Examining Canada's Fiscal Health: A Call For Responsible Governance

Table of Contents

A healthy fiscal state for a nation is characterized by a manageable budget deficit, a sustainable level of national debt relative to its Gross Domestic Product (GDP), efficient government spending, sufficient tax revenue to cover expenses, and robust economic growth. A nation's fiscal health is a complex interplay of these factors, and an imbalance in any area can have significant consequences.

This article aims to analyze Canada's current fiscal health, identifying key challenges and advocating for the implementation of responsible governance policies to ensure long-term fiscal sustainability.

Analyzing Canada's Current Fiscal Situation

The National Debt and Deficit

Canada's national debt and budget deficit are significant concerns. The debt-to-GDP ratio, a key indicator of fiscal health, has been steadily rising in recent years. While precise figures fluctuate, a consistently high debt-to-GDP ratio indicates potential long-term challenges in servicing the debt and leaves less room for government spending on crucial social programs and infrastructure.

- Current debt-to-GDP ratio: [Insert latest available data from a reputable source, e.g., Statistics Canada]. This figure should be compared to historical trends and international benchmarks.

- Projected deficit for the next few years: [Insert projections from the federal budget or reputable economic forecasts]. Highlight the implications of these projections for future debt levels.

- Comparison with other G7 nations: [Include a comparative analysis of Canada's debt-to-GDP ratio with other G7 countries, referencing reputable sources]. This context helps to understand Canada's position relative to other developed economies.

Keywords: National debt, budget deficit, debt-to-GDP ratio, government borrowing, fiscal sustainability

Government Spending and Revenue

Government spending in Canada is spread across various sectors, including healthcare, education, social programs, and defense. Revenue generation relies heavily on income tax, corporate tax, and the Goods and Services Tax (GST)/Harmonized Sales Tax (HST). Analyzing the efficiency of spending and revenue collection is crucial.

- Breakdown of government spending by sector: [Present a detailed breakdown of government spending using data from the federal budget or Statistics Canada]. Identify areas where potential cost savings or increased efficiency might be possible.

- Tax revenue projections: [Include projections of tax revenue for the coming years, sourced from government documents or credible economic forecasts]. Discuss the potential impact of economic fluctuations on tax revenue.

- Potential areas for cost savings: [Highlight specific areas where streamlining processes or reducing inefficiencies could generate savings, such as improving healthcare delivery systems or optimizing government procurement].

Keywords: Government spending, tax revenue, fiscal policy, expenditure review, budget allocation

Economic Growth and its Impact on Fiscal Health

Economic growth plays a critical role in Canada's fiscal health. Strong economic growth increases tax revenue, making it easier to manage the budget deficit and reduce the national debt. Conversely, economic downturns reduce tax revenue and increase government spending on social programs, exacerbating the deficit.

- GDP growth rate: [Include the latest GDP growth rate and projections, with sources cited]. Explain how variations in GDP growth impact the government's fiscal position.

- Impact of interest rates on debt servicing: [Explain how interest rate changes affect the cost of servicing the national debt]. This is a crucial aspect of fiscal sustainability.

- Effects of inflation: [Discuss how inflation impacts government spending and revenue, and its consequences for the fiscal balance].

Keywords: Economic growth, GDP, inflation, interest rates, fiscal stimulus, economic recovery

The Need for Responsible Fiscal Governance in Canada

Promoting Fiscal Transparency and Accountability

Fiscal transparency and accountability are essential for maintaining public trust and ensuring responsible government spending. Open access to budget information, independent fiscal agencies providing objective analysis, and robust parliamentary oversight mechanisms are crucial.

- Open budget data: [Advocate for greater transparency in budget data, enabling citizens and independent analysts to scrutinize government spending].

- Independent fiscal agencies: [Highlight the role of independent organizations in providing unbiased assessments of government fiscal policies].

- Parliamentary oversight: [Emphasize the importance of parliamentary committees in scrutinizing government spending and holding the government accountable].

Keywords: Fiscal transparency, accountability, budget process, parliamentary scrutiny, government oversight

Strategies for Long-Term Fiscal Sustainability

Achieving long-term fiscal sustainability requires a multifaceted approach. This includes controlling government spending, reforming the tax system to broaden the tax base and improve efficiency, and promoting economic diversification to reduce reliance on specific sectors.

- Spending cuts: [Discuss potential areas for spending reductions while minimizing negative impacts on essential social programs]. Prioritization and efficiency improvements are key.

- Tax reforms: [Explore potential tax reforms, such as closing tax loopholes or introducing more progressive tax systems, to increase revenue].

