Tesla Stock Performance Following Q1 Earnings Announcement: 71% Net Income Decrease

Table of Contents

The 71% Net Income Decrease: A Deep Dive

The dramatic 71% plunge in Tesla's Q1 2024 net income is a significant event that demands a thorough examination. Several interconnected factors contributed to this decline, impacting both Tesla stock and investor confidence.

Key Factors Contributing to the Decline:

-

Aggressive Price Reductions: Tesla implemented substantial price cuts across its vehicle lineup to boost sales volume and maintain market share in a highly competitive EV landscape. While this strategy increased sales units, it significantly compressed profit margins.

-

Intensified EV Market Competition: The electric vehicle market is rapidly evolving, with established automakers and new entrants aggressively vying for market share. This increased competition puts pressure on pricing and profitability for all players, including Tesla.

-

Rising Production Costs and Supply Chain Challenges: Escalating raw material costs, persistent supply chain disruptions, and increased logistics expenses all negatively affected Tesla's profitability during Q1 2024.

-

Heavy Investment in Future Projects: Tesla's significant investment in new projects, such as the highly anticipated Cybertruck production ramp-up, diverted resources and capital, impacting short-term profitability. These long-term investments are expected to yield future returns, but they exerted pressure on current earnings.

-

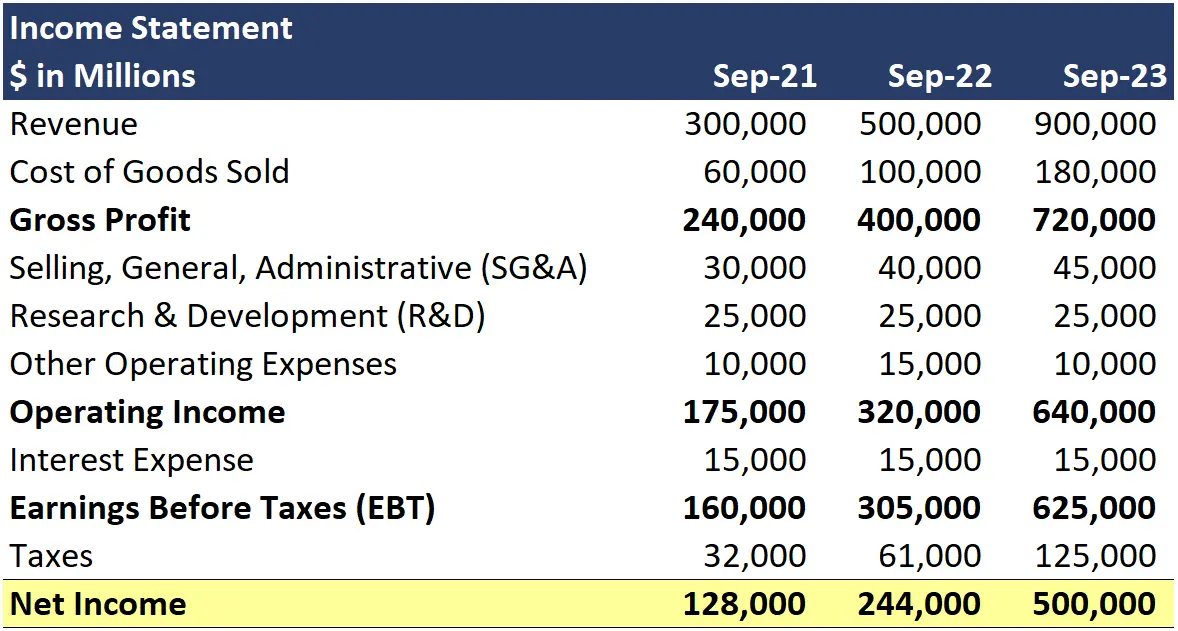

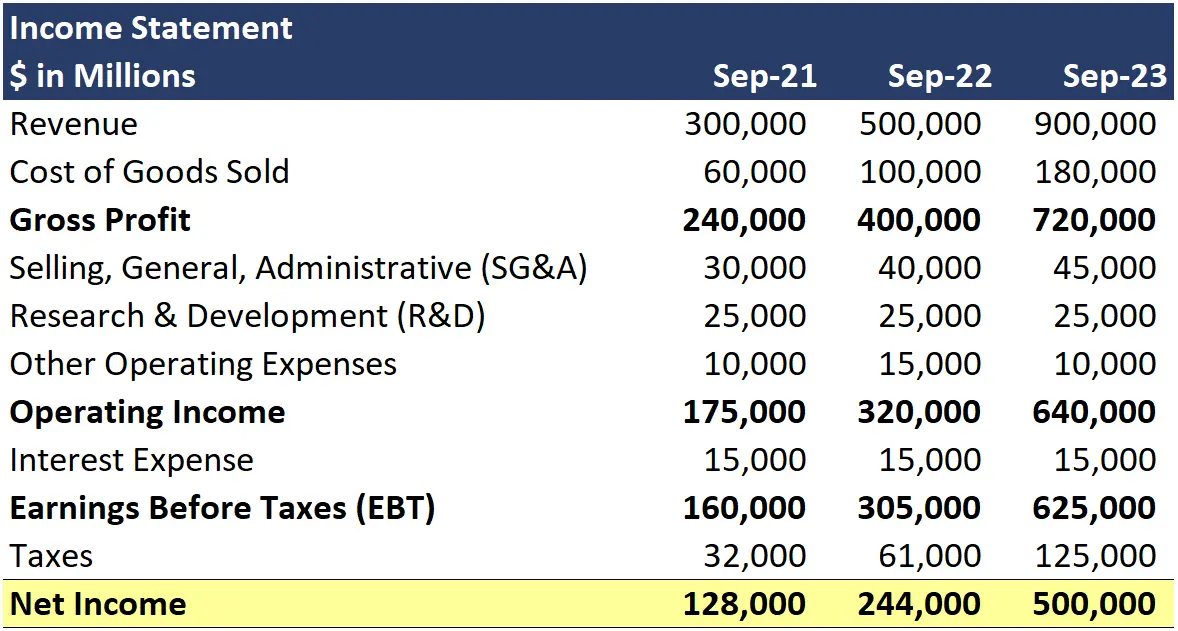

Specific Financial Figures (Illustrative): According to the Q1 2024 report (source citation needed), Tesla reported a net income of [insert actual figure] compared to [insert previous quarter/year figure], representing a [insert percentage] decrease. Gross margin was reported at [insert figure], a significant drop from [insert previous figure]. These figures, when compared to analyst expectations, further fueled the negative market reaction.

Market Reaction to the Earnings Report:

The announcement of Tesla's Q1 earnings immediately triggered a significant drop in the TSLA stock price.

-

