TikTok And Trump Tariffs: How Businesses Are Circumventing Import Taxes

Table of Contents

Shifting Sourcing Strategies to Avoid Tariffs

The most direct approach to mitigating the impact of Trump tariffs is to shift sourcing strategies away from affected regions. This involves a complex interplay of logistical, financial, and strategic considerations.

Relocating Manufacturing

Many businesses are relocating their manufacturing operations to countries unaffected by the tariffs. This often entails significant upfront investment but can lead to long-term cost savings and increased control over the supply chain.

- Examples: Vietnam, Mexico, and some Southeast Asian countries have become popular destinations for relocated manufacturing facilities.

- Supply Chain Implications: Relocating manufacturing necessitates careful planning and management of the new supply chain, including logistics, transportation, and potential language barriers.

- Increased Costs: While relocation may ultimately reduce tariff costs, businesses must account for the initial investment in setting up new facilities, training employees, and managing the transition.

Finding Alternative Suppliers

Businesses are actively searching for alternative suppliers in regions unaffected by tariffs. This requires a thorough and diligent approach.

- Online Platforms: Utilizing platforms like Alibaba allows businesses to access a vast network of potential suppliers globally.

- Smaller Suppliers: Directly sourcing from smaller, independent suppliers can provide flexibility and competitive pricing.

- Due Diligence: Thorough background checks and verification of supplier capabilities are crucial to mitigate potential risks associated with new partnerships. This includes verifying certifications, quality control measures, and production capacity.

Leveraging TikTok for Smarter Sourcing and Marketing

Surprisingly, TikTok has emerged as a powerful tool for businesses navigating the complexities of TikTok and Trump Tariffs. Its unique features provide access to information and market reach that traditional methods often miss.

TikTok's Role in Identifying Alternative Suppliers

TikTok’s vast user base and diverse content offer unexpected opportunities for businesses to identify alternative suppliers.

- Hashtag Search: Utilizing relevant hashtags like #manufacturing, #supplier, and #MadeInMexico can connect businesses with potential suppliers in specific regions.

- Influencer Marketing: Collaborating with influencers who focus on manufacturing or trade can provide access to niche supplier networks.

- Trend Analysis: Monitoring trends related to sourcing and manufacturing on TikTok can offer insights into emerging markets and suppliers.

Marketing Strategies to Mitigate Tariff Impacts

Smart marketing on TikTok can help offset increased costs associated with tariffs by boosting brand awareness and demand.

- Targeted Advertising: Precise targeting allows businesses to reach specific demographics who are less price-sensitive and more receptive to value propositions.

- Community Building: Engaging with potential customers on TikTok builds brand loyalty and fosters positive relationships.

- Influencer Marketing: Leveraging influencer marketing campaigns can build brand awareness and trust, enabling businesses to command premium prices. User-generated content adds authenticity and social proof.

Exploring Legal Loopholes and Tariff Mitigation Strategies

Understanding the nuances of trade regulations and tariff classifications is essential for minimizing the impact of tariffs.

Understanding Tariff Classifications

Proper classification of imported goods is critical, as misclassification can lead to higher or lower tariffs.

- Customs Brokers: Consulting with experienced customs brokers ensures accurate classification and minimizes the risk of penalties.

- Tariff Classification Tools: Utilizing online tools and resources can aid in determining the correct tariff codes for imported goods.

- Contesting Classifications: In some cases, businesses can challenge tariff classifications they believe are incorrect. This requires careful legal counsel and substantial evidence.

Utilizing Free Trade Agreements

Free trade agreements (FTAs) can significantly reduce or eliminate tariffs on goods imported from participating countries.

- FTA Identification: Businesses need to carefully identify any applicable FTAs to determine their eligibility for tariff reductions.

- Requirements and Benefits: Understanding the specific requirements and potential benefits of each FTA is crucial for maximizing its advantages.

- Navigating Complexities: Successfully utilizing FTAs requires careful attention to detail and adherence to all relevant regulations.

