Deloitte Predicts Considerable Slowdown In US Economic Growth

Table of Contents

Deloitte's Key Findings and Forecasts

Deloitte, a globally recognized leader in professional services, recently released a comprehensive report forecasting a notable slowdown in US economic growth. Their analysis carries significant weight due to Deloitte's extensive research capabilities and access to crucial economic data. The report paints a less-than-rosy picture for the near future.

Key findings from Deloitte's report include:

- Projected GDP growth for 2024: 1.5% (a significant decrease from previous years' growth).

- Inflation forecast for 2024: 3.0% (though still elevated, showing a gradual decrease from current levels).

- Unemployment rate prediction for 2024: 4.2% (a slight increase indicating potential job market challenges).

- Decreased Consumer Spending: Deloitte anticipates a moderation in consumer spending due to persistent inflation and higher interest rates.

- Weakened Business Investment: Uncertainty surrounding the economic outlook is expected to lead to a pullback in business investment.

Sectors predicted to be most severely impacted include manufacturing, which faces challenges from global supply chain issues and reduced demand, and the technology sector, potentially experiencing a correction after a period of rapid expansion.

Underlying Factors Contributing to the Slowdown

Several interconnected macroeconomic factors contribute to Deloitte's prediction of a considerable slowdown in US economic growth. These factors include:

-

High Interest Rates and Monetary Policy Tightening: The Federal Reserve's aggressive interest rate hikes aim to curb inflation, but this also slows economic activity by increasing borrowing costs for businesses and consumers. Higher interest rates make investments more expensive and reduce consumer spending.

-

Global Economic Uncertainty and Geopolitical Risks: Global events, such as the ongoing war in Ukraine and rising geopolitical tensions, contribute to uncertainty and negatively impact global trade and investment flows. This uncertainty makes businesses hesitant to invest and expand.

-

Supply Chain Disruptions and Inflation: Although easing slightly, persistent supply chain bottlenecks and elevated inflation continue to constrain economic growth. High input costs force businesses to increase prices, further fueling inflation and dampening consumer demand.

-

Decreased Consumer Confidence: Concerns about inflation, rising interest rates, and potential recession have led to decreased consumer confidence. Consumers are less likely to spend when they feel uncertain about the future.

-

Potential for a Recession: The confluence of these factors increases the likelihood of a mild recession in the near term, characterized by reduced economic activity and potential job losses.

Potential Impacts on Various Sectors and the Labor Market

The predicted slowdown will have wide-ranging consequences across various sectors of the US economy and the labor market.

-

Impact on the Technology Sector: The technology sector, after a period of significant growth, is expected to experience a period of consolidation and potentially some job losses.

-

Impact on the Manufacturing Sector: The manufacturing sector faces ongoing challenges from global supply chain disruptions and weakened demand, potentially leading to reduced production and job cuts.

