The Dax And German Politics: Forecasting Market Trends After Elections

Table of Contents

The Influence of Coalition Governments on the DAX

The stability and policy priorities of coalition governments significantly influence investor confidence and, consequently, DAX performance.

Stability vs. Uncertainty

The formation of a stable coalition government generally boosts investor confidence, leading to increased market stability and positive DAX performance. Conversely, prolonged coalition negotiations or unstable governing alliances can create uncertainty, resulting in market volatility and potential DAX declines.

- Examples of stable coalitions and their positive effects on the DAX: The "Grand Coalition" governments of the past (CDU/CSU and SPD) often provided a degree of predictability, leading to periods of sustained economic growth and positive DAX performance. Specific economic policies like targeted infrastructure investments had demonstrably positive effects.

- Examples of unstable coalitions and their negative impact: Periods of coalition fragility or frequent changes in government can lead to uncertainty about future economic policy, impacting investor sentiment negatively. This can translate to increased DAX volatility and potential downward pressure on the index.

Policy Priorities and their Market Implications

Differing policy priorities among coalition partners have significant implications for specific DAX sectors. For example:

- Impact on the automotive sector: Policies related to emission standards and the transition to electric vehicles can significantly impact automotive companies listed on the DAX. Stricter regulations could present challenges, while supportive policies could stimulate growth.

- Impact on the renewable energy sector: Government support for renewable energy through subsidies or tax incentives can boost the performance of companies in this sector. Conversely, reduced support could lead to decreased investment and slower growth.

- Impact on the technology sector: Policies related to digitalization, data privacy, and investment in technological infrastructure will impact technology companies' performance. A proactive government approach could stimulate growth, whereas a less supportive approach could hinder development.

- Impact on the financial sector: Fiscal policies and regulations impacting banks and financial institutions will have a direct effect on the performance of financial firms listed on the DAX. Stricter capital requirements or increased taxes could negatively affect profitability.

