Strong Performance In Emerging Markets: Outpacing US Stock Market In 2024

Table of Contents

Economic Growth Potential in Emerging Markets

Emerging markets are projected to experience robust economic growth in 2024, potentially surpassing the growth rate of the US. This superior growth potential stems from several key factors.

Higher GDP Growth Projections

Reputable economic forecasters like the IMF and World Bank predict significantly higher GDP growth rates for several key emerging markets compared to the US. This disparity creates a compelling case for shifting investment focus.

- India: India's young and expanding population, coupled with significant infrastructure development and technological advancements, fuels projections of strong GDP growth.

- Vietnam: Vietnam's strategic location, export-oriented economy, and ongoing foreign investment contribute to its impressive growth trajectory.

- Indonesia: Indonesia's large domestic market and substantial natural resources position it for continued economic expansion.

- Brazil: Despite recent challenges, Brazil's vast natural resources and growing domestic market provide opportunities for investors.

This sustained growth is not merely speculative; it's driven by concrete factors like increasing domestic consumption and burgeoning middle classes.

Increased Domestic Consumption

The expanding middle class in numerous emerging markets is a key driver of economic activity. This rise in disposable income translates directly into increased consumer spending, boosting various sectors.

- The middle class in countries like China, India, and Indonesia is growing at an unprecedented rate.

- Industries benefiting most from this increased consumption include consumer goods, technology, retail, and healthcare.

- This surge in domestic demand creates a robust foundation for sustained economic growth, making these markets attractive for investment.

Attractive Valuation Compared to US Equities

Beyond superior growth projections, emerging markets often present more attractive valuations compared to their US counterparts. This undervaluation offers significant potential for higher returns.

Lower Price-to-Earnings Ratios (P/E)

Emerging market stocks frequently exhibit lower P/E ratios than US stocks, suggesting they may be undervalued relative to their earnings potential.

- Many emerging market sectors, especially in technology and infrastructure, offer significantly lower P/E ratios than comparable sectors in the US.

- This undervaluation presents a compelling opportunity for investors seeking higher returns on their investments.

- Careful analysis of specific sectors and companies is crucial to identifying the most attractive opportunities.

Higher Dividend Yields

Investors can also benefit from potentially higher dividend yields offered by emerging market equities.

- Compared to the relatively low dividend yields prevalent in some mature markets, many emerging markets offer significantly higher payouts.

- This provides an additional avenue for generating income and enhancing overall investment returns.

- It is essential to research individual companies and sectors to find those with strong dividend payout histories and future prospects.

Strategic Investment Opportunities in Emerging Markets

Investing in emerging markets offers not only the potential for higher returns but also significant diversification benefits.

Diversification Benefits

Diversifying your portfolio with emerging market investments can effectively mitigate risk.

- Emerging markets often exhibit a low correlation with the US stock market, meaning their performance doesn't always mirror that of US equities.

- This lack of correlation can be beneficial during market downturns, potentially reducing overall portfolio volatility.

- A well-diversified portfolio that includes emerging markets is often more resilient to market fluctuations.

Sector-Specific Opportunities

Emerging markets present numerous opportunities across various sectors.

- The technology sector in emerging markets is rapidly expanding, presenting exciting growth prospects.

- Renewable energy initiatives in several emerging economies offer significant investment potential, aligned with global sustainability goals.

- Massive infrastructure projects across many emerging markets create opportunities in construction, materials, and related industries.

Conclusion

In summary, the strong performance potential of emerging markets in 2024 is supported by several compelling factors. Their higher projected GDP growth, attractive valuations relative to US equities, and significant diversification benefits make them a compelling investment alternative. While emerging markets offer exciting opportunities, thorough research and a well-defined investment strategy are crucial. Consider diversifying your portfolio with carefully selected emerging market investments to potentially outperform the US stock market in 2024 and capture significant returns. Learn more about effective emerging market investment strategies and explore the opportunities available to you today.

Featured Posts

-

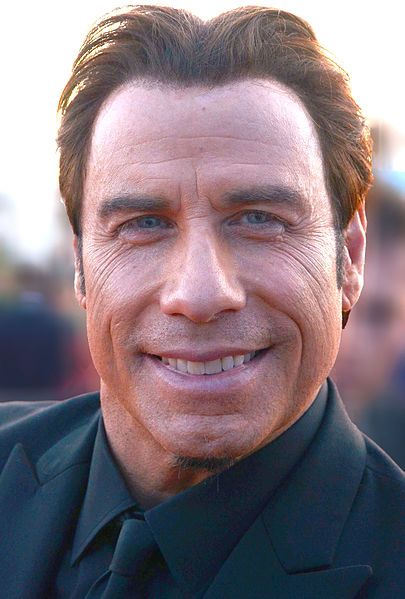

John Travoltas Rotten Tomatoes Record Is It Really That Bad

Apr 24, 2025

John Travoltas Rotten Tomatoes Record Is It Really That Bad

Apr 24, 2025 -

The Danger Of Missed Mammograms Learning From Tina Knowles Diagnosis

Apr 24, 2025

The Danger Of Missed Mammograms Learning From Tina Knowles Diagnosis

Apr 24, 2025 -

Office365 Data Breach Federal Investigation Uncovers Multi Million Dollar Scheme

Apr 24, 2025

Office365 Data Breach Federal Investigation Uncovers Multi Million Dollar Scheme

Apr 24, 2025 -

Nba 3 Point Contest 2024 Tyler Herros Victory Over Buddy Hield

Apr 24, 2025

Nba 3 Point Contest 2024 Tyler Herros Victory Over Buddy Hield

Apr 24, 2025 -

Bitcoins Btc Recent Climb A Deep Dive Into Market Drivers

Apr 24, 2025

Bitcoins Btc Recent Climb A Deep Dive Into Market Drivers

Apr 24, 2025