Higher Stock Prices, Higher Risks: What Investors Need To Know

Table of Contents

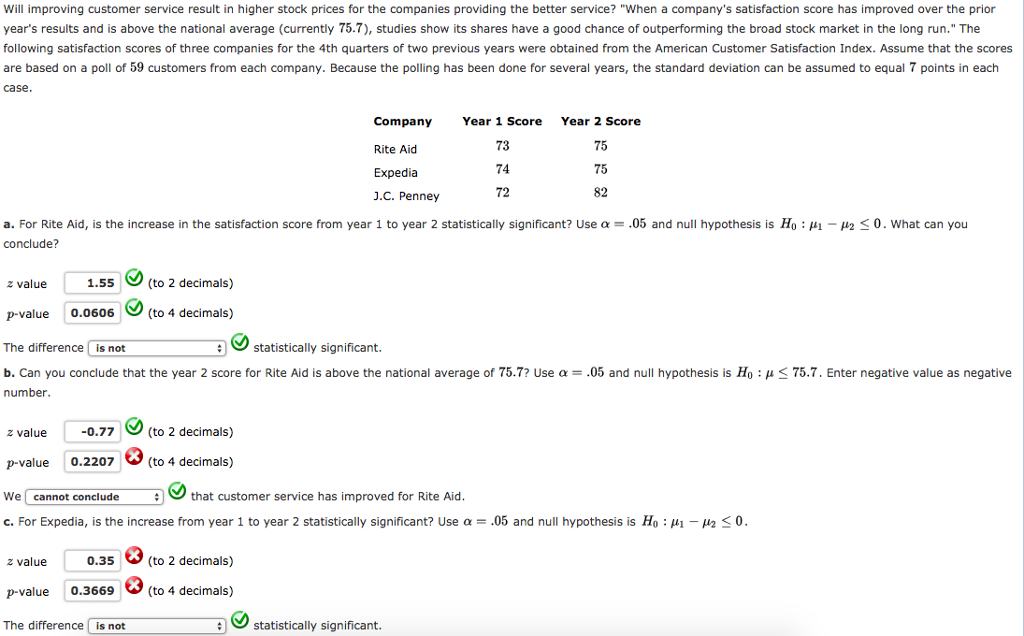

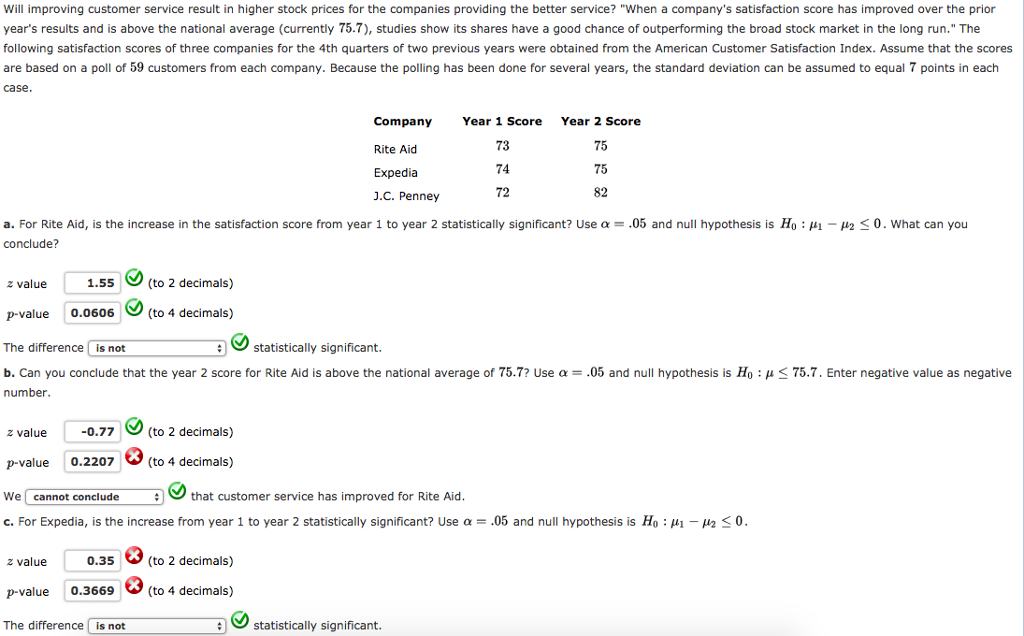

Understanding the Correlation Between Stock Prices and Risk

The stock market operates on a fundamental principle: higher potential returns usually mean higher risk. This inverse relationship between risk and return is a cornerstone of investment theory. When stock prices are high, the potential for significant gains might seem attractive, but the risk of substantial losses also increases. This is because several factors come into play:

-

Increased market volatility with higher prices: As prices climb, the market becomes more sensitive to news and events, leading to larger price swings in either direction. A small piece of negative news can trigger a sharp downturn.

-

Higher valuations leading to potential overvaluation and subsequent corrections: When prices consistently rise beyond the fundamental value of a company, a correction becomes increasingly likely. This correction can be a gradual decline or a sharp drop, wiping out significant gains.

