Tesla's Q1 Financial Results: Exploring The Fallout From Musk's Actions

Table of Contents

Q1 Financial Performance: A Deep Dive into the Numbers

Tesla's Q1 2024 financial performance offers a mixed bag. While we need to wait for the official release of the complete report to analyze specific figures, early reports suggest several key areas of focus. Let's examine the expected financial highlights:

-

Tesla Revenue: Early predictions point towards a strong revenue figure, driven by increased vehicle deliveries and growth in the energy segment. However, potential price reductions to boost sales might have affected overall margins. Comparing this to Q1 2023 and Q4 2023 will be crucial in assessing growth trends.

-

Tesla Profit and Margins: Profit margins are expected to be a key area of scrutiny. The impact of raw material costs, increased production expenses, and pricing strategies will play a significant role in determining Tesla's profitability. A detailed cost analysis will be needed to understand the contributing factors.

-

Tesla Sales and Deliveries: While Tesla aims for record deliveries, achieving these targets depends on consistent production output and overcoming any supply chain challenges. Comparing actual deliveries to projections will provide insight into the success of their sales strategies. Analysis will include a comparison to previous quarters and rival EV manufacturers.

-

Tesla Energy Performance: The contribution of Tesla Energy (solar panels and energy storage solutions) to overall revenue and profitability will be a factor worth monitoring. This segment's growth potential is crucial for Tesla's long-term diversification strategy.

The Musk Factor: How Elon Musk's Actions Shaped the Results

Elon Musk's leadership style and activities outside Tesla have undoubtedly influenced the company's Q1 performance and market perception. His involvement in Twitter, along with other ventures, created significant stock volatility and impacted investor sentiment.

-

Twitter Acquisition and Stock Volatility: The significant financial resources allocated to Twitter and the subsequent controversies have undoubtedly impacted Tesla's stock price and investor confidence. Analyzing the correlation between Musk's Twitter activities and Tesla's stock performance will be key.

-

Brand Image and Consumer Perception: Musk's public statements and actions can significantly influence Tesla's brand perception. Any negative publicity could affect consumer confidence and sales, particularly in a competitive EV market.

-

Potential Conflicts of Interest: Musk's involvement in multiple ventures raises potential conflicts of interest. This issue needs careful examination to assess any potential negative effects on Tesla's management and operational efficiency.

-

Leadership Style and Operational Efficiency: Musk's leadership style, characterized by its demanding and unconventional nature, can have both positive and negative effects on Tesla's operational efficiency and strategic decision-making. The Q1 results will offer insights into the impact of this style on overall performance.

Impact on the EV Market and Competition

Tesla's Q1 results have major implications for the broader EV market and its competitors. The company's performance affects its market share and influences the strategies of rivals.

-

Tesla's Market Position: Tesla's Q1 performance directly impacts its market leadership in the electric vehicle sector. Analyzing the changes in its market share in comparison to the previous quarter and its main competitors will provide valuable insight.

-

Impact on Competitors: Tesla's success or struggles affect competitors like Rivian, Lucid, and established automakers. A strong Tesla performance can put pressure on competitors, while a weaker performance can open opportunities for them.

-

Industry Trends: The overall EV market trends, including government regulations, consumer preferences, and technological advancements, all influence Tesla's performance and its future prospects. Analyzing these trends alongside Tesla’s Q1 results helps provide a comprehensive understanding of the market's dynamics.

Future Outlook and Predictions for Tesla

Predicting Tesla's future is challenging, given the volatile nature of the EV market and the influence of Elon Musk. However, based on Q1 results and market trends, we can speculate on potential scenarios.

-

Tesla Stock Forecast: Analyst predictions for Tesla's stock price will be influenced by the Q1 results and projections for future growth. The impact of the Musk factor and broader market conditions will also play a significant role.

-

Challenges and Opportunities: Tesla faces challenges like increasing competition, supply chain disruptions, and managing production costs. However, opportunities exist in expanding its product range, entering new markets, and developing advanced technologies.

-

Impact of Technology and Regulations: Technological advancements and government regulations related to EVs will significantly impact Tesla's future growth trajectory. Adapting to these changes will be crucial for continued success.

