Understanding The Canadian Dollar's Recent Volatility

Table of Contents

Global Economic Uncertainty and its Impact on the Canadian Dollar

Global economic headwinds significantly influence the Canadian dollar's value. The interconnectedness of the global economy means that events far removed from Canada can have a direct and immediate impact on the CAD. Uncertainty breeds volatility, and recent events have certainly contributed to a turbulent period for the Loonie.

-

Impact of rising interest rates globally on CAD value: As central banks worldwide raise interest rates to combat inflation, investors often shift their capital towards higher-yielding currencies. This can lead to increased demand for these currencies and, consequently, a strengthening of their value relative to the CAD. If global interest rates rise faster than Canadian rates, the CAD can weaken.

-

Influence of the US dollar's strength on CAD performance: The US dollar remains a dominant global currency. A strengthening US dollar often puts downward pressure on the CAD, as the USD becomes more attractive to investors. This is particularly true given the close economic ties between Canada and the United States.

-

Effect of global supply chain disruptions on Canadian exports and the CAD: Disruptions to global supply chains, such as those experienced during the COVID-19 pandemic, can negatively impact Canadian exports. Reduced exports translate to lower demand for the CAD, leading to a depreciation in its value.

-

Geopolitical risks and their effect on investor confidence and the CAD: Geopolitical instability, such as the war in Ukraine, creates uncertainty in global markets. This uncertainty can lead to investors seeking safe haven assets, often driving up the value of the US dollar and simultaneously weakening the CAD. The resulting volatility in the Canadian Dollar exchange rate makes international trade and investment more unpredictable.

The war in Ukraine, for example, significantly impacted global energy prices, directly affecting the Canadian economy and the CAD's value due to Canada's significant energy exports. Similarly, rising inflation in the US, coupled with aggressive interest rate hikes by the Federal Reserve, has exerted considerable pressure on the Loonie's value.

Commodity Prices and Their Correlation with the Canadian Dollar

Canada's economy is heavily reliant on the export of natural resources. This strong correlation between Canada's resource-based economy and the value of its currency means that commodity price fluctuations directly impact the CAD.

-

The role of oil prices in influencing the CAD: Oil is a major Canadian export. When global oil prices rise, the demand for the Canadian dollar increases, leading to appreciation. Conversely, a fall in oil prices negatively impacts the CAD.

-

Impact of fluctuations in other commodity prices (e.g., lumber, gold) on the CAD: Fluctuations in the prices of other commodities such as lumber, potash, and gold also affect the CAD, although to a lesser extent than oil. Changes in global demand for these resources influence the Canadian dollar's value.

-

How changes in global demand for commodities affect the Canadian dollar: A rise in global demand for Canadian commodities typically strengthens the CAD, while a decline in global demand weakens it. This dynamic creates a fluctuating exchange rate, making it essential for businesses involved in international trade to carefully manage their currency risk.

The relationship between oil prices and the Canadian dollar is particularly striking. Charts clearly demonstrate a strong positive correlation: when oil prices rise, the CAD tends to appreciate, and vice versa. This relationship underscores the importance of monitoring global energy markets for anyone seeking to understand Canadian Dollar volatility.

Bank of Canada Monetary Policy and its Influence on the Canadian Dollar

The Bank of Canada plays a pivotal role in influencing the value of the Canadian dollar through its monetary policy decisions, primarily by adjusting interest rates.

-

Explain the relationship between interest rates and currency value: Higher interest rates generally attract foreign investment, increasing demand for the currency and strengthening its value. Conversely, lower interest rates can weaken a currency.

-

Discuss the impact of unexpected interest rate changes on the CAD: Unexpected changes in interest rates, whether increases or decreases, can cause significant volatility in the CAD as markets react to the news. This highlights the importance of carefully monitoring Bank of Canada announcements and economic forecasts.

