Tech Powerhouses Propel US Stock Market Higher: Tesla's Impact

Table of Contents

Tesla's Financial Performance and Market Influence

Tesla's remarkable financial performance has been a key driver of its market influence. Recent financial reports showcase impressive revenue growth, consistent profitability, and expansion into new markets. This strong financial position has significantly boosted Tesla's market capitalization, pushing it into the ranks of the world's most valuable companies and profoundly impacting major stock market indices like the S&P 500 and Nasdaq.

-

Specific examples of Tesla's financial achievements driving market sentiment: Record-breaking vehicle deliveries, successful launches of new models (like the Cybertruck), and expansion into energy storage solutions (Powerwall, Powerpack) all contribute positively to investor confidence.

-

Significant partnerships and collaborations impacting Tesla's value: Tesla's collaborations with various companies in areas like battery technology and autonomous driving enhance its technological prowess and, consequently, its market value.

The correlation between Tesla's stock performance and the broader tech sector is undeniable. Positive Tesla news often fuels broader market optimism, while negative news can trigger a sell-off across the tech sector. Investor sentiment towards Tesla is crucial; its perceived future prospects significantly influence overall market confidence.

The Broader Tech Sector's Contribution

While Tesla's influence is substantial, the broader tech sector's collective contribution cannot be ignored. Companies like Apple, Microsoft, and Google continue to demonstrate strong performance, driven by technological advancements and robust consumer demand.

- Examples of innovative technologies impacting the market: Artificial intelligence (AI), electric vehicles (EVs), and cloud computing are revolutionizing various industries, fueling growth in the tech sector and influencing investor decisions.

Investor confidence, fueled by positive future projections for these tech giants, further contributes to the market's upward trajectory. Government policies and regulations, while sometimes presenting challenges, also play a significant role in shaping the tech sector's performance and growth potential. Supportive policies can accelerate growth, while restrictive measures can dampen enthusiasm.

Tesla's Innovation and its Ripple Effect

Tesla's impact extends beyond its financial performance. Its groundbreaking innovations in battery technology and autonomous driving are reshaping the automotive industry and inspiring competitors.

- Specific examples of competitors reacting to Tesla's innovations: Established automakers are accelerating their own EV development and investing heavily in autonomous driving technologies, directly responding to the pressure exerted by Tesla's advancements.

Tesla's technological leadership has long-term implications for the broader economy, potentially impacting everything from manufacturing and supply chains to energy production and consumption. The company's influence extends beyond the automotive sector, with its energy solutions (solar panels, energy storage) playing a vital role in the transition to renewable energy.

Risks and Challenges for Tesla and the Tech Sector

Despite its success, Tesla faces several challenges. Intense competition, potential supply chain disruptions, and regulatory hurdles in various markets pose significant risks.

- External factors that could negatively impact Tesla and the tech market: Economic downturns, geopolitical instability, and changes in consumer spending habits could all negatively impact Tesla and the overall tech sector’s performance.

The sustainability of the current growth trajectory for Tesla and the tech sector as a whole is a key consideration. Maintaining high growth rates in the long term requires continued innovation, adaptation to evolving market conditions, and effective management of risks.

Conclusion: Understanding Tesla's Impact on the US Stock Market

Tesla's influence on the US stock market is undeniable. Its strong financial performance, technological innovations, and the broader tech sector's robust contribution have all played a significant role in the recent market surge. However, it's crucial to acknowledge the inherent risks and challenges facing Tesla and the broader tech sector. Maintaining a clear understanding of these factors is critical for informed investment decisions. To stay ahead of the curve, continue to follow Tesla’s performance, monitor developments within the tech industry, and research the evolving impact of companies like Tesla on investment strategies. Further research into "Tesla's Impact" and related topics will provide a deeper understanding of this dynamic market force.

