Private Credit's Growing Instability: Examining The Cracks Before The Crisis

Table of Contents

Rising Leverage and Risk Concentration in Private Credit

The private credit market's expansion has been fueled by increased leverage, concentrating risk within specific sectors and funds. This poses a significant threat to market stability. The pursuit of higher returns has led to a dangerous accumulation of risk, creating vulnerabilities that could trigger a wider financial crisis.

- Higher loan-to-value ratios in leveraged buyouts: Many private credit deals involve leveraged buyouts, where the target company's assets are used as collateral for a significant portion of the acquisition financing. Higher loan-to-value (LTV) ratios increase the risk of default if the value of the assets declines.

- Increased use of covenant-lite loans: Covenant-lite loans, which have fewer restrictions on the borrower, have become increasingly prevalent in the private credit market. This reduces lender protection and increases the risk of loss in case of financial distress.

- Concentration of lending in specific industries (e.g., technology, real estate): A significant portion of private credit is concentrated in specific sectors, particularly technology and real estate. A downturn in these sectors could trigger a wave of defaults, impacting the entire private credit market.

- Growth of fund-of-funds amplifying risk: The layering of funds through fund-of-funds structures can amplify risk. Losses in underlying private credit funds can cascade through the structure, magnifying the impact on investors.

This concentration of risk creates a significant risk of contagion. A default by a large borrower in a concentrated sector could trigger a domino effect, leading to widespread defaults and market instability.

Illiquidity and Reduced Transparency in Private Credit Markets

Assessing the true risk profile of private credit investments is challenging due to a lack of transparency and standardized reporting. This illiquidity and opacity hinder effective risk management and regulatory oversight. The "hidden losses" within this opaque market are a major concern.

- Difficulty in valuing illiquid assets: Private credit investments are often illiquid, making it difficult to determine their fair market value, especially during times of market stress.

- Lack of publicly available data on loan performance: Unlike publicly traded bonds, there is limited publicly available data on the performance of private credit loans, making it difficult for investors and regulators to assess the overall health of the market.

- Opaque fund structures hindering investor scrutiny: The complex structures of many private credit funds make it difficult for investors to fully understand the underlying risks and exposures.

- Limited regulatory oversight compared to public markets: Private credit markets are generally subject to less regulatory oversight than public markets, increasing the potential for risky lending practices.

This lack of transparency creates significant challenges for investors and regulators. Hidden losses can accumulate unnoticed, creating potential for sudden and severe market shocks.

Impact of Rising Interest Rates and Economic Slowdown on Private Credit

Rising interest rates and a potential economic slowdown significantly impact borrowers' ability to service their private debt. This increases the risk of defaults and distressed debt, potentially triggering a cascade of negative consequences.

- Increased refinancing risk for borrowers with floating-rate loans: Borrowers with floating-rate loans face increased refinancing risk as interest rates rise. This can lead to defaults if they are unable to secure new financing at higher rates.

- Potential for defaults and increased distressed debt: As economic conditions deteriorate, the likelihood of defaults on private credit loans increases, leading to a surge in distressed debt.

- Impact on fund performance and investor returns: Increased defaults and lower valuations of underlying assets will negatively impact the performance of private credit funds and the returns for investors.

- Stress on collateral values in a weakening economy: In a weakening economy, the value of collateral backing private credit loans can decline, increasing the risk of losses for lenders.

A cascade of defaults could trigger a crisis, impacting the broader financial system and potentially leading to a severe economic downturn.

The Role of ESG Factors in Assessing Private Credit Risk

Environmental, Social, and Governance (ESG) factors significantly influence the risk profile of private credit investments. Integrating ESG analysis into due diligence is crucial for responsible investing and mitigating financial risks.

- Impact of climate change on specific industries: Climate change poses significant risks to certain industries, such as energy and real estate, impacting the value of underlying assets and the ability of borrowers to repay their loans.

- Social risks associated with labor practices and supply chains: Social risks, such as poor labor practices or unsustainable supply chains, can negatively affect a company's financial performance and increase the risk of default.

- Governance failures leading to increased financial risk: Poor corporate governance can lead to mismanagement, fraud, and other issues that increase the risk of financial distress.

Incorporating ESG factors into due diligence can lead to more informed investment decisions, improving risk assessment and potentially mitigating losses.

Conclusion

The growing instability in the private credit market presents significant challenges. High leverage, illiquidity, and reduced transparency, exacerbated by rising interest rates and a potential economic slowdown, create a potent combination of risks. The lack of transparency and regulatory oversight, coupled with the interconnectedness of the financial system, raises concerns about potential systemic consequences. The risks associated with private debt and alternative lending are becoming increasingly apparent.

Understanding the emerging vulnerabilities within the private credit sector is crucial for investors, regulators, and policymakers. Proactive monitoring, improved transparency, and strengthened regulation are essential to mitigating the risks associated with private credit and preventing a potential crisis. Further research into the intricacies of private debt and alternative lending is needed to ensure the stability of the financial system. Careful consideration of the risks inherent in private credit investments is paramount to avoid future financial instability.

