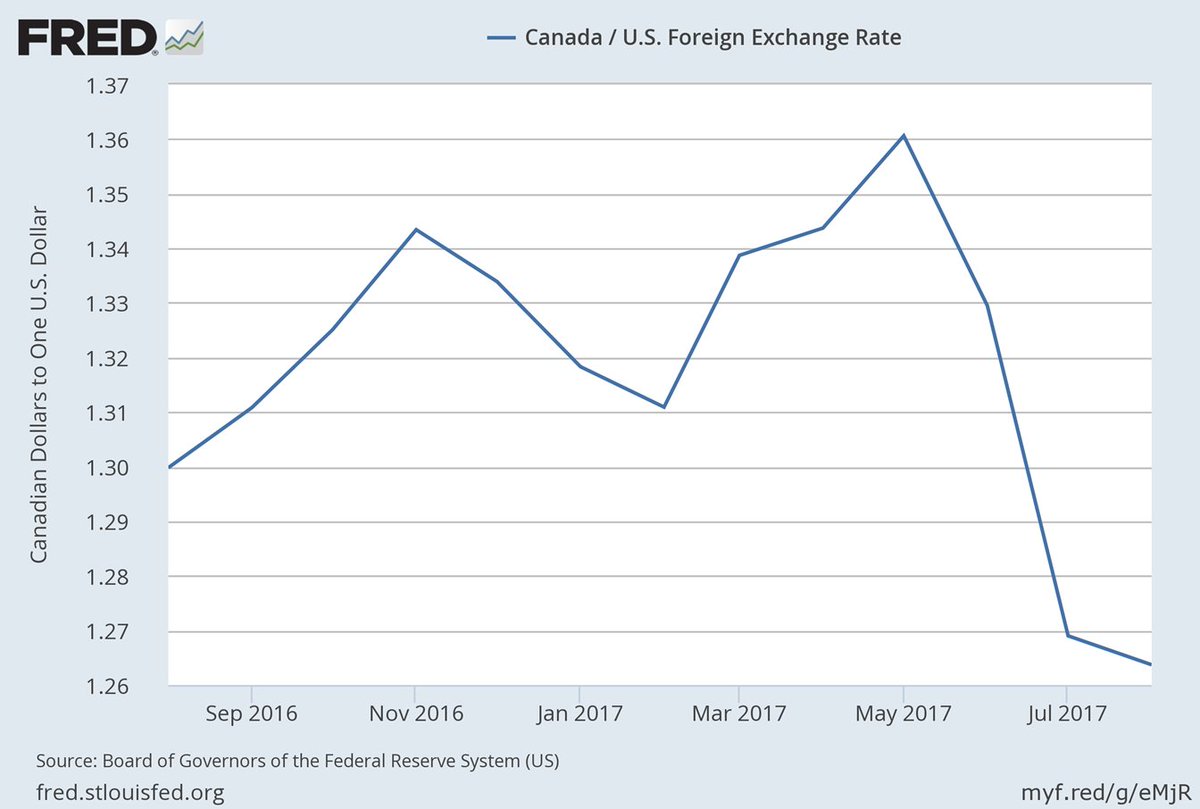

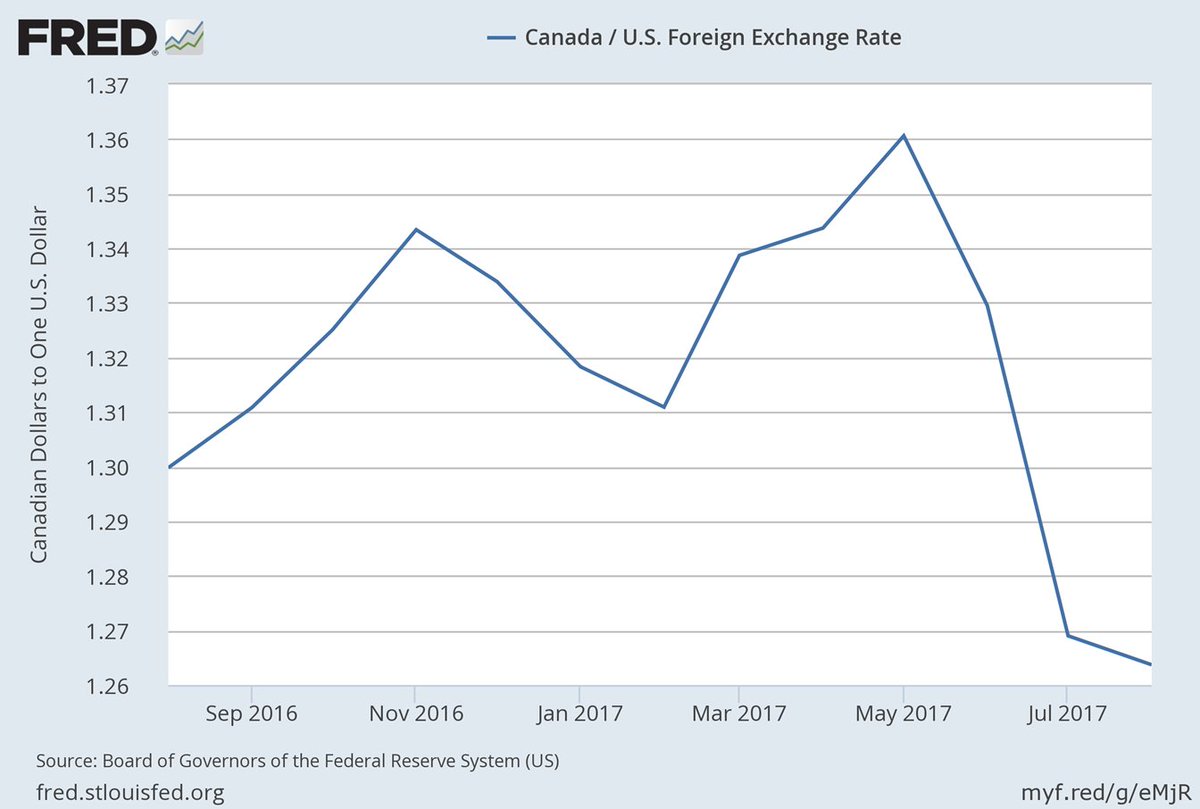

Recent Trends In The Canadian Dollar Exchange Rate

Table of Contents

Impact of Commodity Prices on the Canadian Dollar Exchange Rate

Canada's economy is heavily reliant on commodity exports, making commodity prices a significant driver of the Canadian dollar's value.

Influence of Oil Prices

Canada is a major exporter of crude oil, with West Texas Intermediate (WTI) and Brent crude prices directly impacting the CAD.

- Canada as an Oil Exporter: A large portion of Canada's export revenue comes from oil sales. Higher oil prices lead to increased export earnings, boosting demand for the Canadian dollar.

- Higher Oil Prices Strengthen the CAD: When global oil prices rise, so does the demand for the Canadian dollar, leading to appreciation. This is because international buyers need CAD to purchase Canadian oil.

- Lower Oil Prices Weaken the CAD: Conversely, lower oil prices reduce export earnings, decreasing demand for the CAD and resulting in depreciation.

- Recent Data: For example, the sharp drop in oil prices in early 2020 due to the COVID-19 pandemic significantly weakened the CAD against the USD. Conversely, the price surge in 2022 strengthened the Canadian Dollar.

Impact of Other Commodities

Beyond oil, other Canadian exports, such as lumber, potash, and various metals, influence the CAD exchange rate.

- Relative Importance: While oil holds significant weight, lumber, potash (a crucial fertilizer), and metals like nickel and aluminum also contribute substantially to Canada's export revenue and therefore impact the CAD.

- Global Demand: Global demand for these commodities directly influences their prices. Increased demand leads to higher prices, strengthening the CAD, while decreased demand weakens it.

- Market Events: For instance, increased global construction activity boosts lumber prices and subsequently the CAD. Similarly, global economic slowdown can reduce demand for metals, impacting the Canadian Dollar negatively.