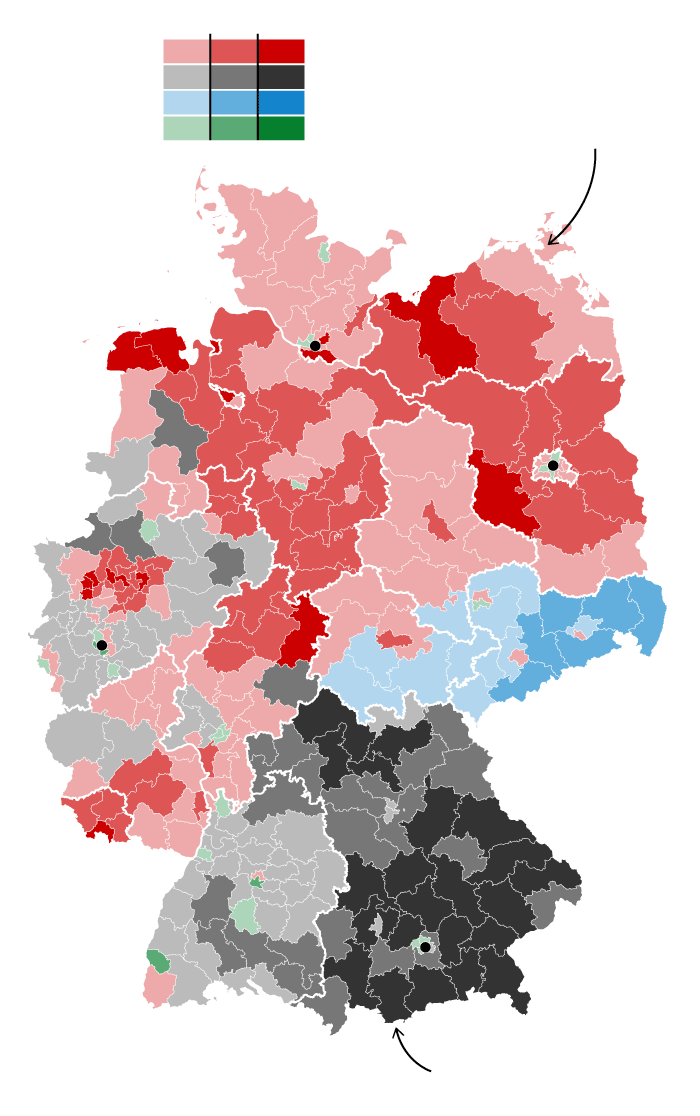

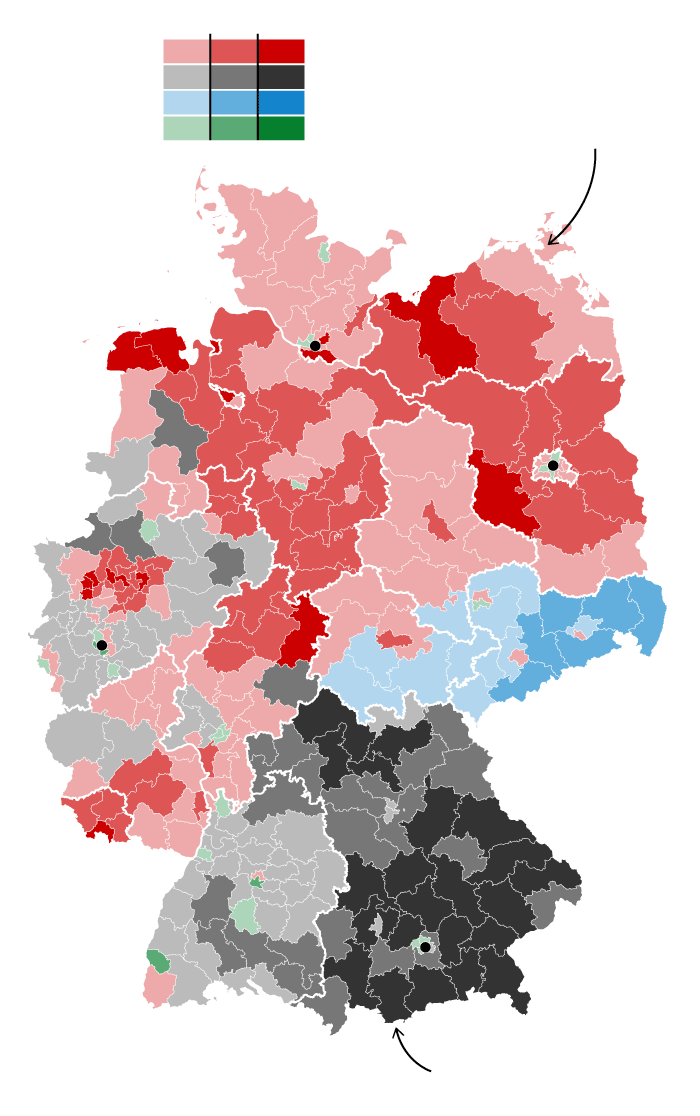

Analyzing Key Political Parties and their Economic Platforms

Understanding the economic platforms of major political parties is crucial for forecasting DAX trends after elections.

CDU/CSU (Christian Democrats)

The CDU/CSU typically advocates for fiscal conservatism, business-friendly policies, and free-market principles.

- Focus on fiscal conservatism: This typically involves controlling government spending and maintaining a balanced budget. This can attract foreign investment and boost investor confidence.

- Business-friendly policies: Lower taxes and reduced bureaucracy are generally favored, fostering business investment and economic growth, which would likely positively affect the DAX.

- Potential effects on specific DAX companies: Companies that benefit most from these policies might see their stock prices rise following a CDU/CSU-led government.

SPD (Social Democrats)

The SPD generally prioritizes social welfare programs and often advocates for increased government spending and progressive taxation.

- Focus on social welfare programs: Investments in education, healthcare, and social security can stimulate domestic demand and employment but might also lead to higher taxes.

- Potential tax increases: Higher taxes on corporations and high-income earners could negatively affect the profitability of some DAX companies and investor sentiment.

- Implications for the DAX: Increased government spending on social programs might boost some sectors, but higher taxes could dampen overall economic growth and negatively affect the DAX's performance.

Greens and FDP (Free Democrats)

The Greens and FDP, often coalition partners, present a more complex scenario with potential for both positive and negative impacts on the DAX.

- Focus on environmental policies: Significant investments in renewable energy and green technologies would benefit related companies on the DAX.

- Fiscal discipline: The FDP's focus on fiscal discipline could counterbalance the Greens' spending proposals, leading to a more balanced budget.

- Overall impact on market sectors: The combined influence could lead to a shift in investment towards sustainable and technologically advanced sectors while potentially moderating growth in traditionally polluting industries.

Assessing Political Risk and its Impact on the DAX

Political risk is an inherent factor in forecasting DAX performance. Understanding and mitigating this risk is essential for investors.

Measuring Political Uncertainty

Several methods exist to assess political uncertainty and its impact on investor sentiment:

- Economic forecasting models: Sophisticated models incorporate political factors to predict economic growth and its effect on the stock market.

- Sentiment indicators: Surveys and analyses of news media and social media can reveal prevailing investor sentiment towards political developments and their potential impact on the DAX.

- Relevant indices: Specialized indices track political uncertainty and its implications for market volatility.

Mitigating Political Risk in Investment Strategies

Investors can implement strategies to mitigate political risk in their DAX investments:

- Diversification: A diversified portfolio across different sectors and asset classes reduces the impact of political shocks on any single investment.

- Hedging strategies: Investors can utilize options or futures contracts to hedge against potential losses resulting from political uncertainty.

- Alternative investment options: Considering investments less sensitive to political risk, such as government bonds or real estate, can help diversify the portfolio.

Conclusion

The German political landscape significantly influences the DAX. Understanding the interplay between coalition governments, the economic platforms of major parties, and the resulting political risk is crucial for forecasting market trends. Stable coalition governments with clearly defined economic policies generally lead to increased investor confidence and positive DAX performance. Conversely, unstable alliances or conflicting policy priorities can create uncertainty and negatively impact the index.

By staying informed about German political developments and utilizing the insights provided here, investors can develop a more robust investment strategy for navigating the complexities of the DAX after elections. Continuously monitor the DAX and the German political landscape for informed decision-making and conduct further research into specific DAX companies and their sensitivity to political changes. Develop a comprehensive DAX forecast that integrates political risk assessment for optimal investment strategies.

Featured Posts

-

40 Abs 1 Wp Hg Pne Ag Veroeffentlicht Wichtige Informationen

Apr 27, 2025

40 Abs 1 Wp Hg Pne Ag Veroeffentlicht Wichtige Informationen

Apr 27, 2025 -

The Blaugrana Promise Ramiro Helmeyers Commitment

Apr 27, 2025

The Blaugrana Promise Ramiro Helmeyers Commitment

Apr 27, 2025 -

Zuckerberg And The Trump Era A New Phase For Meta

Apr 27, 2025

Zuckerberg And The Trump Era A New Phase For Meta

Apr 27, 2025 -

Full List Famous Faces Affected By The Palisades Fires

Apr 27, 2025

Full List Famous Faces Affected By The Palisades Fires

Apr 27, 2025 -

Offenlegung Nach 40 Abs 1 Wp Hg Pne Ag

Apr 27, 2025

Offenlegung Nach 40 Abs 1 Wp Hg Pne Ag

Apr 27, 2025