Tesla Earnings Plunge 71% In Q1: Impact Of Political Backlash Analyzed

Table of Contents

The Steep Decline in Q1 Earnings: A Detailed Look

Tesla's Q1 2024 financial report painted a bleak picture. The 71% drop in earnings compared to Q1 2023 represents a significant setback for the company, prompting concerns about its future financial stability and market share.

Revenue Breakdown:

The most substantial revenue drops occurred in several key areas. Car sales, traditionally Tesla's primary revenue stream, experienced a considerable decline, partly attributed to aggressive price cuts implemented to boost sales volume. The energy generation and storage segment also showed weaker-than-expected performance, impacted by slowing global demand and increased competition. While precise figures are subject to the official financial release, early reports suggest a significant shortfall in both sectors.

Cost Analysis:

Rising production costs, exacerbated by supply chain disruptions and inflationary pressures, severely impacted Tesla's profit margins. The increased cost of raw materials, including lithium and other crucial components used in EV battery production, added significant pressure to the bottom line. Moreover, increased logistics costs and labor expenses further contributed to the reduced profitability.

- Specific figures illustrating the drop in revenue compared to Q1 2023: (Insert specific figures once available from the official report).

- Breakdown of sales by region, highlighting any significant differences: (Insert regional sales data once available from the official report).

- Analysis of the impact of price cuts on profitability: Price cuts, while designed to stimulate demand, negatively affected margins, highlighting a strategic challenge for Tesla.

- Discussion of any unexpected expenses impacting the bottom line: (Insert details of any unexpected expenses from the official report).

The Role of Political Backlash in Tesla's Financial Troubles

The significant drop in Tesla's Q1 earnings cannot be solely attributed to internal factors. The company's increasingly fraught relationship with various governments and the resulting political backlash played a substantial role.

Geopolitical Risks:

Escalating geopolitical tensions, particularly in China – a crucial market for Tesla – significantly impacted operations. Government regulations, trade disputes, and potential factory closures in this region created uncertainty and hampered production and sales. Similar challenges emerged in other key markets, demonstrating the increasing vulnerability of Tesla to shifts in the global political landscape.

Public Relations Challenges:

Negative press surrounding Elon Musk's actions and various controversies have impacted Tesla's brand image and consumer sentiment. These public relations challenges, amplified by social media, have created a perception of risk and uncertainty, potentially affecting purchase decisions.

- Specific examples of political actions impacting Tesla's operations: (Include specific examples of government actions affecting Tesla's operations in different countries).

- Discussion of the impact of social media controversies on Tesla's brand reputation: (Analyze the effect of negative publicity surrounding Elon Musk and its effect on Tesla's brand).

- Analysis of consumer sentiment towards Tesla following negative press: (Cite relevant surveys or reports indicating changes in consumer perception).

- Examples of government investigations or regulatory hurdles affecting Tesla: (List examples of investigations or regulatory hurdles faced by Tesla globally).

Impact on Tesla Stock Price and Investor Confidence

The Q1 earnings report triggered a significant negative reaction in the stock market.

Market Reaction Analysis:

The announcement immediately caused a sharp decline in Tesla's stock price, reflecting investor concern about the company's financial performance and future prospects. This sell-off underlines the market's sensitivity to the combination of poor financial results and ongoing political headwinds.

Long-Term Outlook:

The long-term outlook for Tesla remains uncertain. The company's ability to navigate the ongoing political challenges and adapt to evolving market dynamics will be crucial in determining its future financial stability. The success of future product launches and the ability to mitigate geopolitical risks will significantly influence investor confidence and the trajectory of its stock price.

- Chart illustrating the stock price fluctuation following the earnings announcement: (Insert a chart showing stock price fluctuations post-earnings announcement).

- Analysis of investor sentiment and sell-off trends: (Discuss the magnitude and duration of the sell-off, linking it to news and investor sentiment).

- Expert opinions on the future trajectory of Tesla's stock price: (Quote analysts’ predictions and their rationale).

- Discussion of investor strategies in light of the Q1 results: (Discuss potential investor strategies based on the current circumstances, such as holding, selling, or buying more shares).

Conclusion

Tesla's 71% earnings plunge in Q1 2024 represents a significant setback, highlighting the company's vulnerability to both internal challenges and the intensifying political backlash it faces globally. The impact on the stock price and investor confidence is undeniable. The interplay of financial performance issues and geopolitical risks paints a complex picture, emphasizing the need for careful analysis and a nuanced understanding of the factors influencing Tesla's future trajectory. The dramatic fall in Tesla's Q1 earnings underscores the critical need for ongoing monitoring of the company's performance and the political climate. Stay informed about further developments in Tesla’s financial performance and the ever-shifting geopolitical landscape to make informed investment decisions. Continue your research to gain a deeper understanding of the complex dynamics affecting Tesla's future.

