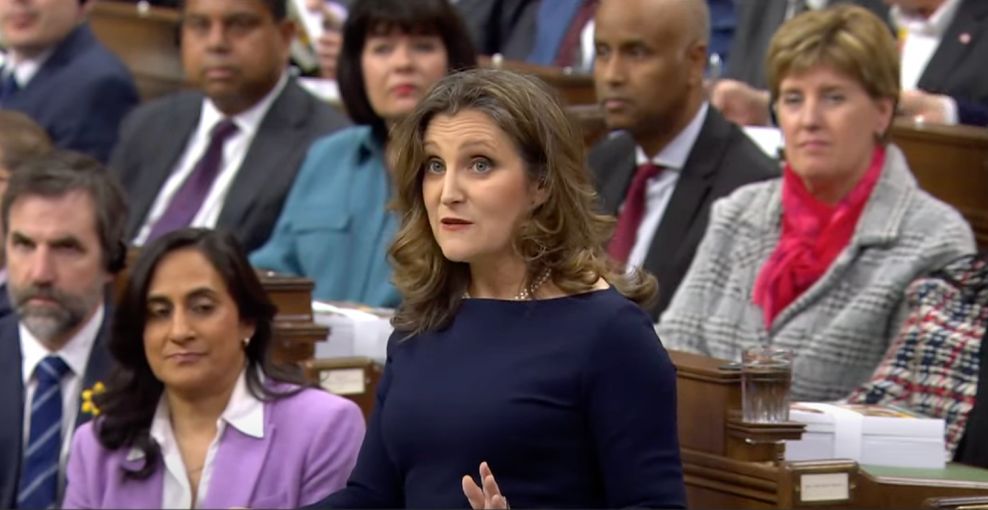

Conservative Party Promises Tax Cuts And Smaller Deficits In Canada

Table of Contents

The Conservative Party of Canada has unveiled its latest platform, promising significant tax cuts and a path towards smaller federal deficits. This ambitious plan has sparked considerable debate, with supporters highlighting its potential to stimulate economic growth and opponents raising concerns about its feasibility and potential impact on social programs. This article delves into the specifics of these proposals, examining their potential economic impact and exploring the feasibility of achieving both tax reductions and fiscal responsibility. We'll analyze the key elements of their plan and consider potential challenges and opportunities.

Proposed Tax Cuts

The Conservative Party's platform centers around substantial tax cuts, targeting both individuals and corporations. These reductions aim to boost disposable income, encourage business investment, and ultimately fuel economic growth.

Income Tax Reductions

The proposed income tax reductions are a cornerstone of the Conservative plan. They propose specific percentage reductions across various income brackets, aiming to provide relief for Canadian taxpayers.

- Specific percentage reductions proposed for each bracket: While the exact percentages may vary depending on the specific platform release, the Conservatives generally propose cuts to individual income tax brackets, aiming for a more competitive tax system compared to other G7 countries. Specific numbers should be verified from the official party platform.

- Estimated savings for different income levels: A family earning $80,000 annually might see savings ranging from $X to $Y per year, depending on the specific bracket and proposed reduction percentage. These figures require detailed analysis from independent economists to verify accuracy.

- Impact on disposable income for average Canadians: The overall impact aims to increase disposable income for average Canadians, allowing for increased consumer spending and economic stimulation. However, the extent of this impact depends on the magnitude of the cuts and individual circumstances.

Corporate Tax Cuts

Lowering the corporate tax rate is another key element. The Conservatives argue that this will incentivize businesses to invest, expand, and create jobs.

- Proposed corporate tax rate reduction: The proposed reduction in the corporate tax rate aims to make Canada more competitive globally, attracting investment and fostering business growth. The specific percentage needs to be confirmed in the official party materials.

- Projected impact on business investment and growth: The party anticipates increased business investment and expansion leading to job creation and economic expansion. However, the actual impact depends on several economic factors and may not fully materialize.

- Potential consequences for small and medium-sized enterprises (SMEs): SMEs are expected to benefit significantly from corporate tax cuts, though the magnitude of this benefit would be dependent on the specifics of the proposed legislation.

Other Tax Measures

Beyond income and corporate taxes, the Conservatives may propose adjustments to other tax measures.

- Details of any proposed changes to other taxes: This could potentially include adjustments to capital gains taxes or changes to the Goods and Services Tax (GST)/Harmonized Sales Tax (HST). The details of any such changes are dependent on the latest platform iteration.

