Fiscal Responsibility: Key To Canada's Long-Term Prosperity

Table of Contents

The Importance of Balanced Budgets in Achieving Fiscal Responsibility

Achieving fiscal responsibility hinges on the pursuit of balanced budgets. High national debt carries significant negative consequences, hindering economic growth and placing undue burdens on future generations.

Reducing National Debt

A high national debt diverts resources from crucial investments in infrastructure, education, and healthcare. Furthermore, it leads to increased interest payments, further straining government finances. Responsible budgeting practices are essential to mitigating this risk.

- Examples of responsible budgeting practices: Implementing spending caps, prioritizing essential services, and identifying areas for efficiency gains.

- Benefits of debt reduction: Improved credit rating, lower borrowing costs, increased investor confidence, and greater financial flexibility for future investments.

Strategic Government Spending

Fiscal responsibility doesn't mean austerity; it means strategic government spending. Prioritizing essential services and infrastructure projects yields long-term economic benefits. Cost-benefit analysis is vital in ensuring that public funds are allocated effectively.

- Examples of effective government spending: Investments in education and skills training, improvements to healthcare infrastructure, and upgrades to public transportation networks.

- Ineffective spending and its consequences: Funding projects with low returns, inefficient procurement processes, and a lack of oversight can lead to wasted resources and missed opportunities.

Revenue Generation and Tax Policy within the Framework of Fiscal Responsibility

A fair and efficient tax system is the cornerstone of responsible government finance. It ensures sufficient revenue to fund essential public services while promoting economic growth.

Fair and Efficient Taxation

A well-designed tax system balances fairness and efficiency. It should be progressive, ensuring that higher earners contribute a larger proportion of their income, while minimizing the administrative burden on taxpayers.

- Different types of taxes and their pros and cons: Income tax, sales tax, corporate tax – each has its strengths and weaknesses regarding revenue generation, economic impact, and fairness.

- Importance of tax compliance: High rates of tax compliance are crucial for maintaining a stable and predictable revenue stream for the government. Tax evasion undermines fiscal responsibility and reduces public resources available for essential services.

Promoting Economic Growth Through Tax Incentives

Strategic tax incentives can stimulate investment, innovation, and job creation, ultimately leading to increased government revenue in the long term. However, poorly designed incentives can lead to inefficiencies and unintended consequences.

- Examples of successful tax incentives: Tax credits for research and development, investments in renewable energy, and support for small and medium-sized enterprises (SMEs).

- Potential pitfalls of poorly designed incentives: Lack of accountability, loopholes exploited by corporations, and insufficient monitoring can negate the intended benefits.

Transparency and Accountability in Government Finances

Openness and accountability are vital for maintaining public trust and ensuring that government funds are used responsibly.

Open and Accessible Budget Information

Making budget information easily accessible to the public fosters transparency and allows citizens to scrutinize government spending decisions.

- Benefits of open data initiatives: Increased public awareness, greater civic engagement, and improved government accountability.

- Methods of improving transparency: Online budget portals, easily understandable summaries of government spending, and regular independent audits.

Strengthening Government Oversight Mechanisms

Robust oversight mechanisms are essential to ensure that government spending is in line with established priorities and free from corruption or mismanagement.

- Role of parliamentary committees, independent agencies, and the media: These institutions play a critical role in holding the government accountable for its financial decisions.

- Importance of ethics: Strong ethical guidelines and enforcement mechanisms are necessary to prevent conflicts of interest and ensure the integrity of public finances.

Fiscal Responsibility and its Impact on Intergenerational Equity

Fiscal responsibility is not simply about balancing the books; it's about ensuring a sustainable future for generations to come.

Sustainable Resource Management

Responsible management of Canada's natural resources is crucial for long-term economic prosperity and environmental sustainability.

- Examples of sustainable practices: Sustainable forestry, responsible mining practices, and the development of renewable energy sources.

- The costs of environmental damage: Failure to account for the environmental consequences of resource extraction can lead to substantial costs in the future.

- Long-term planning for resource use: Strategic planning is essential to ensure that Canada's natural resources are managed in a way that benefits both current and future generations.

