Emerging Market Stocks Outperform US: Year-to-Date Gains And Market Analysis

Table of Contents

Year-to-Date Performance Comparison: Emerging Markets vs. US

A clear comparison of year-to-date returns reveals a striking divergence between emerging market and US stock performance. Let's consider the MSCI Emerging Markets Index as a benchmark for emerging markets and the S&P 500 for the US. (Note: Insert relevant charts and graphs here displaying the year-to-date performance of both indices. Data should be updated to reflect current market conditions).

The visual representation will clearly show the significant difference in returns. For example, (Insert hypothetical data - replace with actual data at publishing time) the MSCI Emerging Markets Index might show a year-to-date return of 15%, while the S&P 500 might only register a 5% gain. This substantial difference highlights the outperformance of emerging market stocks.

- Specific percentage gains: (Insert actual data here for both indices)

- Comparison of volatility: Emerging markets often exhibit higher volatility than developed markets like the US. This should be visually depicted in the charts.

- Significant events: Mention any major global events that impacted either market, such as geopolitical instability or changes in interest rate policies. For instance, a specific emerging market's economic recovery or a global commodity price surge could be factors.

Factors Driving Emerging Market Outperformance

Several macroeconomic and geopolitical factors have contributed to the superior performance of emerging markets. The weakening US dollar, for instance, has boosted the value of assets denominated in other currencies.

- Stronger-than-expected economic growth: Specific emerging economies, such as (insert examples, e.g., India, certain Southeast Asian nations), have demonstrated robust economic growth, surpassing expectations.

- Impact of weakening US dollar: A weaker dollar makes emerging market assets more attractive to international investors.

- Increased demand for commodities: Many emerging markets are significant producers of commodities. Increased global demand has driven up commodity prices, benefiting these economies.

- Government policies supporting economic growth: Certain governments have implemented policies aimed at stimulating economic activity and attracting foreign investment.

- Specific examples: Highlight successful emerging market economies and the factors behind their success.

The Role of Specific Sectors in Emerging Market Growth

The outperformance isn't uniform across all sectors. Certain sectors within emerging markets have been particularly strong performers.

- Analysis of sectoral contribution: Detailed analysis showing the contribution of key sectors (technology, energy, consumer goods etc.) to overall gains is crucial.

- Leading companies: Mention specific high-performing companies within these sectors to illustrate the point. For example, highlight technology companies in India or energy companies in certain African nations.

Risks and Challenges in Emerging Market Investments

While the potential returns are attractive, investing in emerging markets comes with inherent risks.

- Geopolitical instability: Political instability and unrest can significantly impact market performance.

- Currency fluctuations: Changes in exchange rates can significantly affect returns for international investors.

- Higher volatility: Emerging markets are known for their higher volatility compared to developed markets.

- Regulatory uncertainties: Changes in regulations and policies can create uncertainty for investors.

Investment Strategies for Emerging Markets

For investors interested in exploring emerging market opportunities, a well-defined strategy is crucial.

- Diversification: Diversify investments across various emerging markets to reduce risk.

- Investment vehicles: Consider diverse investment vehicles like ETFs, mutual funds, and individual stocks, depending on risk tolerance and investment goals.

- Long-term horizons: Emerging markets often require a long-term investment perspective.

- Professional advice: Always seek advice from a qualified financial advisor before making investment decisions.

Conclusion: Emerging Market Stocks: A Promising Investment Opportunity?

This analysis reveals the compelling year-to-date outperformance of emerging market stocks compared to their US counterparts. Strong economic growth in specific regions, a weaker US dollar, and increased commodity demand have all contributed to these gains. However, investors should be aware of the inherent risks, including geopolitical instability, currency fluctuations, and higher volatility. A balanced approach, incorporating diversification, careful asset allocation, and a long-term investment horizon, is essential. We strongly encourage further research into specific emerging market stocks and the potential benefits of including them in a well-diversified portfolio. Remember to consult a qualified financial advisor before making any investment decisions. The potential for long-term growth in emerging market investments remains significant, presenting exciting opportunities for discerning investors.

Featured Posts

-

President Trump Denies Plans To Fire Jerome Powell

Apr 24, 2025

President Trump Denies Plans To Fire Jerome Powell

Apr 24, 2025 -

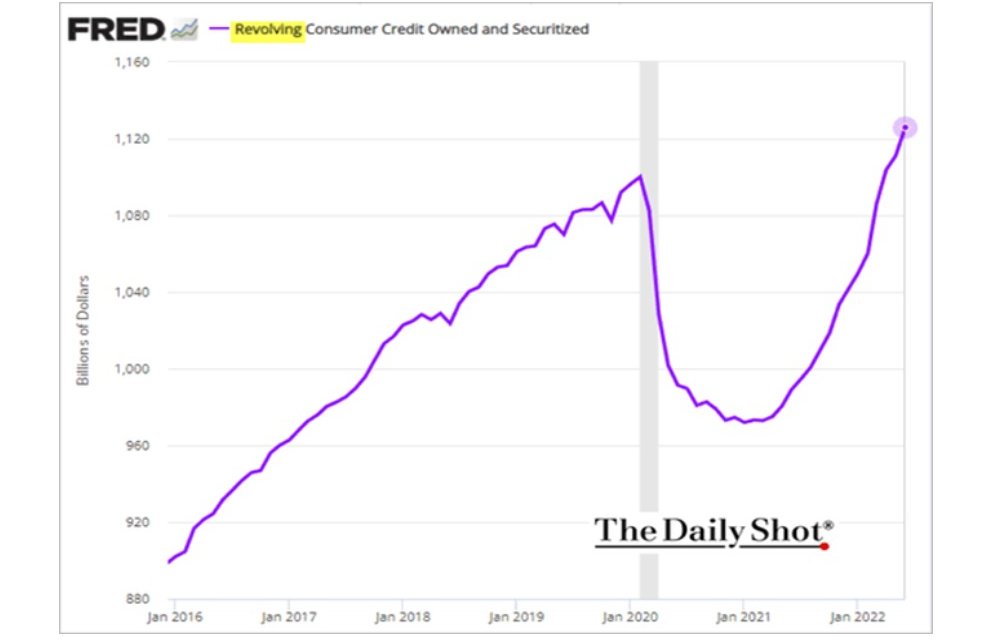

Credit Card Industry Braces For Slowdown In Non Essential Spending

Apr 24, 2025

Credit Card Industry Braces For Slowdown In Non Essential Spending

Apr 24, 2025 -

Exclusive High Rollers John Travoltas New Action Movie Poster And Photo Preview

Apr 24, 2025

Exclusive High Rollers John Travoltas New Action Movie Poster And Photo Preview

Apr 24, 2025 -

Minnesota Attorney General Sues Trump Over Transgender Sports Ban

Apr 24, 2025

Minnesota Attorney General Sues Trump Over Transgender Sports Ban

Apr 24, 2025 -

Remembering Jett Travolta A Photo Shared By His Father On His Birthday

Apr 24, 2025

Remembering Jett Travolta A Photo Shared By His Father On His Birthday

Apr 24, 2025