Musk's X Debt Sale: A Financial Deep Dive And Company Analysis

Table of Contents

The X Debt Sale: Details and Context

The sale involved a substantial amount of debt, the specifics of which are crucial to understanding its impact. This financing round likely included high-yield bonds, reflecting the inherent risk associated with X's current financial position and ambitious growth plans. Musk's rationale for this move likely stems from a need for capital to fund ongoing operations, technological advancements, and potentially future acquisitions or expansion strategies.

- Total amount of debt raised: (Insert actual amount once available, e.g., $10 Billion)

- Interest rates involved: (Insert estimated or actual rates, e.g., High-yield bonds typically carry interest rates above 10%)

- Maturity dates of the debt: (Insert estimated or actual maturity dates, e.g., ranging from 3 to 7 years)

- Credit rating agencies' assessment of the debt: (Insert rating from agencies like Moody's, S&P, Fitch, etc., e.g., 'junk' or 'high-yield' status)

- Investors involved in purchasing the debt: (List known investors or categories of investors if available, e.g., hedge funds, private equity firms, institutional investors)

Financial Implications for X

The significant debt incurred through Musk's X Debt Sale will undeniably reshape X's financial landscape. The increase in debt will elevate its debt-to-equity ratio, increasing financial leverage. While leverage can amplify returns, it also significantly magnifies risk. Higher debt levels translate to substantial interest expenses, potentially impacting profitability and straining cash flow.

- Before & After debt sale financial ratios analysis (Debt-to-equity, Interest Coverage): (Provide comparative data once available. This should showcase the changes in key financial ratios before and after the debt sale.)

- Potential impact on X’s credit rating: A significant debt load could further downgrade X's credit rating, making future borrowing more expensive and potentially limiting access to capital.

- Risk assessment of default or refinancing difficulties: The higher the debt, the greater the risk of default, especially if X fails to meet its revenue projections. Refinancing this debt in the future could prove challenging depending on market conditions and X's financial performance.

- Discussion on the potential impact on X’s operational strategies: The need to service the substantial debt may force X to prioritize cost-cutting measures and focus on revenue generation, potentially impacting product development or expansion plans.

Musk's Overall Financial Strategy and X's Future

Musk's X Debt Sale isn't an isolated event; it fits within his broader financial strategy for X and his other ventures. Understanding this larger picture is crucial to assessing the long-term consequences. Musk's ambitious vision for X involves significant technological investment and a transformation into a "everything app." The debt sale might be viewed as a necessary step to fuel this transformation. However, the significant financial risk associated with such a strategy cannot be ignored.

- Link to Musk's other financial activities and their potential impact on X: Analyze the financial health and performance of SpaceX, Tesla, and other Musk-related companies and how their success (or failure) could influence X's ability to manage its debt.

- Analysis of X’s future growth prospects in light of the debt: Evaluate X's potential for revenue growth based on current market conditions and its potential to service its debt obligations.

- Discussion about potential strategic partnerships or acquisitions impacted by the debt: The debt could limit X's ability to pursue strategic acquisitions or partnerships that would otherwise contribute to its growth.

- Evaluation of X's revenue streams and their capacity to service the debt: Assess the strength and diversification of X's revenue streams and whether they are sufficient to cover interest payments and principal repayments.

Market Reactions and Analyst Opinions on Musk's X Debt Sale

The market's response to Musk's X Debt Sale has been mixed. Stock prices (if applicable) initially reacted negatively, reflecting investor concerns about the increased financial risk. However, some analysts argue that the debt financing is a calculated risk necessary for long-term growth.

- Stock price movements before, during, and after the announcement: (Include charts and data if available, showcasing the impact of the debt sale news on X's stock price.)

- Quotes from prominent financial analysts: (Include quotes from respected financial analysts expressing their opinions on the debt sale and its potential consequences.)

- Comparison to similar debt sales in other tech companies: (Compare the scale and impact of the debt sale with similar transactions in other technology companies, noting similarities and differences.)