-

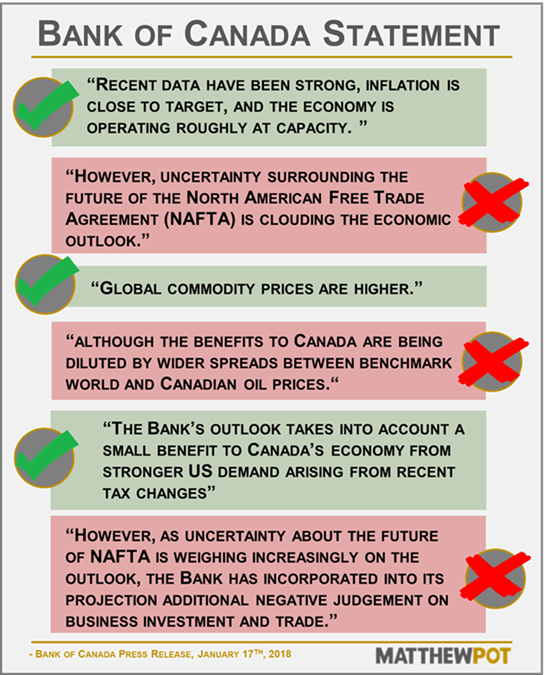

Analyze the Bank of Canada's recent policy decisions and their effect on CAD volatility: The Bank of Canada's recent decisions on interest rates have directly contributed to the fluctuations in the Canadian dollar. Analyzing these decisions in the context of global economic conditions offers insights into the future trajectory of the CAD.

The Bank of Canada's actions often impact the CAD more significantly than other economic factors. Historical data clearly shows a strong correlation between interest rate adjustments and subsequent changes in the CAD's exchange rate. Statements and press releases from the Bank of Canada should be closely followed to gain a better understanding of future monetary policy actions and their likely effects on Canadian Dollar volatility.

Other Factors Affecting Canadian Dollar Volatility

Several other factors can contribute to Canadian Dollar volatility:

-

Domestic political stability and its influence: Political uncertainty or instability within Canada can negatively impact investor confidence and weaken the CAD.

-

Investor sentiment and market speculation: Market sentiment and speculation play a significant role. Periods of heightened uncertainty or negative sentiment can lead to increased volatility.

-

Seasonal factors influencing the CAD: Seasonal factors, such as changes in commodity demand or tourism, can also influence the CAD's value to a minor degree.

Conclusion

The recent volatility of the Canadian dollar is a result of a complex interplay of factors, including global economic uncertainty, fluctuations in commodity prices, particularly oil, and the Bank of Canada's monetary policy decisions. Understanding these interwoven factors is essential for businesses involved in international trade, investors managing portfolios with CAD exposure, and individuals making financial decisions.

Call to Action: Stay informed about the fluctuating Canadian dollar and its impact on your financial decisions. Continue to monitor global economic developments, commodity prices, and Bank of Canada announcements to better understand and manage the risks associated with Canadian Dollar volatility. Regularly review economic news and analysis to make well-informed decisions regarding investments and financial planning involving the Canadian dollar.

Featured Posts

-

Joint Venture Saudi Arabia India Plan Two Large Scale Oil Refineries

Apr 24, 2025

Joint Venture Saudi Arabia India Plan Two Large Scale Oil Refineries

Apr 24, 2025 -

Analysis Of Teslas Q1 2024 Earnings Political Factors And Financial Performance

Apr 24, 2025

Analysis Of Teslas Q1 2024 Earnings Political Factors And Financial Performance

Apr 24, 2025 -

Breast Cancer Awareness Tina Knowles Experience Highlights Mammogram Importance

Apr 24, 2025

Breast Cancer Awareness Tina Knowles Experience Highlights Mammogram Importance

Apr 24, 2025 -

Examining Canadas Fiscal Health A Call For Responsible Governance

Apr 24, 2025

Examining Canadas Fiscal Health A Call For Responsible Governance

Apr 24, 2025 -

Chalet Girl Life Honest Insights Into A High Demand Winter Job

Apr 24, 2025

Chalet Girl Life Honest Insights Into A High Demand Winter Job

Apr 24, 2025