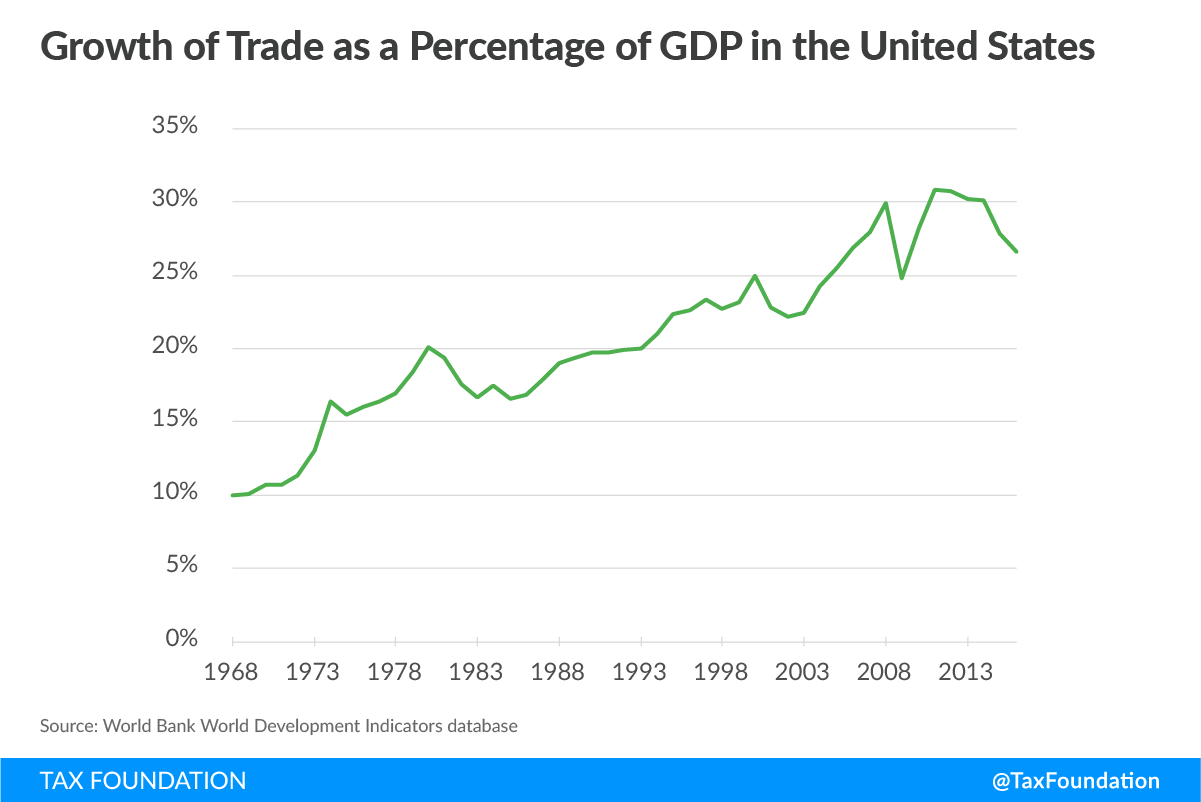

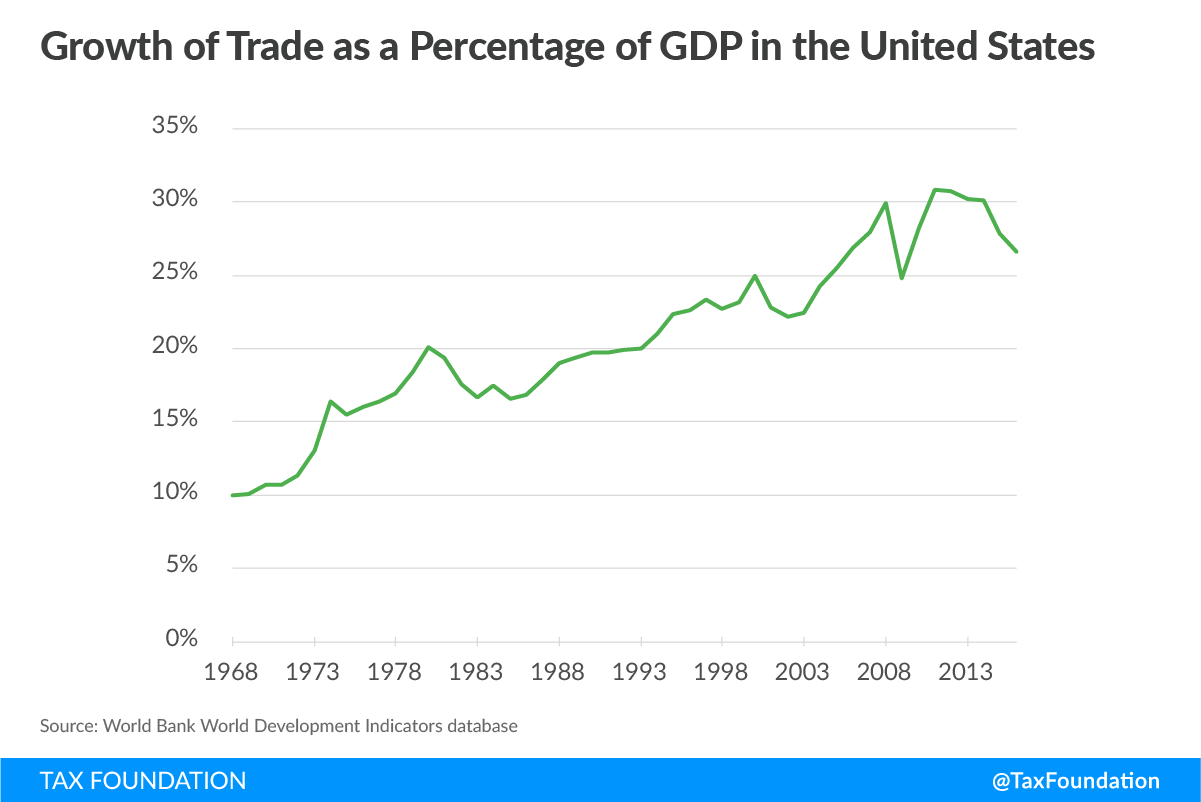

The Long-Term Implications and Future of Trade

The impact of Trump-era tariffs extends beyond immediate cost increases. Businesses are adapting their long-term strategies to account for these ongoing challenges, diversifying supply chains, and building greater resilience into their operations. The unpredictable nature of trade policy necessitates agility and proactive planning.

Conclusion

Successfully navigating the complexities of TikTok and Trump Tariffs requires a multifaceted approach. This article has highlighted several key strategies: diversifying sourcing, leveraging free trade agreements, understanding tariff classifications, and employing innovative marketing strategies – including utilizing the power of TikTok – to mitigate tariff impacts. The key takeaways are the importance of proactive adaptation, thorough due diligence, and innovative approaches to both sourcing and marketing in a globalized and increasingly dynamic trade environment. Learn how to optimize your business strategies to overcome the challenges of TikTok and Trump Tariffs and build a more resilient and profitable future.

Featured Posts

-

Googles Search Monopoly Doj Files New Court Challenge

Apr 22, 2025

Googles Search Monopoly Doj Files New Court Challenge

Apr 22, 2025 -

Stock Investors Defy Gloom Bid Market Higher But At What Cost

Apr 22, 2025

Stock Investors Defy Gloom Bid Market Higher But At What Cost

Apr 22, 2025 -

Us And South Sudan Partner On Repatriation Of Deportees

Apr 22, 2025

Us And South Sudan Partner On Repatriation Of Deportees

Apr 22, 2025 -

Ohio Train Derailment Investigation Into Prolonged Toxic Chemical Presence In Buildings

Apr 22, 2025

Ohio Train Derailment Investigation Into Prolonged Toxic Chemical Presence In Buildings

Apr 22, 2025 -

Higher Stock Prices Higher Risks What Investors Need To Know

Apr 22, 2025

Higher Stock Prices Higher Risks What Investors Need To Know

Apr 22, 2025