Featured Posts

-

Two New Oil Refineries Planned Saudi Arabia India Collaboration

Apr 24, 2025

Two New Oil Refineries Planned Saudi Arabia India Collaboration

Apr 24, 2025 -

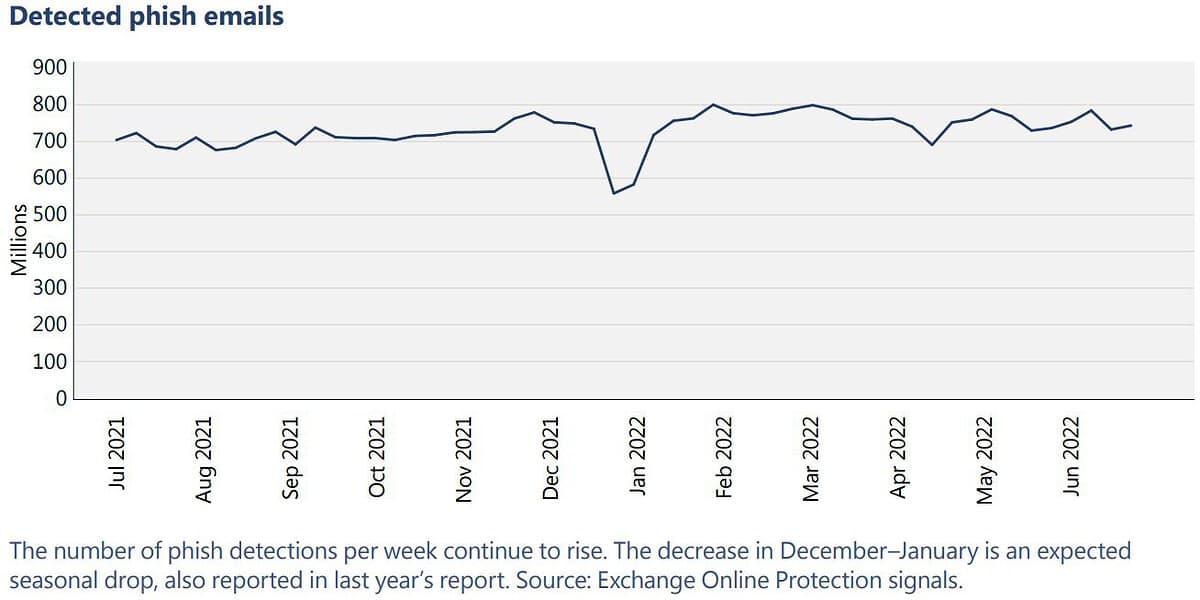

High Profile Office365 Intrusion Leads To Multi Million Dollar Theft

Apr 24, 2025

High Profile Office365 Intrusion Leads To Multi Million Dollar Theft

Apr 24, 2025 -

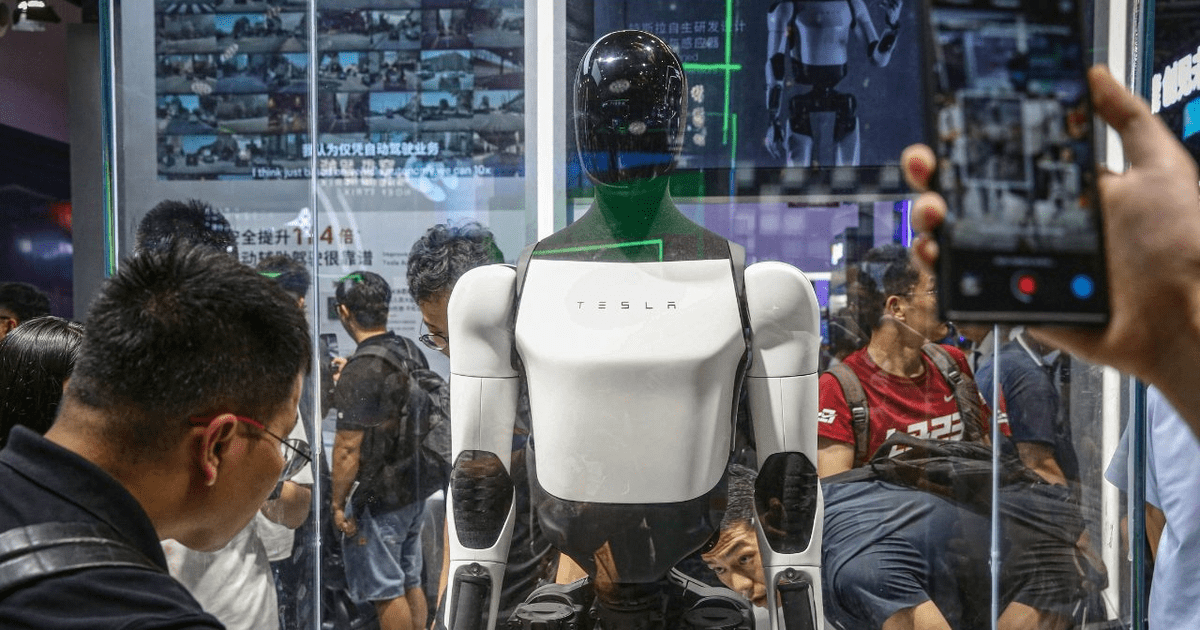

Teslas Optimus Robot Program Faces Delays Due To Chinas Rare Earth Policy

Apr 24, 2025

Teslas Optimus Robot Program Faces Delays Due To Chinas Rare Earth Policy

Apr 24, 2025 -

La Palisades Wildfires Which Celebrities Lost Their Homes

Apr 24, 2025

La Palisades Wildfires Which Celebrities Lost Their Homes

Apr 24, 2025 -

The Bold And The Beautiful April 16 Liams Actions And Bridgets Important Discovery

Apr 24, 2025

The Bold And The Beautiful April 16 Liams Actions And Bridgets Important Discovery

Apr 24, 2025