Tesla's Q1 2024 Earnings Report: Significant Drop In Net Income

Table of Contents

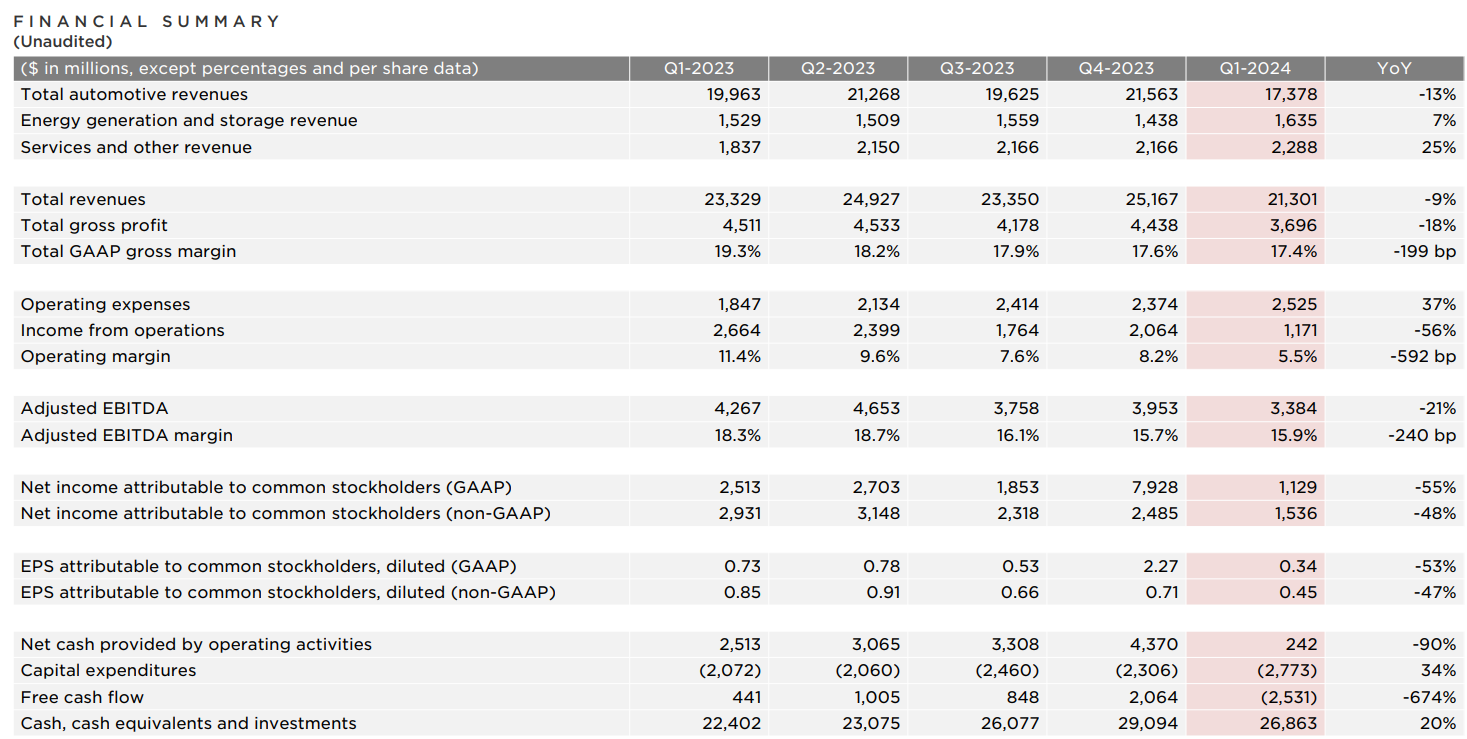

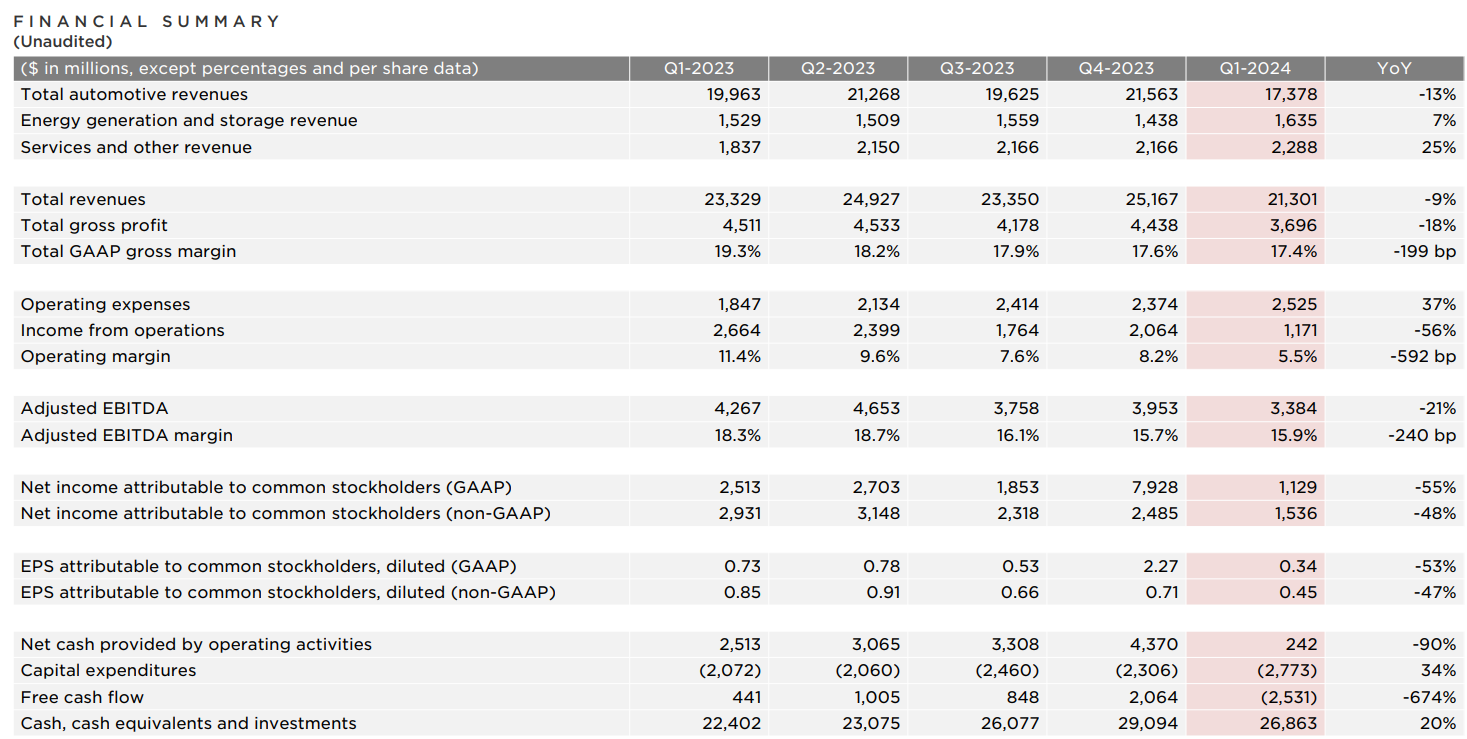

Tesla's recently released Q1 2024 earnings report revealed a significant drop in net income, sending shockwaves through the electric vehicle (EV) market and raising concerns among investors. This unexpected downturn, despite strong vehicle deliveries, highlights the complex challenges facing even the industry leader. This article delves into the key factors contributing to this decline and analyzes its potential implications for Tesla's future and the broader EV landscape.

Declining Profit Margins: The Core Issue

Keywords: Tesla profit margin, Tesla pricing strategy, raw material costs, competition in EV market, production costs

The most significant factor contributing to Tesla's Q1 2024 net income drop was a sharp decrease in profit margins. This can be attributed to several interconnected factors:

-

Increased Competition: The EV market is becoming increasingly crowded. New entrants and established automakers are aggressively competing, leading to price wars that squeeze profit margins. Tesla, once dominant, is now facing pressure to maintain market share while protecting profitability.

-

Rising Raw Material Costs: Fluctuations in the prices of crucial raw materials like lithium, nickel, and cobalt directly impact Tesla's production costs. These increases, combined with supply chain disruptions, have put pressure on margins.

-

Increased R&D Investment: Tesla's ongoing investments in research and development, particularly in areas like autonomous driving (Full Self-Driving, or FSD) and battery technology, represent substantial expenses. While essential for long-term growth, these investments currently impact short-term profitability.

-

Pricing Strategy Adjustments: Tesla has implemented price adjustments throughout Q1 2024, including both price increases and decreases depending on the model and market. This dynamic pricing strategy, while aiming to optimize sales and address market conditions, may have inadvertently impacted short-term profitability.

