Canada Election: Conservatives Vow Tax Cuts, Deficit Control

Table of Contents

Proposed Tax Cuts: Details and Impact

The Conservative Party's platform outlines a series of tax cuts aimed at stimulating the Canadian economy and boosting disposable income. These cuts are designed to benefit both individuals and corporations.

Individual Income Tax Reductions

The Conservatives propose reducing individual income tax rates across various brackets. While the exact percentages may vary depending on the final platform released closer to the election, preliminary proposals suggest:

- A significant reduction in the highest tax bracket, aiming to incentivize higher earners and stimulate investment.

- Targeted tax relief for middle-income families, potentially through increased basic personal amount or other adjustments.

- Potential tax credits for families with children, further enhancing disposable income for this demographic.

The projected impact on disposable income varies significantly depending on income level. Higher-income earners stand to gain the most in absolute terms, while middle-income families would experience a relative increase in their after-tax income. Critics argue this approach disproportionately benefits the wealthy, while proponents contend it will ultimately lead to increased economic activity and job creation. Keywords: Tax brackets, income tax relief, disposable income, middle-class tax cuts.

Corporate Tax Cuts and Business Incentives

To encourage business investment and job creation, the Conservative Party plans to reduce the corporate tax rate. This reduction, coupled with potential incentives such as accelerated capital cost allowances, aims to attract foreign investment and foster domestic economic growth.

- A lower corporate tax rate would make Canada a more competitive location for businesses, both domestically and internationally.

- Accelerated capital cost allowances could incentivize businesses to invest in new equipment and expand their operations.

- This strategy is expected to boost business investment, creating jobs and stimulating economic activity.

However, concerns remain about the potential impact on government revenue and the possibility that these tax cuts might primarily benefit large corporations, rather than small and medium-sized enterprises (SMEs). Expert opinions are divided, with some forecasting robust economic growth and others expressing concern about potential fiscal imbalances. Keywords: Corporate tax rate, business investment, economic growth, job creation.

Conservative Plan for Deficit Control: Strategies and Challenges

The Conservative Party acknowledges the need for fiscal responsibility and outlines strategies to control the national deficit, balancing their tax cut proposals with measures to reduce government spending and enhance revenue generation.

Spending Cuts and Efficiency Measures

The Conservatives plan to achieve deficit reduction through a combination of targeted spending cuts and initiatives aimed at improving government efficiency. This involves:

- Identifying and eliminating wasteful government spending, focusing on areas with low returns on investment.

- Streamlining government operations to improve efficiency and reduce administrative costs.

- Prioritizing essential government services while reducing spending in less critical areas.

Implementing these cuts will inevitably lead to difficult choices and potential controversies. Concerns may arise about the impact on essential social programs and public services. Keywords: Government spending, fiscal responsibility, budget cuts, austerity measures.

Revenue Generation Strategies

Beyond tax cuts, the Conservatives propose strategies to increase government revenue, mitigating the fiscal impact of their tax reduction plans. These include:

- Strengthening tax collection mechanisms to reduce tax evasion and improve compliance.

- Improving the efficiency of government procurement processes to reduce costs.

- Focusing on economic policies that foster growth and increase overall tax revenue.

The success of these strategies depends on effective implementation and the broader economic environment. Critics question the feasibility of achieving significant revenue increases without raising taxes elsewhere. Keywords: Tax revenue, government efficiency, fiscal policy, economic stimulus.

Economic Outlook and Potential Risks

Analyzing the Conservative Party's economic platform requires examining independent economic analyses and comparing it to the plans of other parties.

Independent Economic Analyses

Independent economic analyses of the Conservative platform offer varying perspectives. Some analyses highlight the potential for increased economic growth and job creation resulting from tax cuts and business incentives. Others express concerns about the fiscal sustainability of the proposed tax cuts and the potential for increased national debt if spending cuts are insufficient. These analyses typically cite different economic models and assumptions, resulting in diverging predictions. Reputable sources such as the Parliamentary Budget Officer and independent economic think tanks offer valuable insights into the potential benefits and risks. Keywords: Economic forecast, fiscal sustainability, economic impact assessment, risk assessment.