Influence of Interest Rate Differentials on the Canadian Dollar Exchange Rate

Interest rate differentials between Canada and other major economies significantly influence the CAD exchange rate.

Bank of Canada Monetary Policy

The Bank of Canada's monetary policy decisions, particularly its interest rate adjustments, directly affect the CAD's value.

- Recent Interest Rate Changes: The Bank of Canada has adjusted its policy interest rate in response to inflation and economic growth, impacting the attractiveness of the CAD to investors.

- Interest Rate Differentials: Higher interest rates in Canada compared to other countries make the CAD more attractive to investors seeking higher returns, increasing demand and strengthening the currency. The opposite is true for lower interest rates.

- Interest Rate Comparisons: Comparing the Bank of Canada's interest rate with those of the US Federal Reserve (the Fed) is crucial, as the US dollar is a major trading partner for the CAD.

Comparison with Other Major Central Banks

The Bank of Canada's actions are not in isolation; global monetary policy plays a critical role.

- Diverging Monetary Policies: Differences in monetary policy between the Bank of Canada and other major central banks, such as the European Central Bank (ECB) and the Fed, can lead to significant fluctuations in the CAD exchange rate.

- Future Interest Rate Movements: Forecasts of future interest rate changes by the Bank of Canada and other central banks are closely watched by currency traders, influencing market expectations and the CAD exchange rate.

Geopolitical Factors Affecting the Canadian Dollar Exchange Rate

Geopolitical events significantly impact the Canadian Dollar Exchange Rate, adding another layer of complexity.

Global Economic Uncertainty

Global events create uncertainty and affect investor sentiment, influencing the CAD.

- Global Events and their Influence: Trade wars, political instability in major economies, and global recessions impact investor confidence, often leading to a flight to safety currencies like the US dollar, thus weakening the CAD.

- Safe-Haven Currencies: The CAD is considered a relatively safe haven currency, but during periods of significant global uncertainty, investors might still move towards the US dollar or other perceived safer assets.

US-Canada Relations

Given the close economic ties between Canada and the United States, the US economy significantly impacts the CAD.

- US-Canada Trade: The US is Canada's largest trading partner. Changes in US economic policy or trade relations between the two countries have a profound impact on the Canadian economy and, consequently, the CAD.

- US Economic Policy: Changes in US economic policy, such as trade tariffs or changes in interest rates, can significantly influence the CAD exchange rate due to the strong economic interdependence.

Conclusion

The Canadian Dollar Exchange Rate is influenced by a complex interplay of factors. Commodity prices, especially oil, are crucial drivers, as are interest rate differentials between the Bank of Canada and other major central banks. Geopolitical events and the health of the US economy add further layers of influence. Understanding these factors is essential for businesses involved in international trade, investors managing portfolios with exposure to the CAD, and even travelers planning international trips. Stay informed about the Canadian Dollar Exchange Rate and its fluctuations to make well-informed financial decisions. Monitor the Bank of Canada's announcements, global commodity markets, and geopolitical developments to effectively manage your exposure to CAD exchange rate risks.

Featured Posts

-

Nba 3 Point Contest 2024 Tyler Herros Victory Over Buddy Hield

Apr 24, 2025

Nba 3 Point Contest 2024 Tyler Herros Victory Over Buddy Hield

Apr 24, 2025 -

Canadas Economic Outlook The Importance Of Fiscal Prudence

Apr 24, 2025

Canadas Economic Outlook The Importance Of Fiscal Prudence

Apr 24, 2025 -

Subsystem Malfunction Grounds Blue Origin Rocket Launch

Apr 24, 2025

Subsystem Malfunction Grounds Blue Origin Rocket Launch

Apr 24, 2025 -

Pope Francis Legacy A More Global Yet Divided Church

Apr 24, 2025

Pope Francis Legacy A More Global Yet Divided Church

Apr 24, 2025 -

Investing In Middle Management A Strategic Approach To Business Growth

Apr 24, 2025

Investing In Middle Management A Strategic Approach To Business Growth

Apr 24, 2025