Credit Card Industry Braces For Slowdown In Non-Essential Spending

Table of Contents

Decreased Transaction Volumes and Revenue for Credit Card Companies

Lower spending on discretionary items—dining out, entertainment, travel, and luxury goods—will directly translate to fewer credit card transactions. This decline in transaction volume will directly impact the revenue generated through merchant fees and interchange fees, ultimately affecting the profitability of credit card companies.

- Lower Spending Equals Lower Revenue: A reduction in non-essential spending means less money flowing through credit card networks, directly impacting the fees earned by credit card companies from merchants.

- Impact on Profitability: Merchant fees and interchange fees are crucial components of credit card company revenue. A significant drop in transaction volume will inevitably lead to decreased profitability.

- Adapting to the New Reality: Credit card companies are likely to implement strategic adjustments to maintain profitability, including exploring alternative revenue streams such as subscription services or fee-based financial planning tools and implementing cost-cutting measures. This will significantly impact how they operate, potentially leading to changes in customer service and benefits offered on certain cards. The impact will likely vary across segments; premium card holders might see less impact than users of standard credit cards.

The potential impact on different segments of the credit card market is significant. Premium cards, often associated with higher spending levels, might experience a less dramatic decrease in transaction volume compared to standard cards. However, even premium cardholders are likely to scale back on some non-essential expenses.

