As Markets Swooned, Pros Sold—and Individuals Pounced: A Market Analysis

Table of Contents

Professional Investor Behavior During Market Swings

Professional investors, including hedge funds and institutional investors, often prioritize risk management above all else. Their actions during a market swoon are typically far more cautious than those of individual investors.

Risk Aversion and Hedging Strategies

Professional portfolio management often involves sophisticated risk management techniques. During periods of market instability, professional investors frequently employ hedging strategies to mitigate potential losses. These strategies might include:

- Options: Purchasing put options to protect against downside risk.

- Futures contracts: Using futures to hedge against commodity price fluctuations.

- Diversification: Maintaining a well-diversified portfolio across asset classes to reduce overall portfolio volatility.

The rationale behind this risk-averse approach is simple: professional investors are managing other people's money, and preserving capital is paramount.

Increased Selling Pressure

The increased selling pressure from professional investors can significantly impact market liquidity and exacerbate price fluctuations. Several factors contribute to this selling pressure:

- Profit-taking: Realizing gains after a period of market growth.

- Meeting redemption requests: Hedge funds and other investment vehicles may be forced to sell assets to meet investor withdrawals.

- Risk management: Reducing exposure to potentially volatile assets.

This selling pressure can create a downward spiral, further intensifying the market correction.

Shifting Investment Strategies

Professional investors often adjust their investment strategies based on evolving market conditions. This might involve:

- Moving to safer assets: Shifting investments from equities to bonds or cash equivalents.

- Altering asset allocation: Adjusting the proportions of different asset classes in their portfolios.

- Employing tactical asset allocation: Making short-term adjustments to capitalize on perceived market opportunities.

These shifts reflect a proactive approach to market timing and managing risk within the context of their overall asset allocation strategy.

Individual Investor Behavior Amidst Market Volatility

In contrast to the cautious approach of professional investors, individual investors often demonstrate strikingly different behaviors during market volatility.

The "Fear of Missing Out" (FOMO) Factor

Market downturns can trigger strong emotional responses in individual investors. The fear of missing out (FOMO) is a powerful psychological factor that can lead to impulsive buying decisions. Driven by market sentiment and a desire to avoid further losses, individuals may make irrational investment choices. Understanding investor psychology and the influence of behavioral finance is crucial in analyzing this phenomenon.

Opportunistic Buying

Some individual investors view market dips as compelling buying opportunities, practicing forms of value investing or contrarian investing. They see falling prices as a chance to acquire assets at a bargain price, aiming for long-term growth. While this approach can yield significant rewards, it also carries substantial risk.

- Potential Rewards: Acquiring high-quality assets at discounted prices.

- Potential Risks: The market downturn may continue, resulting in further losses.

Successful long-term investment requires patience and a thorough understanding of the underlying fundamentals.

Access to Information and Trading Platforms

The rise of user-friendly online trading platforms and readily available market information has significantly increased the participation of individual investors – also known as retail investors. This democratization of finance has reshaped market dynamics, with more retail investors actively participating than ever before. The increased access to online brokerage services contributes to this phenomenon.

Analysis of Market Dynamics During the Swoon

Understanding the market dynamics during the market swoon requires analyzing several key factors.

Market Indicators and Data Analysis

Examining market indices such as the S&P 500, along with volatility measures like the VIX index, helps us understand the market's behavior. Charts and graphs visualizing market trends provide valuable insights into the speed and depth of the downturn. Both technical analysis and fundamental analysis are crucial tools in interpreting this data.

Causes of the Market Swoon

Several factors can contribute to a market swoon. These include:

- Economic indicators: Unexpected changes in inflation, unemployment, or GDP growth.

- Geopolitical risk: International conflicts or political instability.

- Interest rate hikes: Increases in interest rates by central banks.

Analyzing these factors helps explain the underlying causes of the market downturn.

Long-Term Implications

The long-term implications of the market swoon are complex and depend on various factors. The market recovery process will likely be influenced by:

- Government policy responses

- The overall economic outlook

- The behavior of both professional and individual investors

Understanding the lessons learned from this event is crucial for developing effective long-term investment strategies and formulating an accurate market outlook. Accurate economic forecasts are important in this process.

Conclusion: Key Takeaways and Call to Action

This market analysis revealed a striking contrast between the cautious approach of professional investors and the more opportunistic behavior of some individual investors during a recent market swoon. Understanding these contrasting strategies is crucial for navigating future market volatility. Professional investors prioritized risk management and employed hedging techniques, while some individual investors saw the downturn as a buying opportunity, driven partly by the FOMO effect. The increased accessibility of information and trading platforms played a significant role in individual investor participation.

Understanding the dynamics of market swoons, like the one analyzed here, is crucial for informed investment decision-making. Continue your market analysis journey by exploring [link to related resource] and refine your approach to navigating future market volatility.