Investing in Human Capital

Investing in education and skills development is a key component of fiscal responsibility. A skilled and productive workforce is essential for long-term economic growth and prosperity.

- The benefits of increased education and training: Higher wages, increased productivity, and improved innovation.

- The relationship between human capital and economic growth: Countries with a highly skilled workforce tend to have higher rates of economic growth and better living standards.

Conclusion

Fiscal responsibility, encompassing balanced budgets, strategic spending, fair taxation, transparency, and accountability, is essential for Canada's long-term prosperity. Responsible fiscal management ensures sustainable economic growth, reduces the burden of national debt, and promotes intergenerational equity. We must prioritize investments in human capital and sustainable resource management to secure a brighter future. Learn more about Canadian fiscal policy, engage in civic discussions surrounding budgeting and taxation, and advocate for greater fiscal responsibility from your elected officials. Demand sound fiscal policies and responsible fiscal management – it's the key to a secure and prosperous future for Canada. Let's work together to build a stronger, more sustainable economy for all Canadians.

Featured Posts

-

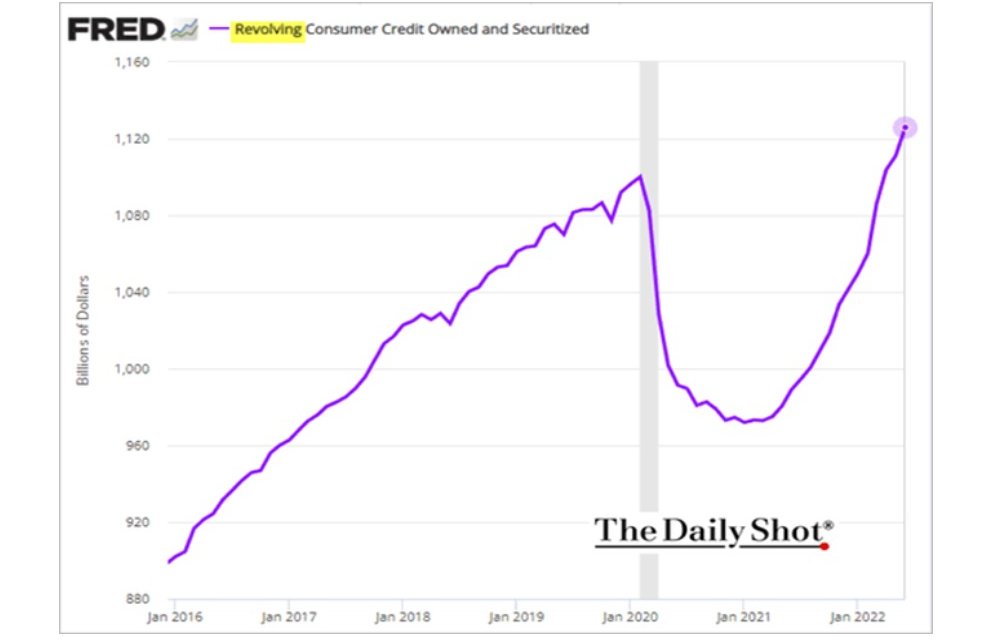

Credit Card Industry Braces For Slowdown In Non Essential Spending

Apr 24, 2025

Credit Card Industry Braces For Slowdown In Non Essential Spending

Apr 24, 2025 -

Us Stock Futures Jump On Trumps Decision Regarding Fed Chair Powell

Apr 24, 2025

Us Stock Futures Jump On Trumps Decision Regarding Fed Chair Powell

Apr 24, 2025 -

Trumps Transgender Sports Ban Faces Legal Challenge From Minnesota Ag

Apr 24, 2025

Trumps Transgender Sports Ban Faces Legal Challenge From Minnesota Ag

Apr 24, 2025 -

Trump Administration Cuts Heighten Tornado Season Dangers Experts Warn

Apr 24, 2025

Trump Administration Cuts Heighten Tornado Season Dangers Experts Warn

Apr 24, 2025 -

Quentin Tarantino Zasto Odbija Gledati Ovaj Film S Johnom Travoltom

Apr 24, 2025

Quentin Tarantino Zasto Odbija Gledati Ovaj Film S Johnom Travoltom

Apr 24, 2025