Understanding High Stock Market Valuations: BofA's Take For Investors

Table of Contents

BofA's Assessment of Current Market Valuations

BofA's analysts consistently monitor market conditions and provide regular updates on equity valuation. While specific assessments fluctuate based on the current economic climate, a general overview of their stance is necessary. (Note: Replace this with a summary of BofA's most recent official stance on market valuations. Directly quote relevant reports and analyses using proper citations if available). For instance, they might classify current valuations as "elevated" but not necessarily "overvalued," considering the influence of specific macroeconomic factors.

BofA employs several key metrics to assess market valuations, including:

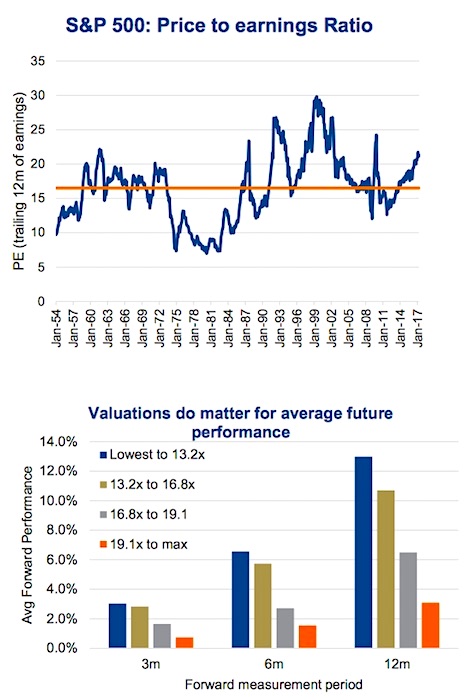

- Price-to-Earnings Ratio (P/E): Compares a company's stock price to its earnings per share. A high P/E ratio generally suggests higher valuations.

- Price-to-Sales Ratio (P/S): Relates a company's stock price to its revenue. Useful for evaluating companies with negative earnings.

- Shiller P/E (CAPE): Uses average inflation-adjusted earnings over the past 10 years to smooth out short-term earnings fluctuations and provide a longer-term valuation perspective.

BofA's reasoning behind its assessment typically considers several macroeconomic factors. These include:

- Interest Rates: Low interest rates reduce the cost of borrowing, encouraging investment and potentially driving up stock prices.

- Inflation: High inflation can erode corporate profits and investor returns, impacting valuations.

- Economic Growth: Strong economic growth usually supports higher valuations, while recessionary fears can lead to lower valuations.

Factors Contributing to High Stock Market Valuations

According to BofA's analysis, several factors contribute to the current high stock market valuations:

- Low Interest Rates: Historically low interest rates have significantly influenced discounted cash flow models, resulting in higher present values for future earnings streams. This makes stocks, as an alternative investment, more attractive.

- Strong Corporate Earnings Growth (or Anticipated Growth): Positive corporate earnings reports and projections fuel investor optimism and support higher valuations.

- Investor Sentiment and Risk Appetite: Positive investor sentiment and a willingness to take on more risk contribute to higher stock prices.

- Technological Advancements and Disruptive Innovations: The emergence of new technologies and innovative business models often drives significant investment and higher valuations for related companies.

- Government Stimulus: Government interventions, such as fiscal stimulus packages, can inject liquidity into the market and artificially inflate valuations.

Risks Associated with High Valuations

Investing in a market with high stock market valuations presents inherent risks:

- Increased Vulnerability to Market Corrections or Crashes: High valuations leave the market more susceptible to sharp corrections or even crashes when investor sentiment shifts.

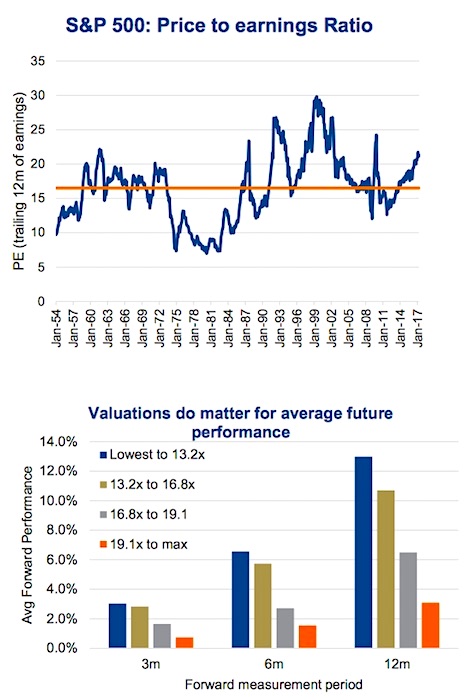

- Lower Potential Returns: Investing at higher valuations typically leads to lower potential returns compared to investing at lower valuations.

- Impact of Rising Interest Rates: An increase in interest rates can negatively affect company profitability and valuations, potentially triggering a market downturn.

- Increased Risk of Inflation Eroding Returns: Persistent inflation can erode the purchasing power of investment returns, especially in a high-valuation environment.

BofA's Recommendations for Investors

Given the current valuation environment, BofA's recommendations for investors generally emphasize a cautious yet strategic approach:

- Diversification Strategies: Diversifying your portfolio across different asset classes (stocks, bonds, real estate) and sectors reduces overall risk.

- Sector-Specific Recommendations: BofA's analysts may provide sector-specific recommendations based on their analysis of growth potential and valuation within specific industries. (Note: Insert specific examples from BofA's reports, if available).

- Asset Allocation: Carefully consider your asset allocation, adjusting it based on your risk tolerance and investment goals.

- Value Investing Strategies: Focusing on undervalued companies can offer better risk-adjusted returns in a high-valuation environment.

- Long-Term Investment Horizons: Maintaining a long-term investment horizon allows you to weather market fluctuations and benefit from the long-term growth potential of the market.

Understanding High Stock Market Valuations: A Call to Action

BofA's analysis highlights the complexities of navigating a market characterized by high stock market valuations. Understanding these valuations is crucial for making informed investment decisions. The potential risks associated with high valuations necessitate a careful and strategic investment approach. To stay informed about the evolving dynamics of high stock market valuations and to develop a well-informed investment strategy, consult BofA's latest market insights and research reports. Stay informed about high stock market valuations and make well-informed investment choices by exploring BofA's latest market insights. Understand the current market environment and plan your investment strategy accordingly. [Insert links to relevant BofA resources here].

Featured Posts

-

Minnesota Attorney General Sues Trump Over Transgender Sports Ban

Apr 24, 2025

Minnesota Attorney General Sues Trump Over Transgender Sports Ban

Apr 24, 2025 -

Disaster Capitalism The Wildfire Betting Market In Los Angeles

Apr 24, 2025

Disaster Capitalism The Wildfire Betting Market In Los Angeles

Apr 24, 2025 -

La Fires Landlords Accused Of Price Gouging Amidst Crisis

Apr 24, 2025

La Fires Landlords Accused Of Price Gouging Amidst Crisis

Apr 24, 2025 -

Ella Travolta Rast I Razvoj Kceri Johna Travolte

Apr 24, 2025

Ella Travolta Rast I Razvoj Kceri Johna Travolte

Apr 24, 2025 -

Canada Election Conservatives Vow Tax Cuts Deficit Control

Apr 24, 2025

Canada Election Conservatives Vow Tax Cuts Deficit Control

Apr 24, 2025