-

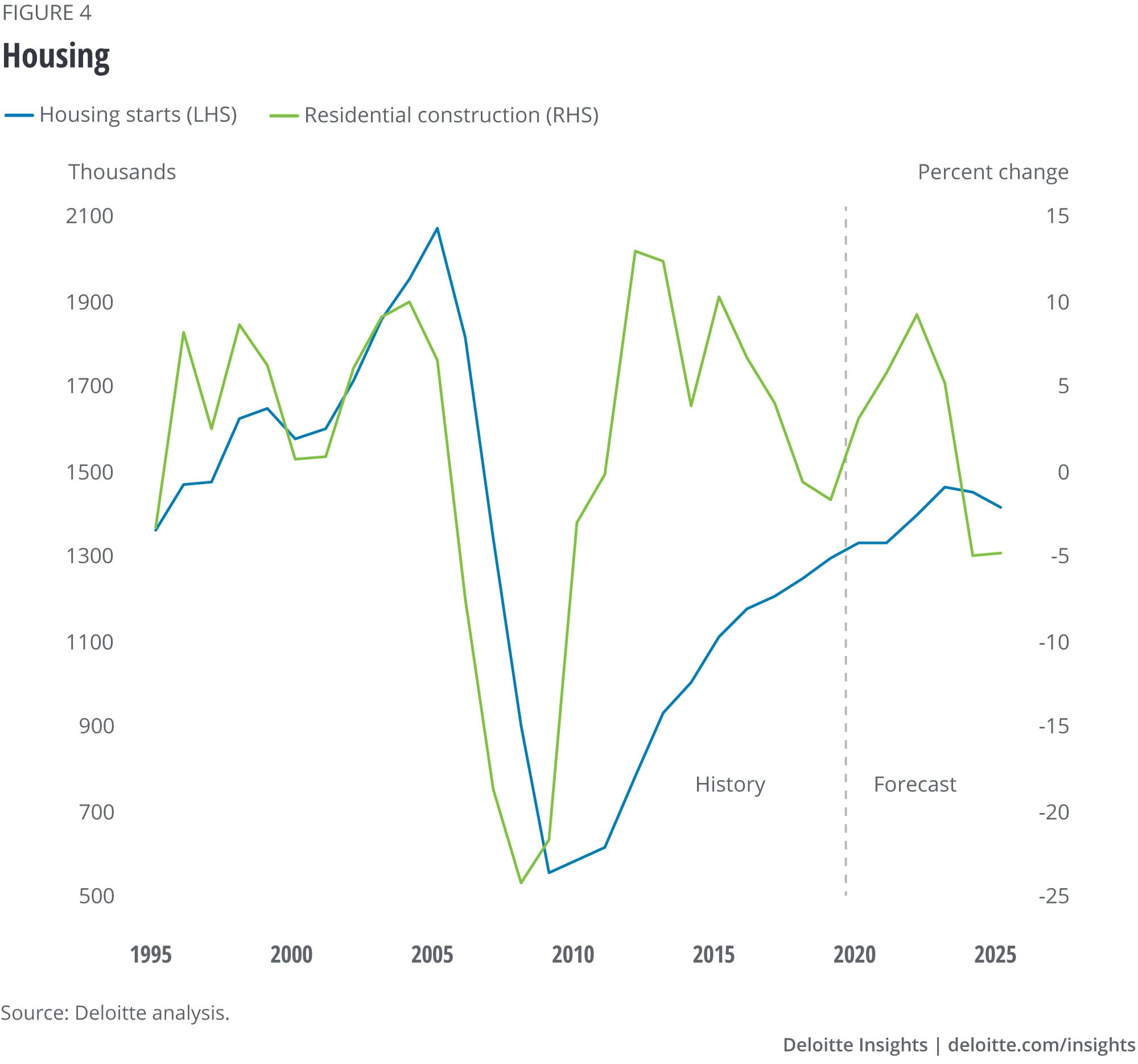

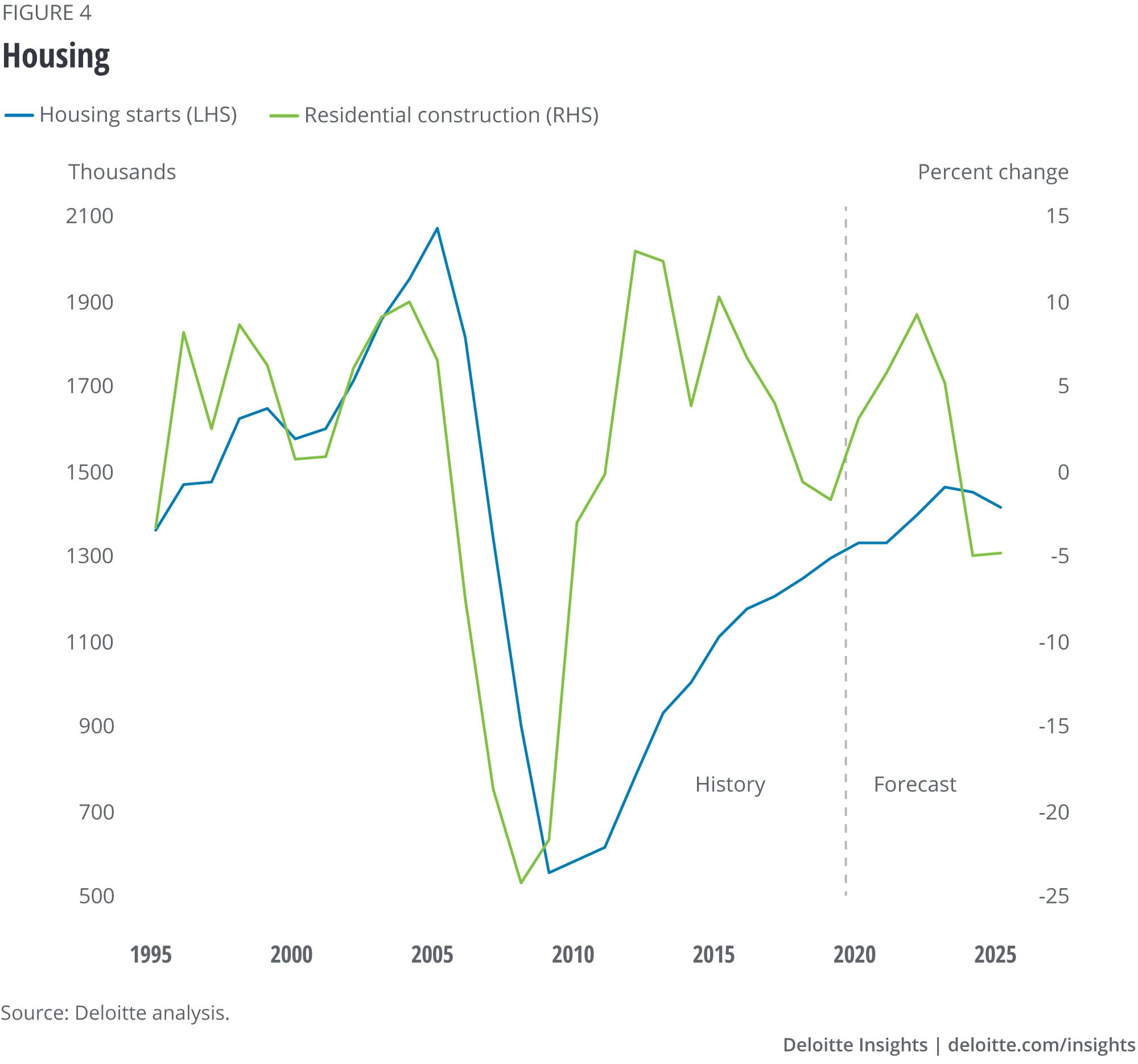

Impact on the Real Estate Market: Higher interest rates are expected to cool the overheated real estate market, potentially leading to a decrease in home prices and construction activity.

-

Impact on the Consumer Goods Sector: Reduced consumer spending, due to inflation and uncertainty, will likely impact sales in the consumer goods sector, leading to potential inventory build-up and reduced hiring.

The labor market will likely experience slower job growth, with some sectors facing potential job losses. The degree of impact will depend on the severity and duration of the slowdown. Inflationary pressures will continue to erode real wages, impacting consumer purchasing power. Economic uncertainty will also affect hiring decisions, leading to greater caution by businesses.

Deloitte's Recommendations and Mitigation Strategies

Deloitte's report concludes with recommendations for businesses, consumers, and policymakers to navigate the anticipated slowdown and build economic resilience.

-

Strategies for Businesses: Businesses should focus on enhancing operational efficiency, managing costs effectively, diversifying supply chains, and investing in technology to improve productivity and reduce reliance on human labor. Risk management strategies are critical to prepare for the changing economic landscape.

-

Recommendations for Consumers: Consumers should prioritize budgeting, paying down debt, building emergency savings, and carefully considering major purchases.

-

Policy Suggestions for the Government: The government should consider targeted fiscal policies to support vulnerable sectors and individuals, such as extended unemployment benefits or investment in infrastructure projects to stimulate economic activity. A measured approach to monetary policy will be crucial to balance inflation control with supporting sustainable economic growth. Effective policy response is essential to mitigate the impact of the slowdown.