Immediate Stock Price Plunge: Following the earnings release, Tesla stock experienced a sharp decline of [insert percentage] in after-hours trading.

-

Analyst Downgrades: Many analysts revised their price targets for Tesla stock downwards, reflecting concerns about the company's profitability and future growth prospects.

-

Investor Sentiment Shift: Investor sentiment turned significantly negative, with increased selling pressure and a drop in trading volume initially, followed by increased volatility.

-

Quarter-over-Quarter and Year-over-Year Comparison: Comparing Q1 2024 performance with Q4 2023 and Q1 2023 reveals a substantial decline in key financial metrics, highlighting the severity of the situation.

-

Stock Price Movement Data (Illustrative): The TSLA stock price fell from [insert price] before the announcement to [insert price] immediately afterward (source citation needed). Trading volume increased by [insert percentage] (source citation needed), indicating high market activity and uncertainty.

Analyzing Tesla's Long-Term Stock Outlook

Despite the significant challenges presented by the Q1 earnings report, Tesla's long-term stock outlook remains a subject of considerable debate among investors.

Future Growth Potential Despite Q1 Challenges:

-

Upcoming Product Launches: The launch of new vehicles and product updates (e.g., the Cybertruck) is expected to drive future revenue growth and potentially boost Tesla's stock price.

-

Market Expansion: Tesla's continued expansion into new global markets presents significant growth opportunities, tapping into untapped demand for electric vehicles.

-

Technological Innovation: Tesla's ongoing investment in research and development (R&D) is crucial for maintaining its technological edge and developing next-generation EVs.

-

Market Share: Although facing increased competition, Tesla still holds a substantial share of the EV market, providing a strong foundation for future growth.

-

Positive Future Prospects (Illustrative): Analysts predict [insert projected growth figures] in sales for the next [insert timeframe], based on [insert supporting data or source]. This suggests a potential turnaround in the company's financial performance.

