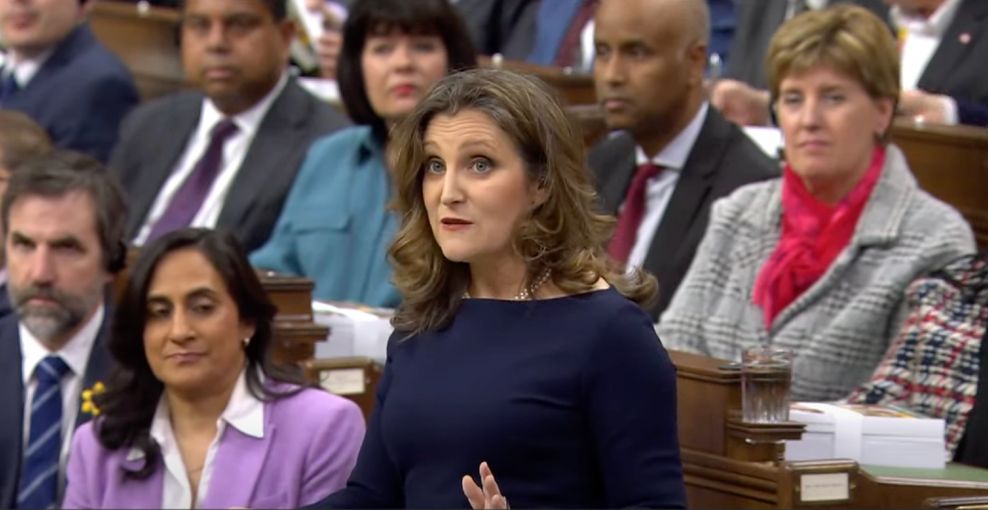

Liberal Spending: Is Canada's Fiscal Responsibility At Risk?

Table of Contents

Increased Government Debt and Deficit

Canada's government debt and deficit are major concerns within the current fiscal landscape. Understanding the scale of this challenge requires looking at concrete data. The current debt-to-GDP ratio is a key indicator of a nation's financial health, showing the proportion of national debt relative to the size of its economy. A high ratio generally indicates higher risk. While Canada's ratio is comparatively lower than some other developed nations, the increasing trend is cause for concern.

- Current debt-to-GDP ratio: (Insert current and up-to-date data from a reliable source like Statistics Canada. Include a link to the source.)

- Projected deficit for the next few years: (Insert projected deficit data for the next few years, again citing a reputable source and including a hyperlink.)

- Comparison to historical data and other developed nations: (Compare Canada's debt-to-GDP ratio and deficit with historical data and other comparable countries like the US, UK, or Germany. Illustrate with a chart or graph if possible.)

- Impact of increased interest rates on debt servicing: Rising interest rates significantly impact the cost of servicing Canada's national debt. Higher interest payments mean less money available for essential public services and investments in infrastructure. (Provide specific examples and calculations if possible). The rising cost of borrowing significantly increases the pressure on the government's budget.

Impact of Social Programs on Fiscal Sustainability

Canada's robust social safety net, including healthcare and pension programs, plays a vital role in supporting citizens. However, the rising cost of these programs is a key driver of increased government spending. An aging population and increasing life expectancy put immense pressure on these systems.

- Cost projections for major social programs in the coming decades: (Provide projections for healthcare, pensions (CPP/QPP), and other major social programs. Cite credible sources). These projections should highlight the potential for exponential cost increases.

- Potential solutions for long-term sustainability: Addressing the long-term fiscal sustainability of social programs requires innovative solutions. These include pension reforms (e.g., increasing the retirement age, adjusting contribution rates), healthcare efficiency improvements (e.g., technological advancements, streamlining administrative processes), and exploring alternative care models.

- Explore different models used in other countries to address similar challenges: Analyze successful and unsuccessful strategies implemented in other developed nations to manage the costs of aging populations and maintain sustainable social programs. (Provide examples from countries like Germany, Sweden, or Japan.)

Economic Growth and Revenue Generation

The government's ability to generate sufficient revenue to meet its spending commitments is crucial for maintaining fiscal responsibility. Economic growth directly impacts government revenue through tax collections.

- Analysis of current tax revenue and potential for increased tax revenue: Analyze current tax revenue streams and explore the potential for increasing revenue through tax reforms, closing loopholes, or broadening the tax base. (Consider different types of taxes – income tax, corporate tax, GST/HST).

- Impact of economic growth on government revenue: Explain the direct correlation between economic growth and government revenue. A strong economy generates higher tax revenue, which helps reduce deficits and manage debt.

- Discussion of potential tax reforms or alternative revenue streams: Explore potential tax reforms, such as carbon pricing or adjustments to corporate tax rates, and discuss the potential impact of each. Also, explore alternative revenue streams, such as increased efficiency in government operations or privatization of certain assets.

Comparison with Other Developed Nations

Benchmarking Canada's fiscal situation against other comparable countries provides valuable context.

- Comparison of debt-to-GDP ratios with peer nations: Compare Canada's debt-to-GDP ratio with similar nations (e.g., G7 countries). This comparison helps gauge whether Canada's debt levels are significantly higher or lower than those of its peers.

- Examination of different fiscal policies adopted by comparable countries: Analyze the fiscal policies implemented in other developed nations to manage their debts and deficits. Identify successful strategies and lessons learned.

- Analysis of the success or failure of various fiscal strategies in other nations: Examine both the positive and negative outcomes of different fiscal approaches used in other countries. This comparative analysis can offer insights into the effectiveness of various strategies in managing public debt.

Conclusion: Addressing Concerns about Liberal Spending in Canada

This analysis highlights the multifaceted challenges facing Canada's fiscal responsibility. The combination of rising government debt, the increasing cost of social programs, and potential economic headwinds necessitates careful consideration of current fiscal policies. While social programs are vital, their long-term sustainability requires proactive measures. Similarly, generating sufficient revenue requires a balanced approach that considers both economic growth and responsible taxation. Understanding the complexities of liberal spending in Canada requires ongoing dialogue and informed debate. We urge readers to delve deeper into the issues discussed here and engage in constructive conversations about ensuring Canada’s long-term fiscal stability. A sustainable approach to fiscal management is crucial for securing Canada's future economic prosperity.

Featured Posts

-

The Bold And The Beautiful Spoilers Wednesday April 23 Finns Vow To Liam

Apr 24, 2025

The Bold And The Beautiful Spoilers Wednesday April 23 Finns Vow To Liam

Apr 24, 2025 -

Nba 3 Point Contest Herro Triumphs Over Hield In Nail Biting Finish

Apr 24, 2025

Nba 3 Point Contest Herro Triumphs Over Hield In Nail Biting Finish

Apr 24, 2025 -

Why I Chose The Lg C3 77 Inch Oled Tv A Personal Perspective

Apr 24, 2025

Why I Chose The Lg C3 77 Inch Oled Tv A Personal Perspective

Apr 24, 2025 -

Conservative Party Promises Tax Cuts And Smaller Deficits In Canada

Apr 24, 2025

Conservative Party Promises Tax Cuts And Smaller Deficits In Canada

Apr 24, 2025 -

Subsystem Malfunction Grounds Blue Origin Rocket Launch

Apr 24, 2025

Subsystem Malfunction Grounds Blue Origin Rocket Launch

Apr 24, 2025