- Potential effects on different sectors of the economy: These adjustments could significantly impact different sectors, potentially stimulating some while others may face challenges depending on the specifics of each proposed change.

Deficit Reduction Strategies

To offset the cost of tax cuts and maintain fiscal responsibility, the Conservative Party outlines strategies to reduce the federal deficit.

Spending Cuts

The party proposes cuts in various government programs and departments to achieve fiscal balance.

- Specific programs or departments targeted for cuts: The specific programs targeted for cuts are typically outlined in the party’s full platform. Identifying these requires reviewing their official documents.

- Estimated savings from each proposed cut: The estimated savings from these cuts would be subject to independent economic analysis to ensure accuracy and feasibility.

- Potential social or economic consequences of these cuts: These cuts may have social and economic consequences, potentially impacting essential services and leading to debate regarding their impact on vulnerable populations.

Increased Revenue Generation (Beyond Tax Cuts)

The plan might also include strategies to generate additional government revenue beyond tax cuts.

- Potential sources of increased revenue: The party might propose increased efficiency in government operations, targeted investments to stimulate economic activity generating tax revenues, or other measures to boost government coffers.

- Estimated revenue increases from each strategy: The estimated revenue increases are subject to economic analysis and projections, and these can be subject to significant uncertainty.

- Feasibility and potential challenges associated with these strategies: The feasibility of these strategies would be heavily dependent on external economic conditions and the success of implementation.

Economic Impact and Feasibility

The Conservative Party’s proposals have the potential to significantly impact the Canadian economy.

Potential Economic Growth

The proposed measures aim to stimulate economic growth through various channels.

- Increased consumer spending due to tax cuts: Tax cuts could lead to increased consumer spending, boosting economic activity.

- Business investment stimulated by corporate tax cuts: Corporate tax cuts are intended to incentivize business investment, leading to job creation and economic expansion.

- Job creation possibilities: The combined effects of increased consumer spending and business investment could lead to job creation across various sectors.

Potential Risks and Challenges

Despite the potential benefits, there are inherent risks and challenges.

- Increased national debt if tax cuts aren't offset by spending cuts: If the tax cuts are not adequately offset by spending reductions, it could lead to a significant increase in the national debt.

- Impact on social programs: Spending cuts could negatively impact essential social programs, potentially impacting vulnerable populations and leading to public backlash.

- Potential for increased inequality: The benefits of tax cuts might disproportionately benefit higher-income earners, potentially exacerbating income inequality.

Conclusion

The Conservative Party's promise of tax cuts and smaller deficits presents a complex picture. While the proposed tax cuts aim to stimulate economic growth and boost disposable income, the feasibility of achieving these goals while simultaneously reducing the deficit remains a central point of discussion. The potential for increased national debt, negative impacts on social programs, and the possibility of increased inequality all require careful consideration. The success of this plan hinges on the careful balancing of tax cuts, spending reductions, and effective revenue generation strategies.

Call to Action: Learn more about the Conservative Party's plan for tax cuts and deficit reduction by visiting their official website. Understand how these policies could impact you and engage in informed discussions about the future of Canadian fiscal policy. Compare their proposals with those of other parties and critically assess their feasibility and potential consequences. Informed participation is crucial for shaping the future of Canada's economic landscape.

Featured Posts

-

Decrease In Illegal Border Crossings Between U S And Canada White House Statement

Apr 24, 2025

Decrease In Illegal Border Crossings Between U S And Canada White House Statement

Apr 24, 2025 -

Positive Market Sentiment Driving The Niftys Uptrend In India

Apr 24, 2025

Positive Market Sentiment Driving The Niftys Uptrend In India

Apr 24, 2025 -

New Business Hot Spots A National Map And Analysis

Apr 24, 2025

New Business Hot Spots A National Map And Analysis

Apr 24, 2025 -

The Truth About Chalet Girls Serving Europes Wealthy Skiers

Apr 24, 2025

The Truth About Chalet Girls Serving Europes Wealthy Skiers

Apr 24, 2025 -

Nba All Star Weekend Recap Herros 3 Point Win And Cavs Skills Challenge Domination

Apr 24, 2025

Nba All Star Weekend Recap Herros 3 Point Win And Cavs Skills Challenge Domination

Apr 24, 2025