Featured Posts

-

Foreign Automakers In China Case Studies Of Bmw And Porsches Experiences

Apr 27, 2025

Foreign Automakers In China Case Studies Of Bmw And Porsches Experiences

Apr 27, 2025 -

The Perfect Couple Season 2 New Cast And Source Material Revealed

Apr 27, 2025

The Perfect Couple Season 2 New Cast And Source Material Revealed

Apr 27, 2025 -

Ariana Grandes New Look Professional Hair And Tattoo Artists At Work

Apr 27, 2025

Ariana Grandes New Look Professional Hair And Tattoo Artists At Work

Apr 27, 2025 -

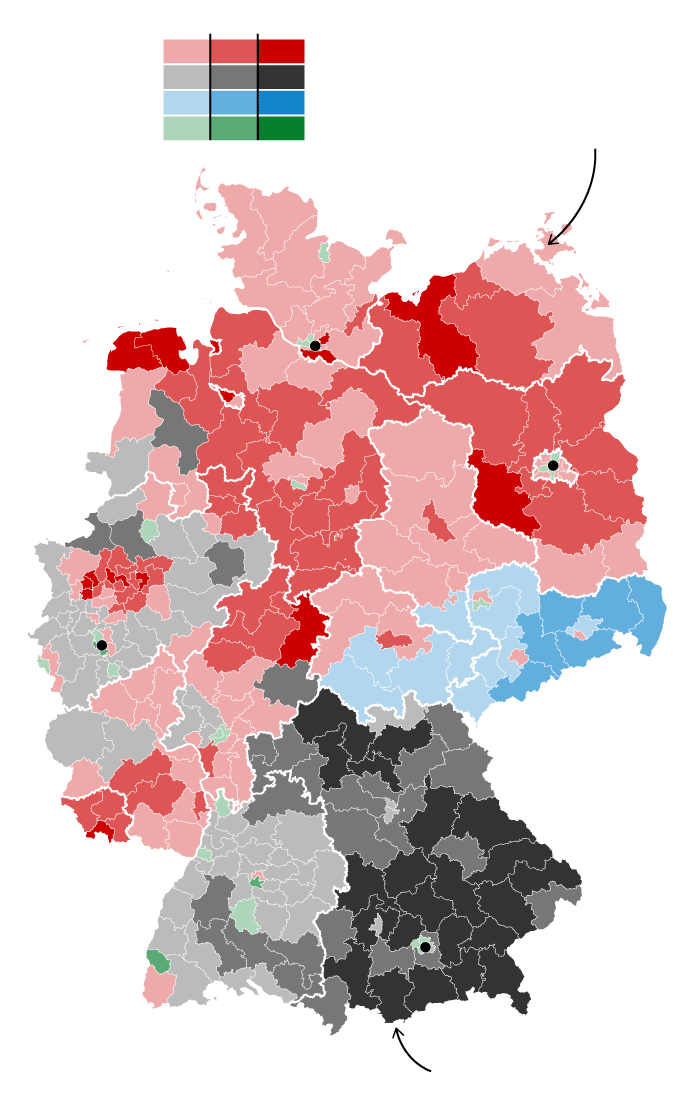

The Dax And German Politics Forecasting Market Trends After Elections

Apr 27, 2025

The Dax And German Politics Forecasting Market Trends After Elections

Apr 27, 2025 -

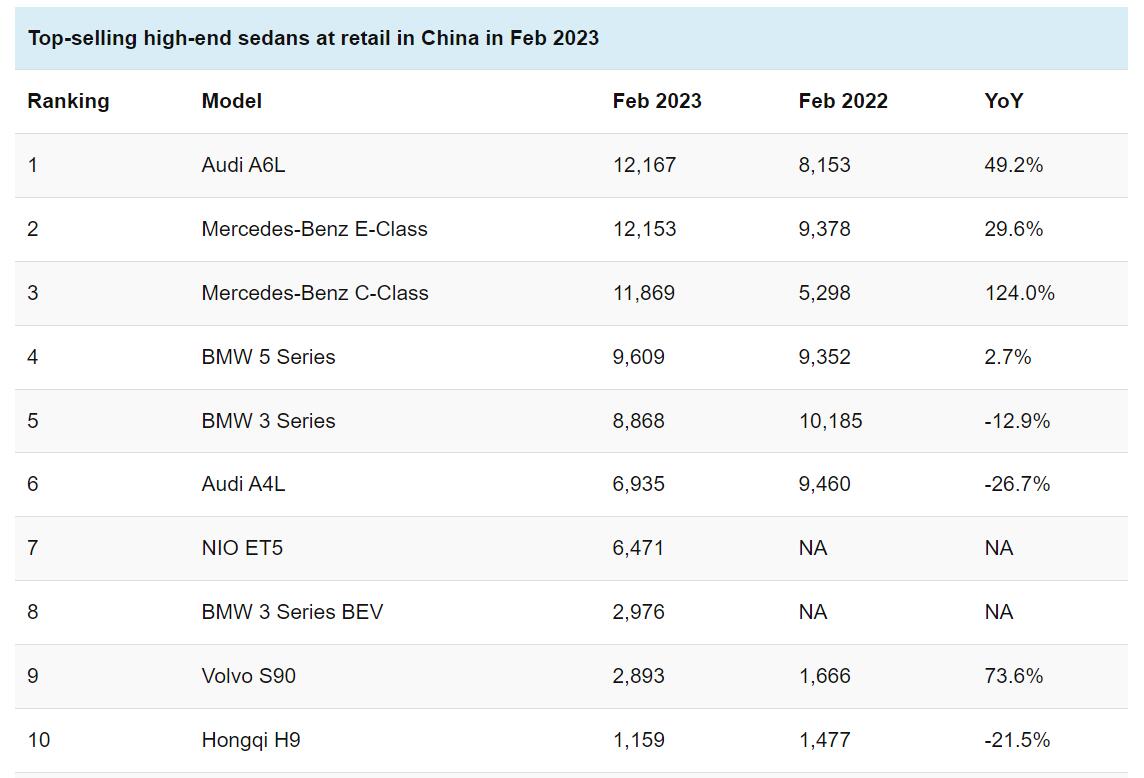

Chinas Automotive Landscape A Difficult Terrain For Luxury Brands

Apr 27, 2025

Chinas Automotive Landscape A Difficult Terrain For Luxury Brands

Apr 27, 2025