Featured Posts

-

Nuclear Talks Conclude Us And Iran Remain At Odds

Apr 28, 2025

Nuclear Talks Conclude Us And Iran Remain At Odds

Apr 28, 2025 -

Series Turning Point How Judge And Goldschmidt Saved The Yankees

Apr 28, 2025

Series Turning Point How Judge And Goldschmidt Saved The Yankees

Apr 28, 2025 -

Is The U S Dollar Headed For Its Worst 100 Days Since Nixons Presidency

Apr 28, 2025

Is The U S Dollar Headed For Its Worst 100 Days Since Nixons Presidency

Apr 28, 2025 -

U S Dollars Troubled Start Worst First 100 Days Since Nixon

Apr 28, 2025

U S Dollars Troubled Start Worst First 100 Days Since Nixon

Apr 28, 2025 -

Virginia Giuffre Timeline Of Her Life And Legal Battles

Apr 28, 2025

Virginia Giuffre Timeline Of Her Life And Legal Battles

Apr 28, 2025

Latest Posts

-

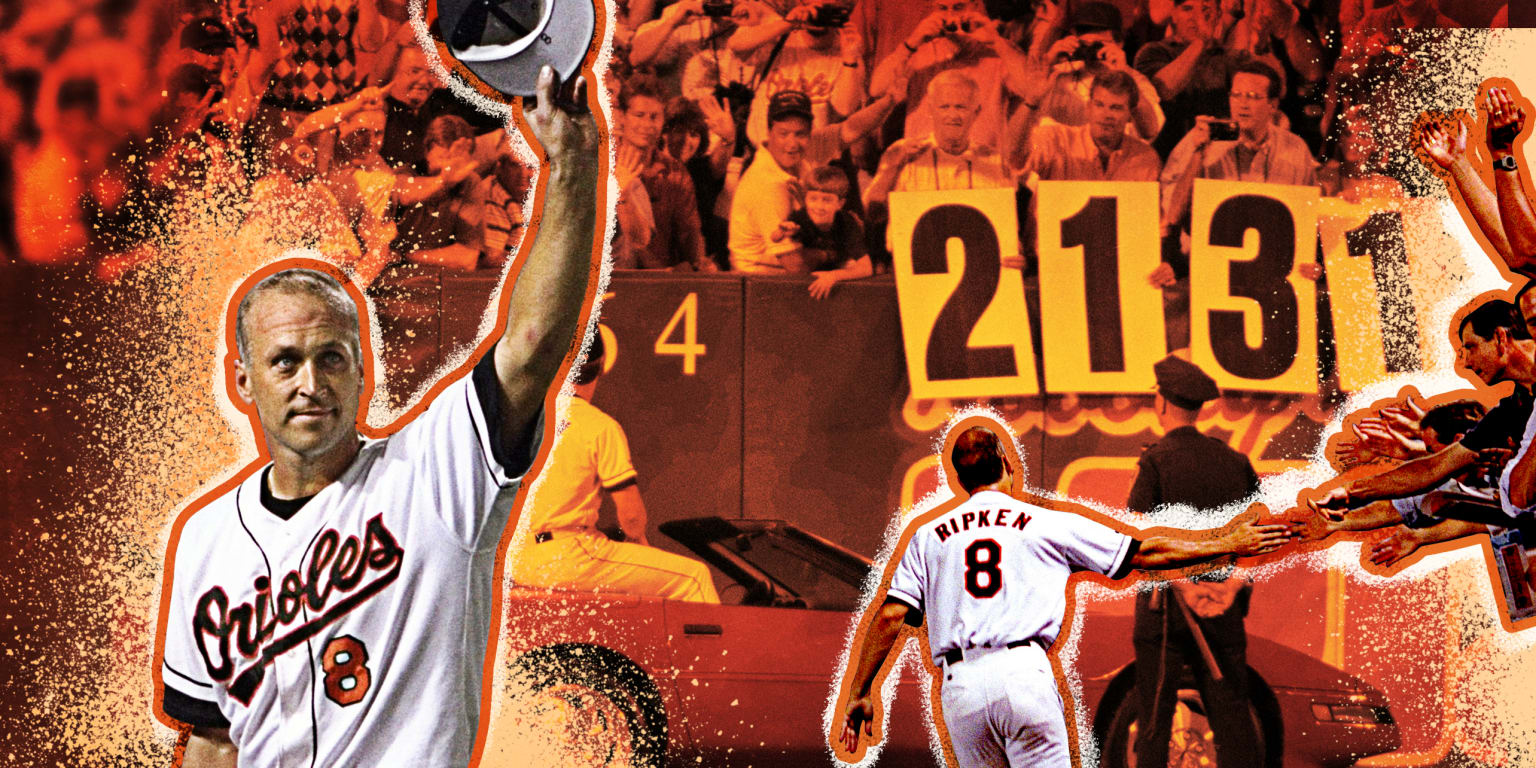