-

The impact of economic indicators and interest rates on stock prices: Macroeconomic factors like inflation, interest rate hikes, and economic growth directly influence stock prices. High stock prices in an environment of rising interest rates, for example, can be unsustainable.

-

The role of investor sentiment and speculation in driving prices up: Market psychology plays a significant role. Excessive optimism and speculation can inflate prices beyond rational levels, creating a bubble that is prone to bursting.

Identifying Potential Red Flags in a High-Price Market

Knowing when the market is becoming overheated is crucial. Several red flags can signal potential trouble:

-

High Price-to-Earnings (P/E) ratios across multiple sectors: A consistently high P/E ratio across various sectors suggests that the market might be overvalued. This means investors are paying a premium for each dollar of earnings.

-

Increased speculative trading and "meme stocks": A surge in speculative trading and the popularity of "meme stocks" (stocks driven by social media hype rather than fundamentals) are often signs of an overheated market.

-

Growing levels of debt in the market: High levels of corporate and consumer debt can make the market vulnerable to economic shocks.

-

A widening gap between market valuations and fundamental company performance: If stock prices are rising significantly faster than a company's earnings or revenues, it's a strong indicator of overvaluation.

-

Excessively optimistic investor sentiment and lack of critical analysis: A general feeling of euphoria and a lack of critical analysis among investors create a breeding ground for a market correction.

Analyzing Company Fundamentals Despite High Stock Prices

Even in a high-price market, focusing solely on the price is a mistake. Analyzing a company's intrinsic value – its true worth based on its assets, earnings, and future prospects – is essential. This involves:

-

Reviewing the company's financial statements (revenue, earnings, debt): Look for consistent growth in revenue and earnings, and assess the level of debt.

-

Assessing the company's competitive landscape and market position: Understand the company's competitive advantages and its ability to maintain its market share.

-

Examining management's track record and strategic direction: A strong and experienced management team is crucial for long-term success.

-

Considering the company's long-term growth prospects: Invest in companies with sustainable competitive advantages and long-term growth potential.

Diversification and Risk Management Strategies for High-Price Markets

Mitigating risk in a high-price environment requires a well-defined strategy:

-

Diversify your investment portfolio across different asset classes (stocks, bonds, real estate): Don't put all your eggs in one basket. Diversification helps to reduce overall portfolio volatility.

-

Consider investing in less volatile stocks or bonds: Some stocks and bonds are less susceptible to market fluctuations.

-

Implement dollar-cost averaging to reduce the impact of market fluctuations: Invest a fixed amount of money at regular intervals, regardless of the stock price.

-

Rebalance your portfolio regularly to maintain your desired asset allocation: Periodically adjust your portfolio to ensure it aligns with your risk tolerance and investment goals.

-

Use stop-loss orders to limit potential losses: Set predetermined prices at which you'll sell a stock to limit potential losses.

The Importance of Long-Term Investing in High-Risk Markets

A long-term perspective is crucial for weathering market volatility:

-

Avoid panic selling during market downturns: Market corrections are a normal part of the investment cycle. Panic selling often leads to significant losses.

-

Focus on your investment goals and time horizon: Maintain a long-term focus on your financial goals.

-

Regularly review your investment strategy and adjust as needed: Your investment strategy should be dynamic and adaptable to changing market conditions.

-

Consider seeking advice from a qualified financial advisor: A financial advisor can provide personalized guidance and help you navigate the complexities of the market.

Conclusion:

Higher stock prices, while tempting, often signal increased risk. Understanding the correlation between price and risk is crucial for successful investing. By diligently analyzing company fundamentals, diversifying your portfolio, and adopting a long-term perspective, you can navigate the challenges of a high-price market and achieve your investment goals. Remember, staying informed and making well-researched decisions are key to mitigating the risks associated with higher stock prices. Don't let soaring stock prices blind you to potential risks; make informed investment choices by carefully evaluating the relationship between higher stock prices and higher risk.

Featured Posts

-

1 Billion Funding Cut Looms For Harvard Amid Trump Administration Dispute

Apr 22, 2025

1 Billion Funding Cut Looms For Harvard Amid Trump Administration Dispute

Apr 22, 2025 -

Controversy Erupts Hegseth And Allegations Of Pentagon Dysfunction Following Signal Chat Release

Apr 22, 2025

Controversy Erupts Hegseth And Allegations Of Pentagon Dysfunction Following Signal Chat Release

Apr 22, 2025 -

Crooks Office365 Hack Millions In Losses For Executives Feds Say

Apr 22, 2025

Crooks Office365 Hack Millions In Losses For Executives Feds Say

Apr 22, 2025 -

Hollywood Strike Actors Join Writers Bringing Production To A Halt

Apr 22, 2025

Hollywood Strike Actors Join Writers Bringing Production To A Halt

Apr 22, 2025 -

The Economic Impact Of Trumps Trade Actions On Us Financial Primacy

Apr 22, 2025

The Economic Impact Of Trumps Trade Actions On Us Financial Primacy

Apr 22, 2025