Extreme Price Increase For VMware: AT&T Sounds Alarm Over Broadcom Deal

Table of Contents

AT&T's Public Expression of Concern

AT&T, a major player in the telecommunications industry and a significant VMware customer, has openly voiced its alarm over the substantial price hikes following Broadcom's takeover. Their concerns extend beyond mere cost increases; they point to potential monopolistic practices and a reduction in competition within the virtualization market. This isn't simply about a price adjustment; it's about the potential erosion of a healthy competitive landscape.

- Quote: "The significant price increases in VMware products post-acquisition raise serious concerns about the potential for anti-competitive behavior and reduced choices for businesses," (This would be replaced with an actual quote from an official AT&T statement or a reputable news source).

- Specific Examples: AT&T has reportedly cited specific examples of price increases ranging from [Insert Percentage or specific examples, citing sources]. These increases are not isolated incidents but represent a broader pattern of price escalation affecting various VMware products and services.

- Regulatory Actions: AT&T's concerns have prompted calls for regulatory scrutiny, with some suggesting the need for investigations into potential antitrust violations. This has initiated discussions regarding the potential for regulatory intervention to address the extreme VMware price increase.

Analysis of Broadcom's Acquisition and its Impact on VMware Pricing

Broadcom's acquisition of VMware represents a significant consolidation of power in the enterprise software market. Understanding Broadcom's business model is crucial to understanding the subsequent VMware price increase. Broadcom is known for its aggressive acquisition strategy, often focusing on integrating acquired companies and leveraging their market position to increase profitability.

- Broadcom's Business Model: Broadcom typically targets acquisitions to expand its market share and consolidate its position within a given industry. This often leads to cost-cutting measures and price increases to maximize return on investment.

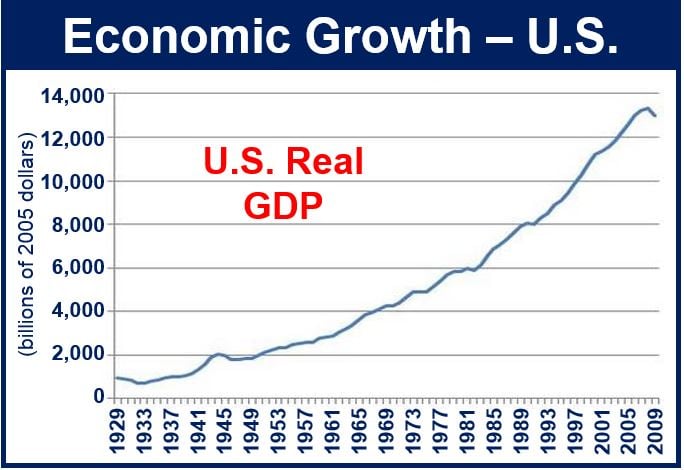

- Price Comparison: Comparing VMware pricing before and after the Broadcom acquisition reveals a substantial increase across a range of products and services. [Insert data or graphs illustrating the price difference, citing sources].

- Long-Term Impacts: The extreme VMware price increase could force businesses to reconsider their reliance on VMware solutions, leading to a potential shift in the market share and potentially hindering innovation in the virtualization space.

Implications for the IT Industry and VMware Customers

The VMware price hike isn't just impacting individual businesses; it has far-reaching implications for the entire IT industry. This extreme VMware price increase could trigger a domino effect, impacting pricing strategies of competitors and creating a ripple effect throughout the IT ecosystem.

- Alternatives to VMware: Businesses are now actively exploring alternatives to VMware, potentially accelerating the adoption of open-source solutions or competing virtualization platforms. This increased competition could, in the long run, benefit customers.

- Impact on Businesses: Smaller businesses are disproportionately affected by these price increases, potentially limiting their access to crucial virtualization technologies. Larger enterprises, while able to absorb some cost increases, are still facing significant budget implications.

- Market Shifts: The extreme VMware price increase could lead to increased competition and innovation in the virtualization market, potentially fostering the development of new and more affordable alternatives.

Regulatory Scrutiny and Antitrust Concerns

The extreme VMware price increase has attracted significant regulatory attention and sparked concerns about potential antitrust violations. The substantial price hikes following the acquisition are raising questions about whether Broadcom is abusing its newfound market power.

- Ongoing Investigations: [Mention any ongoing or announced investigations by regulatory bodies like the FTC or EU Commission]. These investigations will play a crucial role in determining whether Broadcom's actions violate antitrust laws.

- Likelihood of Success: The outcome of potential antitrust challenges depends on several factors, including the evidence of anti-competitive behavior and the interpretation of relevant antitrust laws.

- Potential Penalties: If found guilty of antitrust violations, Broadcom could face significant penalties, including fines and potential divestiture of VMware assets.

Conclusion: Navigating the Extreme VMware Price Increase

The extreme VMware price increase following Broadcom's acquisition has triggered significant concern, particularly highlighted by AT&T's public statement. The potential for monopolistic practices, reduced competition, and the substantial financial burden on businesses are key takeaways. This situation highlights the importance of monitoring VMware pricing changes and staying updated on the Broadcom acquisition. Businesses should actively explore VMware alternatives and understand the implications of the extreme VMware price increase for their long-term IT strategies. Staying informed is crucial to navigating this evolving landscape and making informed decisions about your virtualization infrastructure.

Featured Posts

-

Pegula Defeats Collins To Win Charleston Title

Apr 27, 2025

Pegula Defeats Collins To Win Charleston Title

Apr 27, 2025 -

Mc Cook Jeweler Supports Nfl Players Post Football Futures

Apr 27, 2025

Mc Cook Jeweler Supports Nfl Players Post Football Futures

Apr 27, 2025 -

Us Economic Growth To Slow Considerably Deloittes Prediction

Apr 27, 2025

Us Economic Growth To Slow Considerably Deloittes Prediction

Apr 27, 2025 -

Ecbs Simkus Hints At Two Further Interest Rate Cuts Amidst Trade War Impact

Apr 27, 2025

Ecbs Simkus Hints At Two Further Interest Rate Cuts Amidst Trade War Impact

Apr 27, 2025 -

El Metodo Alberto Ardila Olivares Para Garantizar Goles

Apr 27, 2025

El Metodo Alberto Ardila Olivares Para Garantizar Goles

Apr 27, 2025