Risks and Uncertainties Facing Tesla Stock:

Despite the positive potential, several significant risks and uncertainties could impact Tesla's future stock performance.

-

Competitive Pressure: The intensifying competition within the EV market continues to present a significant threat.

-

Economic Uncertainty: Global economic uncertainty and potential recessions could dampen consumer demand for high-priced vehicles.

-

Regulatory and Geopolitical Risks: Regulatory changes and geopolitical instability could disrupt Tesla's operations and supply chains.

-

Supply Chain Disruptions: Continued supply chain disruptions could affect production volumes and increase costs.

-

Potential Threats (Illustrative): The potential for further price wars in the EV sector could continue to squeeze profit margins. Government regulations regarding EV subsidies and emissions could also significantly impact Tesla's financial performance.

Strategies for Tesla Investors

Navigating the complexities of Tesla stock requires a well-defined investment strategy tailored to individual risk tolerance and financial goals.

Short-Term vs. Long-Term Investment Strategies:

-

Short-Term Risks: Investing in Tesla stock in the short term carries significant risk due to its volatility and sensitivity to news and market sentiment.

-

Long-Term Potential: A long-term investment approach in Tesla stock may be more suitable for investors with a higher risk tolerance, focusing on the company's potential for long-term growth.

-

Diversification: Diversifying investments across various asset classes is crucial to mitigate risk.

-

Alternative EV Investments: Exploring investment opportunities in other EV companies can help diversify and potentially offset risks associated with a single stock.

-

Investment Approach Recommendations (Illustrative): Conservative investors might consider allocating only a small percentage of their portfolio to Tesla stock, while more aggressive investors might consider a larger allocation, but always with diversification in mind.

Monitoring Key Performance Indicators (KPIs):

Regularly monitoring key performance indicators is critical for making informed investment decisions regarding Tesla stock.

-

Production Numbers and Sales Figures: Tracking Tesla's production capacity, sales volume, and delivery numbers provides insights into the company's growth trajectory.

-

Margins and Profitability: Closely monitoring profit margins and overall profitability is essential to assess the impact of price changes and cost pressures.

-

Industry News and Competitive Landscape: Staying informed about developments in the EV industry and competitive landscape is crucial for understanding the challenges and opportunities facing Tesla.

-

Regulatory Changes: Keeping abreast of regulatory changes and policy updates affecting the EV sector is vital.

-

Financial Reports: Regularly reviewing Tesla's financial reports (quarterly and annual) is crucial for informed decision-making.

Conclusion

The 71% decrease in Tesla's Q1 net income was a significant event impacting its stock performance. While the short-term outlook may appear challenging due to several factors including price wars and increased competition, Tesla's long-term prospects remain tied to its innovative spirit and market position within the rapidly growing EV sector. Investors should carefully weigh the risks and rewards, understanding the inherent volatility of Tesla stock, before making decisions about their Tesla stock holdings. Analyzing macroeconomic factors, competitive landscapes, and the company's operational efficiency are paramount.

Call to Action: Understanding the complexities of Tesla stock performance requires ongoing monitoring and analysis. Stay informed about future developments, including upcoming product launches, production numbers, and financial reports, and carefully consider your investment strategy regarding Tesla stock and other related EV investments. Remember that this analysis is for informational purposes only and does not constitute financial advice. Consult with a qualified financial advisor before making any investment decisions.

Featured Posts

-

The Reality Of Working As A Chalet Girl Responsibilities And Experiences

Apr 24, 2025

The Reality Of Working As A Chalet Girl Responsibilities And Experiences

Apr 24, 2025 -

Hollywood Shutdown Double Strike Cripples Film And Television Production

Apr 24, 2025

Hollywood Shutdown Double Strike Cripples Film And Television Production

Apr 24, 2025 -

Positive Market Sentiment Driving The Niftys Uptrend In India

Apr 24, 2025

Positive Market Sentiment Driving The Niftys Uptrend In India

Apr 24, 2025 -

Legal Battle Over Banned Chemicals E Bay And The Limits Of Section 230

Apr 24, 2025

Legal Battle Over Banned Chemicals E Bay And The Limits Of Section 230

Apr 24, 2025 -

Klaus Schwab Under Scrutiny World Economic Forum Faces New Investigation

Apr 24, 2025

Klaus Schwab Under Scrutiny World Economic Forum Faces New Investigation

Apr 24, 2025