Conclusion: Understanding Deloitte's Prediction of US Economic Slowdown

Deloitte's prediction of a considerable slowdown in US economic growth highlights the challenges facing the US economy. Factors such as high interest rates, global uncertainty, supply chain disruptions, and decreased consumer confidence contribute to this forecast. The potential impacts are significant, with various sectors and the labor market expected to experience slower growth or potential job losses. Deloitte's recommendations for businesses, consumers, and policymakers emphasize proactive measures to mitigate the effects of the slowdown and build economic resilience. Stay informed about the evolving economic landscape and Deloitte's insights to effectively navigate the predicted slowdown in US economic growth. For more detailed information, refer to the full Deloitte report.

Featured Posts

-

Thueringen Amphibien Und Reptilienatlas Ein Umfassender Ueberblick

Apr 27, 2025

Thueringen Amphibien Und Reptilienatlas Ein Umfassender Ueberblick

Apr 27, 2025 -

The China Factor Why Bmw Porsche And Others Struggle In The Worlds Largest Auto Market

Apr 27, 2025

The China Factor Why Bmw Porsche And Others Struggle In The Worlds Largest Auto Market

Apr 27, 2025 -

Pne Group Secures Permits For German Wind And Solar Projects

Apr 27, 2025

Pne Group Secures Permits For German Wind And Solar Projects

Apr 27, 2025 -

When Fear Kept Robert Pattinson Awake A Horror Movie Night To Remember

Apr 27, 2025

When Fear Kept Robert Pattinson Awake A Horror Movie Night To Remember

Apr 27, 2025 -

Mc Cooks Local Jeweler A Helping Hand For Former Nfl Players

Apr 27, 2025

Mc Cooks Local Jeweler A Helping Hand For Former Nfl Players

Apr 27, 2025