US Economic Growth To Slow Considerably: Deloitte's Prediction

Table of Contents

Deloitte's Key Predictions and Underlying Factors

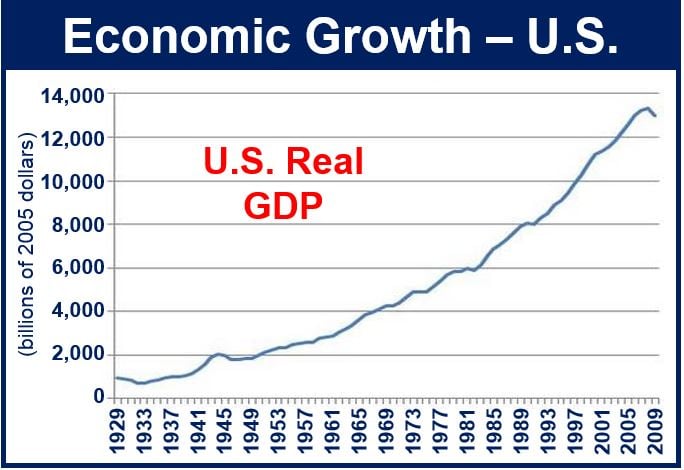

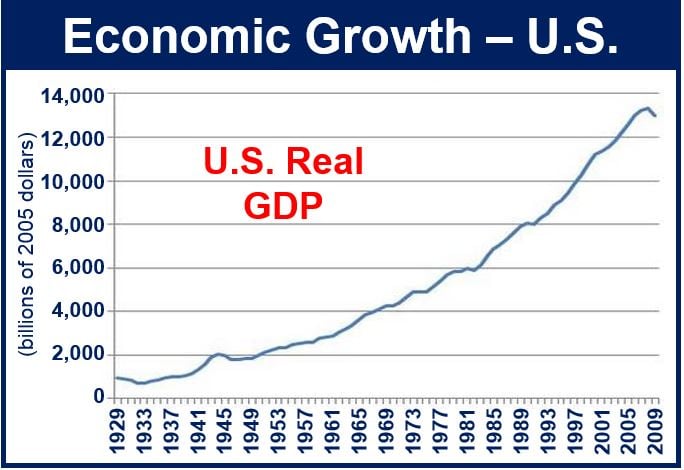

Deloitte's report ( insert link to report here if available) forecasts a significantly reduced growth rate for the US economy in the next year, predicting a [insert predicted growth rate]% increase in GDP, compared to [insert previous year's growth rate]% in the previous year and an average of [insert average growth rate over a longer period]% over the last [number] years. This substantial decrease is attributed to several interconnected factors:

-

Decreased consumer spending due to inflation: Soaring inflation has eroded consumer purchasing power, leading to decreased spending on non-essential goods and services. This reduced consumer demand ripples through the economy, impacting businesses across various sectors. Keywords: inflation impact, consumer spending decline, reduced demand.

-

Weakening housing market impacting construction and related industries: Rising interest rates and increased housing costs have cooled the previously hot housing market. This slowdown directly affects the construction industry and related sectors, leading to potential job losses and reduced investment. Keywords: housing market slowdown, construction industry impact, interest rate hikes.

-

Global economic uncertainty impacting US exports and investment: Global economic instability, including geopolitical tensions and recessionary fears in other major economies, negatively impacts US exports and foreign direct investment. This uncertainty discourages investment and hinders economic growth. Keywords: global economic uncertainty, US exports decline, foreign investment slowdown.

-

Potential impact of rising interest rates on business investment: The Federal Reserve's efforts to combat inflation through rising interest rates increase borrowing costs for businesses. This can lead to reduced business investment, hindering expansion and job creation. Keywords: interest rate impact, business investment decline, borrowing costs.

-

Supply chain disruptions and their continued effect on prices and production: While supply chain issues have eased somewhat, lingering disruptions continue to impact prices and production, contributing to inflationary pressures and slowing economic growth. Keywords: supply chain bottlenecks, inflation, production delays.

Impact on Key Economic Sectors

The predicted slowdown in US economic growth will differentially impact various economic sectors.