- Investments in infrastructure: [Discuss the importance of strategic investments in infrastructure to stimulate economic growth and create jobs].

- Pension reform: [Address the long-term sustainability of the Canadian pension system].

Keywords: Fiscal sustainability, long-term fiscal planning, debt reduction, economic diversification, responsible budgeting

The Role of Citizens in Promoting Responsible Governance

An informed citizenry plays a crucial role in demanding responsible fiscal governance. Public awareness campaigns, active voter engagement, and the work of advocacy groups can all contribute to holding the government accountable for its fiscal decisions.

- Public awareness campaigns: [Advocate for increased public education on fiscal issues to foster informed citizen participation].

- Voter engagement: [Encourage citizens to actively participate in the electoral process and hold their elected officials accountable].

- Advocacy groups: [Recognize the contribution of civil society organizations in advocating for fiscal responsibility].

Keywords: Citizen engagement, civic participation, voter education, public awareness, government accountability

Conclusion: A Call for Responsible Governance of Canada's Fiscal Health

Canada faces significant challenges in managing its national debt and ensuring long-term fiscal sustainability. The analysis presented here highlights the urgent need for responsible fiscal governance, characterized by transparency, accountability, and long-term planning. This requires a concerted effort from all stakeholders, including the government, independent agencies, and the citizenry.

Examining Canada's fiscal health requires ongoing vigilance and participation. Let's demand responsible governance to secure a sustainable future for our nation. Contact your elected officials, participate in civic discussions, and stay informed about Canada's fiscal situation. Your voice matters in shaping a fiscally responsible future for Canada.

Featured Posts

-

New Legal Hurdles For Trump Administrations Immigration Enforcement

Apr 24, 2025

New Legal Hurdles For Trump Administrations Immigration Enforcement

Apr 24, 2025 -

The Impact Of Over The Counter Birth Control In A Post Roe World

Apr 24, 2025

The Impact Of Over The Counter Birth Control In A Post Roe World

Apr 24, 2025 -

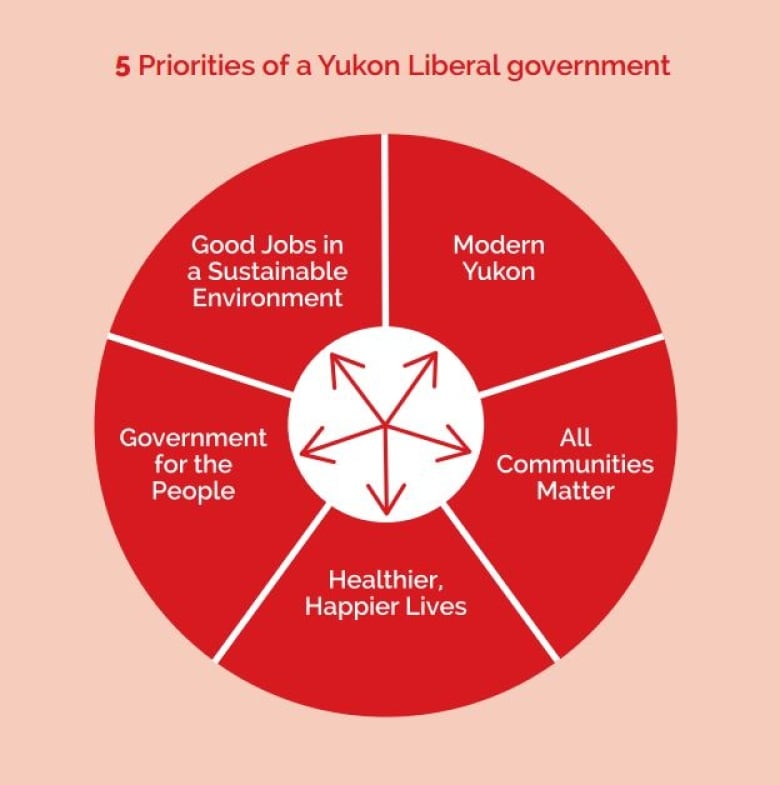

William Watsons Analysis A Critical Look At The Liberal Platform

Apr 24, 2025

William Watsons Analysis A Critical Look At The Liberal Platform

Apr 24, 2025 -

Bitcoins Btc Recent Climb A Deep Dive Into Market Drivers

Apr 24, 2025

Bitcoins Btc Recent Climb A Deep Dive Into Market Drivers

Apr 24, 2025 -

Hollywood Shutdown Double Strike Cripples Film And Television Production

Apr 24, 2025

Hollywood Shutdown Double Strike Cripples Film And Television Production

Apr 24, 2025