Comparison to Other Parties' Platforms

The Conservative Party's economic platform differs significantly from those of other major parties. While other parties may also propose tax cuts, their approach to deficit reduction, the scale of their proposed cuts, and their prioritization of spending differ considerably. A direct comparison reveals contrasting approaches to fiscal policy and their differing visions for the Canadian economy. Detailed examination of these differences is crucial for informed voting. Keywords: Political platforms, election comparison, economic policy comparison.

Conclusion

The Conservative Party's economic platform centers on a bold promise: significant tax cuts while simultaneously controlling the national deficit. This strategy, while potentially stimulating economic growth, carries inherent risks related to fiscal sustainability. The feasibility of achieving both ambitious tax cuts and significant deficit reduction hinges on the effective implementation of spending cuts, revenue generation strategies, and a favorable economic climate. Independent economic analyses offer diverse perspectives, highlighting both potential benefits and considerable challenges. Understanding these nuances is vital for Canadians as they approach the upcoming federal election.

The upcoming Canada election requires informed voters. Understanding the Conservative Party's plans for tax cuts and deficit reduction is crucial before casting your ballot. Stay informed about the Canada Election and the different parties' approaches to economic policy. Learn more about the Conservative Party platform and its implications for the Canadian economy. Research the tax cut proposals and their potential effects on your personal finances. Make your voice heard and participate in shaping the future of Canada's economy.

Featured Posts

-

Pope Francis A Globalized Church Facing Deep Divisions

Apr 24, 2025

Pope Francis A Globalized Church Facing Deep Divisions

Apr 24, 2025 -

The Bold And The Beautiful April 9th Recap Steffys Anger And Liams Plea For Secrecy

Apr 24, 2025

The Bold And The Beautiful April 9th Recap Steffys Anger And Liams Plea For Secrecy

Apr 24, 2025 -

The Bold And The Beautiful Spoilers Liams Medical Crisis And Survival Chances

Apr 24, 2025

The Bold And The Beautiful Spoilers Liams Medical Crisis And Survival Chances

Apr 24, 2025 -

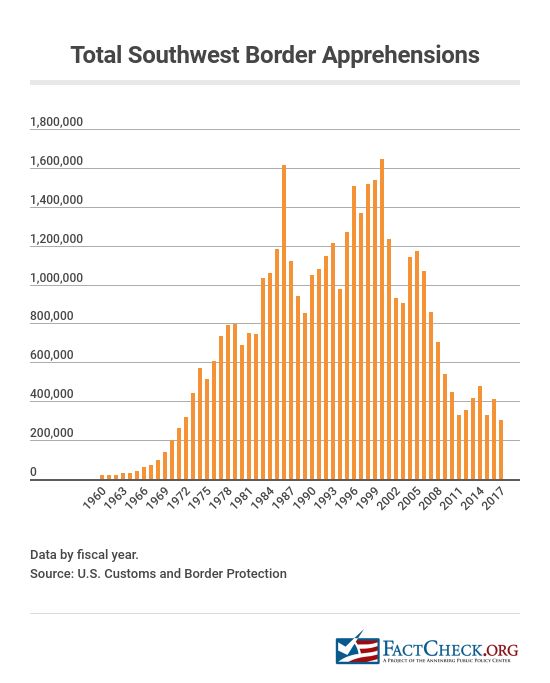

Fewer Border Crossings White House Reports Decline In Canada U S Border Apprehensions

Apr 24, 2025

Fewer Border Crossings White House Reports Decline In Canada U S Border Apprehensions

Apr 24, 2025 -

Liberal Spending Is Canadas Fiscal Responsibility At Risk

Apr 24, 2025

Liberal Spending Is Canadas Fiscal Responsibility At Risk

Apr 24, 2025