Rent Increase Slowdown In Metro Vancouver: Analyzing The Housing Market Trends

Table of Contents

Declining Vacancy Rates and Their Impact

The relationship between vacancy rates and rent increases is largely inverse: lower vacancy rates typically translate to higher rents. A tight rental market with few available units gives landlords more leverage to increase prices. Understanding current vacancy rates in Metro Vancouver is crucial to analyzing the rent increase slowdown.

- Statistics on current vacancy rates: While precise, up-to-the-minute data varies depending on the source, recent reports suggest a slight increase in vacancy rates in some Metro Vancouver municipalities compared to the previous year. For example, while some areas like Surrey might still see low vacancy rates, others could show a modest increase, contributing to the overall slowdown. Accurate data can be found through reports from organizations like the Canada Mortgage and Housing Corporation (CMHC).

- Comparison of vacancy rates to previous years: Historically low vacancy rates in recent years have fuelled significant rent increases. A comparison of current rates with those from the past two to three years reveals a potential trend of stabilization, or even a slight upward movement, suggesting a lessening of pressure on rental prices.

- Impact of new rental construction on vacancy rates: Increased construction of new rental units can help alleviate the housing shortage and ease pressure on rental prices. However, the pace of new construction needs to significantly outpace population growth to create a noticeable impact on vacancy rates.

- External factors influencing vacancy rates: Immigration levels, economic conditions, and seasonal fluctuations all contribute to the dynamics of the Metro Vancouver rental market. High immigration can increase demand, while economic downturns might reduce it.

Increased Interest Rates and Their Effect on Rental Demand

Rising interest rates significantly impact the affordability of homeownership. Higher mortgage payments make it more challenging for potential homebuyers to enter the market, potentially increasing the demand for rental properties in the short term. This increased demand, however, is now being counteracted by other factors leading to a rent increase slowdown.

- Data on current interest rates and their impact on mortgage payments: The Bank of Canada's interest rate hikes have resulted in substantially higher mortgage payments, making homeownership less accessible for many. This has had a ripple effect on the rental market.

- Analysis of the shift in demand from homeownership to renting: While initially, higher interest rates drove more people to rent, the sustained high rental costs are now tempering this shift. Fewer people can afford to move, regardless of homeownership prospects.

- Consequences of decreased rental demand on rental increases: The combination of high rental costs and increased financial strain on potential renters is likely contributing to the observed rent increase slowdown. Landlords might find it harder to justify substantial rent increases when facing a less competitive market.

- Shift in rental preferences: The high cost of living is pushing renters to consider smaller units, shared accommodations, or locations further from city centers, potentially impacting demand in certain market segments.

Government Interventions and Regulatory Changes

Several government interventions at the local, provincial, and federal levels aim to regulate rent increases and increase rental supply. The effectiveness of these initiatives is a key factor in understanding the current rent increase slowdown.

- Summary of relevant legislation or policies: British Columbia has implemented various rental regulations, including rent control measures for certain tenancies. These policies, though complex, play a part in moderating rental increases.

- Analysis of the effectiveness of these interventions: The impact of these regulations is a subject of ongoing debate, with some arguing for stronger protections for tenants while others express concern about their effects on rental investment.

- Potential future policy changes: Ongoing discussions about affordable housing initiatives and stricter regulations could further influence the Vancouver rent landscape and affect the sustainability of the current trend.

- Government support programs for renters: Various government programs offer assistance to renters struggling to afford housing. These programs can ease the burden on individuals and families, but are often limited in scope.

Analyzing Long-Term Trends and Predictions

The question remains: is the observed rent increase slowdown a temporary reprieve or a long-term shift? Predicting future rental market trends requires considering various interconnected factors.

- Forecast for future rental market trends: While a definitive forecast is challenging, considering the interplay of vacancy rates, interest rates, and government policies suggests a potential period of relatively slower rent increases. However, this is not a guarantee of affordability.

- Factors influencing future rent increases: Future construction projects, economic growth, population changes, and shifts in immigration patterns will all play a significant role in shaping the long-term outlook for the Vancouver real estate market.

- Expert opinions or predictions from real estate analysts: Consulting real estate analysts and market reports can provide valuable insights into the long-term predictions for the housing market forecast in Metro Vancouver.