Conclusion:

Tesla's Q1 2024 financial results present a complex picture, significantly influenced by Elon Musk's actions and the wider EV market dynamics. The interplay between these factors is crucial for investors and industry watchers. To stay updated on the evolving landscape of Tesla and the electric vehicle market, continue following our analysis of future Tesla results and the impact of Elon Musk’s decisions. Stay tuned for our next deep dive into Tesla's Q2 performance and the ongoing fallout from Musk's actions. Understanding Tesla's Q1 results is key to navigating the future of this influential EV company.

Featured Posts

-

Deportation Flights A New Revenue Stream For A Startup Airline

Apr 24, 2025

Deportation Flights A New Revenue Stream For A Startup Airline

Apr 24, 2025 -

Sophie Nyweide Child Actor In Mammoth And Noah Dies At 24

Apr 24, 2025

Sophie Nyweide Child Actor In Mammoth And Noah Dies At 24

Apr 24, 2025 -

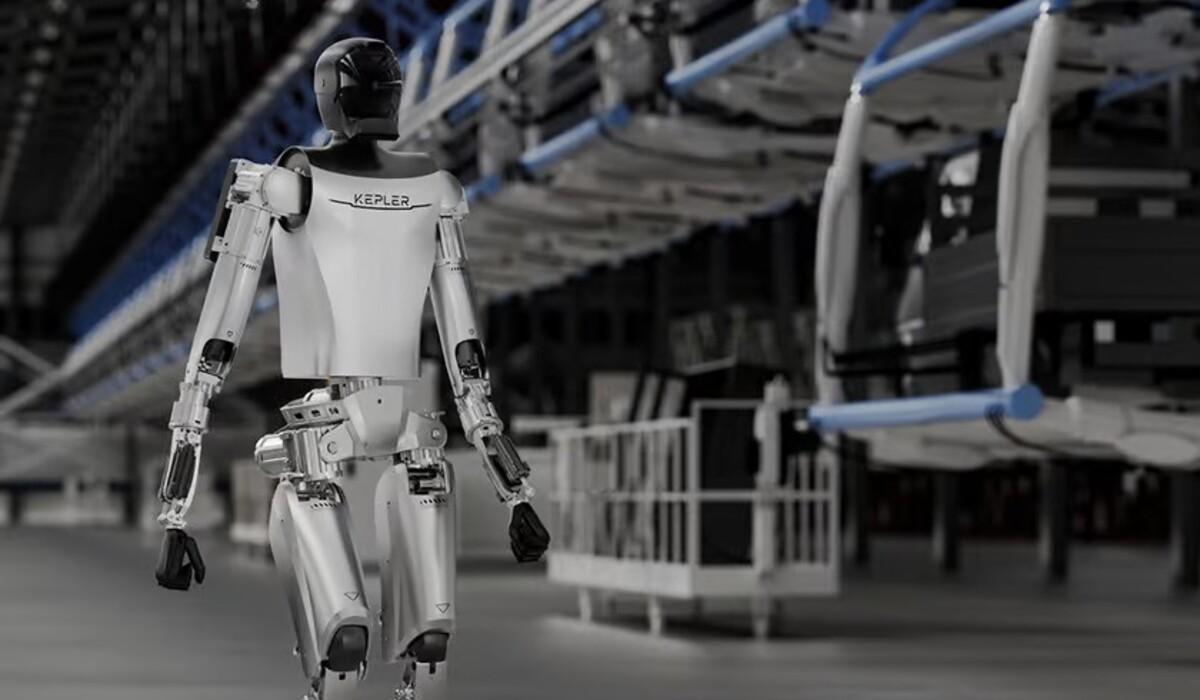

Rare Earth Supply Chain Issues Hamper Teslas Optimus Humanoid Robot Development

Apr 24, 2025

Rare Earth Supply Chain Issues Hamper Teslas Optimus Humanoid Robot Development

Apr 24, 2025 -

Hong Kong Market Rally Chinese Stocks On The Rise Amidst Trade Optimism

Apr 24, 2025

Hong Kong Market Rally Chinese Stocks On The Rise Amidst Trade Optimism

Apr 24, 2025 -

The Truth About Chalet Girls Serving Europes Wealthy Skiers

Apr 24, 2025

The Truth About Chalet Girls Serving Europes Wealthy Skiers

Apr 24, 2025