Featured Posts

-

Hollywood Shut Down Writers And Actors On Strike

Apr 28, 2025

Hollywood Shut Down Writers And Actors On Strike

Apr 28, 2025 -

The Broader Reach Of Trumps Higher Education Crackdown

Apr 28, 2025

The Broader Reach Of Trumps Higher Education Crackdown

Apr 28, 2025 -

Millions In Losses Office365 Executive Email Accounts Targeted In Cybercrime Ring

Apr 28, 2025

Millions In Losses Office365 Executive Email Accounts Targeted In Cybercrime Ring

Apr 28, 2025 -

Shedeur Sanders Cleveland Browns Draft Pick

Apr 28, 2025

Shedeur Sanders Cleveland Browns Draft Pick

Apr 28, 2025 -

Musks X Debt Sale A Financial Deep Dive And Company Analysis

Apr 28, 2025

Musks X Debt Sale A Financial Deep Dive And Company Analysis

Apr 28, 2025

Latest Posts

-

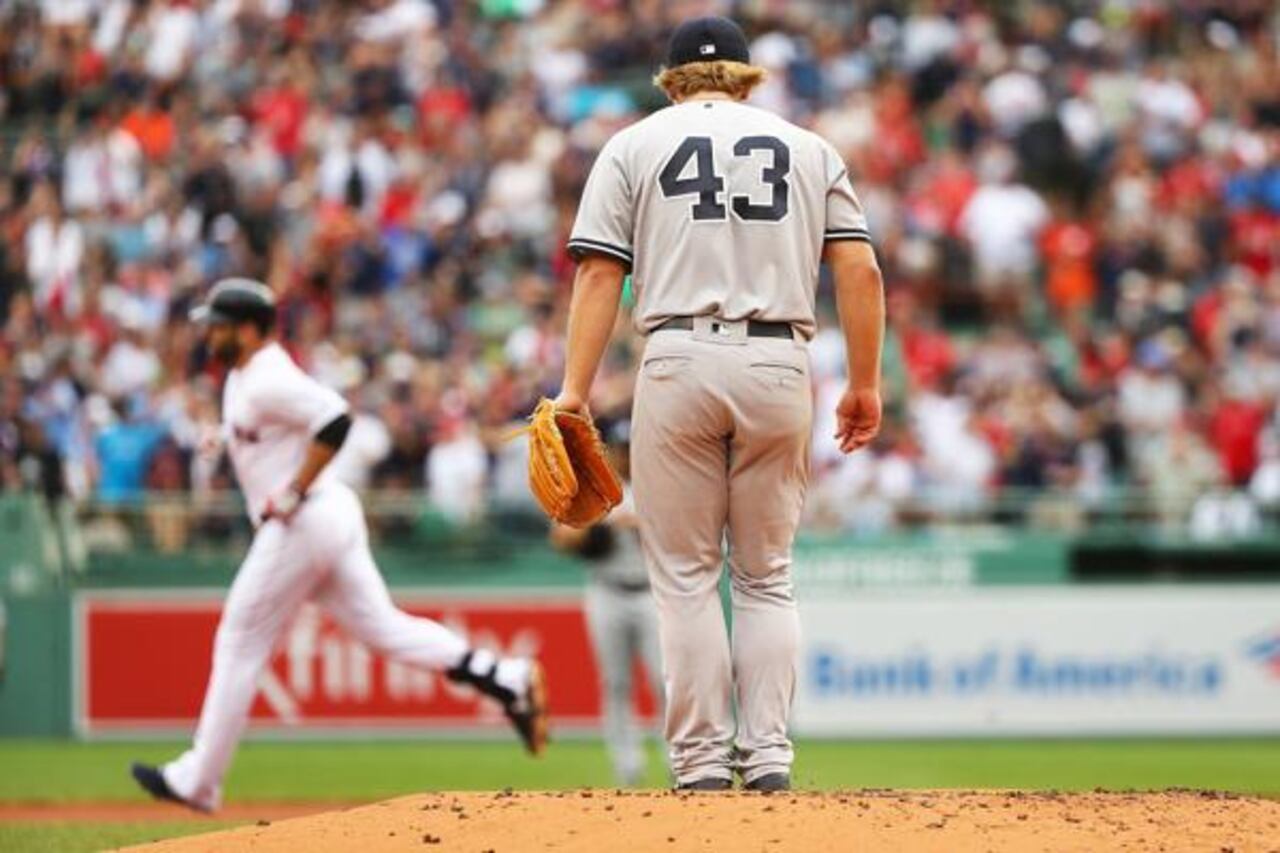

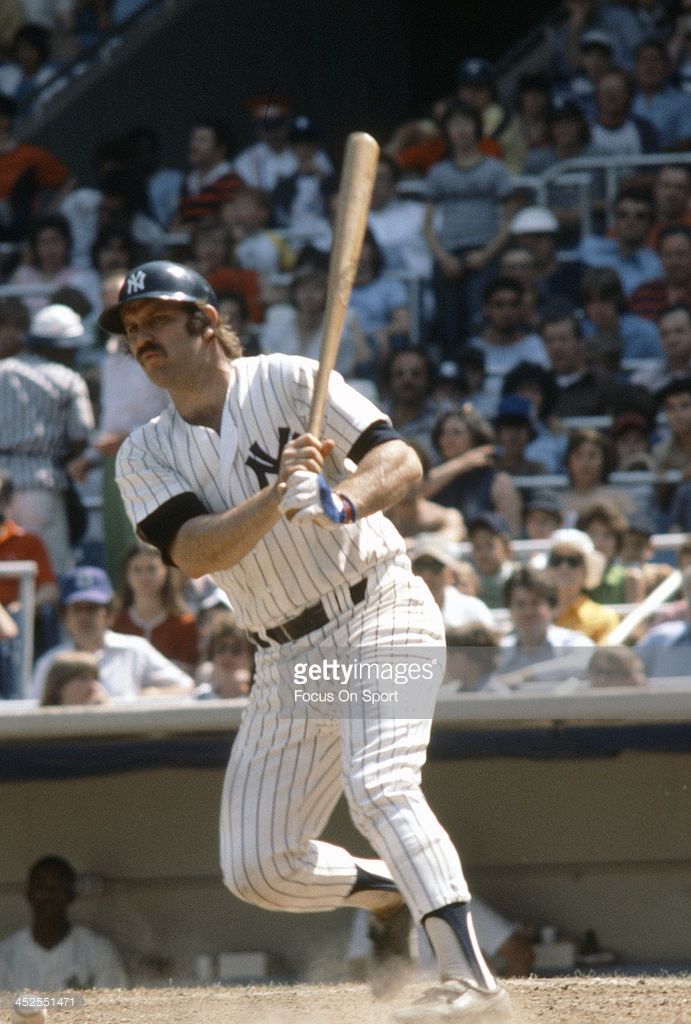

Early Offense And Rodons Masterclass Secure Yankees Win Prevent Sweep

Apr 28, 2025

Early Offense And Rodons Masterclass Secure Yankees Win Prevent Sweep

Apr 28, 2025 -

Yankees Avoid Sweep With Early Offense Rodons Pitching Prowess

Apr 28, 2025

Yankees Avoid Sweep With Early Offense Rodons Pitching Prowess

Apr 28, 2025 -

Yankees Pitching Fails Again Williams Implosion Leads To Blue Jays Victory

Apr 28, 2025

Yankees Pitching Fails Again Williams Implosion Leads To Blue Jays Victory

Apr 28, 2025 -

Rodons Strong Start Leads Yankees To Victory Avoids Historic Sweep

Apr 28, 2025

Rodons Strong Start Leads Yankees To Victory Avoids Historic Sweep

Apr 28, 2025 -

Devin Williams Struggles Continue Leading To Yankees Defeat

Apr 28, 2025

Devin Williams Struggles Continue Leading To Yankees Defeat

Apr 28, 2025