Bitcoin's (BTC) Recent Climb: A Deep Dive Into Market Drivers

Table of Contents

Macroeconomic Factors Fueling Bitcoin's Rise

Several macroeconomic trends are significantly impacting Bitcoin's price. These large-scale economic forces are creating a favorable environment for Bitcoin's growth as an alternative asset.

Inflationary Pressures and Safe-Haven Demand

High inflation rates in various global economies are pushing investors towards alternative assets like Bitcoin, perceived as a hedge against inflation. Traditional fiat currencies are losing purchasing power, driving a search for stores of value that retain their worth despite economic instability. Bitcoin's inherent scarcity—a fixed supply of only 21 million coins—further enhances its appeal as a store of value. This limited supply acts as a natural inflation hedge, contrasting sharply with the potentially inflationary policies of many central banks.

Data from the past few years shows a strong correlation between rising inflation rates and Bitcoin price movements. While not a perfect correlation, periods of high inflation often coincide with increased demand for Bitcoin.

- Increased institutional adoption of Bitcoin as an inflation hedge.

- Growing investor interest in Bitcoin as a safe haven asset.

- Correlation between inflation and Bitcoin price increase (further research and specific data points could be added here).

Geopolitical Instability and Uncertainty

Global political uncertainties and conflicts are also contributing to Bitcoin's rise. Investors seeking refuge from geopolitical turmoil often turn to decentralized assets like Bitcoin, which are less susceptible to government control and censorship. Bitcoin’s decentralized nature makes it resistant to the impacts of sanctions and political instability. This inherent resilience makes it an attractive alternative to traditional financial systems during periods of global uncertainty.

Several recent examples highlight the correlation between geopolitical events and Bitcoin price increases. For instance, [insert specific examples of geopolitical events and their correlation with Bitcoin price increases].

- Bitcoin’s resilience to geopolitical risks.

- Increased demand for Bitcoin during times of uncertainty.

- Examples of recent geopolitical events influencing Bitcoin's price (Specific examples should be added here with links to reliable sources).

Microeconomic Factors Driving Bitcoin's Momentum

Beyond macroeconomic forces, several microeconomic factors are fueling Bitcoin's upward trajectory. These factors relate to the specific dynamics within the Bitcoin ecosystem itself.

Increased Institutional Investment and Adoption

The growing adoption of Bitcoin by large financial institutions is a significant driver of its price increase. Major players like Grayscale, MicroStrategy, and others are accumulating substantial amounts of Bitcoin, signaling a shift in institutional perception and increasing legitimacy. Regulatory clarity and supportive policies in certain jurisdictions are also encouraging greater institutional involvement. The entry of institutional investors brings significant capital into the market, pushing prices higher.

- Growing number of institutional investors holding Bitcoin.

- Impact of regulatory developments on institutional adoption.

- Key players driving institutional Bitcoin investment (Specific examples of companies and their holdings should be added).

Technological Advancements and Network Upgrades

Technological advancements within the Bitcoin ecosystem are crucial for driving long-term growth. Improvements in scalability, such as the Lightning Network, are making Bitcoin transactions faster and cheaper. Network upgrades enhance security and efficiency, further bolstering investor confidence. The ongoing development and innovation surrounding Bitcoin are essential for its continued adoption and price appreciation.

- Lightning Network adoption and impact on transaction fees.

- Upgrades to the Bitcoin network improving scalability.

- Positive impact of technological advancements on Bitcoin's price (Specific examples of upgrades and their impact should be included).

Growing Retail Investor Interest and Public Awareness

Increased retail investor participation fuels Bitcoin's price volatility and growth. Positive media coverage, social media trends, and overall increased public awareness are attracting more individual investors to the cryptocurrency market. This heightened interest translates into greater demand, pushing prices higher. Understanding retail investor behavior and the influence of social media is critical to analyzing Bitcoin's price fluctuations.

- Rising interest in Bitcoin amongst retail investors.

- Influence of social media and media coverage on Bitcoin's price.

- Factors driving retail investor participation (Specific examples and trends should be included).

Conclusion

Bitcoin's recent climb is a multifaceted phenomenon driven by a powerful interplay of macroeconomic and microeconomic factors. From inflationary pressures and geopolitical uncertainties to institutional investment and technological advancements, numerous elements are contributing to the increased demand and rising price of BTC. Understanding these drivers is crucial for navigating the cryptocurrency market effectively. To stay informed on the latest developments impacting Bitcoin price and to make informed investment decisions, continue to monitor macroeconomic trends, institutional investment activity, and technological advancements within the Bitcoin ecosystem. Keep up-to-date on the latest news and analysis regarding Bitcoin's (BTC) future movements. Stay informed about Bitcoin (BTC) price movements and market trends for successful cryptocurrency investments.

Featured Posts

-

New Legal Hurdles For Trump Administrations Immigration Enforcement

Apr 24, 2025

New Legal Hurdles For Trump Administrations Immigration Enforcement

Apr 24, 2025 -

From Scatological Data To Engaging Podcast Ais Role In Document Digest

Apr 24, 2025

From Scatological Data To Engaging Podcast Ais Role In Document Digest

Apr 24, 2025 -

The Closure Of Anchor Brewing Company Reflecting On 127 Years Of History

Apr 24, 2025

The Closure Of Anchor Brewing Company Reflecting On 127 Years Of History

Apr 24, 2025 -

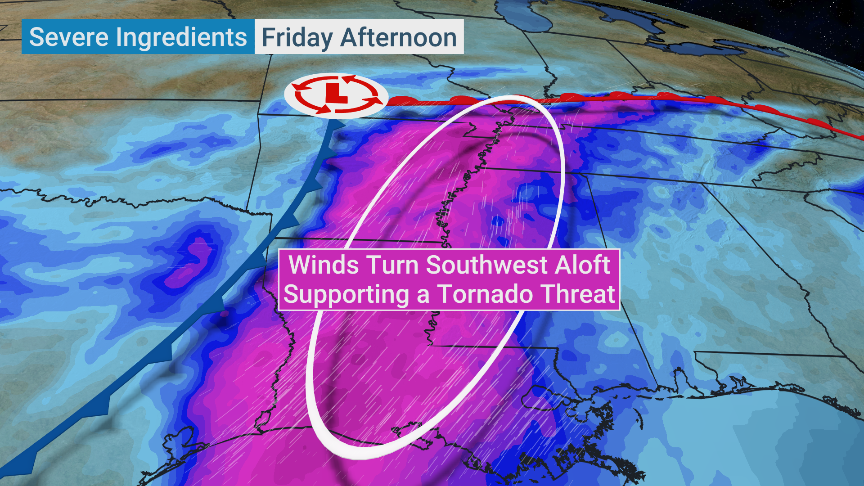

Severe Weather And Budget Cuts The Growing Risk Of Tornadoes Under Trump

Apr 24, 2025

Severe Weather And Budget Cuts The Growing Risk Of Tornadoes Under Trump

Apr 24, 2025 -

Film Koji Je Tarantino Odbio Gledati S Travoltom Sto Se Dogodilo

Apr 24, 2025

Film Koji Je Tarantino Odbio Gledati S Travoltom Sto Se Dogodilo

Apr 24, 2025