- Discussion on the long-term effects of the debt sale on investor confidence: Assess how the debt sale will impact investor sentiment toward X in the long run and its ability to attract future investment.

Conclusion: Musk's X Debt Sale: A Financial Deep Dive and Company Analysis

Musk's X Debt Sale represents a significant gamble. While it provides immediate capital to fund X's ambitious plans, it also introduces substantial financial risk. The success of this strategy hinges on X's ability to rapidly increase its revenue and demonstrate sustainable profitability to service the substantial debt. The market reaction and analyst opinions highlight the uncertainty surrounding the outcome. The coming months will be crucial in determining whether this bold financial move strengthens X's position or weakens its long-term prospects. Stay informed about further developments regarding Musk's X Debt Sale and its impact on the company by following reputable financial news sources and analyses. (Link to relevant financial news websites or analysis here.)

Featured Posts

-

Targeted Tariff Exemptions Chinas Latest Move On Us Imports

Apr 28, 2025

Targeted Tariff Exemptions Chinas Latest Move On Us Imports

Apr 28, 2025 -

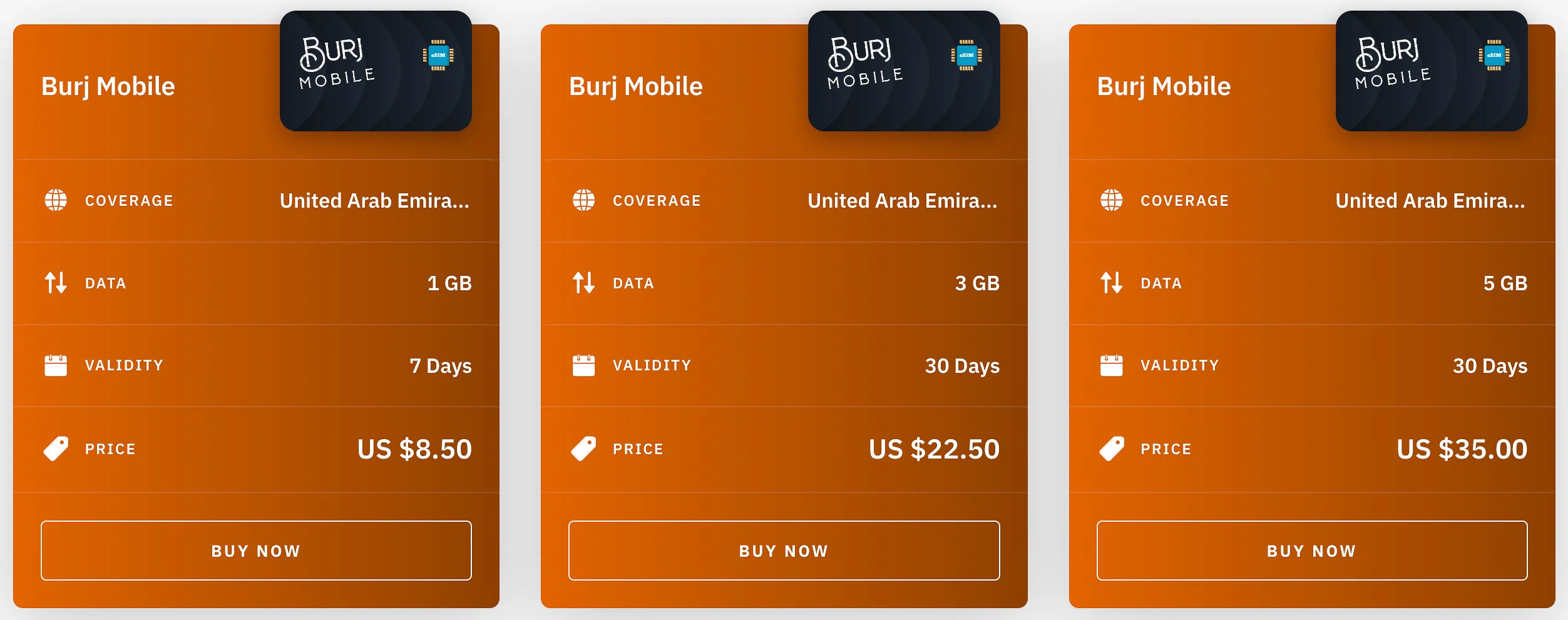

10 Gb Uae Sim Card And Abu Dhabi Pass 15 Attraction Discount

Apr 28, 2025

10 Gb Uae Sim Card And Abu Dhabi Pass 15 Attraction Discount

Apr 28, 2025 -

Fn Abwzby Kl Ma Thtaj Merfth En Alhdth Almntzr

Apr 28, 2025

Fn Abwzby Kl Ma Thtaj Merfth En Alhdth Almntzr

Apr 28, 2025 -

Cybercriminal Accused Of Millions In Office365 Executive Account Compromise

Apr 28, 2025

Cybercriminal Accused Of Millions In Office365 Executive Account Compromise

Apr 28, 2025 -

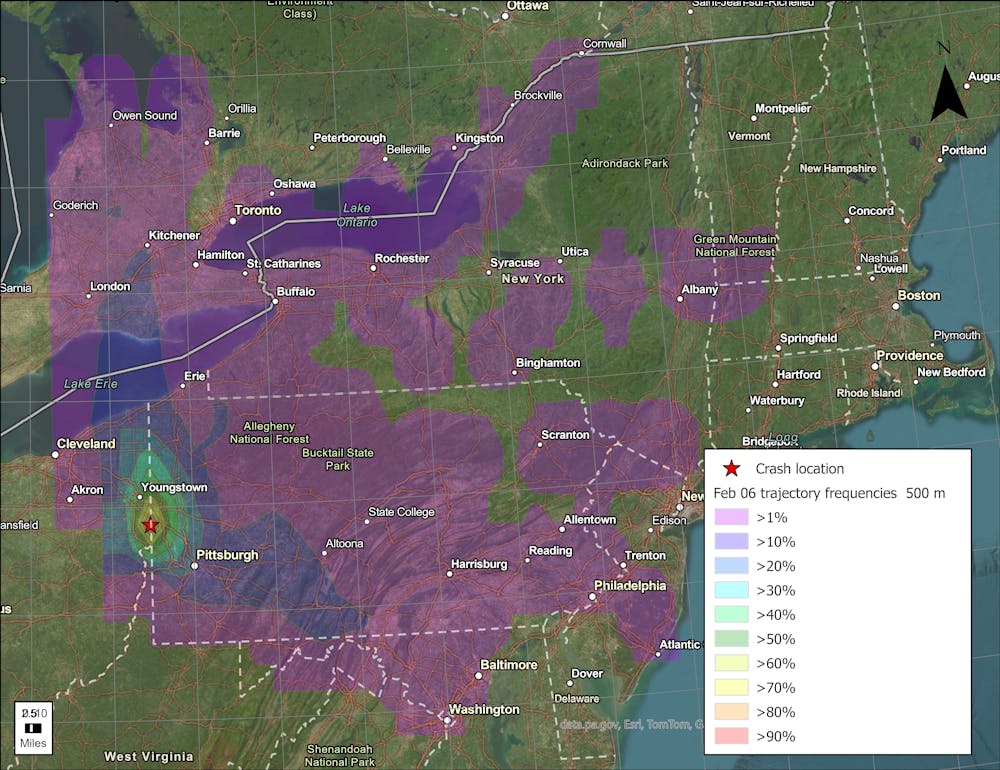

Toxic Chemicals Lingered In Ohio Derailment Buildings For Months

Apr 28, 2025

Toxic Chemicals Lingered In Ohio Derailment Buildings For Months

Apr 28, 2025