export Costs: Changes in exchange rates can significantly influence the competitiveness of exports and the cost of imports for businesses.

- Effect on International Investments: Currency fluctuations create uncertainty and risks for international investors, requiring sophisticated hedging strategies. Keywords: US dollar, Chinese Yuan, exchange rates, currency fluctuations, foreign exchange market.

Investor Sentiment and Market Behavior

The trade war has significantly impacted investor sentiment and market behavior.

Investor Confidence and Risk Appetite

Trade tensions have led to decreased investor confidence and risk appetite.

- Market Indices: Market indices have exhibited volatility reflecting the uncertainty surrounding the trade war's impact.

- Volatility Measures: Measures of market volatility have increased significantly during periods of heightened trade tensions.

- Investor Surveys: Investor surveys consistently reveal a decline in confidence during escalations of the trade dispute. "Flight to safety" has been observed, with investors moving towards less risky assets. Keywords: Investor sentiment, market volatility, risk aversion, market indices, stock market outlook.

Portfolio Diversification Strategies

Navigating a volatile market requires implementing robust risk management strategies.

- Diversified Investment Portfolios: Diversifying investments across different asset classes and geographies helps mitigate the risk associated with the trade war.

- Hedging Strategies: Employing hedging strategies can help protect against adverse movements in specific markets or currencies.

- Asset Allocation: Adjusting asset allocation based on the evolving situation is crucial for minimizing losses and maximizing returns. Keywords: Portfolio diversification, risk management, hedging strategies, asset allocation, investment portfolio.

Conclusion: Understanding the Ongoing Impact of the US-China Trade War on Your Stock Market Investments

The US-China trade war has had a profound and multifaceted impact on the stock market, affecting various sectors and macroeconomic indicators. Understanding this impact is crucial for effective investment decision-making. The volatility in tech stocks, challenges faced by the agricultural sector, and the broader impacts on manufacturing highlight the need for a cautious and diversified approach to investment. Monitoring trade developments, carefully analyzing macroeconomic indicators, and adapting investment strategies are paramount. Conduct further research, consult with qualified financial advisors, and stay informed about the evolving US-China trade relationship to make informed decisions regarding your stock market investments. Ongoing stock market analysis is essential to navigate this dynamic and uncertain landscape. Keywords: US-China trade war impact on stocks.

Featured Posts

-

Open Ai Unveils Streamlined Voice Assistant Development Tools

Apr 26, 2025

Open Ai Unveils Streamlined Voice Assistant Development Tools

Apr 26, 2025 -

The Next Fed Chair Inheriting Trumps Economic Challenges

Apr 26, 2025

The Next Fed Chair Inheriting Trumps Economic Challenges

Apr 26, 2025 -

La Fire Victims Face Exploitative Rent Hikes Claims Reality Star

Apr 26, 2025

La Fire Victims Face Exploitative Rent Hikes Claims Reality Star

Apr 26, 2025 -

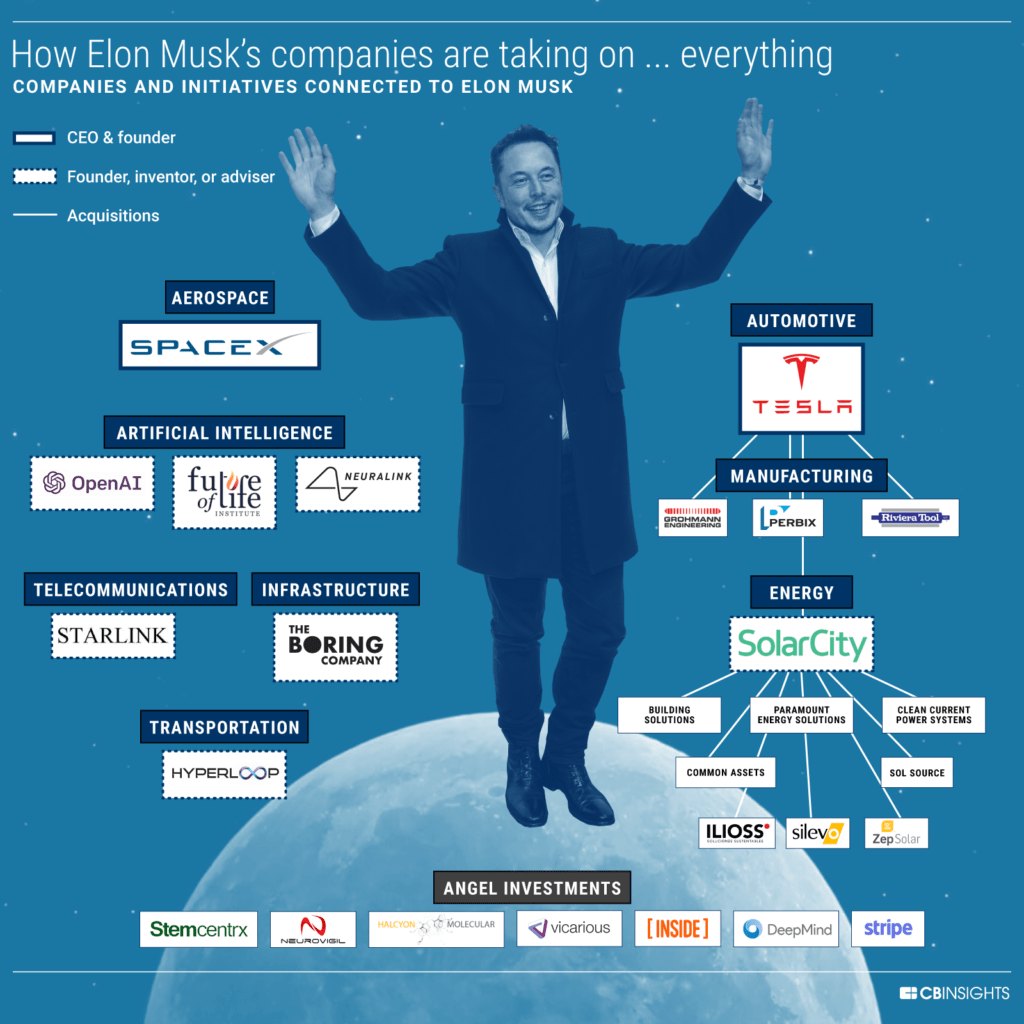

A Side Hustle Access To Elon Musks Private Companies

Apr 26, 2025

A Side Hustle Access To Elon Musks Private Companies

Apr 26, 2025 -

American Battleground Confronting The Worlds Richest Man

Apr 26, 2025

American Battleground Confronting The Worlds Richest Man

Apr 26, 2025