Economic Uncertainty: The Challenges Facing The Next Federal Reserve Chairman

Table of Contents

The US economy is facing a confluence of challenges unlike anything seen in decades. Inflation remains stubbornly high, geopolitical instability rattles global markets, and the national debt continues to climb. This unprecedented level of economic uncertainty presents a formidable challenge for the next Federal Reserve Chairman. This article explores the key economic headwinds the incoming chair will need to navigate, highlighting the complexities and potential consequences of their decisions.

<h2>Inflationary Pressures and the Tightrope Walk of Monetary Policy</h2>

The Federal Reserve's primary mandate is to maintain price stability and maximum employment. However, the current inflationary environment forces a delicate balancing act. High inflation erodes purchasing power, impacting consumers and businesses alike. The Consumer Price Index (CPI) and Producer Price Index (PPI) remain elevated, indicating persistent inflationary pressures.

- Current inflation rate and its impact on consumers: High inflation leads to reduced consumer spending and a decline in real wages, squeezing household budgets.

- Challenges of predicting future inflation accurately: Forecasting inflation accurately is notoriously difficult, and unexpected shifts can necessitate rapid policy adjustments.

- Potential for further interest rate hikes and their consequences: To curb inflation, the Fed might continue raising interest rates, potentially slowing economic growth and increasing the risk of recession.

- Risk of triggering a recession through aggressive monetary tightening: Aggressive rate hikes, while potentially effective in controlling inflation, risk triggering a recession by dampening economic activity.

The Fed must carefully calibrate its monetary policy response to strike a balance between controlling inflation and avoiding a significant economic downturn. This tightrope walk demands exceptional skill and judgment from the next chairman.

<h2>Geopolitical Instability and its Ripple Effect on the US Economy</h2>

The global landscape is fraught with geopolitical risks, each with the potential to significantly impact the US economy. The war in Ukraine, ongoing trade tensions, and rising global uncertainty all contribute to a complex and unpredictable environment.

- Supply chain disruptions and their effect on prices: Global supply chain disruptions, exacerbated by geopolitical events, continue to fuel inflationary pressures.

- Energy price volatility and its influence on inflation: Fluctuations in global energy prices, often driven by geopolitical events, directly impact inflation and overall economic stability.

- Impact of global economic slowdowns on US growth: Slowdowns in major global economies can ripple through the US economy, impacting export markets and investor sentiment.

- Need for proactive policy responses to geopolitical risks: The next Fed chairman must be prepared to adapt monetary policy to respond to unexpected geopolitical shocks.

The interconnected nature of the global economy means that the US is not immune to international instability. The ability to anticipate and react effectively to these external shocks will be crucial.

<h2>Managing Debt Levels and the Long-Term Economic Outlook</h2>

The US national debt has reached unprecedented levels, posing significant long-term economic challenges. Rising interest rates increase the cost of servicing this debt, placing further strain on government finances.

- Impact of rising interest rates on government borrowing costs: Higher interest rates make it more expensive for the government to borrow money, potentially leading to increased budget deficits.

- Need for fiscal responsibility and sustainable government spending: Fiscal prudence and strategic government spending will be essential to maintain long-term economic stability.

- Long-term implications of high debt levels for economic growth: High debt levels can crowd out private investment, hindering economic growth and future prosperity.

- Potential for political gridlock hindering effective fiscal policy: Political gridlock can make it difficult to implement necessary fiscal reforms, exacerbating the challenges posed by high debt.

The next chairman will need to navigate the complex interplay between monetary and fiscal policy to ensure long-term economic sustainability. Data on the national debt and deficit clearly illustrate the scale of this challenge.

<h3>Navigating the Uncertain Labor Market</h3>

The labor market presents a further complication. While unemployment remains relatively low, wages are rising, contributing to inflationary pressures. The next chairman must find a way to balance employment growth with inflation control.

- Current unemployment rates and their implications: Low unemployment rates indicate a strong labor market, but also contribute to upward pressure on wages.