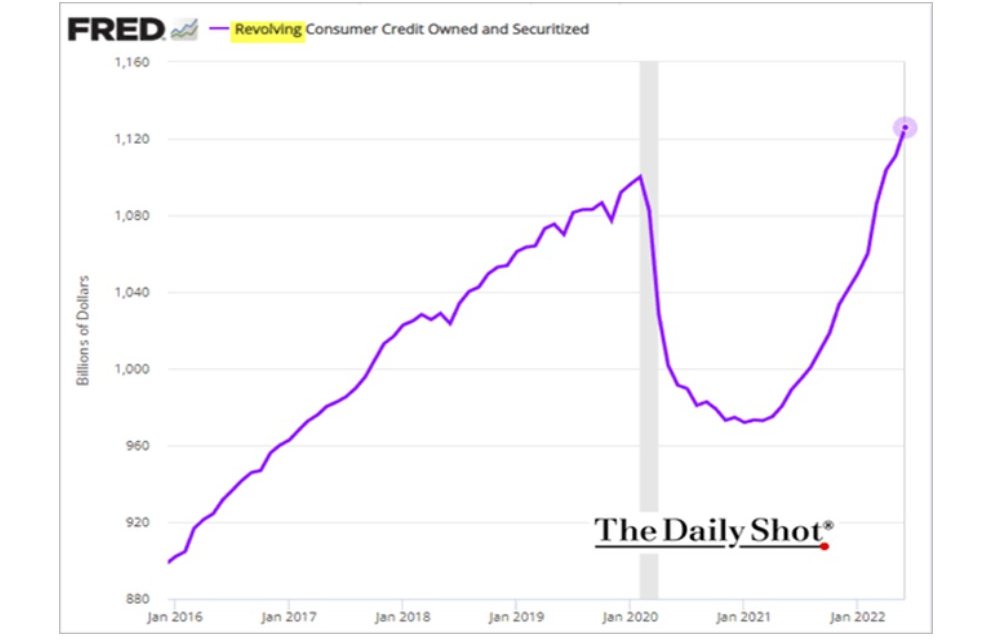

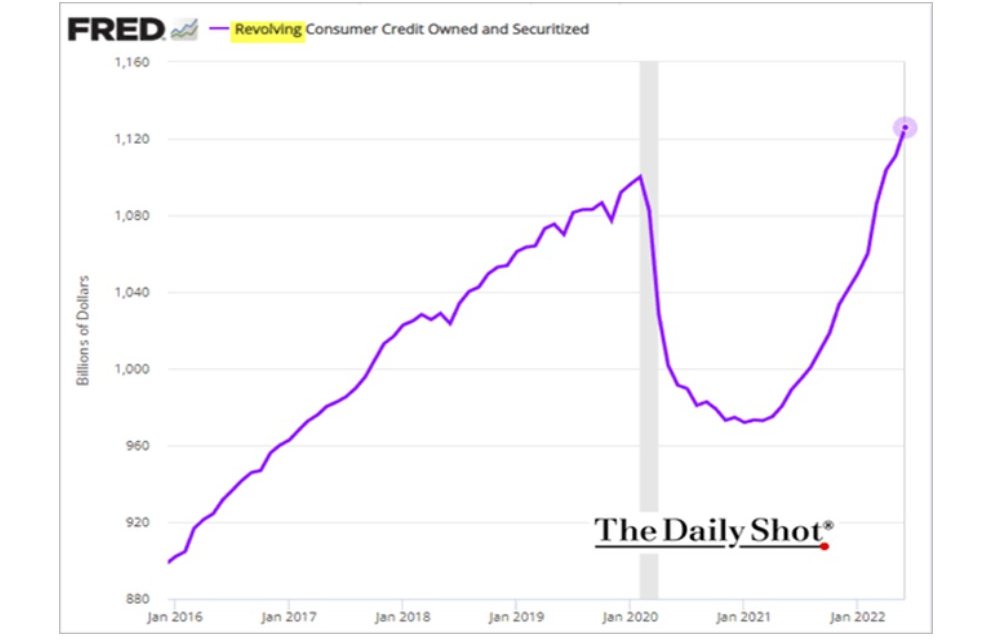

Rising Credit Card Debt and Delinquencies

As consumers curtail spending on non-essentials, they may increasingly rely on credit cards to cover essential expenses like groceries, utilities, and rent. This reliance, coupled with rising interest rates, will likely lead to a surge in credit card debt and an increase in delinquency rates.

- Increased Debt Burden: Using credit cards to meet essential expenses can quickly lead to mounting debt, especially with higher interest rates making repayment more difficult.

- Rising Interest Rates Exacerbate the Problem: The combination of increased spending on credit cards and higher interest rates creates a perfect storm for rising debt levels. Consumers will find it harder to manage their repayments.

- Higher Delinquency and Default Rates: As debt levels rise, so too will delinquency and default rates. This poses a significant risk to credit card companies' profitability and financial stability.

The implications for consumers facing increased debt are severe. Many may struggle to manage their finances, potentially leading to financial hardship and impacting their credit scores. Credit counseling agencies and debt management programs will play a crucial role in assisting those facing financial difficulties.

Shifting Consumer Spending Habits and Payment Preferences

The economic slowdown is forcing consumers to re-evaluate their spending habits and explore alternative payment methods. This shift will significantly impact the credit card industry.

- Prioritizing Essential Spending: Consumers are likely to focus their spending on essential goods and services, significantly reducing discretionary purchases.

- Increased Use of Budgeting Apps: Consumers are increasingly turning to budgeting apps and financial planning tools to manage their finances more effectively in these challenging times.

- Growth of Alternative Payment Methods: The popularity of Buy Now, Pay Later (BNPL) schemes is on the rise, providing an alternative to traditional credit cards. However, these schemes also carry inherent risks if not managed carefully. The rise of digital wallets and mobile payment platforms is also challenging the dominance of credit cards.

The evolving landscape of payment methods presents a significant challenge to credit card companies. They need to adapt to changing consumer preferences and compete effectively with other payment platforms. This could involve developing innovative products and services tailored to the needs of a more financially cautious consumer base.

The Impact on the Fintech Sector

The slowdown in non-essential spending and the subsequent changes in consumer behavior are also significantly impacting the Fintech sector.

- Reduced Spending and Increased Defaults: Fintech companies providing credit products will likely experience a reduction in spending and an increase in defaults, echoing the challenges faced by traditional credit card companies.

- Intensified Competition: The competition for customer acquisition will intensify as Fintech firms vie for a share of the market in a more financially constrained environment.

- Innovation and Adaptation: The current economic climate will drive innovation within the Fintech sector. New solutions and technological advancements are likely to emerge to address the needs of both consumers and lenders navigating this period of uncertainty. This could include more sophisticated credit scoring models and AI-powered risk assessment tools.

Conclusion

The slowdown in non-essential spending poses significant challenges for the credit card industry. Decreased transaction volumes, a surge in credit card debt, and shifting consumer behaviors will require credit card companies and fintech firms to adapt their strategies and offerings to navigate this economic uncertainty.

Understanding the contributing factors to this slowdown is crucial for both consumers and businesses operating within this sector. Consumers need to be mindful of their spending habits, manage their credit card debt effectively, and explore alternative financial tools to stay financially healthy. Businesses need to adapt their strategies to accommodate reduced spending and changing consumer preferences. Stay informed about the evolving landscape of the credit card industry and prepare for potential changes in consumer spending habits and credit market conditions. Learn more about managing your credit card debt and making informed financial decisions during this period of economic uncertainty.

Featured Posts

-

Golden States Bench Players Hield And Payton Deliver Against Portland

Apr 24, 2025

Golden States Bench Players Hield And Payton Deliver Against Portland

Apr 24, 2025 -

Google Fi Launches Affordable 35 Unlimited Data Plan

Apr 24, 2025

Google Fi Launches Affordable 35 Unlimited Data Plan

Apr 24, 2025 -

John Travolta And Rotten Tomatoes An Unexpectedly Negative Correlation

Apr 24, 2025

John Travolta And Rotten Tomatoes An Unexpectedly Negative Correlation

Apr 24, 2025 -

Canadas Economic Outlook The Importance Of Fiscal Prudence

Apr 24, 2025

Canadas Economic Outlook The Importance Of Fiscal Prudence

Apr 24, 2025 -

John Travolta Addresses Concerns After Sharing Intimate Family Home Photo

Apr 24, 2025

John Travolta Addresses Concerns After Sharing Intimate Family Home Photo

Apr 24, 2025