The Manufacturing Sector

The manufacturing sector is particularly vulnerable to the predicted slowdown. A "manufacturing slowdown" is expected due to decreased demand for manufactured goods, rising input costs impacting profitability, and challenges in securing skilled labor. This could lead to production cuts and potential job losses, further dampening economic growth. Keywords: manufacturing slowdown, supply chain bottlenecks, production cuts, job losses.

- Decreased demand for manufactured goods: Reduced consumer spending and weakened global demand directly impact the manufacturing sector's output.

- Rising input costs impacting profitability: Increased costs for raw materials, energy, and transportation squeeze profit margins, making it difficult for manufacturers to remain competitive.

- Challenges in securing skilled labor: A tight labor market and skills gaps make it difficult for manufacturers to find and retain qualified workers.

The Tech Sector

The tech sector, while historically resilient, is not immune to economic downturns. The forecast suggests reduced venture capital funding, potential for layoffs and hiring freezes, and increased competition and consolidation within the industry. Keywords: tech investment, venture capital, layoffs, tech sector slowdown, innovation.

- Reduced venture capital funding: Investors become more risk-averse during economic slowdowns, leading to decreased funding for startups and tech companies.

- Potential for layoffs and hiring freezes: Companies may resort to cost-cutting measures, including layoffs and hiring freezes, to maintain profitability.

- Increased competition and consolidation: Slower growth can trigger increased competition and consolidation as weaker companies struggle to survive.

The Consumer Sector

The consumer sector will likely experience a significant impact. Decreased consumer spending power due to inflation, a shift in consumer preferences towards essential goods, and a potential increase in personal debt are all anticipated. Keywords: consumer confidence, inflation, retail sales, disposable income.

- Decreased consumer spending power due to inflation: Inflation erodes purchasing power, leading to reduced spending on discretionary items.

- Shift in consumer preferences towards essential goods: Consumers prioritize essential goods over non-essentials, impacting sales in other sectors.

- Potential increase in personal debt: Consumers might resort to borrowing to maintain their lifestyle, leading to increased personal debt levels.

Mitigation Strategies and Potential Outcomes

Businesses can employ several strategies to navigate this period of slower US economic growth.

- Investing in automation and efficiency improvements: Automating processes can reduce labor costs and improve productivity.

- Focusing on niche markets and customer loyalty: Targeting specific customer segments and building strong customer relationships can help businesses weather economic storms.

- Exploring new revenue streams and business models: Diversifying revenue streams and adapting business models to changing market conditions is crucial.

- Strategic workforce planning: Implementing strategies to retain skilled employees and manage workforce needs effectively is essential.

The potential outcomes depend on various factors, including the severity and duration of the slowdown, government policy responses, and global economic conditions. Positive outcomes could include a period of controlled economic adjustment leading to long-term stability, while negative outcomes could involve a deeper recession and prolonged economic hardship. Scenario planning is crucial for businesses to prepare for various possibilities.

Conclusion

Deloitte's prediction of a considerable slowdown in US economic growth underscores the need for proactive planning and adaptation by businesses and investors. The factors contributing to this slowdown are multifaceted, impacting various sectors differently. Understanding these challenges and implementing appropriate mitigation strategies, such as those outlined above, is crucial for navigating the coming economic climate. Stay informed about the evolving landscape of US economic growth by regularly reviewing Deloitte’s reports and other economic analyses. Proactive monitoring and strategic planning are essential to mitigating the risks associated with this predicted slowdown in US economic growth. Careful analysis of US economic growth indicators is vital for future success.

Featured Posts

-

Vaccine Safety Under Scrutiny Hhss Decision To Hire David Geier

Apr 27, 2025

Vaccine Safety Under Scrutiny Hhss Decision To Hire David Geier

Apr 27, 2025 -

10

Apr 27, 2025

10

Apr 27, 2025 -

Pfc Announces 4th Cash Dividend For Fy 25 On March 12 Details And Expectations

Apr 27, 2025

Pfc Announces 4th Cash Dividend For Fy 25 On March 12 Details And Expectations

Apr 27, 2025 -

Eliminacion Temprana De Paolini Y Pegula En El Wta 1000 De Dubai

Apr 27, 2025

Eliminacion Temprana De Paolini Y Pegula En El Wta 1000 De Dubai

Apr 27, 2025 -

Why Canada Is Attracting More Tourists Than The Us

Apr 27, 2025

Why Canada Is Attracting More Tourists Than The Us

Apr 27, 2025