- Impact of automation and technological advancements on employment: Automation and technological change may displace workers in certain sectors, requiring proactive policies to address job displacement.

- Need for policies that support worker retraining and upskilling: Investing in worker retraining and upskilling programs is essential to adapt to changing labor market demands.

- Challenge of maintaining a strong labor market while managing inflation: The next chairman must find a way to maintain a robust labor market without exacerbating inflationary pressures.

The interplay between inflation, employment, and technological change requires a nuanced and multifaceted approach from the next Federal Reserve Chairman.

<h2>Conclusion</h2>

The next Federal Reserve Chairman faces an extraordinarily challenging environment. Successfully navigating the current economic uncertainty requires a deft hand in managing inflation, responding to geopolitical risks, addressing high national debt, and fostering a strong labor market. The complexity of these interwoven challenges demands exceptional leadership, foresight, and a willingness to adapt to rapidly evolving economic conditions. Understanding the challenges of economic uncertainty is critical for navigating the future. Stay informed about the Federal Reserve's actions and their impact on your finances, and your future.

Featured Posts

-

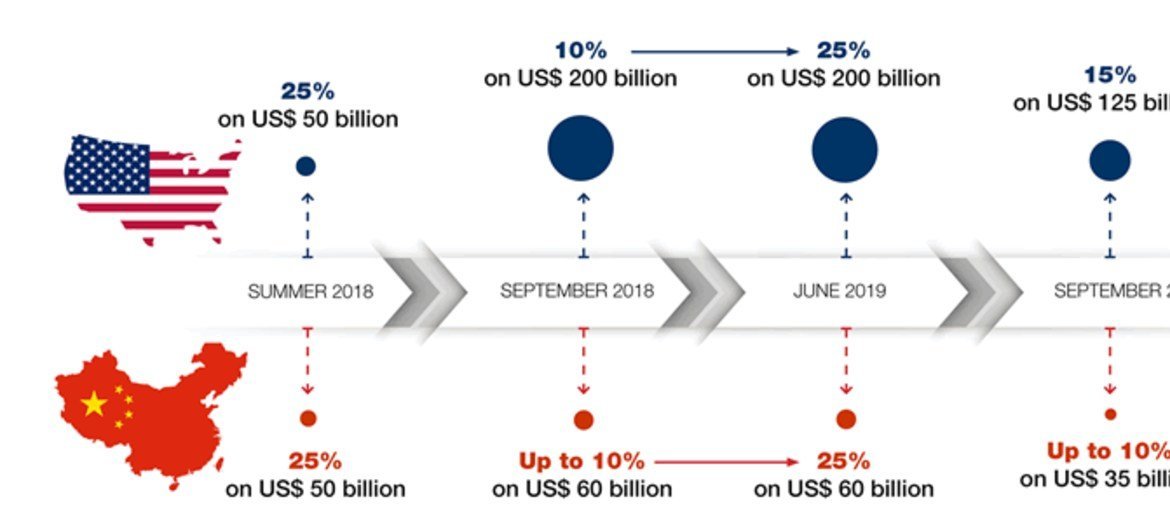

Us China Trade War Impact Todays Stock Market Analysis

Apr 26, 2025

Us China Trade War Impact Todays Stock Market Analysis

Apr 26, 2025 -

Floridas Charm A Cnn Anchors Favorite Vacation Spot

Apr 26, 2025

Floridas Charm A Cnn Anchors Favorite Vacation Spot

Apr 26, 2025 -

Microsofts Design Lead Human Creativity In The Age Of Artificial Intelligence

Apr 26, 2025

Microsofts Design Lead Human Creativity In The Age Of Artificial Intelligence

Apr 26, 2025 -

The Impact Of Trumps First 100 Days On A Rural School 2700 Miles From Dc

Apr 26, 2025

The Impact Of Trumps First 100 Days On A Rural School 2700 Miles From Dc

Apr 26, 2025 -

I Got My Switch 2 Preorder At Game Stop My Experience

Apr 26, 2025

I Got My Switch 2 Preorder At Game Stop My Experience

Apr 26, 2025