Orioles Hit Streak Ends At 160 Games The Announcers Jinx Explained

Apr 28, 2025

Orioles Hit Streak Ends At 160 Games The Announcers Jinx Explained

Apr 28, 2025 -

160 Game Hit Streak Ends Orioles Announcers Jinx Finally Broken

Apr 28, 2025

160 Game Hit Streak Ends Orioles Announcers Jinx Finally Broken

Apr 28, 2025 -

Baltimore Orioles Announcers Jinx Snapped 160 Game Hit Streak Over

Apr 28, 2025

Baltimore Orioles Announcers Jinx Snapped 160 Game Hit Streak Over

Apr 28, 2025 -

Orioles Broadcasters Jinx Broken 160 Game Hit Streak Ends

Apr 28, 2025

Orioles Broadcasters Jinx Broken 160 Game Hit Streak Ends

Apr 28, 2025 -

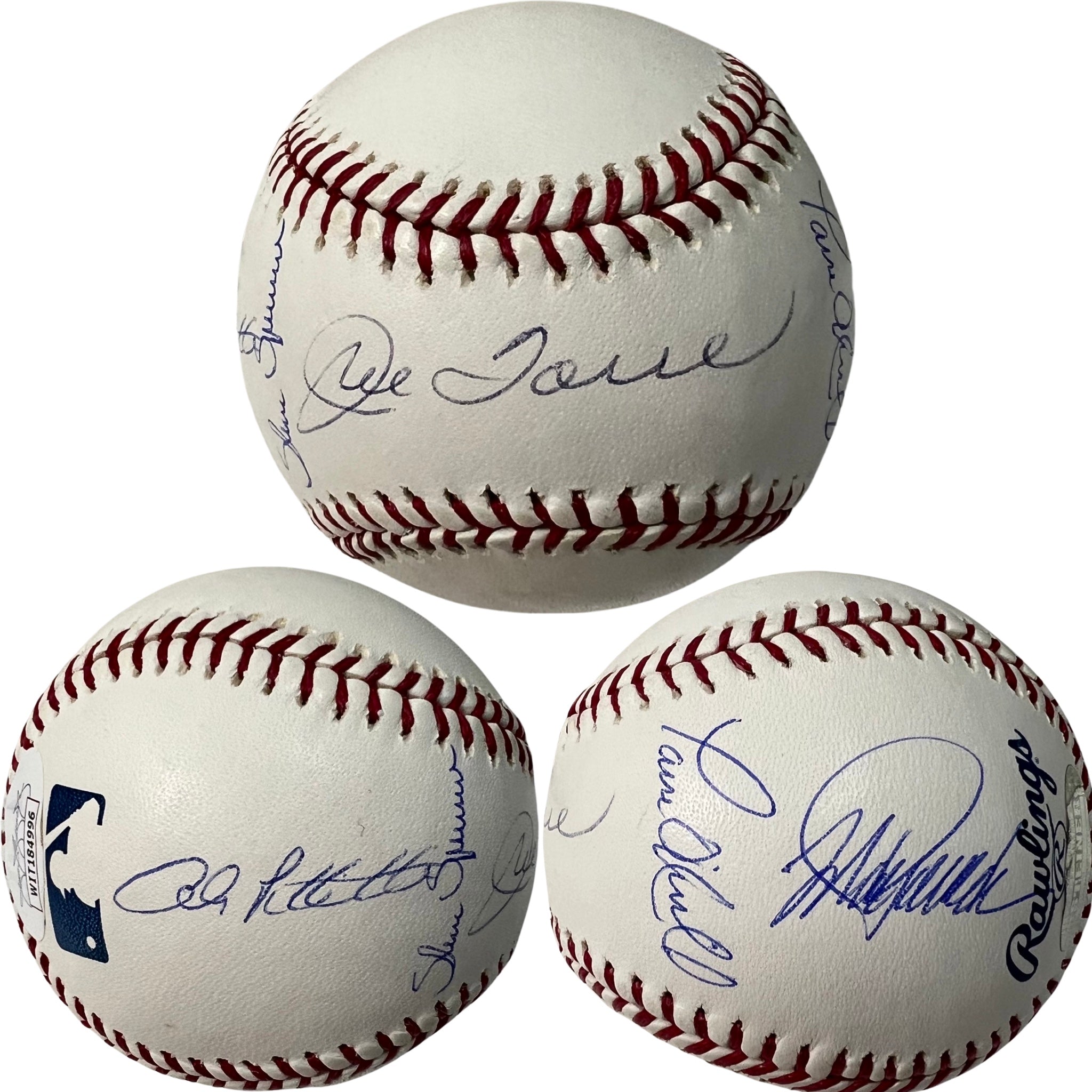

The 2000 Yankees A Look At Key Moments With Joe Torre And Andy Pettitte

Apr 28, 2025

The 2000 Yankees A Look At Key Moments With Joe Torre And Andy Pettitte

Apr 28, 2025