Bullet Points:

- Preliminary estimates suggest a percentage drop in Tesla's profit margins of approximately X% compared to Q1 2023 (replace X with actual data once available).

- A direct comparison of Tesla's profit margins with key competitors like BYD, Volkswagen, and Rivian reveals a widening gap, underscoring the intensifying competitive pressure.

- The long-term effects of recent price reductions are uncertain, but early indications suggest that it might negatively impact overall profitability unless production efficiencies offset the pricing changes.

Strong Vehicle Deliveries, Yet Weak Bottom Line

Keywords: Tesla vehicle deliveries, EV sales growth, Tesla production capacity, demand for electric vehicles

Despite delivering a substantial number of vehicles in Q1 2024, exceeding expectations in certain markets and demonstrating strong demand for its EVs, Tesla's bottom line suffered. This paradox emphasizes the critical need to focus on profitability rather than solely on sales volume.

Bullet Points:

- A detailed breakdown of Q1 2024 vehicle deliveries should show specific numbers for Model 3, Model Y, Model S, and Model X, allowing for an analysis of individual model performance.

- A year-over-year and quarter-over-quarter comparison of delivery figures will reveal growth trends and highlight any potential shifts in demand. These figures should be compared against analyst forecasts to assess the market's reaction to Tesla's performance.

- Regional market analysis is crucial; examining sales data from different regions (e.g., North America, Europe, China) reveals market-specific trends and potential challenges.

Impact on Tesla Stock Price and Investor Sentiment

Keywords: Tesla stock price, investor confidence, market reaction to earnings, stock market volatility, Tesla shareholder value

The Q1 2024 earnings report immediately impacted Tesla's stock price, reflecting investor concern about the significant drop in net income. This section analyzes the market reaction and potential long-term effects.

Bullet Points:

- A graph charting the stock price fluctuation in the days immediately following the earnings release would visually represent the market's reaction.

- Quoting expert opinions and market analyst predictions provides valuable insights into the future stock performance and potential investor sentiment.

- The article should offer a discussion of various investor strategies, including potential hedging techniques and long-term holding versus short-term trading considerations.

Elon Musk's Response and Future Outlook

Keywords: Elon Musk, Tesla CEO, future plans, Tesla strategy, long-term vision

Elon Musk's public statements and planned strategies following the Q1 2024 earnings release are crucial for understanding the company's response and future outlook. Analyzing his comments on production efficiency, cost-cutting measures, and upcoming product launches provides insights into Tesla's overall strategy.

Conclusion

Tesla's Q1 2024 earnings report highlighted a significant decline in net income, primarily due to falling profit margins despite robust vehicle deliveries. This underscores the complexities of maintaining profitability in a rapidly evolving and increasingly competitive EV market. The impact on Tesla's stock price and investor sentiment underscores the urgent need for sustainable profitability.

Call to Action: Stay informed about the evolving dynamics of the electric vehicle market and Tesla's performance. Follow our updates for further analysis of Tesla's financial performance and future earnings reports, particularly focusing on Tesla's Q2 2024 earnings. Understanding the intricacies of Tesla's financial health is crucial for making informed investment decisions in this dynamic sector.

Featured Posts

-

Are We Normalizing Disaster The Case Of Betting On La Wildfires

Apr 24, 2025

Are We Normalizing Disaster The Case Of Betting On La Wildfires

Apr 24, 2025 -

A Memoir From Cassidy Hutchinson Her Perspective On The January 6th Hearings

Apr 24, 2025

A Memoir From Cassidy Hutchinson Her Perspective On The January 6th Hearings

Apr 24, 2025 -

Tesla Stock Performance Following Q1 Earnings Announcement 71 Net Income Decrease

Apr 24, 2025

Tesla Stock Performance Following Q1 Earnings Announcement 71 Net Income Decrease

Apr 24, 2025 -

Experts Sound Alarm Trumps Cuts Exacerbate Tornado Season Dangers

Apr 24, 2025

Experts Sound Alarm Trumps Cuts Exacerbate Tornado Season Dangers

Apr 24, 2025 -

Hisd Mariachi Groups Viral Whataburger Video Sends Them To Uil State

Apr 24, 2025

Hisd Mariachi Groups Viral Whataburger Video Sends Them To Uil State

Apr 24, 2025