- Considerations for both landlords and tenants moving forward: Both landlords and tenants need to adapt to the evolving market conditions. Landlords need to adjust their pricing strategies while tenants should carefully consider their options and financial capabilities.

Conclusion

Several key factors contribute to the potential rent increase slowdown in Metro Vancouver: declining (though still low) vacancy rates, rising interest rates impacting homeownership, and government interventions aimed at regulating the rental market. The sustainability of this slowdown remains to be seen, requiring continuous monitoring of these interconnected factors for accurate future rent predictions. Understanding these housing market trends is crucial for both tenants and landlords.

Call to Action: Stay informed about the evolving Metro Vancouver rental market by regularly checking reliable sources for updated data and analyses on Vancouver rent and housing market trends. Understanding these trends is crucial for both tenants and landlords to make informed decisions in this dynamic market. Keep an eye out for further updates on the rent increase slowdown in Metro Vancouver.

Featured Posts

-

As Markets Swooned Pros Sold And Individuals Pounced A Market Analysis

Apr 28, 2025

As Markets Swooned Pros Sold And Individuals Pounced A Market Analysis

Apr 28, 2025 -

Over The Counter Birth Control A New Era Of Reproductive Healthcare

Apr 28, 2025

Over The Counter Birth Control A New Era Of Reproductive Healthcare

Apr 28, 2025 -

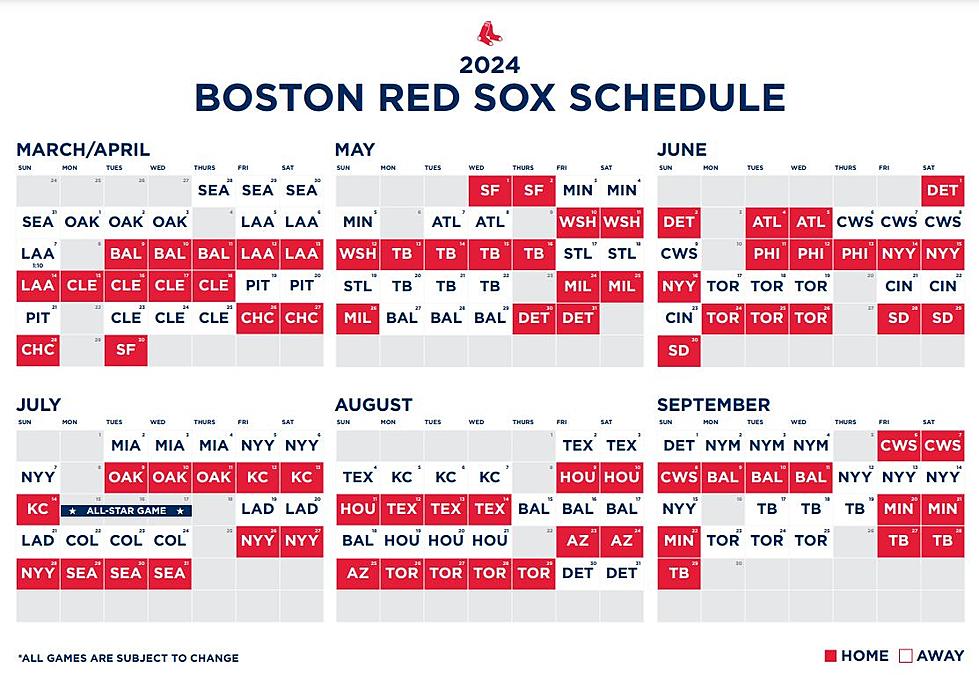

Boston Red Sox Lineup Changes For Doubleheaders Game 1

Apr 28, 2025

Boston Red Sox Lineup Changes For Doubleheaders Game 1

Apr 28, 2025 -

Red Sox Kutter Crawford Brayan Bello Wilyer Abreu And Ceddanne Rafaela Injury Report

Apr 28, 2025

Red Sox Kutter Crawford Brayan Bello Wilyer Abreu And Ceddanne Rafaela Injury Report

Apr 28, 2025 -

Oppo Find X8 Ultra

Apr 28, 2025

Oppo Find X8 Ultra

Apr 28, 2025